Basic Information

India

India

Score

India

|

5-10 years

|

India

|

5-10 years

| https://wisdomcapital.in

Website

Rating Index

Influence

C

Influence index NO.1

India 5.81

India 5.81 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

India

India wisdomcapital.in

wisdomcapital.in United States

United States

| Broker Name | Wisdom Capital |

| Founded in | 2019 |

| Registered in | India |

| Regulated by | Not regulated |

| Market Instruments | stocks, futures & options, commodities, currency trading, equity trading |

| Account Types | Trading Account; Wealth Management Account; Demat Account; Margin Trading Account |

| Commission | account-based |

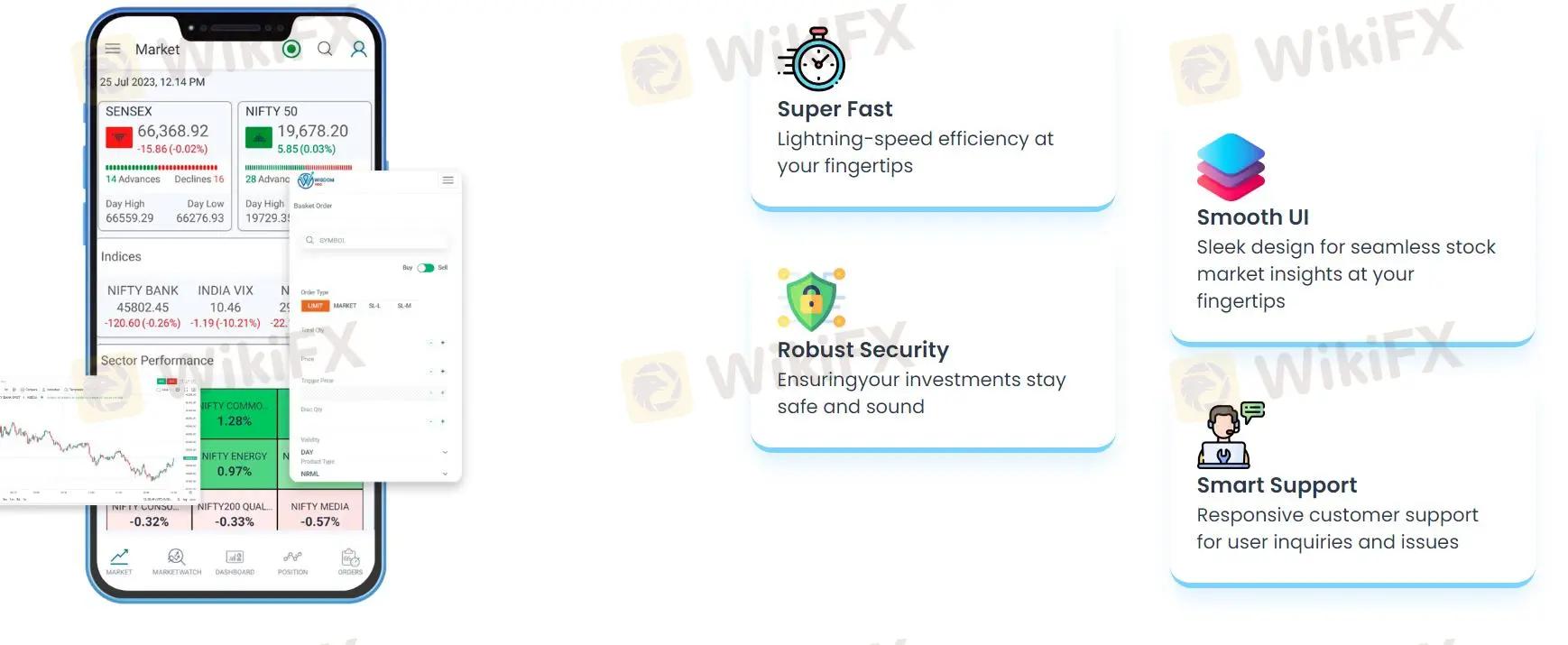

| Trading Platform | Access through Mobile App and Web Trading |

| Customer Support | 1800-123-9343; help@wisdomcapital.in |

Wisdom Capital is an Indian brokerage firm offering a range of market instruments including stocks, futures & options, commodities, and currency trading. It provides various account types such as Trading Account, Wealth Management Account, Demat Account, and Margin Trading Account, tailored to different investor needs. While it operates without regulation, it offers a commission structure that varies by account type. Accessible through both a Mobile App and Web Trading platform, Wisdom Capital emphasizes convenience in trading. Customer support is available via phone at 1800-123-9343 and email at help@wisdomcapital.in, ensuring assistance for client inquiries and issues.

