Company Summary

| Axiance Review Summary | |

| Founded | 2005 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (Offshore), CYSEC (Unverified) |

| Market Instruments | Forex, commodities, stocks, indices, cryptocurrencies and futures |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | 1 pips (EUR/USD) |

| Trading Platform | MT4, MT5, Axiance app |

| Minimum Deposit | $100 |

| Customer Support | Live chat, contact form |

| Email: support@axianceint.com | |

| Social Media: Facebook, X, LinedIn, Instagram, YouTube | |

| Regional Restriction | the United States of America, Canada (including Quebec), Seychelles, Belgium, North Korea |

Axiance Information

Axiance is a multi-asset CFD broker that works in Seychelles and Mauritius under the names Aerarium Limited and Aurum Capital. The company has more than 300 CFD instruments, such as more than 50 forex pairs, equities, commodities, indices, cryptocurrencies, and futures. Clients can trade using MetaTrader 4/5 or the broker's own mobile app. The maximum leverage is 1:500 and the minimum deposit is $100. However, it does not provide services for residents from certain areas.

Pros and Cons

| Pros | Cons |

| Offers a wide range of products | Offshore regulation risks |

| MT4 and MT5 platforms available | High minimum deposit for premium and VIP accounts |

| Demo account available | Regional restriction |

| Live chat support |

Is Axiance Legit?

| Regulated Country | Regulatory Authority | Status | Licensed Entity | License Type | Licence No. |

| Seychelles | Seychelles Financial Services Authority (FSA) | Offshore Regulated | Aerarium Limited | Securities Dealer | SD036 |

| Mauritius | Mauritius Financial Services Commission (FSC) | Unverified | Aerarium Limited | Investment Dealer | GB20025770 |

