Company Summary

| BOQ Review Summary | |

| Founded | 1874 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Financial Services | Bank accounts, home loans, credit cards, personal loans, insurance, business loans, business accounts, foreign exchange and trade services, merchant and payment products |

| Minimum Deposit | 0 |

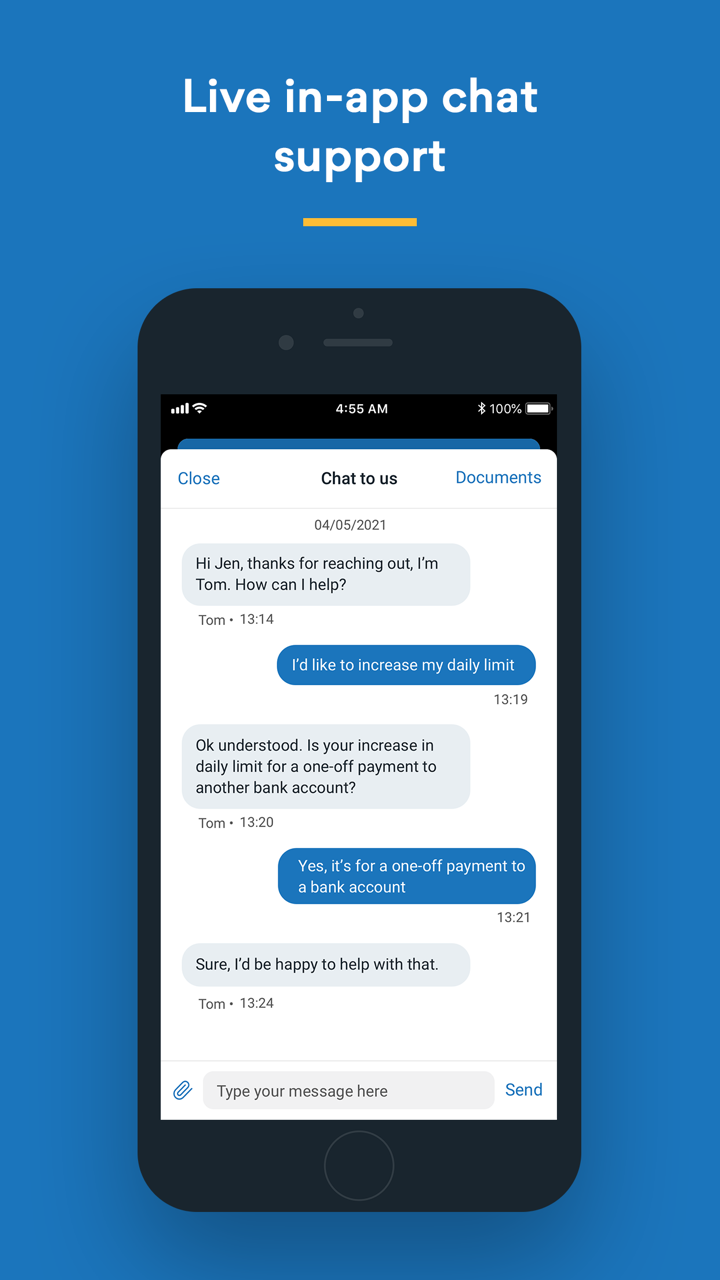

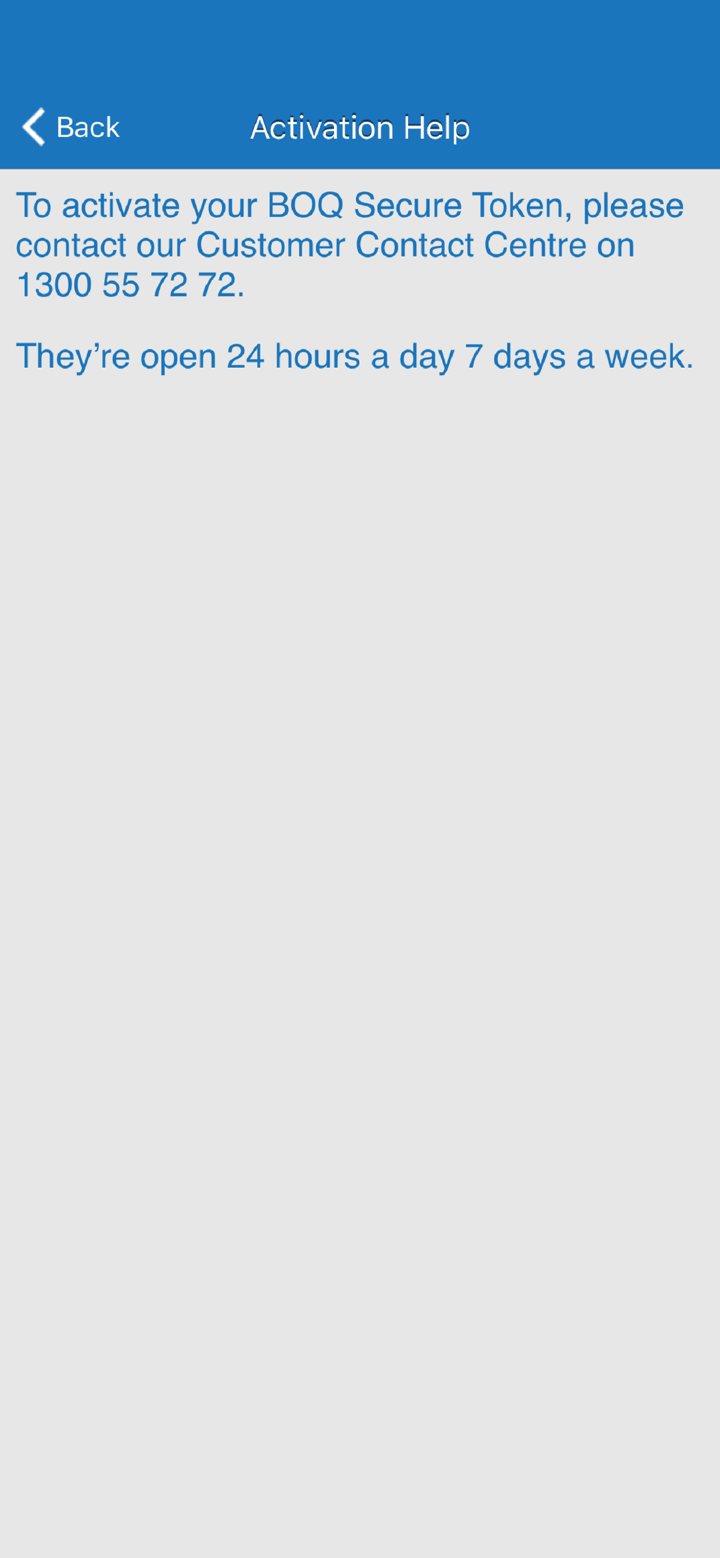

| Customer Support | Tel: 1300 55 72 72 |

BOQ Information

BOQ, established in 1874 and regulated by ASIC, offers diverse financial services for individuals and businesses, including various bank accounts, home and personal loans, credit cards, insurance, and specialized business banking solutions. They are noted for having a zero minimum deposit requirement for some accounts.

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | Age restrictions on high-yield savings |

| Diverse account types | Limited channels for customer support |

| Zero minimum deposit | |

| Long operation time |

Is BOQ Legit?

BOQ has a Market Maker (MM) license regulated by the Australian Securities and Investments Commission (ASIC) in Australia with a license number of 000244616.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | Bank of Queensland Limited | Australia | Market Maker (MM) | 000244616 |

Financial Services

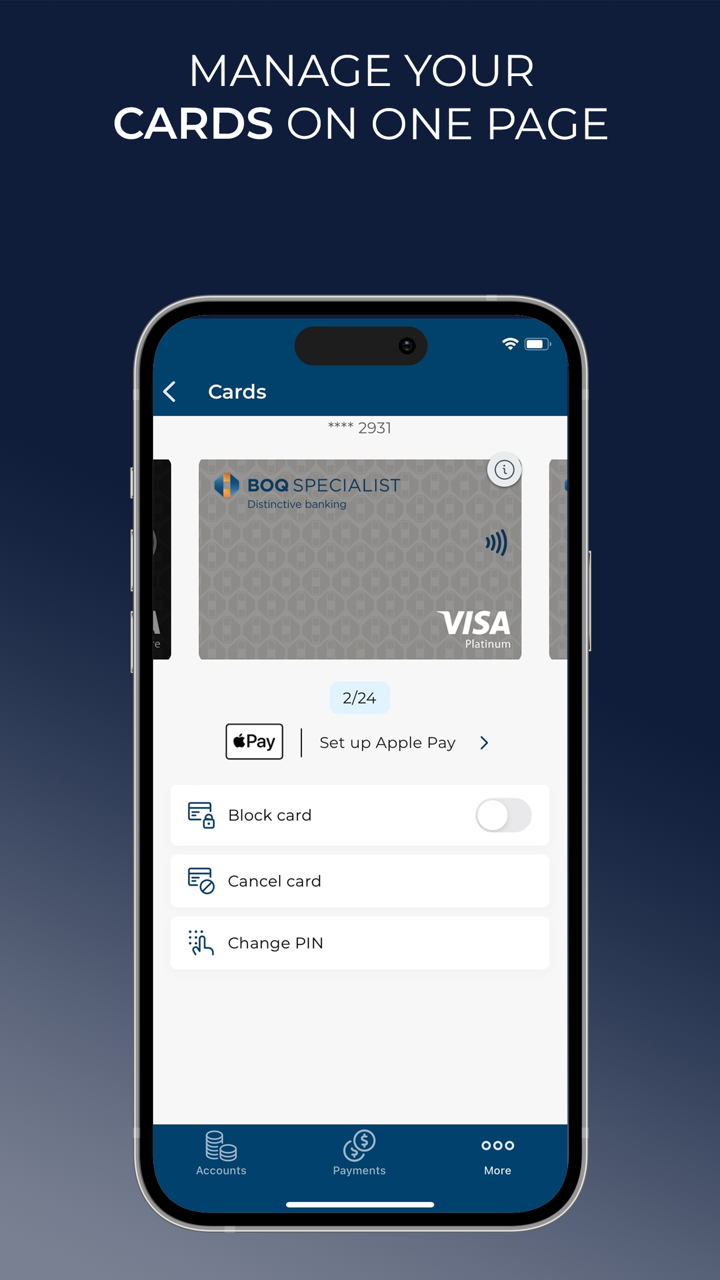

- For individuals, BOQ offers bank accounts (transaction, savings, term deposits), home loans (including refinancing and calculators), credit cards (with rewards), personal loans, and insurance (home/contents and car).

