Basic Information

Nigeria

Nigeria

Score

Nigeria

|

5-10 years

|

Nigeria

|

5-10 years

| https://trustbancgroup.com

Website

Rating Index

Influence

C

Influence index NO.1

Nigeria 3.19

Nigeria 3.19 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

Nigeria

Nigeria trustbancgroup.com

trustbancgroup.com United States

United States| TrustBanc Financial Group Review Summary | |

| Registered Country/Region | Nigeria |

| Regulation | Unregulated |

| Market Instruments | Quick Loans, Fixed Deposits, Enterprise Loans, Savings, Corporate Banking |

| Demo Account | Unavailable |

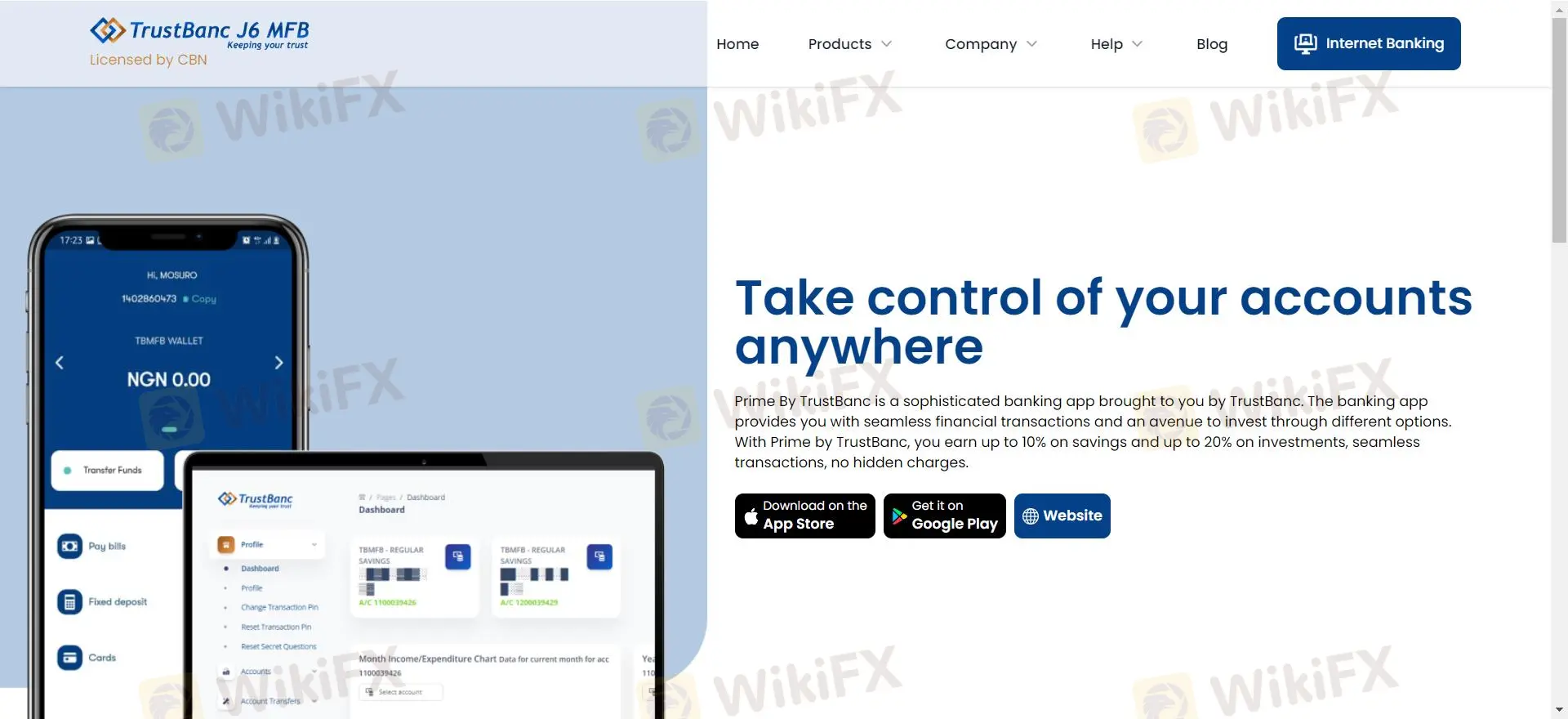

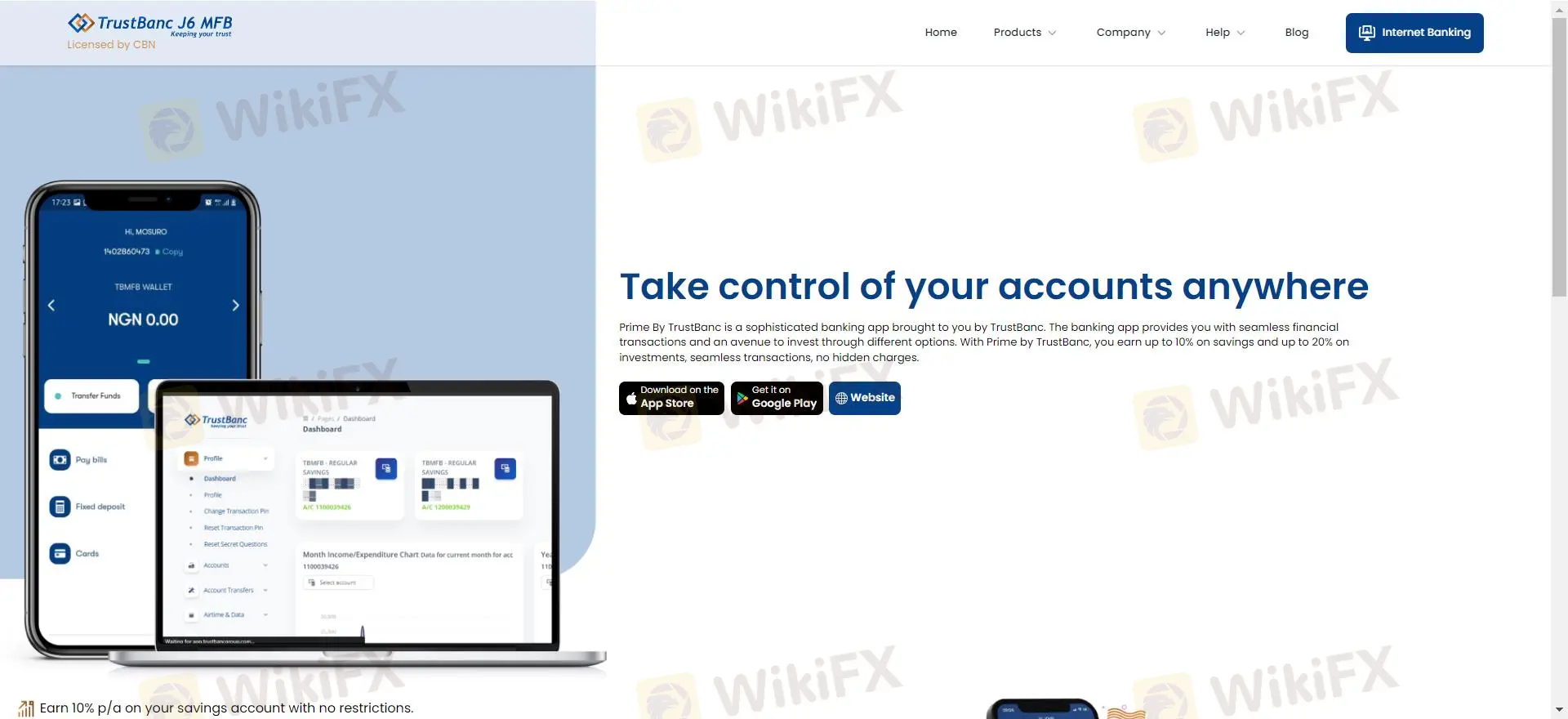

| Trading Platform | Prime by TrustBanc app, Web-Based Banking |

| Min Deposit | 0 for most accounts |

| Customer Support | Phone: 07004446147 |

| Email: support@trustbancgroup.com | |

| 24/7 Online Chat: × | |

| Physical Address: 163, Sinari Daranijo Street, Off Ligali Ayorinde, Victoria Island, Lagos, Nigeria | |

Founded in Lagos, Nigeria, TrustBanc Financial Group provides a range of financial services catered for both people and companies. Though it's not regulated, its products include fixed deposits, rapid loans, business loans, savings accounts, and corporate banking options. Through its Prime by TrustBanc app, consumers may access $0 account initial deposits.

