Company Summary

| PNB Review Summary | |

| Founded | 1916 |

| Registered Country/Region | Philippines |

| Regulation | No regulation |

| Products and Services | Retail & Corporate Banking, Loans & Mortgages, Remittance, Insurance, Investments, Stock Brokerage, Mobile & Online Banking |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | PNB Digital App |

| Minimum Deposit | PHP 3,000 (for basic savings account) |

| Customer Support | Trunkline: (+632) 8526 3131 |

| Bank Hotline: (+632) 8573-8888 | |

| Email: customercare@pnb.com.ph | |

| Social Media: Facebook, X, Instagram, YouTube, LinkedIn | |

PNB Information

Philippine National Bank (PNB) is one of the oldest and biggest private commercial banks in Philippines, which opened in 1916. It is currently not regulated by any financial authorities, either in the US or abroad, but it does offer a full range of traditional and digital financial services to customers in the US and abroad through its large network of branches and ATMs.

Pros and Cons

| Pros | Cons |

| Long-standing banking history since 1916 | Not regulated |

| Extensive local and international branch network | Complex fee structure |

| Offers a wide range of banking services | |

| Various contact channels |

Is PNB Legit?

PNB is not regulated by any Philippine financial institution, including the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP). Furthermore, it is not overseen by any internationally recognized financial regulators, like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Products and Services

PNB provides a wide range of traditional and innovative financial services, including retail banking, corporate banking, remittance, asset management, lending, insurance, and investment options. It has one of the largest domestic and foreign branch networks of any Philippine bank, serving both local and worldwide Filipino clients.