- For businesses, BOQ offers loans and finance (including business loans and overdraft), business accounts (transaction, savings, Visa debit card), foreign exchange and trade services, merchant and payment products, industry expertise (e.g., agribusiness, healthcare), and business banking support (tools, calculators, knowledge hub).

Account Type

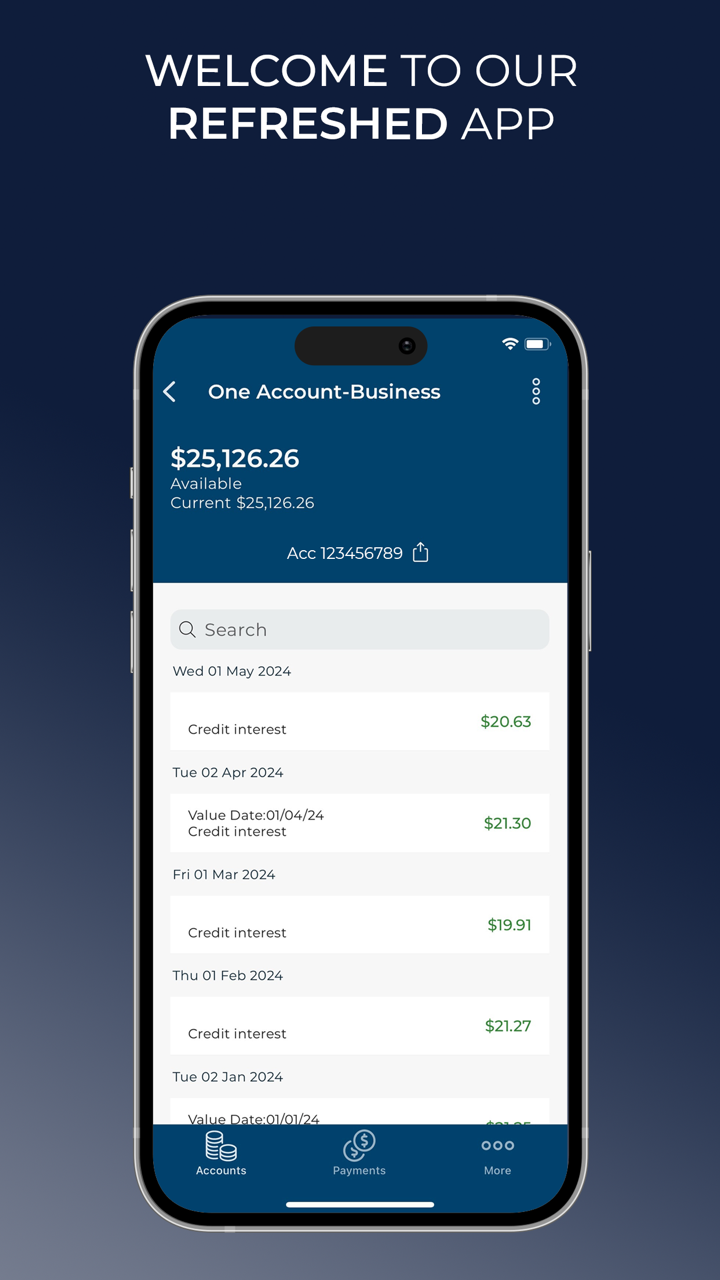

Business bank account: BOQ offers various business bank accounts, including Business Transaction Accounts for daily operations and Savings and Investment Accounts to earn interest on business funds. They also provide Industry Specialist Accounts tailored for sectors like Solicitors, Real Estate Agents, and Not-for-Profits.