| Pros | Cons |

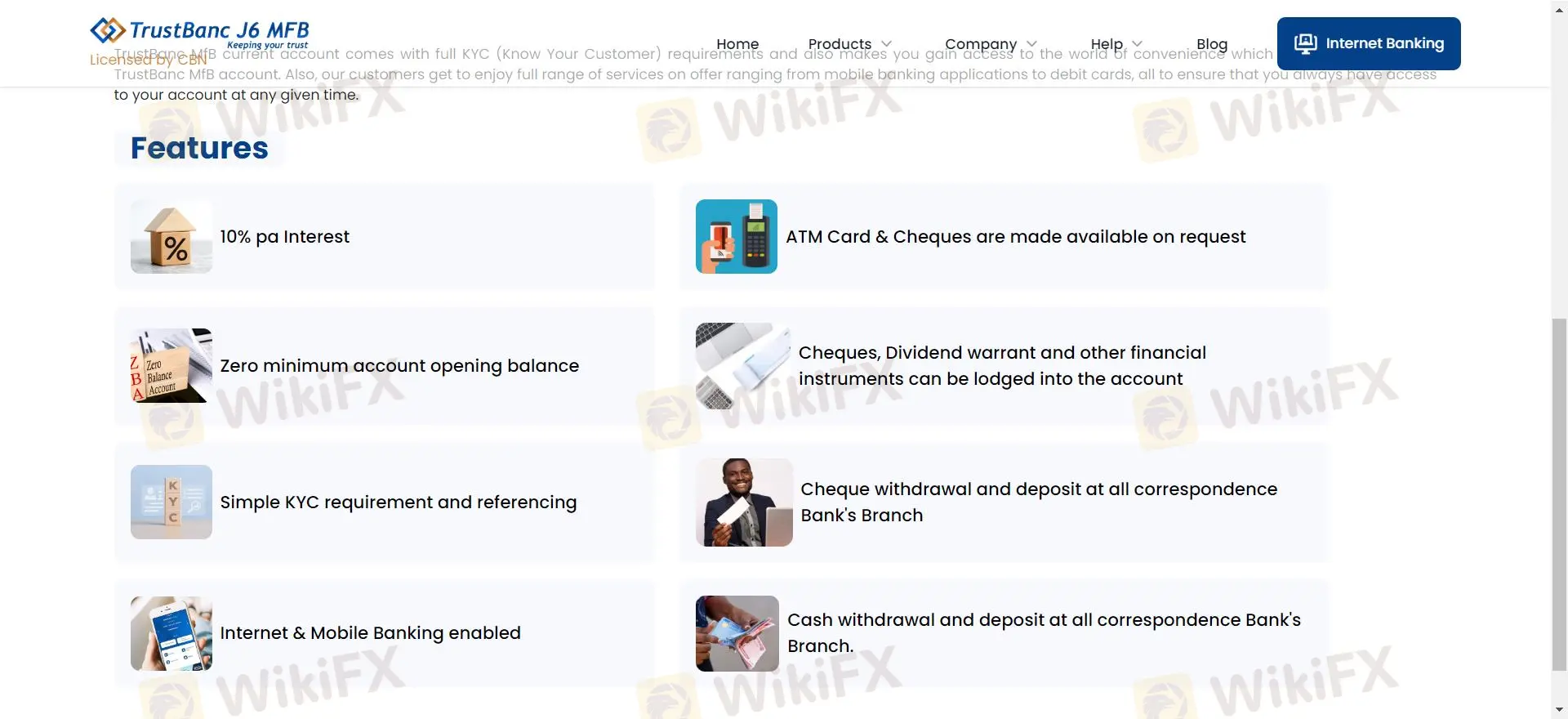

| 0 minimum deposit for accounts | Unregulated |

| Competitive interest rates (up to 10% on savings and 20% on investments) | No demo account or trading-related leverage offerings |

| Many financial services |

TrustBanc Financial Group is unregulated.

TrustBanc Financial Group offers many financial products and services for individuals and businesses. These include loans, savings, fixed deposits, corporate banking, and investment services.

| Service | Supported |

| Quick Loans | ✔ |

| Fixed Deposits | ✔ |

| Enterprise Loans | ✔ |

| Savings Accounts | ✔ |

| Corporate Banking | ✔ |

TrustBanc Financial Group provides 4 account options, designed for different businesses.

| Quick Loan Accounts | ✔ |

| Fixed Deposit Accounts | ✔ |

| Savings Accounts | ✔ |

| Investment Accounts | ✔ |

Each account type provides both individual and corporate options.