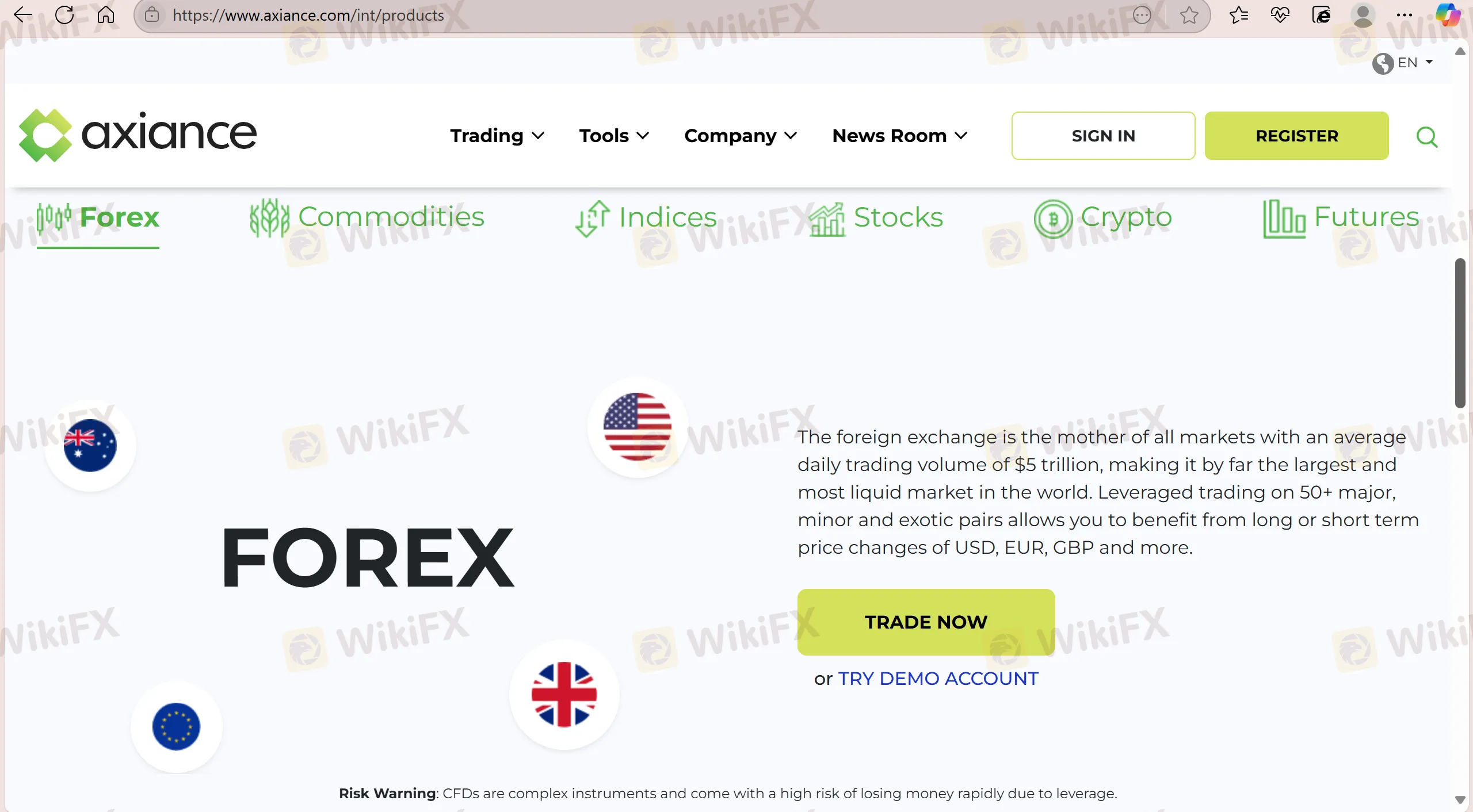

What Can I Trade on Axiance?

Axiance offers CFD trading on over 300 instruments: more than 50 forex pairs, commodities (metals & energy), major stock indices, shares, cryptocurrencies and futures.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| Futures | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

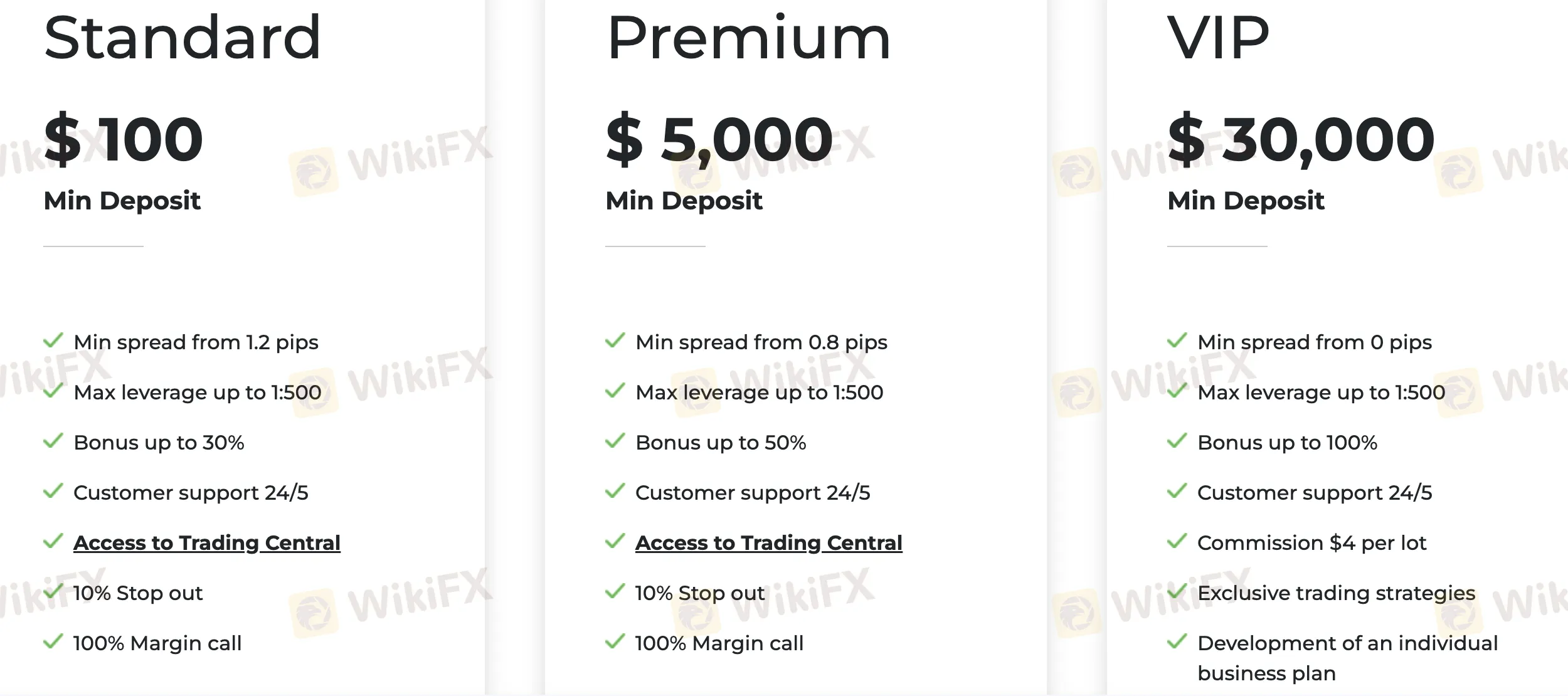

Account Types

Axiance offers three active accounts: Standard, Premium, and VIP. It also offers a demo account, but it doesn't say anything about an Islamic (swap-free) alternative.