| Products / Services | Supported |

| Retail & Corporate Banking | ✔ |

| Loans & Mortgages (e.g. OPHL) | ✔ |

| Remittance Services | ✔ |

| Insurance (Life & Non-life) | ✔ |

| Investment & Trust Services | ✔ |

| Stock Brokerage | ✔ |

| Mobile & Online Banking | ✔ |

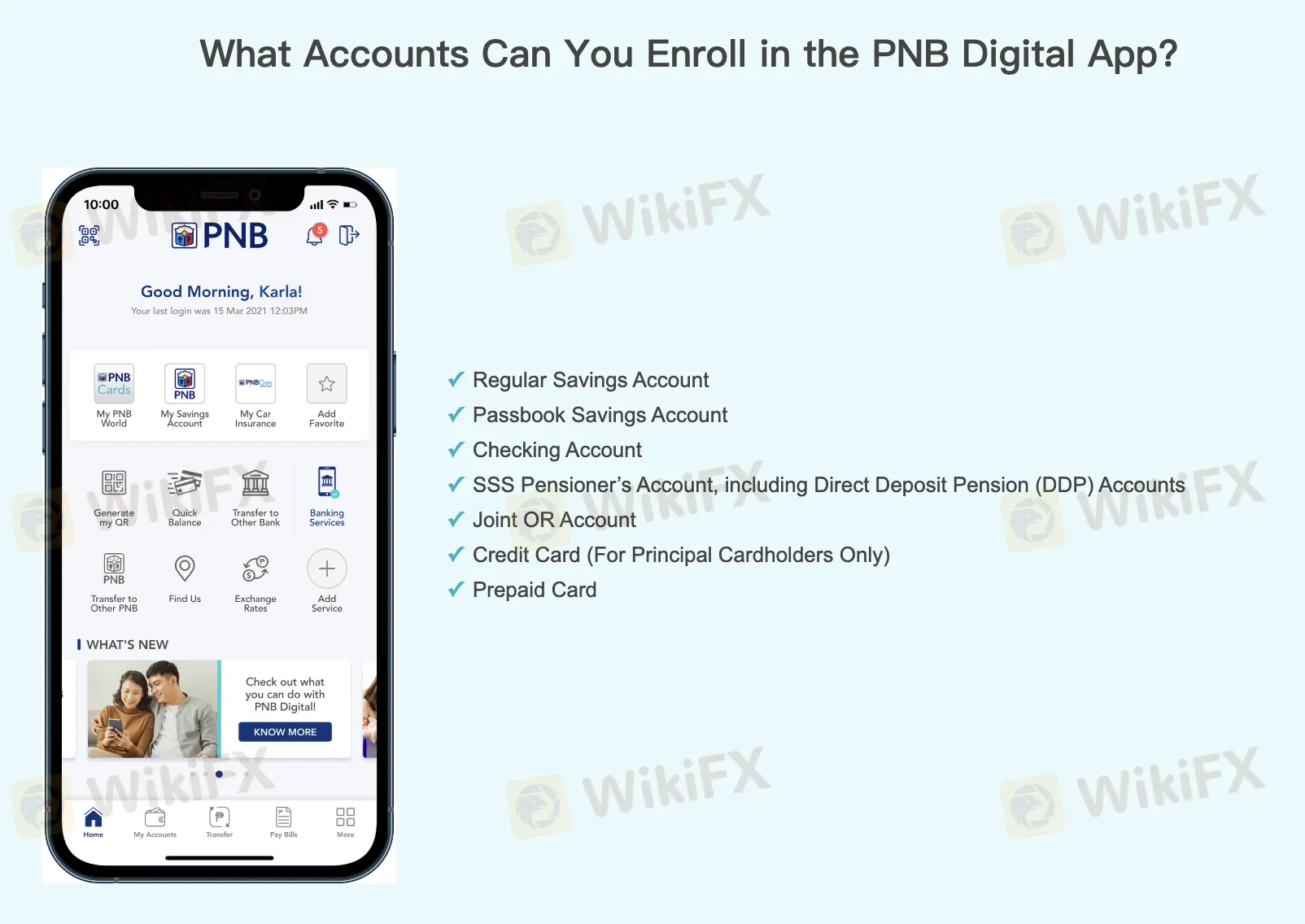

Account Types

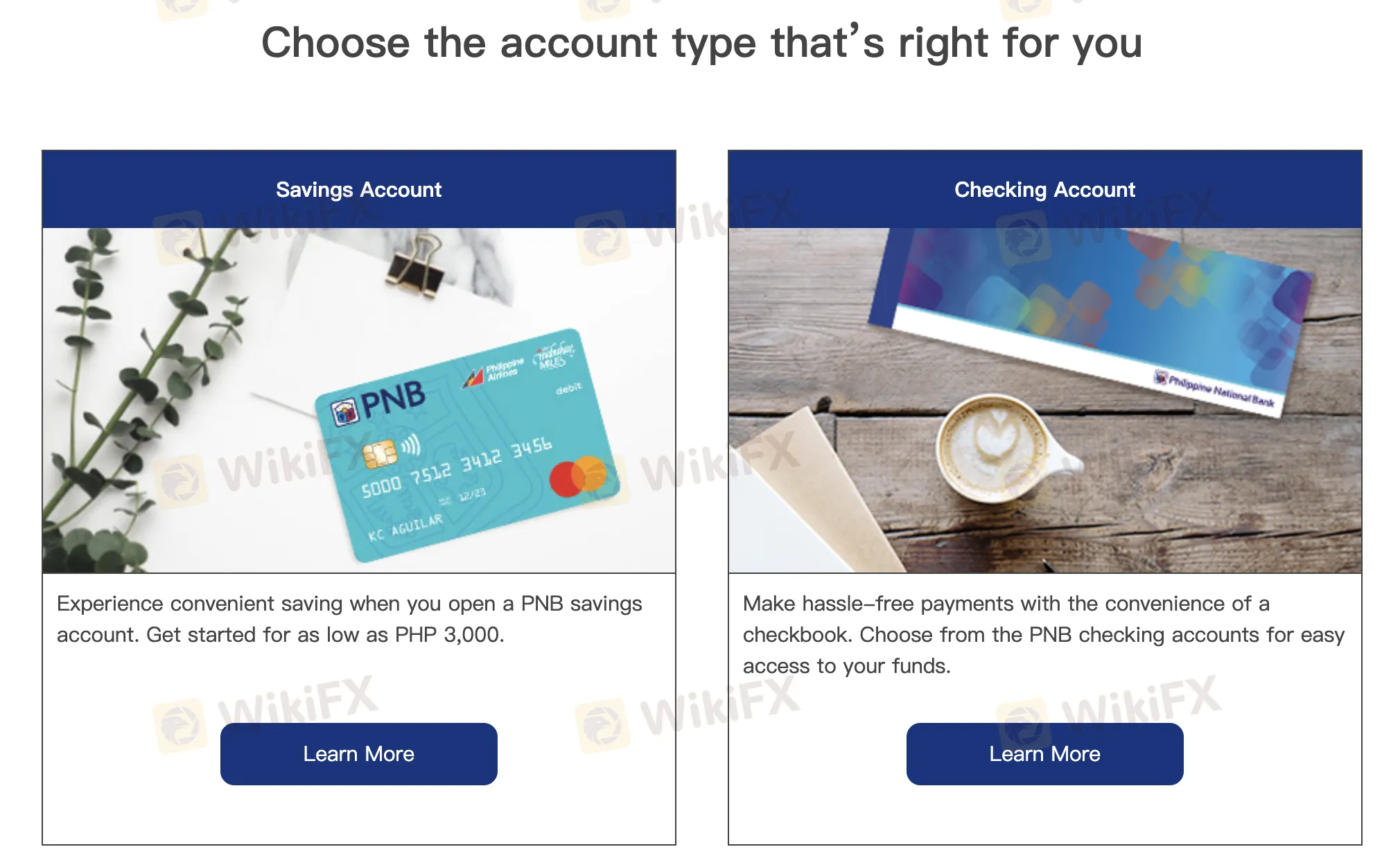

| Account Type | Purpose / Features | Suitable For |

| Savings Account | Basic deposit account; initial deposit starts from PHP 3,000 | Everyday savers |

| Checking Account | Comes with checkbook; for easy payments and fund access | Individuals/businesses needing payment flexibility |

| Time Deposit | Fixed-term savings with interest | Those seeking secure savings growth |

| Foreign Currency | For holding foreign currencies securely | Individuals with forex needs or overseas transactions |

PNB Fees

Compared to other banks, PNB charges moderate to high fees, notably for transactions between branches and with people from other countries. Within its network, some services, like checking your balance and using an ATM, are free. However, many others, notably those that involve branches in different regions, on other islands, or with different currencies, have different fees.

| Fee Category | Description | Fee |