Wisdom Capital appears to operate without regulation. As of the latest information available, there are no indications that Wisdom Capital is subject to oversight by any financial regulatory authority. This lack of regulation means that clients and investors should exercise caution when considering engaging with the company.

Wisdom Capital offers a diverse range of trading instruments and a user-friendly platform, catering to different trading preferences and ensuring ease of use for clients. However, the brokerage falls short in educational resources and transparency regarding its operational policies, which could hinder client understanding and trust. Furthermore, operating without regulatory oversight poses significant risks to traders, potentially affecting investor protection and recourse in case of disputes. Additionally, the limited deposit and withdrawal methods restricted to crypto wallets may inconvenience clients seeking broader financial transaction options.

| Pros | Cons |

| • Various trading instruments to trade | • Operates without regulatory oversight, potentially exposing traders to risks |

| • Offers multiple account types | • Lack of educational resources or transparency regarding company policies and procedures |

| • User-Friendly Platform | • Deposit and withdrawal methods limited to crypto wallets |

Wisdom Capital offers a comprehensive range of market instruments including stocks, futures & options, commodities, currency trading, equity trading, and Nifty trading. As a full-service financial firm, Wisdom Capital enables investors to engage in diverse investment opportunities across these instruments.

Trading Account: This type of account allows you to trade a variety of financial instruments, including stocks, bonds, and commodities. There are no fees associated with opening this account, but there are charges for equity executions (₹0.01 per order or ₹29/executed order) and other brokerage fees.

Wealth Management Account: This type of account is designed for investors who want to delegate their investment decisions to a professional money manager. The fees for this type of account are not shown on the screenshot.

Demat Account: This type of account is required to hold shares and other securities in electronic form in India. There is a zero account opening charge and a ₹400 annual maintenance charge associated with this account type.

Margin Trading Account: This type of account allows you to borrow money from the broker to purchase securities. The fees for this type of account are not shown on the screenshot, and it is important to note that margin trading can be risky.

Wisdom Capital seems to offer a web-based trading platform accessible through a desktop or laptop computer. The platform likely prioritizes user-friendliness with features for:

Wisdom Capital prides itself on delivering exceptional customer support through its Call & Trade service, accessible by dialing 1800-123-9343 or emailing help@wisdomcapital.in. This service ensures that clients receive prompt assistance and guidance regarding their investment queries and trading needs. Whether customers require assistance with executing trades over the phone or seek clarification on account-related matters, Wisdom Capital's dedicated support team is readily available to provide timely and reliable solutions. By prioritizing customer satisfaction and accessibility, Wisdom Capital strives to maintain a strong rapport with its clients, fostering trust and confidence in their investment journey.

In conclusion, Wisdom Capital emerges as a versatile brokerage firm in India, offering a wide array of market instruments including stocks, futures & options, commodities, and currency trading. Established in 2019 and operating without regulatory oversight, it provides various account types tailored to diverse investor needs, supported by a user-friendly Mobile App and Web Trading platform. While it excels in accessibility and trading convenience, potential clients should consider the risks associated with the lack of regulatory supervision. With a commitment to responsive customer support and a range of trading opportunities, Wisdom Capital aims to cater effectively to the needs of its clientele in the competitive financial markets.

Is Wisdom Capital safe?

Wisdom Capital is not regulated, which means there are no regulatory safeguards in place to protect investors.

What account types does Wisdom Capital offer?

Wisdom Capital offers Trading Accounts, Wealth Management Accounts, Demat Accounts, and Margin Trading Accounts.

How do I fund my Wisdom Capital account?

Information on deposit methods is currently unavailable, but it might be limited to crypto wallets.

Does Wisdom Capital offer educational resources?

There is no clear information on the extent or quality of educational resources available through Wisdom Capital.

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now