Company Summary

| Key Information | Details |

| Company Name | Mercury FX |

| Year of Establishment | 2007 |

| Headquarters | United Kingdom |

| Office Locations | South Africa, Australia |

| Regulation | FCA (EXCEEDED, FSCA (EXCEEDED) |

| Tradable Assets | Forex |

| Account Types | Private Account, Corporate Account |

| Minimum Deposit | Private Account: $250, Corporate Account: $50,000 |

| Leverage | Up to 1:1000 |

| Spread | From 0.8 pips |

| Deposit/Withdrawal Methods | Bank Wire Transfer, Credit Card, Debit Card, E-wallets |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Live Chat, Email, Phone |

Overview of Mercury FX

Mercury FX is a well-established financial company founded in 2007 and headquartered in London, the UK. They offer forex trading services and provide access to various financial instruments, including stocks, commodities, indices, and cryptocurrencies. The company caters to different types of traders with their account options, such as Private and Corporate Accounts, each having specific leverage ratios and spreads. It's important to note that their license has been exceeded, which raises potential risk concerns.

Traders can use popular trading platforms like MetaTrader 4 and MetaTrader 5, known for their ease of use and versatility. They have expanded their reach with offices in South Africa and Australia and provide customer support through live chat, email, and phone channels.

Regulation

Mercury FX holds two licenses, one for the UK and South Africa, respectively.

Regulation of Mercury FX by Financial Conduct Authority (FCA):

Mercury FX is regulated by the Financial Conduct Authority (FCA) in the UK with license number 531127. However, it's important to note that their license status is “EXCEEDED.” Despite being authorized to provide payment services within the UK, Mercury FX's scope of business surpasses the limitations outlined in their FCA license.

Being regulated by the Financial Conduct Authority (FCA) indicates that Mercury FX has met the necessary requirements to offer payment services within the UK. However, their “EXCEEDED” license status implies that the company's activities go beyond the parameters set by their FCA license.

Regulation of Mercury FX by Financial Sector Conduct Authority (FSCA):

Mercury FX is also regulated by the Financial Sector Conduct Authority (FSCA) in South Africa with license number 46875. Nevertheless, it's essential to acknowledge that their license status is “EXCEEDED” as well. Despite being licensed to provide financial services within South Africa, Mercury FX's operations extend beyond the limits specified in their FSCA license.

Being regulated by the Financial Sector Conduct Authority (FSCA) permits Mercury FX to offer financial services in compliance with South African laws and regulations. However, their “EXCEEDED” license status signifies that the company's activities surpass the boundaries established by their FSCA license.

Pros and Cons

Mercury FX offers a variety of financial instruments, including forex trading services and access to stocks, commodities, indices, and cryptocurrencies. Traders have the option to choose between Private and Corporate Accounts, each with different leverage ratios and spreads. The availability of popular trading platforms like MetaTrader 4 and MetaTrader 5 ensures a user-friendly experience for traders of all levels. Additionally, the company offers customer support through live chat, email, and phone channels through a support form. Their regulation by the Financial Conduct Authority (FCA) and the Financial Sector Conduct Authority (FSCA) adds an element of trust and compliance with financial standards.

A significant concern with Mercury FX lies in their “EXCEEDED” license status for both FCA and FSCA regulations, indicating that their scope of business surpasses their licensed parameters. This lack of adherence to licensed limitations may raise potential risks and uncertainties for traders. Additionally, some customers have reported complaints about high fees and slow withdrawals, which could impact the overall trading experience. While the company provides access to a range of financial instruments, the leverage offered for cryptocurrencies is limited to 1:20, which may not be sufficient for traders seeking higher leverage opportunities.

| Pros | Cons |

| Offers various financial instruments | EXCEEDED license status for FCA and FSCA regulations |

| Multiple account types available | Potential risks and uncertainties due to scope exceeding licensed limits |

| Popular trading platforms | Complaints about high fees and slow withdrawals |

| 24/7 customer support | Limited leverage (1:20) for cryptocurrencies |

| Regulated by FCA and FSCA |

Market Instruments

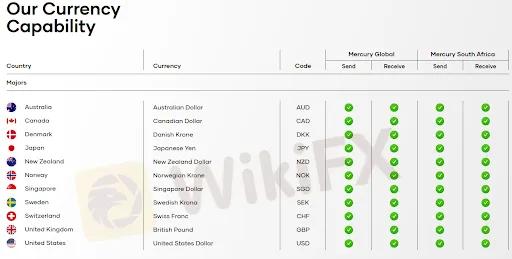

Mercury FX focuses solely on forex trading services. In comparison to other brokerages, they offer a narrower range of market instruments, which severely limits trading opportunities.