| Account Type | Minimum Deposit | Leverage | Spreads | Commission |

| Standard | $100 | Up to 1:500 | From 1.2 pips | ❌ |

| Premium | $5 000 | Up to 1:500 | From 0.8 pips | ❌ |

| VIP | $30 000 | Up to 1:500 | From 0 pips | $4 per lot |

Leverage

Axiance gives Standard, Premium, and VIP accounts leverage of up to 1:500. High leverage can make returns bigger, but it also makes risks much bigger.

Axiance Fees

The costs of trading are in the middle range. Standard Account spreads start at 1.2 pips, Premium at 0.8 pips, and VIP spreads can be 0 pips but carry a commission of $4 per lot. As for forex trading, the spread for EUR/USD is 1 pips.

Trading Platform

| Platform | Supported | Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Windows, macOS | Beginners |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS | Experienced traders |

| Proprietary Mobile App | ✔ | iOS, Android | / |

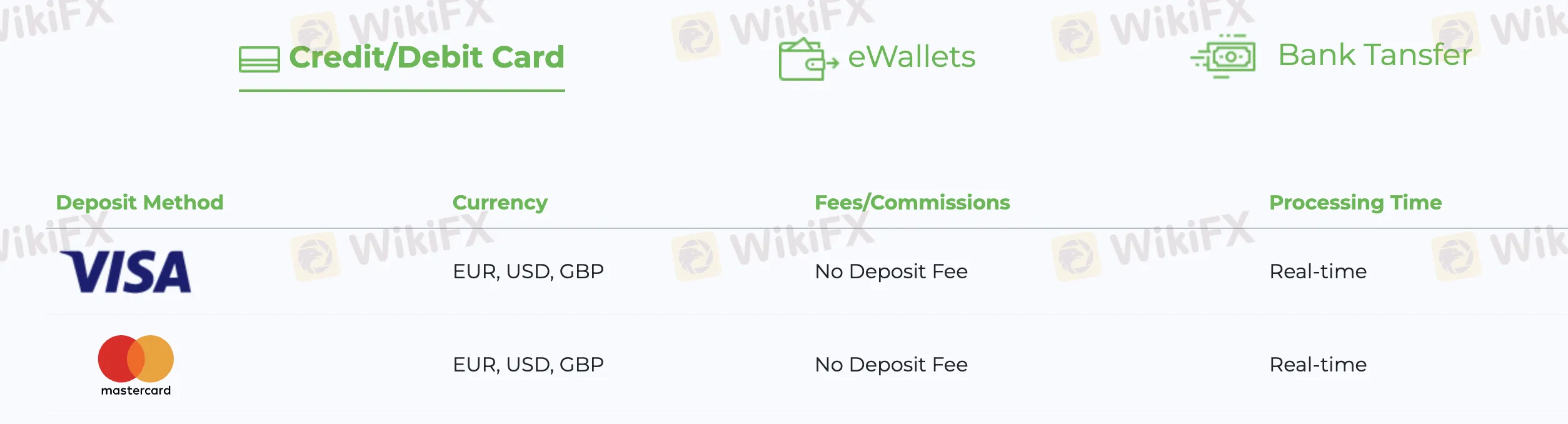

Deposit and Withdrawal

Axiance doesn't charge any deposit fees and accepts credit and debit cards, eWallets, and bank transfers. You can process deposits in real time, with a limit of 30,000 currency units per transaction. There are no fees for withdrawals, but you must take out at least 50 units.

| Payment Options | Minimum Deposit | Fees | Deposit Processing Time | Minimum Withdrawal | Withdrawal Processing Time |

| Credit/Debit Card | $100 | ❌ | Real‑time | 50 units | 1 business day |

| eWallets | $100 | ❌ | Real‑time | 50 units | 1 business day |

| Bank Transfer | $100 | ❌ | Real‑time | 50 units | 1 business day to 3 business days |