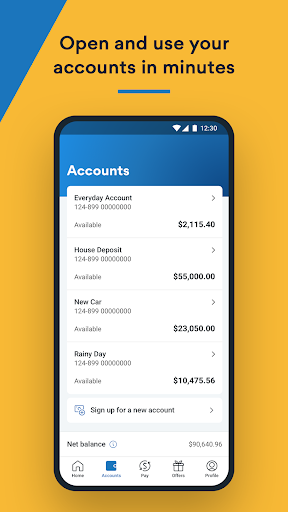

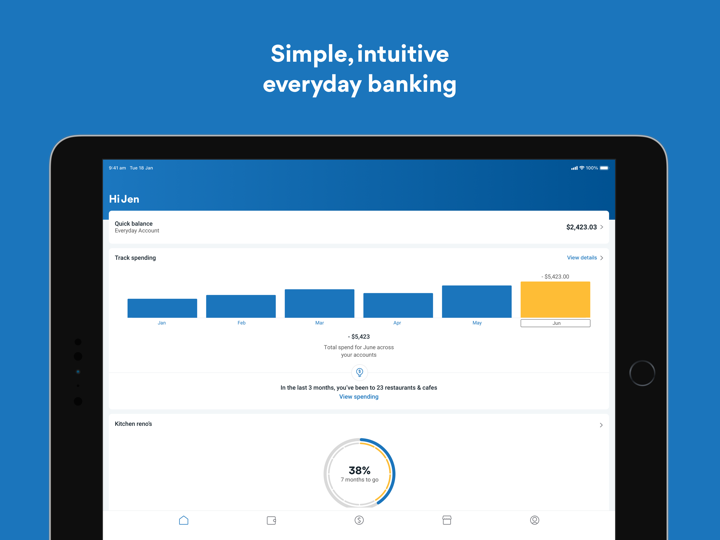

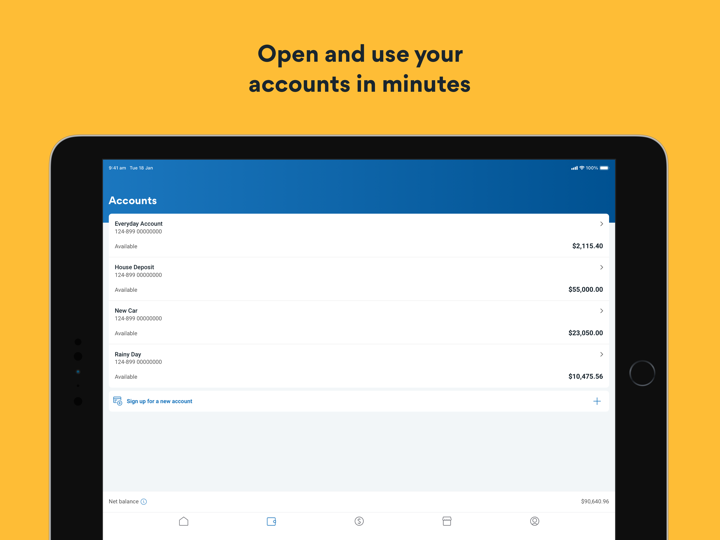

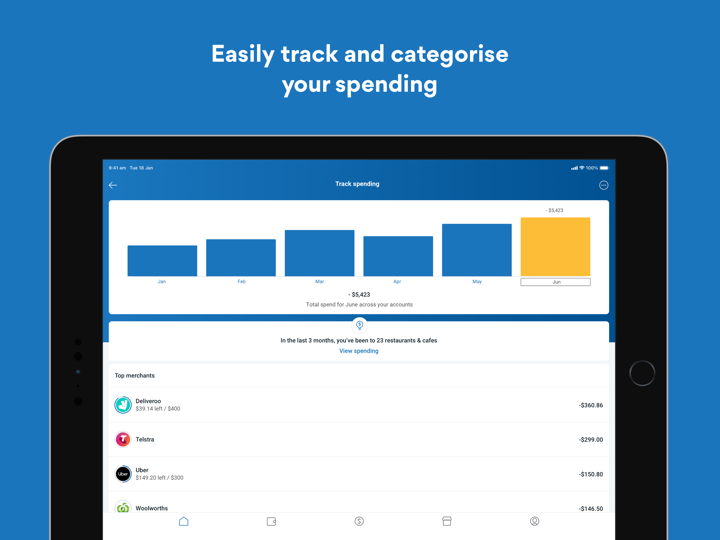

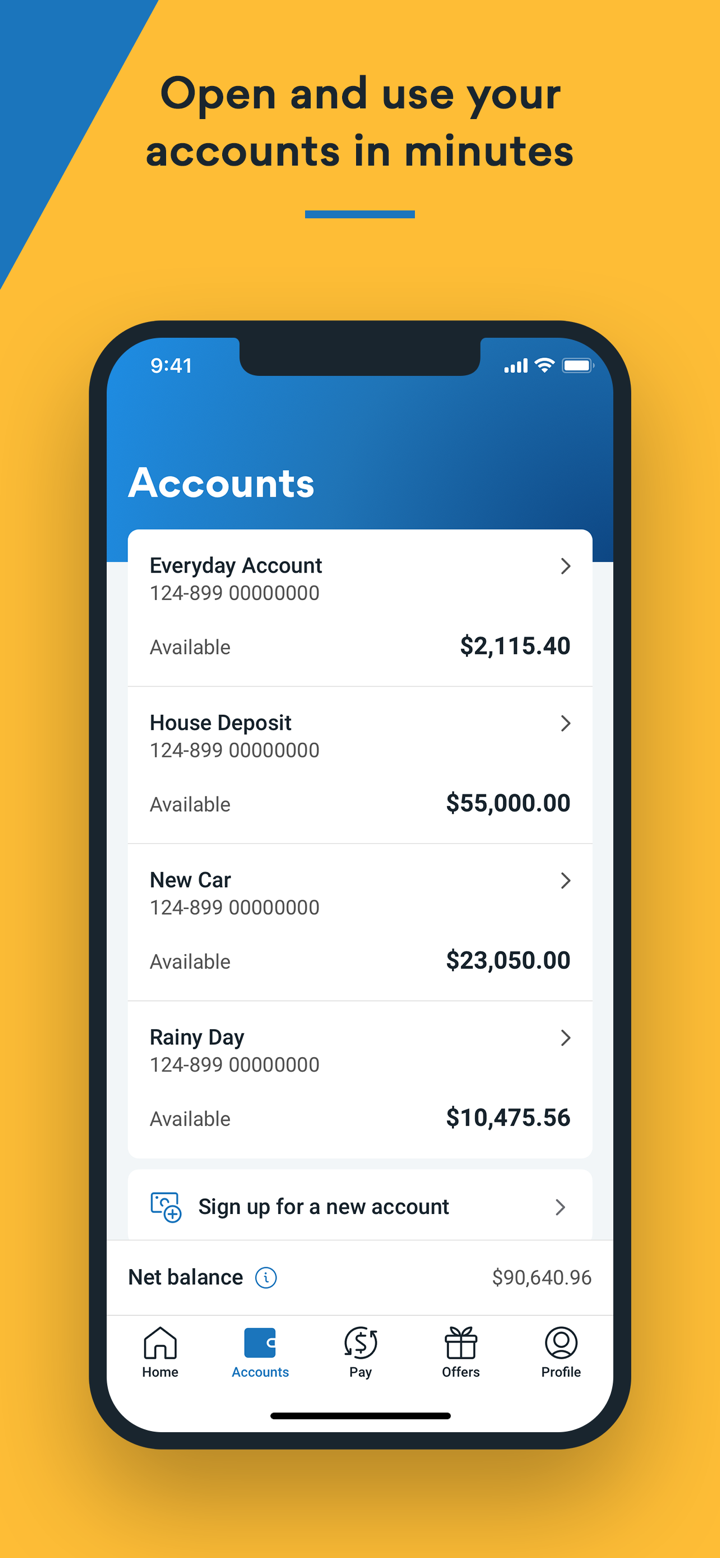

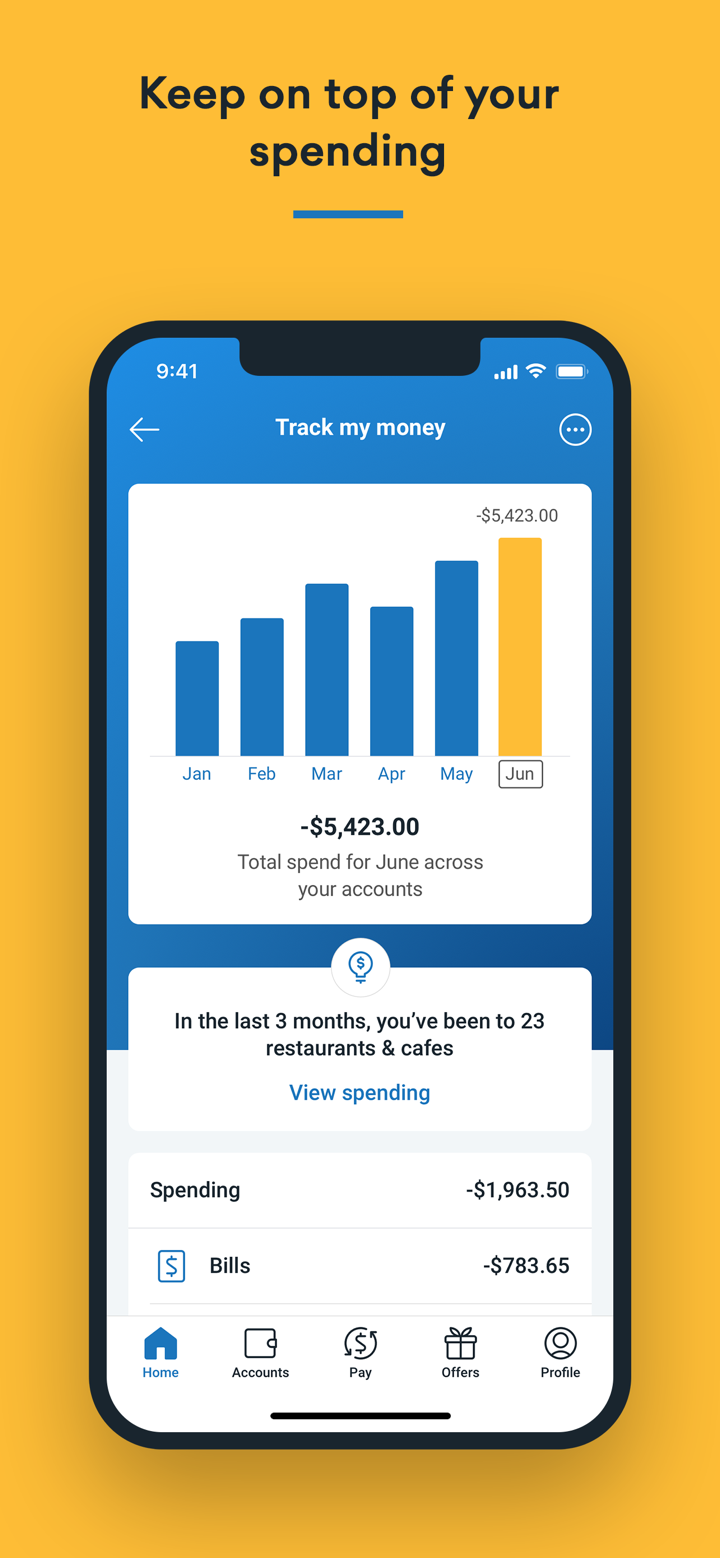

Personal account: BOQ offers two types of personal accounts, which are the Transaction Account and Savings Accounts.

Transaction account: BOQ's transaction accounts generally feature no monthly account-keeping fees, no withdrawal fees at BOQ ATMs within Australia, and no transaction fees within Australia. They also state no overdrawn fees if you happen to overdraw your account.

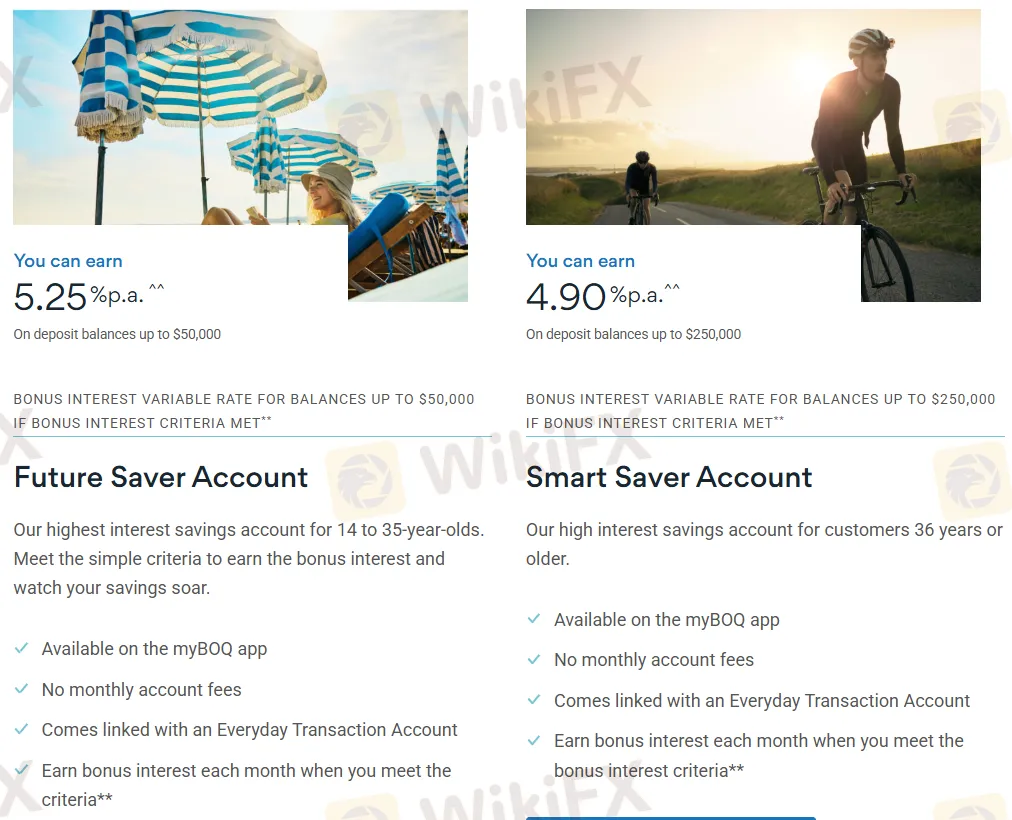

Savings accounts:

| Feature | Future Saver Account (14-35 years old) | Smart Saver Account (36 years or older) | Simple Saver Account | Term Deposits (Balances $5,000 - $249,999, Term 12-24 months) |

| Interest Rate | 5.25% p.a. on balances up to $50,000 | 4.90% p.a. on balances up to $250,000 | 4.55% p.a. on balances up to $5M | 4.00% P.A. |

| Bonus Interest | Variable rate up to $50,000 if criteria met | Variable rate up to $250,000 if criteria met | Get a great, ongoing interest rate | Fixed term interest rates and no account fees |

| Availability | Available on the myBOQ app | - | ||

| Monthly Account Fees | ❌ | ❌ | ❌ | ❌ |

| Minimum Deposit | - | - | 0 | $1,000 |

| Other Features | Earn bonus interest each month when criteria met | Simply sit back and watch your savings grow | Flexible terms from just 1 month, choose interest payment frequency | |

2025 SkyLine Malaysia

2025 SkyLine Malaysia

jun26

Zimbabwe

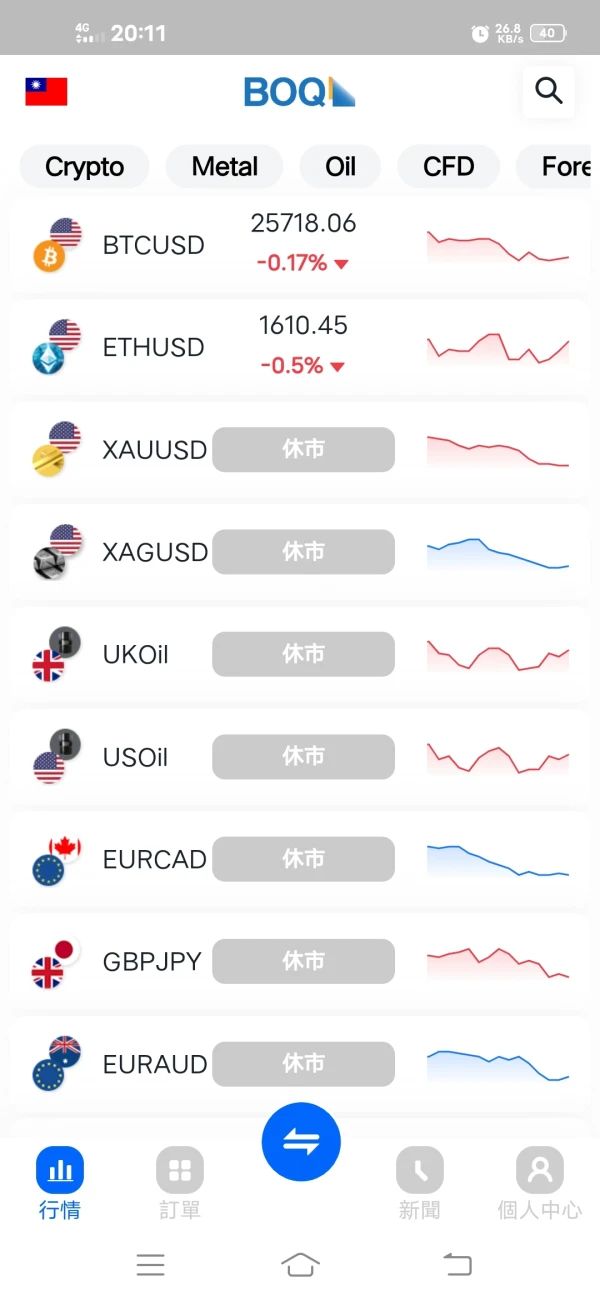

Fake platform. If you encounter a BOQ that requires you to deposit money, be careful. You can only deposit money but not withdraw money. They will find various reasons to prevent you from withdrawing money and ask you to continue to pay a margin.

