Company Summary

| SHIMADAI Review Summary | |

| Founded | 2011 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Stocks, mutual funds, bonds, investment trust |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Phone: 076-423-8331, 0765-52-2200 (9:00~17:00 / Closed : Saturdays, Sundays, and holidays) | |

| Address: 〒930-0044 富山県富山市中央通り2丁目4-9 | |

Founded in 2011, Shimadai Securities is a Japanese brokerage firm regulated by the Financial Services Agency (FSA). The company offers diverse market instruments, including stocks, mutual funds, bonds, and investment trust. However, information on trading platforms and accounts is limited. Additionally, the firm only supports the Japanese language on its website.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited info on accounts |

| Various trading products | Single supported language |

| No demo accounts | |

| Lack of info on trading platforms |

Is SHIMADAI Legit?

Yes, at present, SHIMADAI is regulated by FSA, holding a Retail Forex License.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Services Agency (FSA) | 島大証券株式会社 | Regulated | Retail Forex License | 北陸財務局長(金商)第6号 |

What Can I Trade on SHIMADAI?

On SHIMADAI, you can trade with stocks, mutual funds,bonds, and investment trust.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Mutual Funds | ✔ |

| Investment Trust | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

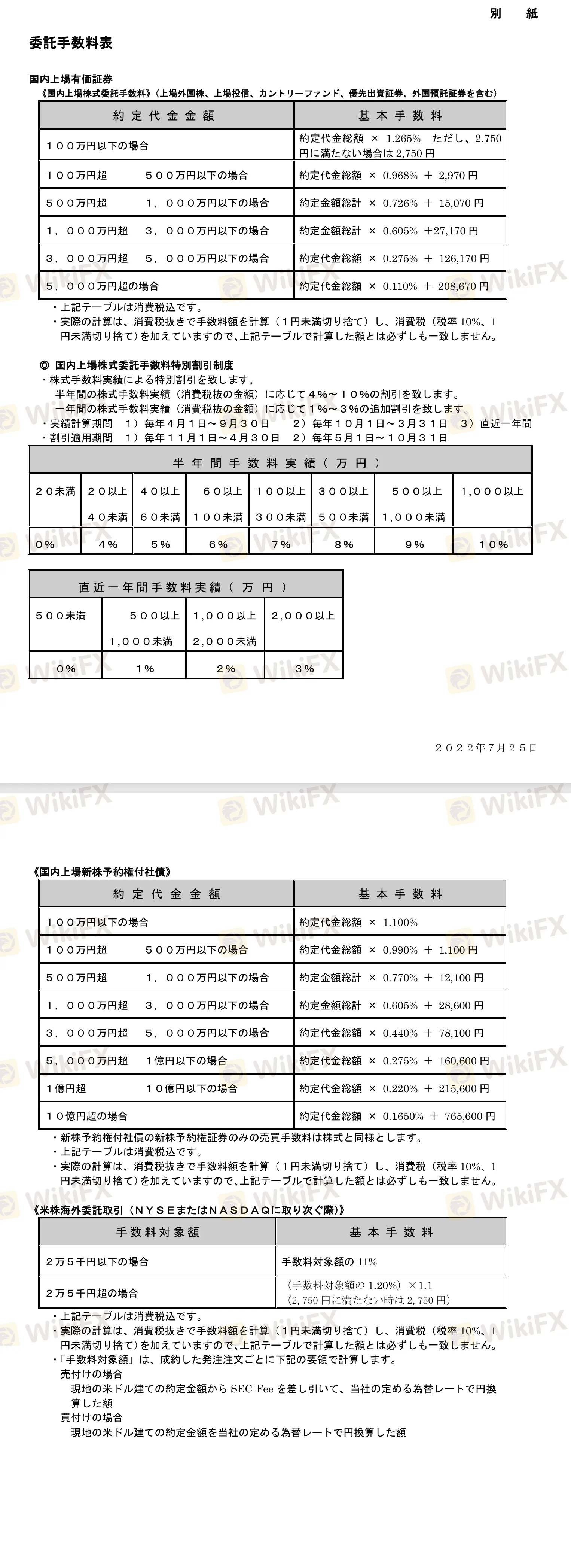

Fees

For detailed fee structure, you can refer to their website: http://shimadai.com/service/. However, it seems that the language only supports Janpanese.