TrustBanc Financial Group provides a related low fees compared to industry average.

| Fee Type | |

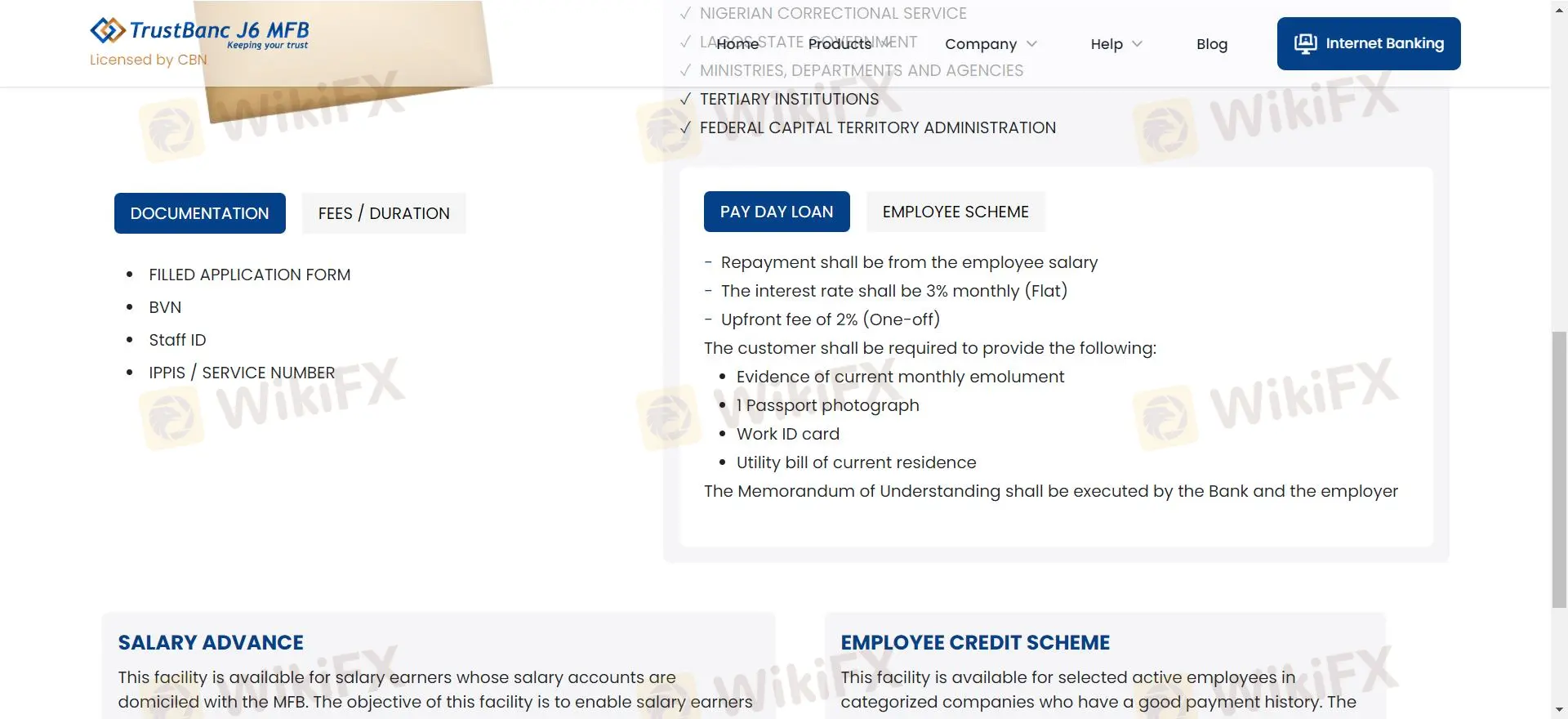

| Quick Loan Interest | 3% monthly (flat) interest. |

| Upfront Loan Fee | 2% one-off upfront fee for salary advance loans. |

| Management Fees | 0 fees for savings and standard account opening. |

| Fixed Deposit Fees | No additional charges for deposits or withdrawals. |

TrustBanc Financial Group offers its unique trading app with some trading convenience for users.

It asks for 0 management fees.

| Platform | Supported | Available Devices | Suitable For |

| Prime App | ✔ | iOS, Android | All users for seamless banking and investments |

| Web Banking | ✔ | Web | Users preferring desktop access |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now