Exposure

gerry400

Jersey

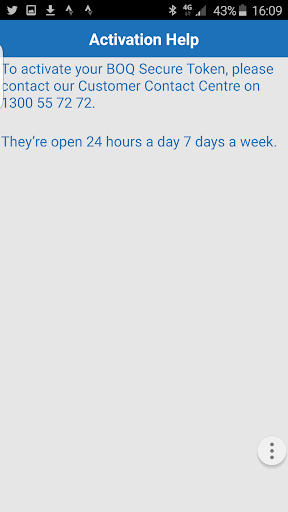

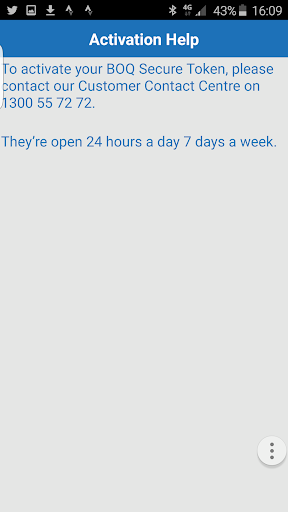

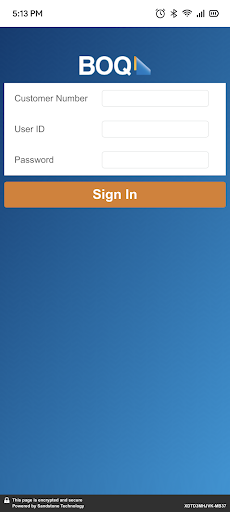

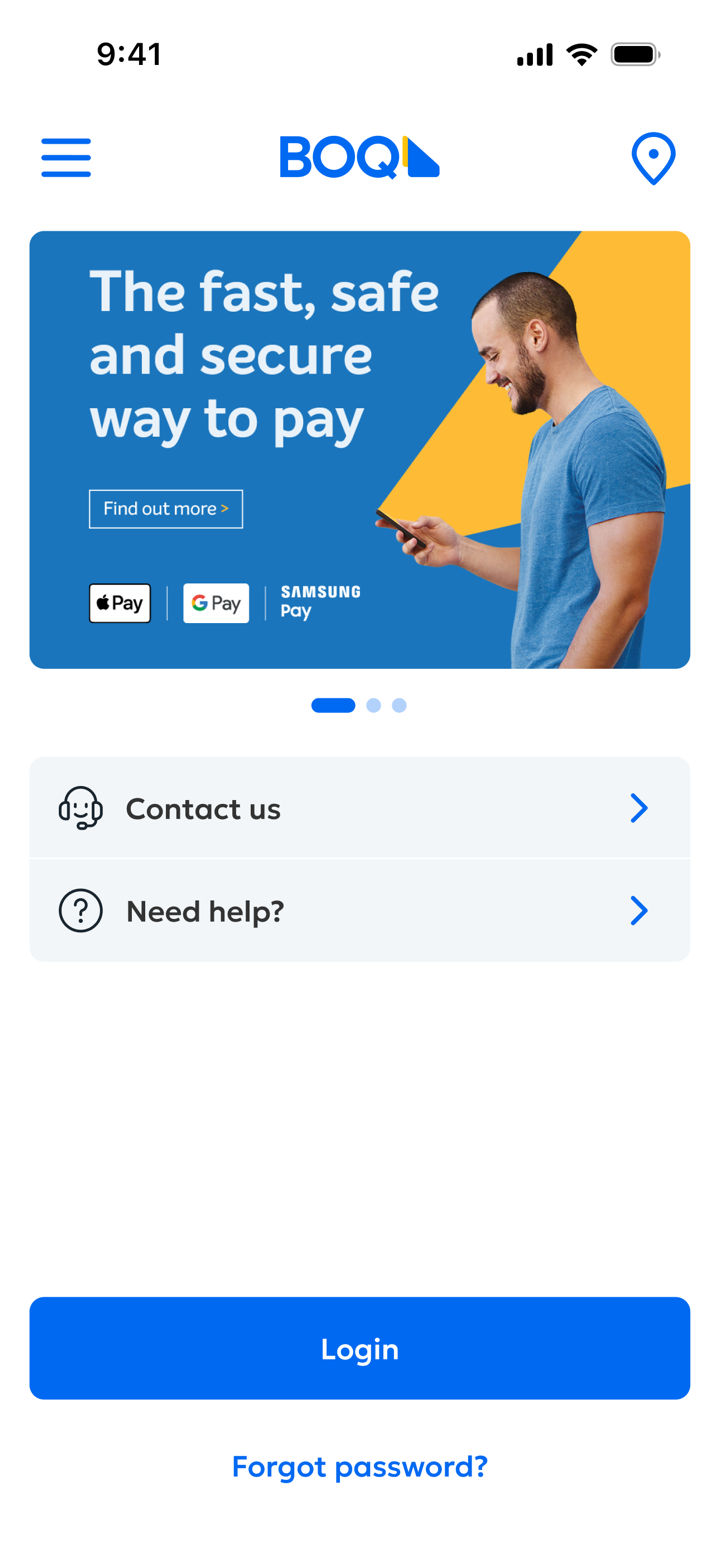

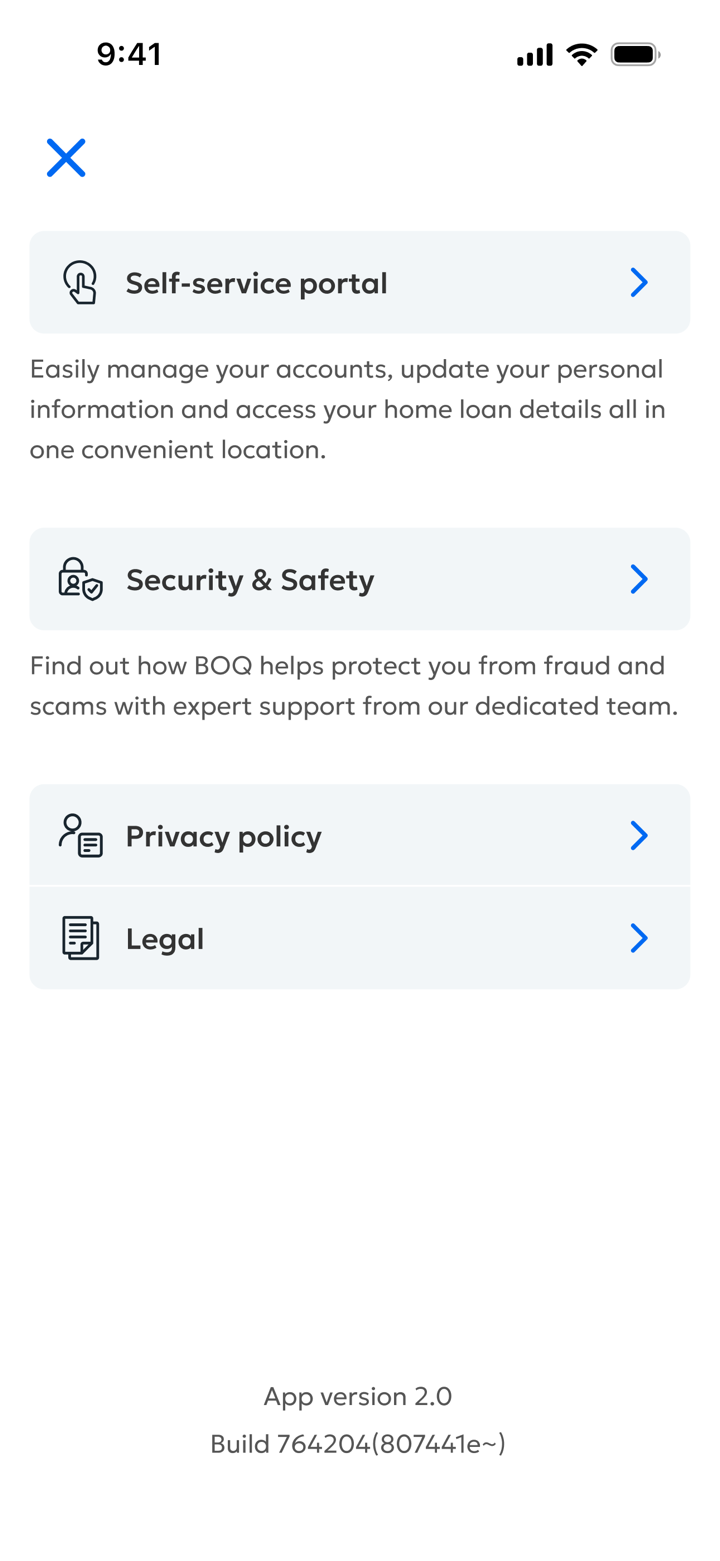

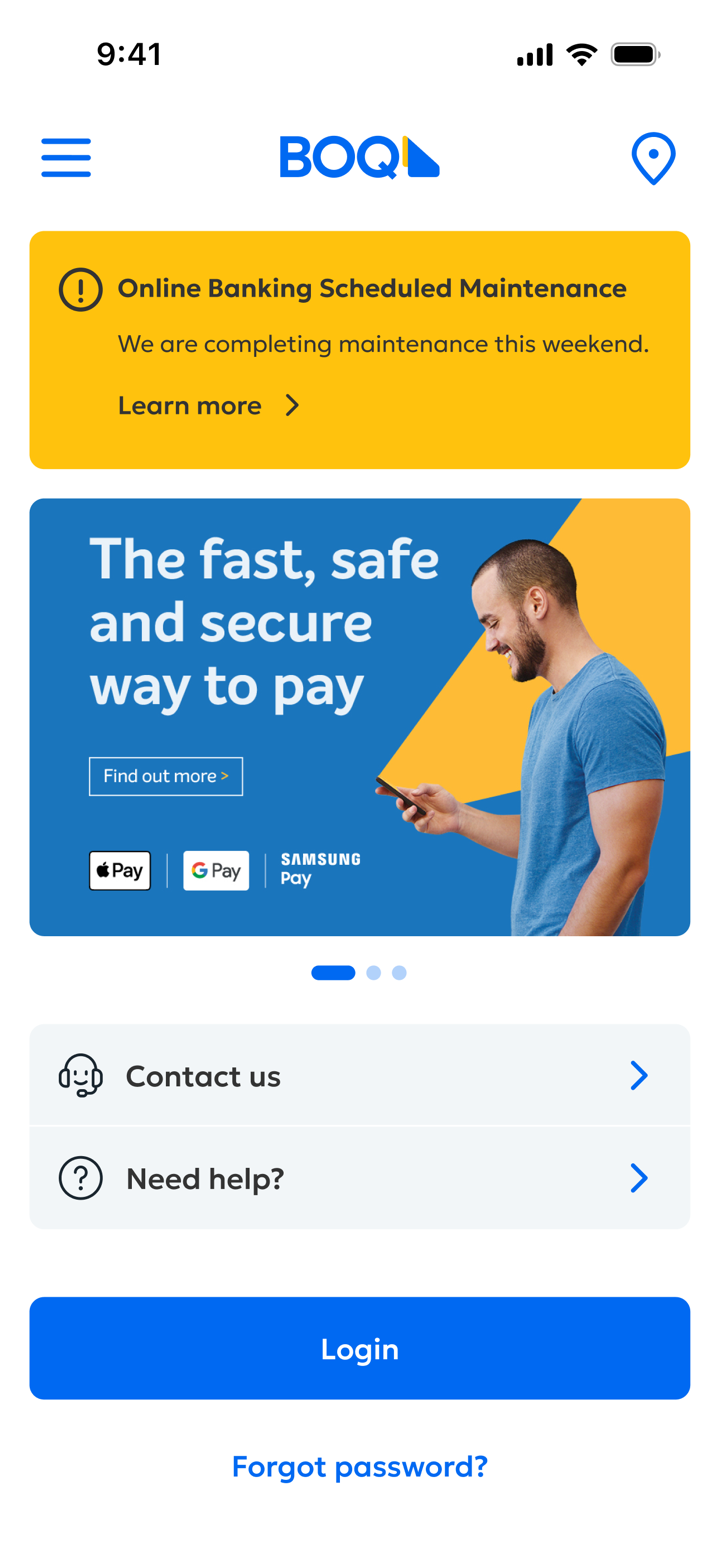

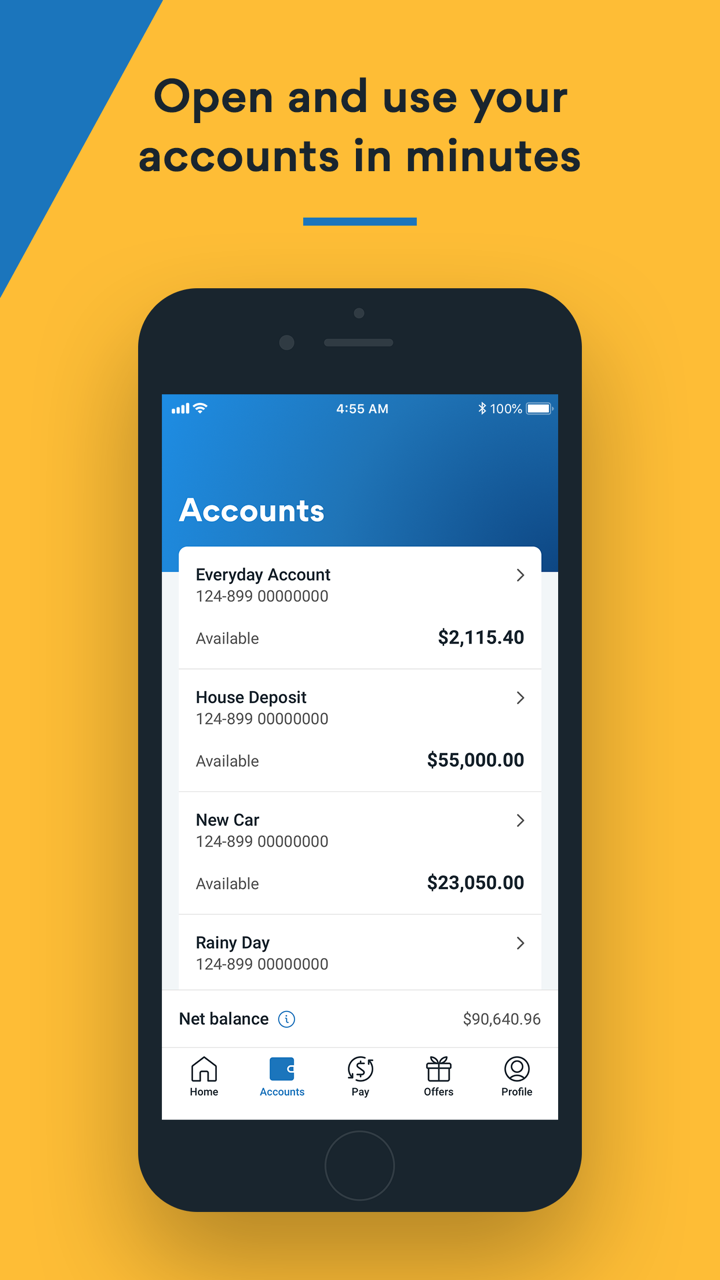

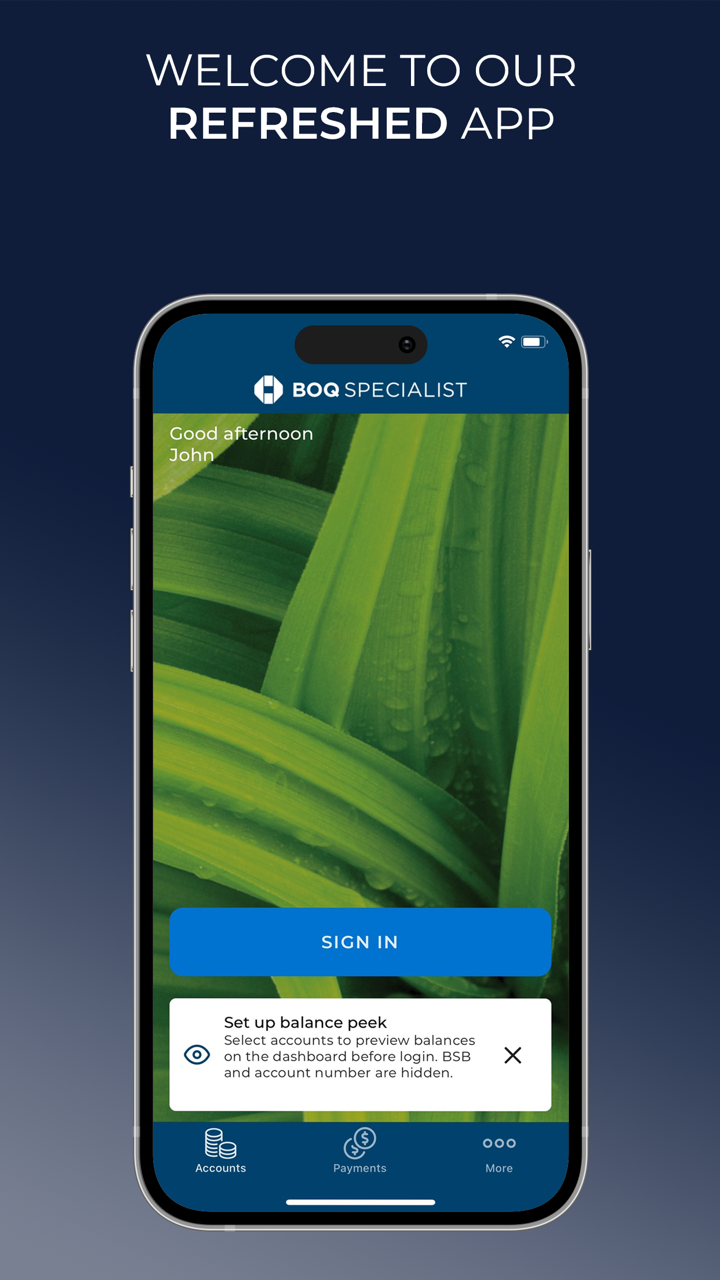

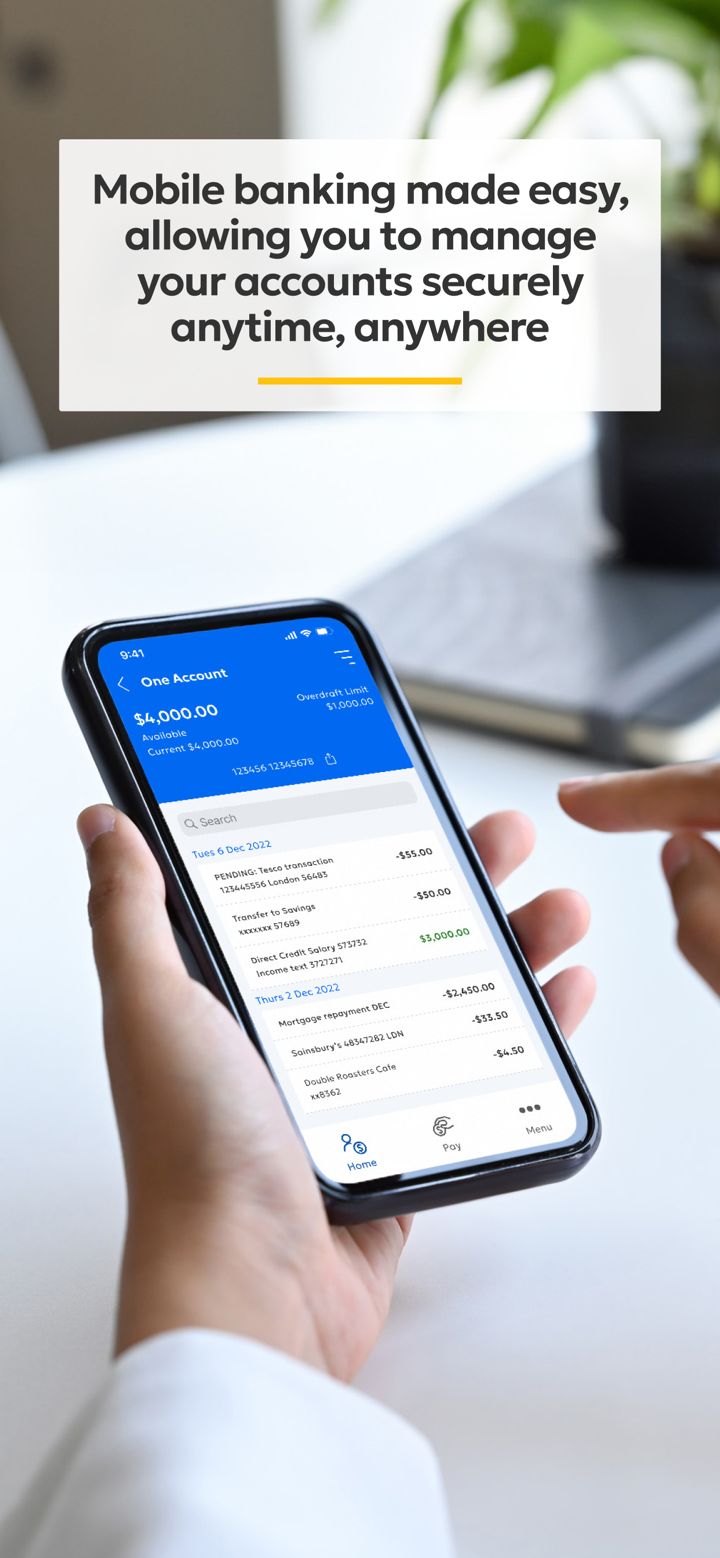

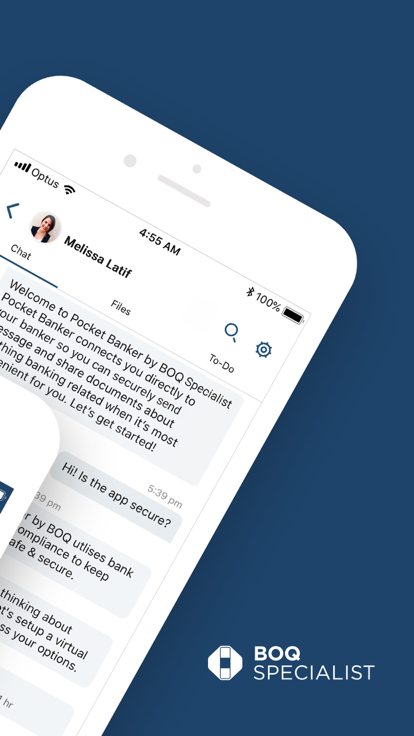

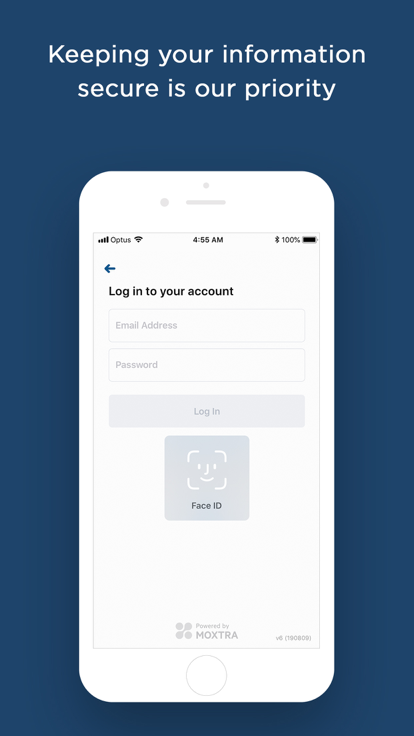

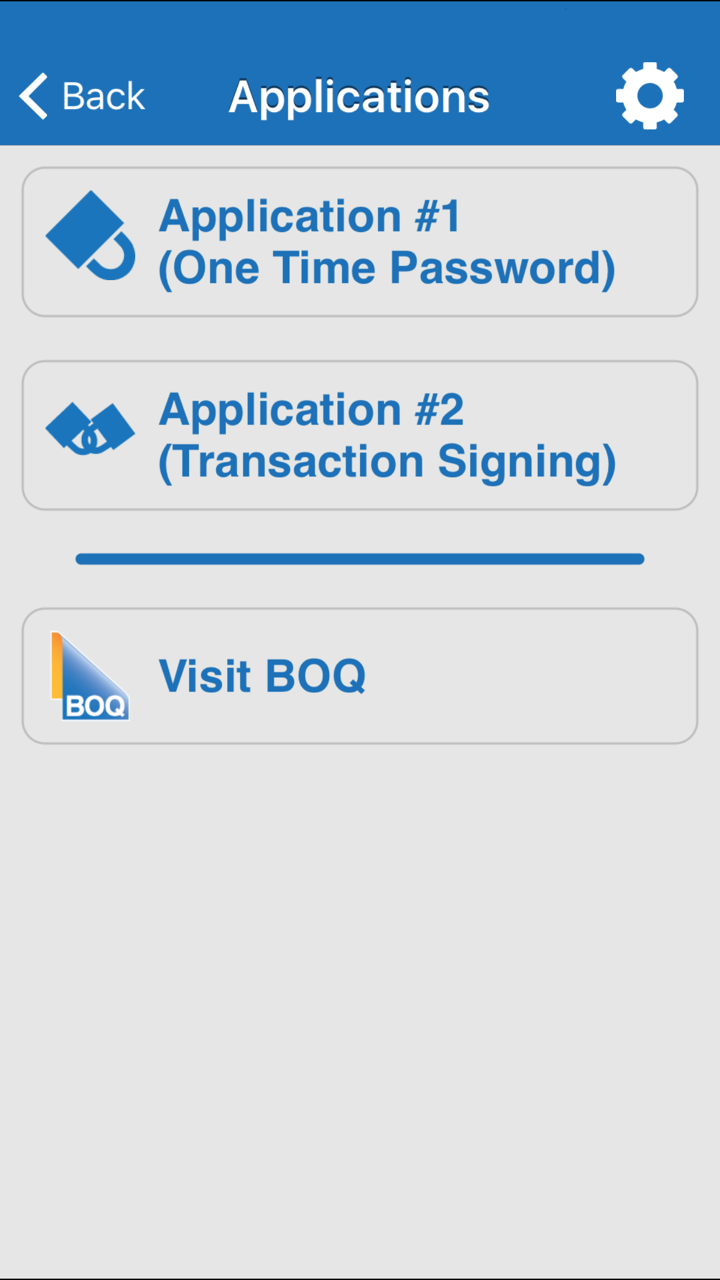

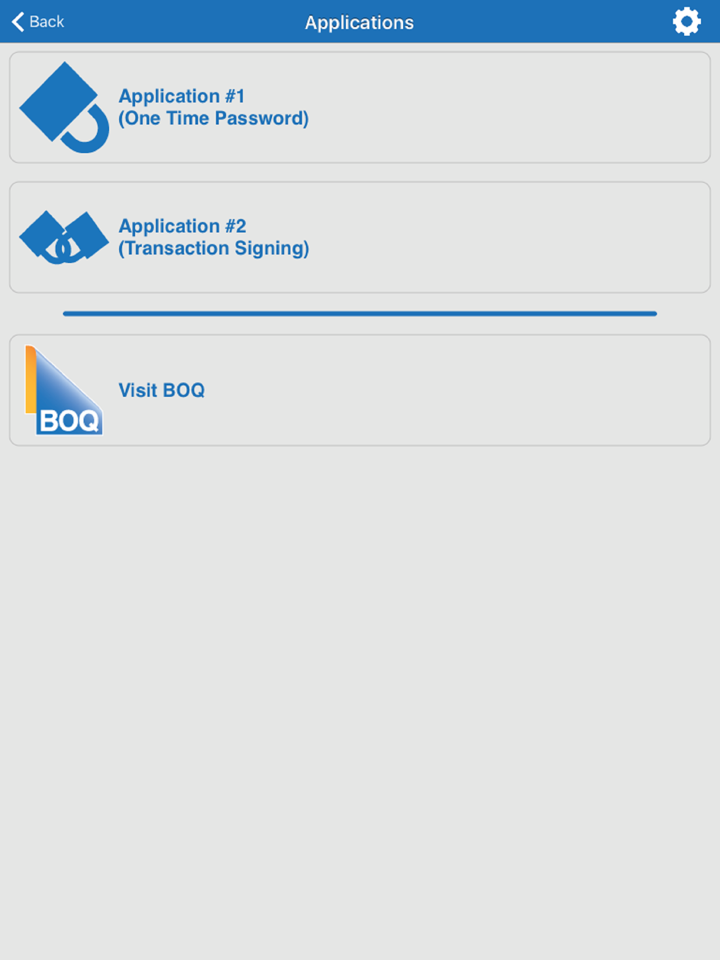

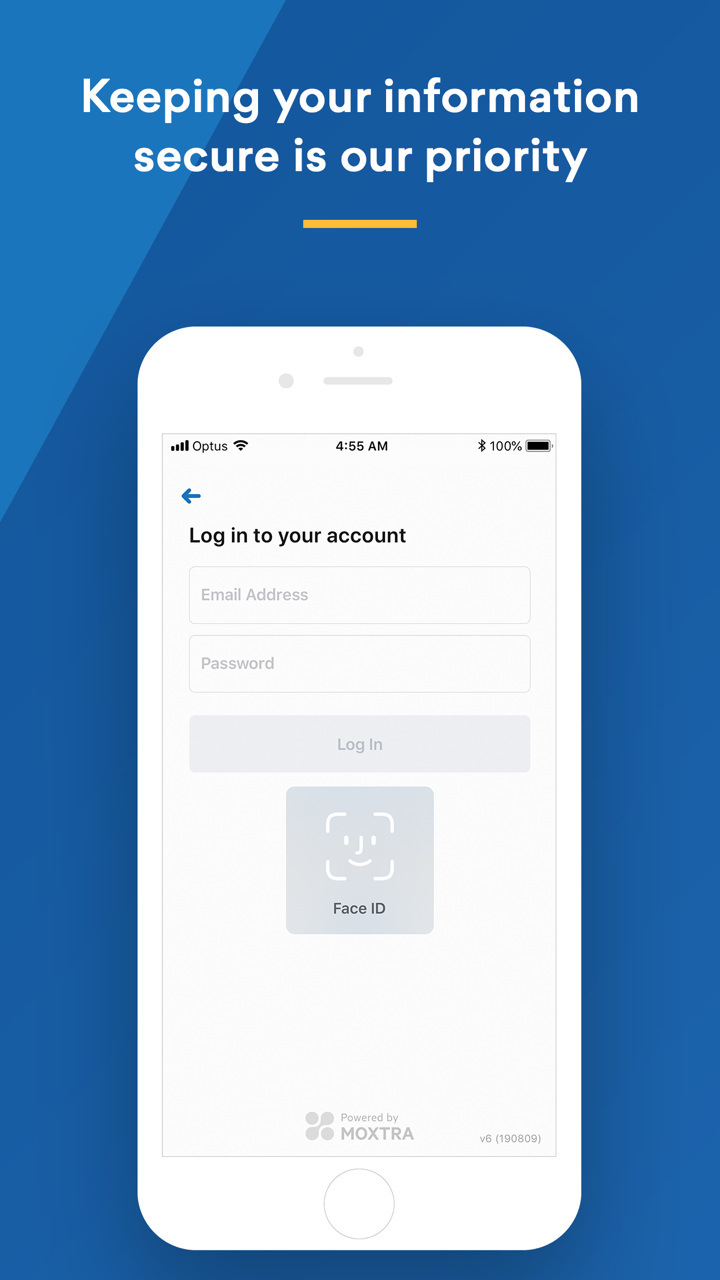

