Company Summary

| Royal Trust Review Summary | |

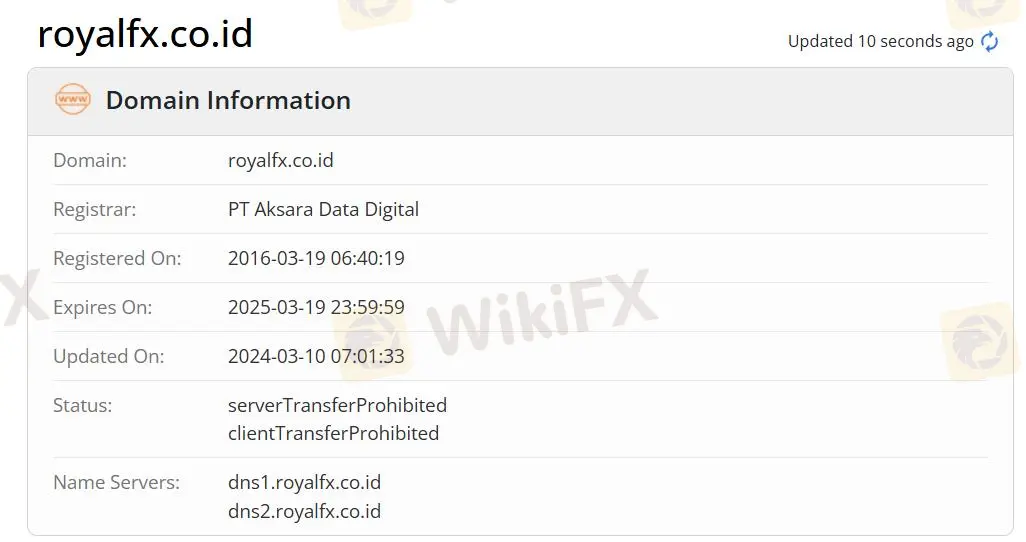

| Founded | 2016-03-19 06:40:19 |

| Registered Country/Region | Indonesia |

| Regulation | Regulated |

| Market Instruments | Forex/Loco London/Crude Oil/Multilateral |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| Spread | / |

| Trading Platform | MT4(Android/iOS/Windows) |

| Min Deposit | / |

| Customer Support | Phone: +62 21 30304129 |

| Complaint Phone: +62 21 252 1503 | |

| WhatsApp: +62 877 4904 0042/+62 852 1007 6719 | |

| Email: support@royalfx.co.id | |

| Facebook/Instagram/Tiktok/YouTube | |

Royal Trust Information

Royal Trust is a broker. The tradable instruments with a maximum leverage of 1:200 include Forex, Loco London, and Crude Oil. The MT4 is available in Android, iOS, and Windows versions. Although Royal Trust is regulated by Badan Pengawas Perdagangan Berjangka Kamoditi Kementerian Perdagangan, risks cannot be completely avoided.

Pros and Cons

| Pros | Cons |

| Leverage up to 1:200 | No specific transfer method |

| 24-Hour Customer Service | Unspecific withdrawal and deposit information |

| Regulated | No account and fee information |

| MT4 available | |

| Demo account available | |

| Various tradable instruments |

Is Royal Trust Legit?

Royal Trust is regulated by Badan Pengawas Perdagangan Berjangka Kamoditi Kementerian Perdagangan with license number 922/BAPPEBTI/SI/08/2006.

What Can I Trade on Royal Trust?

Royal Trust offers a wide range of market instruments, including Forex, Loco London,Crude Oil, and Multilateral.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Loco London | ✔ |

| Crude Oil | ✔ |

| Multilateral | ✔ |

| Commodities | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Precious Metals | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Leverage

The maximum leverage is 1:200 meaning that profits and losses are magnified 200 times.

Trading Platform

Royal Trust cooperates with the authoritative MT4 trading platform. It is available in Android, iOS, and Windows to trade. Junior traders prefer MT4 over MT5. MT4 provides various trading strategies and implements EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Android/iOS/Windows | Junior traders |