Forex: Mercury FX offers forex trading services only, allowing traders to participate in the foreign exchange market. They provide access to major and minor currency pairs, enabling clients to engage in currency exchange and speculate on currency price movements.

The following is a table that compares Mercury FX to competing brokerages:

| Broker | Market Instruments |

| Mercury FX | Forex |

| Alpari | Forex, Stocks, Commodities, Indices, Cryptocurrencies, Bonds |

| HotForex | Forex, Stocks, Commodities, Indices, Cryptocurrencies, Bonds, ETFs |

| IC Markets | Forex, Stocks, Commodities, Indices, Cryptocurrencies, Bonds |

| RoboForex | Forex, Stocks, Commodities, Indices, Cryptocurrencies, ETF |

Account Types

Mercury FX offers two account types: Private Account and Corporate Account. Specifics are as follows:

Private Account: The Private Account offered by Mercury FX requires a minimum deposit of $250. Traders can access leverage of up to 1:500, allowing them to amplify their positions. The spreads for this account type start from 1.0 pips, and there are no commissions or account fees associated with it. The Private Account is suitable for traders looking for lower initial deposit requirements and competitive leverage options.

Corporate Account: For the Corporate Account, a higher minimum deposit of $50,000 is required. Traders using this account type can access higher leverage of up to 1:1000, providing the potential for more substantial positions. The spreads for the Corporate Account start from 0.8 pips, and like the Private Account, there are no commissions or account fees. The Corporate Account is tailored for professional and institutional traders seeking enhanced leverage and tighter spreads.

| Account | Minimum Deposit | Leverage | Spreads | Commissions |

| Private Account | $250 | Up to 1:500 | From 1.0 pips | None |

| Corporate Account | $50,000 | Up to 1:1000 | From 0.8 pips | None |

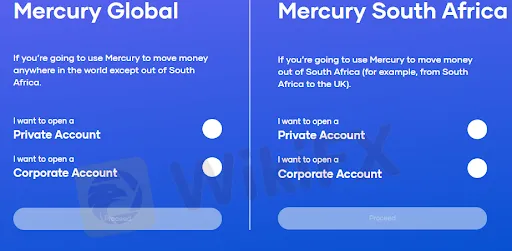

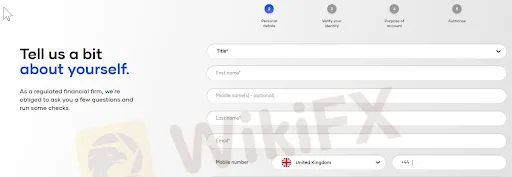

How to open an account?

To open an account with Mercury FX, locate the “Sign up” button on their website.

2. You will then be prompted to select the kind of account you want to create, and in which region.

3. You will then be redirected to a sign up form where you are required to provide the necessary information.

Minimum Deposit

Mercury FX offers different minimum deposit rates for its account types. The Private Account requires a minimum deposit of $250, while the Corporate Account demands a higher minimum deposit of $50,000.

Leverage

Mercury FX provides varying leverage options to traders. For the Private Account, traders can access leverage of up to 1:500, allowing them to increase their position sizes relative to their initial deposit. The Corporate Account offers even higher leverage, with traders being able to access up to 1:1000, providing more substantial leverage for professional and institutional clients.

Comparing the maximum leverage of Mercury FX with other brokerages, a table has been provided below:

| Broker | Maximum Leverage |

| Mercury FX | Up to 1:1000 |

| Alpari | Up to 1:1000 |

| HotForex | Up to 1:1000 |

| IC Markets | Up to 1:500 |

| RoboForex | Up to 1:2000 |

Spread

Mercury FX provides varying spreads for its forex trading services. For the Private Account, spreads start from 1.0 pips, while for the Corporate Account, spreads start from 0.8 pips. These spreads indicate the difference between the buying and selling price of currency pairs, and they can influence trading costs.