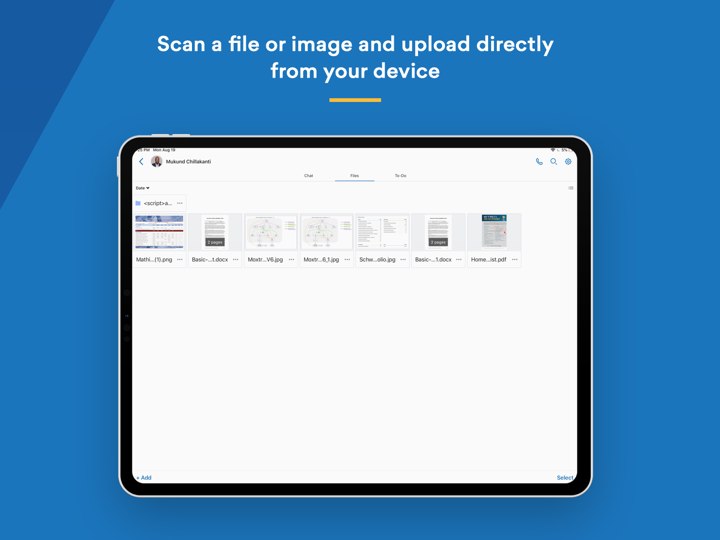

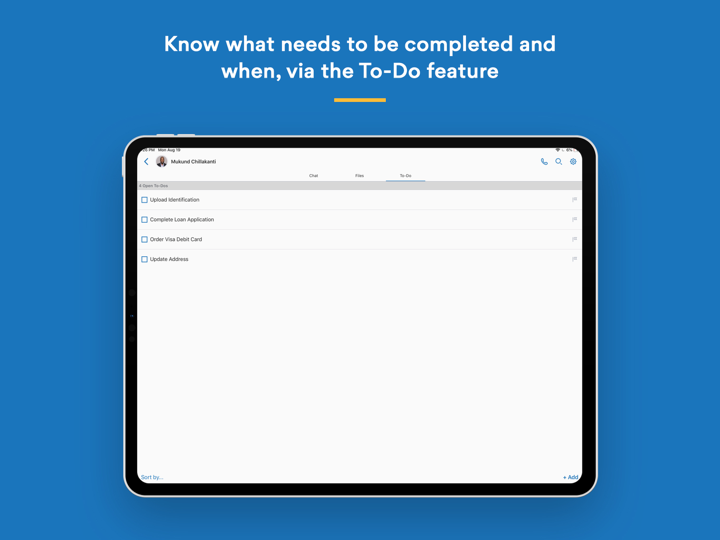

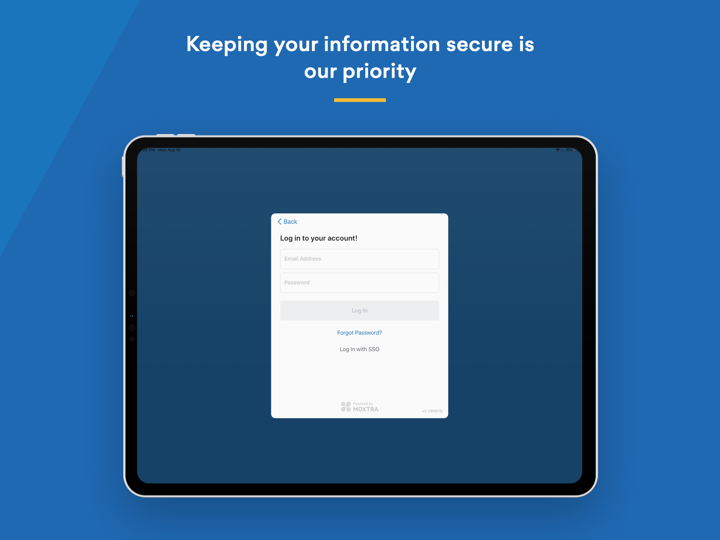

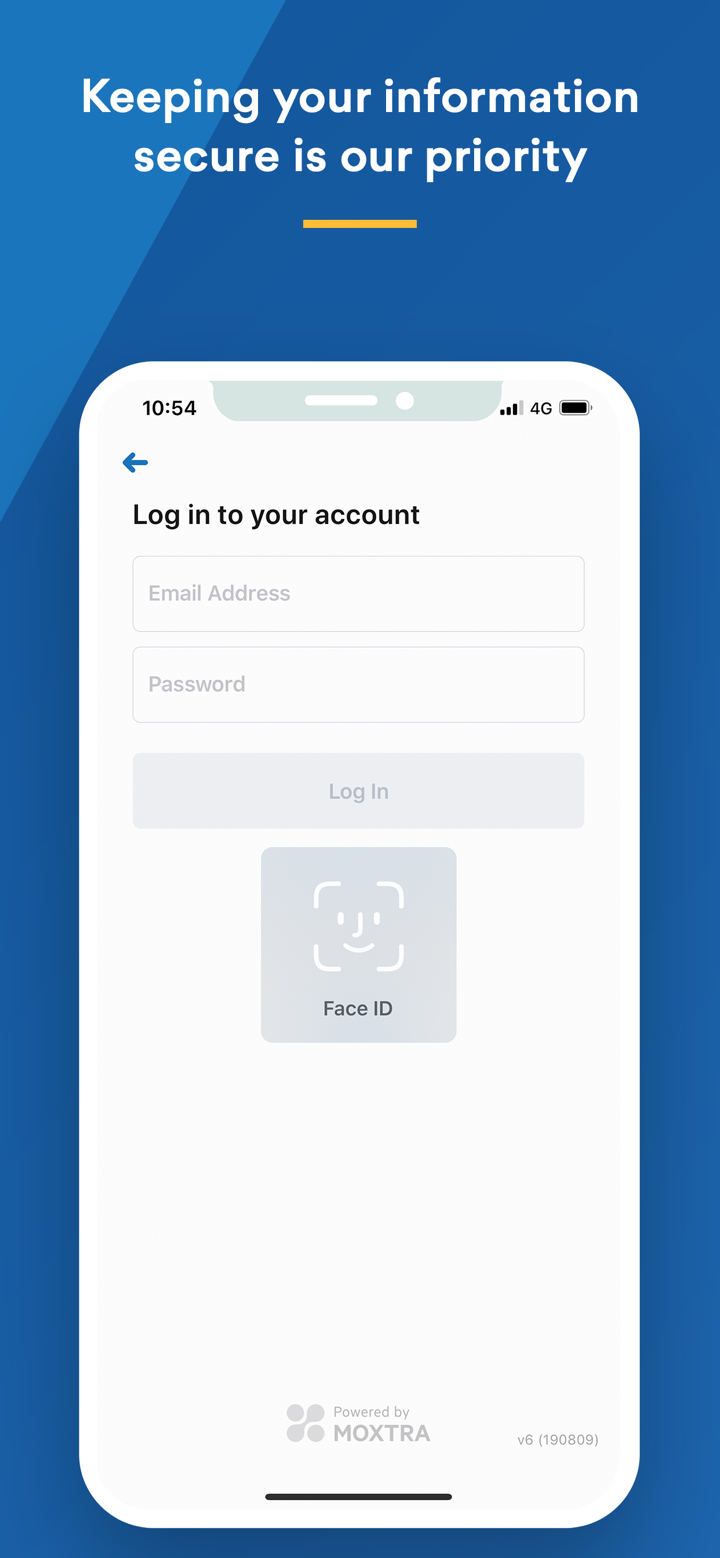

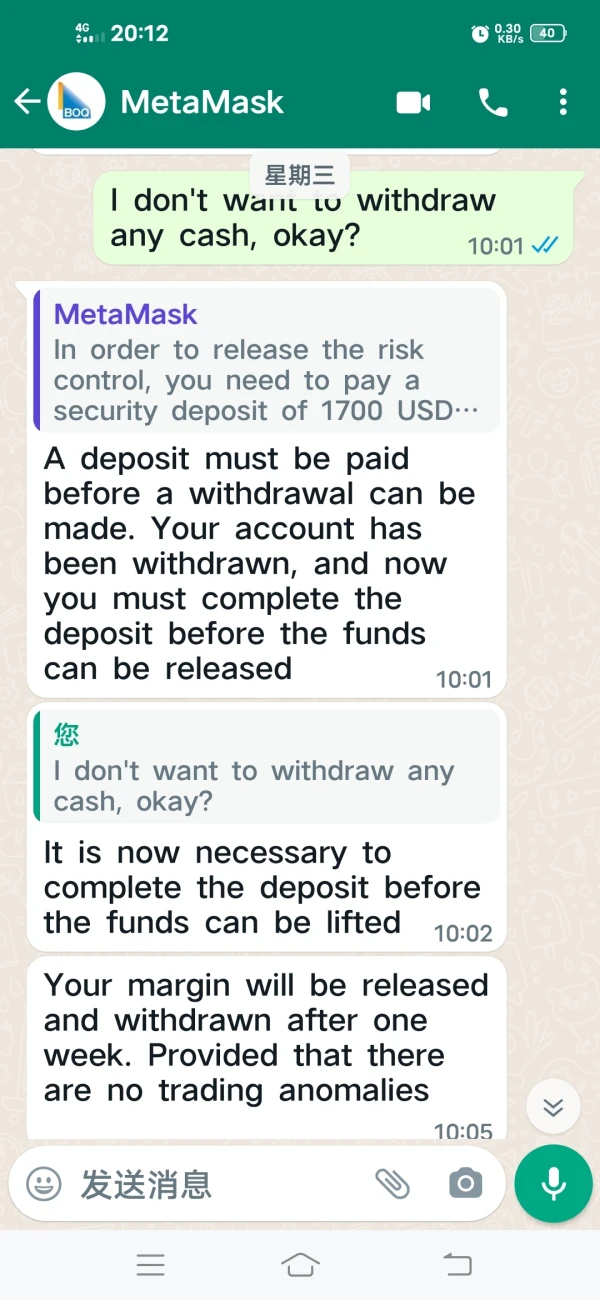

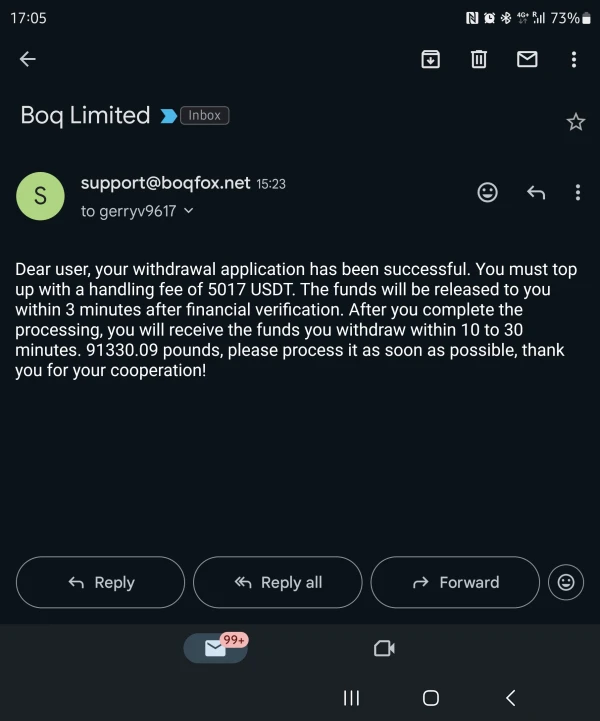

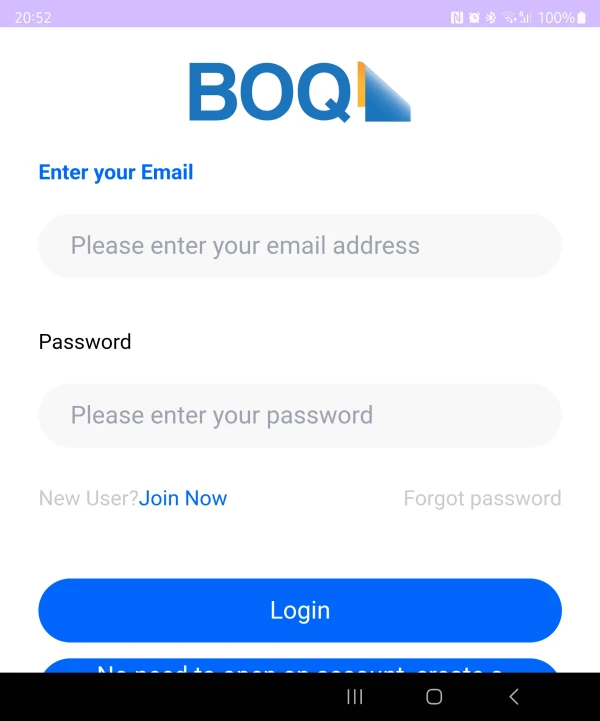

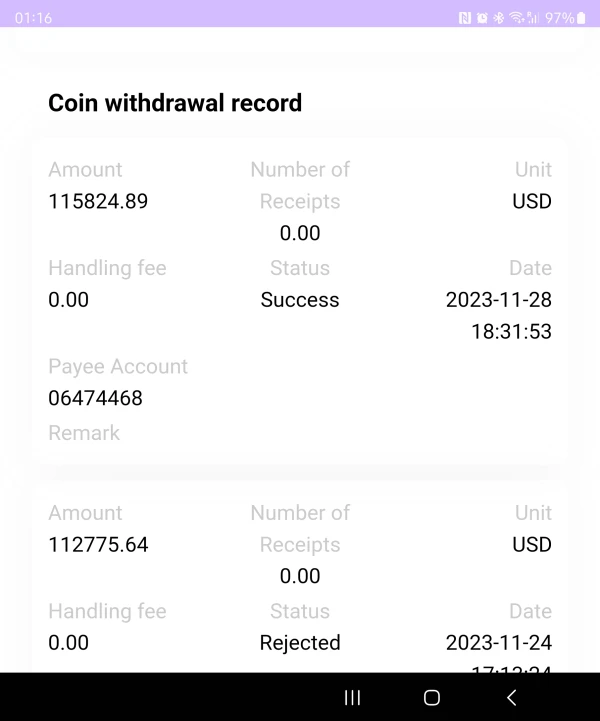

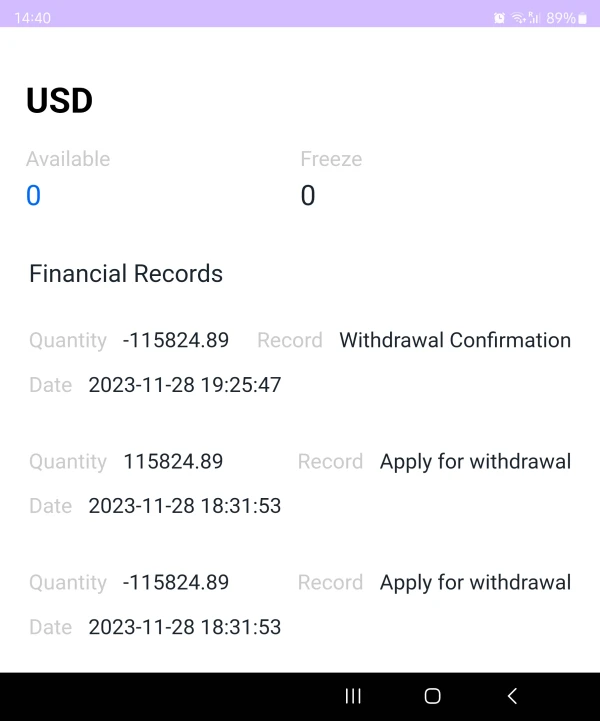

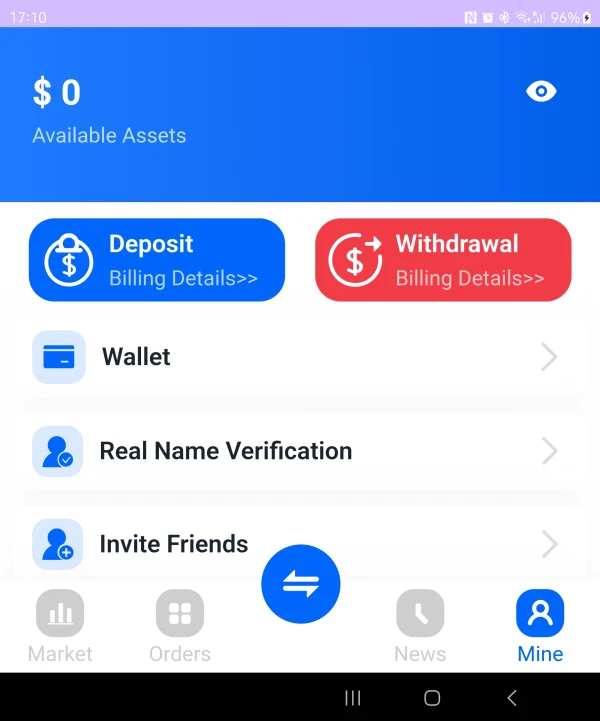

i have made a withdawal of 112,775 USD and its under review. i follow up thru customer service and they advice me that the amount that i have withdrawn cannOT be release due to ID Account Abnormality and needS to recharge to the