| Interbranch Cash Deposit | Same region: FreeDifferent region: ₱50/₱100K or more | ₱50 minimum, ₱50 per ₱100K |

| Interbranch Check Deposit | Regular ↔ Island Branch | ₱100 |

| USD Cash/Check Deposit | All branches | ₱100 |

| Interbranch Withdrawal (PHP) | Regular ↔ Island Branch | ₱200 |

| USD Withdrawal/Encashment | All branches | ₱200 |

| ATM (Local) | PNB ATM: FreeOther banks: ₱15 withdrawal, ₱2 balance inquiry | ₱2–₱15 |

| ATM (International) | Withdrawal: ₱150–₱250Balance Inquiry: ₱75 | ₱75–₱250 |

| Digital Transfers (Retail) | InstaPay / PESONet | ₱20 per transaction |

| Digital PNB to PNB Transfer | First 3 per week free; next ₱10 each | ₱0–₱10 |

| Over-the-Counter Services | Withdrawal slip: ₱50Checkbook reorder: ₱250–₱500Bank cert: ₱200 | Varies |

| Inward USD Remittance | Service fee + DST | $5–$8 |

| Dormancy Fee | After 5 years inactive | ₱30 / $0.50 (selected accounts) |

| Early Closure (≤30 days) | PHP accounts: ₱500USD accounts: $10 | ₱500 / $10+ |

| Maintaining Balance Penalty | Peso: ₱350–₱500USD: $10–$20Other currencies vary | ₱350+ / $10+ |

| Other Fees | SOA requests, remittances, demand drafts, safety box rental, etc. | Varies by service |

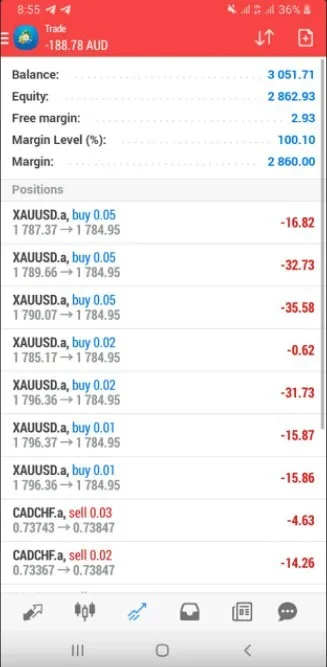

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| PNB Digital App | ✔ | Android, iOS | / |