Deposit & Withdrawal

Mercury FX offers a variety of deposit and withdrawal methods for its clients. Traders can fund their accounts through bank wire transfers, credit cards, debit cards, and e-wallets. These methods provide flexibility and convenience for clients to deposit funds into their trading accounts.

Additionally, the absence of deposit fees further enhances the appeal of these deposit options. Withdrawals can be made using the same methods, and while the specific withdrawal fees vary depending on the chosen payment method, the company does not charge any deposit fees.

Trading Platforms

Mercury FX provides its clients with access to popular and widely used trading platforms, including MetaTrader 4 and MetaTrader 5. These platforms are known for their user-friendly interfaces, advanced charting tools, technical indicators, and automated trading capabilities, catering to traders of all levels of experience. With the choice of either MetaTrader 4 or MetaTrader 5, traders can execute their forex trading strategies efficiently and effectively.

The following table compares the trading platforms offered by Mercury FX with those of Alpari, HotForex, IC Markets, and RoboForex:

| Broker | Trading Platforms |

| Mercury FX | MetaTrader 4, MetaTrader 5 |

| Alpari | MetaTrader 4, MetaTrader 5, Alpari WebTrader, Alpari Mobile |

| HotForex | MetaTrader 4, MetaTrader 5, HotForex WebTrader, HotForex Mobile |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader, IC Markets WebTrader, IC Markets Mobile |

| RoboForex | MetaTrader 4, MetaTrader 5, cTrader, R Trader, RoboForex Mobile |

Customer Support

Mercury FX provides customer support through phone and email, with dedicated contact information for different regions. They also offer a contact form on their website, giving traders multiple channels to reach out for assistance.

Phone Support: Traders can reach Mercury FX's customer support via phone at +44(0)207 199 3790 for English support, +27 10 329 0470 for English support in South Africa, and +852 3753 7597 for English support in Hong Kong.

Email Support: Customers can also contact the company through email at contact@mercury-fx.com, contact@mercury-fx.co.za for South Africa, and contacthk@mercury-fx.com for Hong Kong.

Customer Feedback

Customer feedback for Mercury FX is varied, with some positive and negative reviews. One customer reported a negative experience, stating that their account was closed, and they faced issues with both withdrawals and deposits. On the other hand, another customer praised the company's transferring service, highlighting the great customer service and assistance in finding the best exchange rates. However, this customer also expressed concern about the lack of regulatory oversight. Another customer had a positive experience with the company's currency transfer services, commending the prompt support provided by the Mercury FX team and the favorable exchange rate.

Conclusion

In conclusion, Mercury FX, a brokerage with an unregulated status as the limit on the regulation is exceeded. Mercury FX offers forex trading services to its clients. Its website provides access to popular trading platforms like MetaTrader 4 and MetaTrader 5, catering to traders of varying experience levels. The company also offers multiple account types, including Private and Corporate Accounts, each with its unique features in terms of minimum deposit requirements, leverage, and spreads.

Additionally, Mercury FX provides a variety of deposit and withdrawal methods, granting traders flexibility and convenience in managing their funds. Customer feedback presents a mixed picture, with both positive remarks about its customer service and efficient currency transfer services, and negative comments concerning issues with account closures and processing delays.

FAQs

Q: What type of trading platforms does Mercury FX offer?

A: Mercury FX provides access to popular MetaTrader 4 and MetaTrader 5 platforms.

Q: How can I contact Mercury FX's customer support?

A: You can reach their customer support through phone or email.

Q: Are there any deposit fees?

A: No, Mercury FX does not charge any deposit fees.

Q: What are the leverage options for the Corporate Account?

A: The Corporate Account offers leverage of up to 1:1000.

Q: Is there a contact form on the Mercury FX website?

A: Yes, there appears to be a contact form available for inquiries.

Q: Does Mercury FX have any regulatory oversight?

A: Mercury FX is regulated by relevant financial authorities. However, their current licenses do not cover their current scope of operations.