last amount 3,035 USDT which is being deposited thru OKX via merchants. they explained to me the problem so i was encourage to pay the recharge fee. after a while customer service sent me a message that the are ready to release including the too up payment. however since i agree to release the money i need to pay from my own pocket the amount if 5,017USD as a handling fee and after receiving the payment they will release the money within 10 to 30 minutes. i didnt pay because i realizes ive been scammed already. the last picture on the bottom is their BOQ forex platform and the second one is the log in. this is different from legit BOQ platform which is yellow in color as shown on the last photo

Exposure

David Wilson

United Kingdom

Queensland Bank,a big bank, great service.👍👍👍 They are first-class.

Positive

王苏彬

United Kingdom

ASIC is one of the best regulators in the world and BOQ is my current forex broker. It's able to provide a series of satisfactory services and my money is safe.

Neutral

Aung Myohlaing

Spain

I love the experience of trading with BOQ so far! It is an honest and caring company. They can always answer my questions in time and solve them as soon as possible.

Positive

想當年

Hong Kong

BOQ’s customer support service leaves me a very good impression! Their stuff can always answer my questions patiently and gently, and give me some useful suggestions. So they have become one of my favorite brokers.haha..they did a really good job! Respect!!

Positive

卡布奇诺80913

Hong Kong

I never use this bank before, but it is quite influential in Australia… Its customer support seems quite excellent, their staff would answer your questions politely.

Neutral

漫步咖啡

Hong Kong

I do not know what to say, bank transfers sometimes need longer time... I once used its services, then it disappointed me. I suggest that you should go to find other companies...

Neutral