Basic Information

United Kingdom

United Kingdom

Score

United Kingdom

|

5-10 years

|

United Kingdom

|

5-10 years

| https://www.capital-iom.com/

Website

Rating Index

Influence

C

Influence index NO.1

South Africa 4.55

South Africa 4.55 Licenses

LicensesLicensed Entity:CILSA INVESTMENTS (PTY) LTD

License No. 44894

United Kingdom

United Kingdom capital-iom.com

capital-iom.com United States

United States

| Capital International Group Review Summary | |

| Founded | 1996 |

| Registered Country/Region | United Kingdom |

| Regulation | FSCA (Unverified) |

| Trading Products | Stocks, ETFs, funds, bonds, structured products, forex |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | Execution-only Investment Platform (Web-based) |

| Minimum Deposit | £50,000 |

| Customer Support | 📞 +44 (0) 1624 654200 |

Capital International Group, which started in the UK in 1996, is not a licensed broker and has been caught using an unverified FSCA license. It offers discretionary asset management, a web-based investing platform, and banking products like live FX trading and interest-bearing accounts to high-net-worth individuals, intermediaries, and businesses.

| Pros | Cons |

| Wide range of investment products & banking services | Unverified FSCA license |

| Multi-currency accounts and live FX dealing | No demo accounts |

| Tiered interest and account options for HNWIs | No MT4/MT5 |

| High minimum deposit requirement (£50,000+) |

Capital International Group is not a regulated broker. It currently only holds an unverified Financial Service Corporate license from the Financial Sector Conduct Authority (FSCA) in South Africa.

| Regulatory Authority | Financial Sector Conduct Authority (FSCA) |

| Current Status | Unverified |

| Regulated by | South Africa |

| Licensed Institution | CILSA INVESTMENTS (PTY) LTD |

| Licensed Type | Financial Service Corporate |

| Licensed Number | 44894 |

| Products & Services | Supported |

| Stocks & ETFs | ✔ |

| Funds & Bonds | ✔ |

| Structured Products | ✔ |

| Money Market Funds | ✔ |

| Discretionary Asset Management | ✔ |

| Multi-Asset Portfolio Solutions | ✔ |

| Bank Accounts (Multi-Currency) | ✔ |

| Live FX Trading | ✔ |

| Interest-Earning Deposit Products | ✔ |

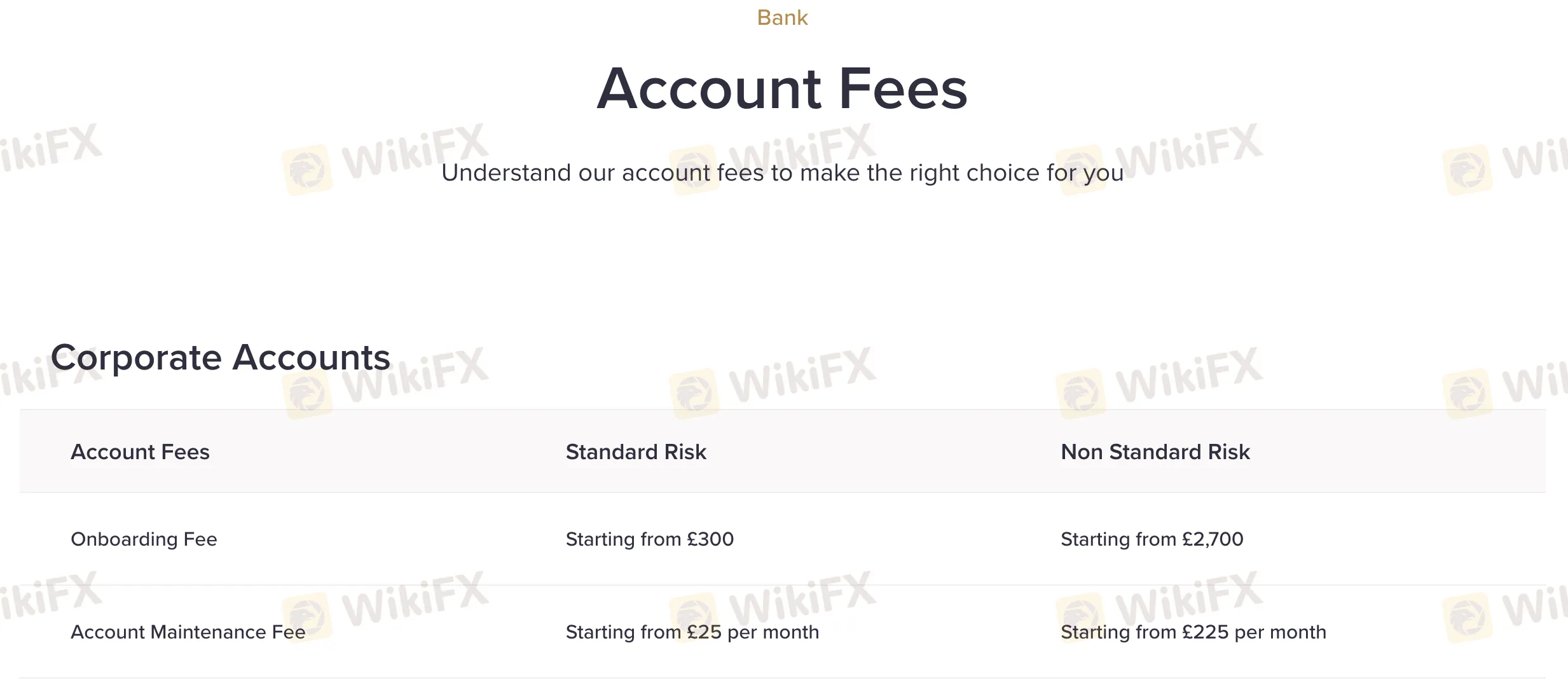

Capital International Group charges different fees and interest rates depending on the type of account and what you do with it.

In general, its fees are higher than those of regular retail brokers. This is because it focuses on private banking and institutional clients, especially high-net-worth people and businesses.

| Category | Fees |

| Premier Rate Interest | GBP: Up to 2.00% (≥ £5M) |

| USD: Up to 2.25% (≥ $5M) | |

| Trading Account Interest | GBP/USD: 0% |

| JPY: -0.10% | |

| Corporate Account Fees | Onboarding: from £300 (standard) / £2,700 (non-standard) |

| Maintenance: from £25/mo | |

| Individual Account Fees | Charges apply (varies by risk) |

| Payment Fees | BACS: £0.50 |

| Faster Payments: £2 | |

| CHAPS: £25 | |

| SWIFT: £25–£35 depending on type | |

| FX Commissions | BFA: 0.75% |

| EFA: GBP 0.85%, EUR 0.375%, USD 0.60% (charged quarterly) | |

| Other Fees | Manual payments: £25 |

| Audit letters: £50 + VAT | |

| Manual requests: time-based |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now