Company Summary

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | Geratsu |

| Regulation | Not regulated by any valid regulatory authority |

| Minimum Deposit | Cent Account: $10 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Cent Account: Starting from 1.1 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex currency pairs, metals, CFDs on major indices, oil, cryptocurrencies |

| Account Types | Cent, Cent (Pro), Classic, ECN |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Live chat, email, phone |

| Deposit Methods | Cryptocurrencies (Bitcoin, Bitcoin Cash, Litecoin, Tether), VISA/MasterCard, Help2Pay, ThunderXpay, VNPay, ZotaPay, bank wire transfers, local deposit |

| Withdrawal Methods | Same methods as deposits |

| Educational Tools | Latest market analysis and forecasts, daily analytics, indicators, video reviews, analysis of trading instruments, trading signals, economic calendar |

General Information

Registered in Saint Vincent and the Grenadines, Geratsu is an online forex broker offering clients series of trading instruments, such as Forex, Stocks & Indices, Cryptos through the advanced MT4 trading platform. Investors may choose from four different trading accounts on the Geratsu platform, and there is help accessible around the clock if you ever run into any issues. One important aspect to consider is that Geratsu is currently not regulated by any valid regulatory authority. This lack of regulation raises concerns regarding the platform's credibility and the level of investor protection it provides. Traders should approach Geratsu with caution and carefully assess the associated risks before engaging in any trading activities. On the technological front, Geratsu operates on the popular MetaTrader 4 (MT4) trading platform, offering traders a familiar and user-friendly interface. The platform provides real-time price updates, a wide range of analytical tools, and customizable trading indicators to assist users in making informed trading decisions.

In terms of funding options, Geratsu supports various deposit and withdrawal methods, including cryptocurrencies, bank wire transfers, and electronic payment systems. It also offers customer support services to address client inquiries and provide assistance with trading-related matters.

Pros and Cons

Geratsu offers traders a range of pros and cons to consider before engaging with the platform. On the positive side, it provides access to a diverse set of market instruments, including Forex currency pairs, metals, CFDs on major indices, oil, and cryptocurrencies. The platform operates on the popular MetaTrader 4 (MT4) trading platform, offering a familiar interface and a range of analytical tools for informed decision-making. Additionally, Geratsu supports multiple funding options, including cryptocurrencies, bank wire transfers, and electronic payment systems.

However, there are some notable cons that potential users should be aware of. The most significant concern is the lack of regulation, as Geratsu is not currently regulated by any valid regulatory authority. This raises questions about the platform's credibility and investor protection. Additionally, the absence of regulation may lead to increased risks for traders. It is also important to note that while Geratsu offers customer support services, there may be limitations in terms of response time or quality of support.

Overall, traders should carefully weigh the pros and cons of Geratsu, considering factors such as the diverse market offerings, user-friendly interface, and funding options, alongside the lack of regulation and associated risks.

Table: Pros and Cons of Geratsu

| Pros | Cons |

| Diverse range of market instruments | Lack of regulation |

| Operates on MetaTrader 4 (MT4) | Potential increased risks |

| Multiple funding options | Limitations in customer support services |

Is Geratsu Legit?

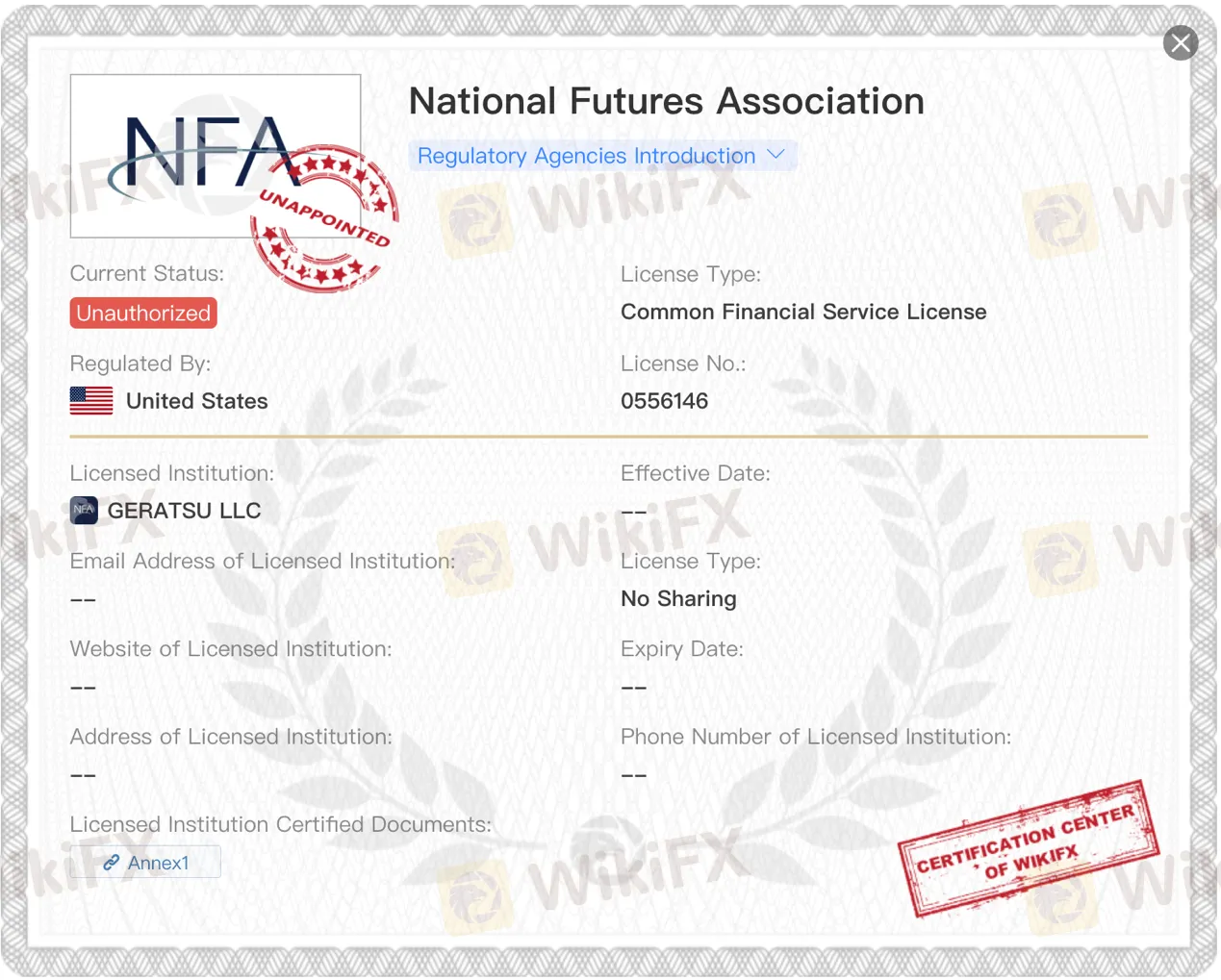

According to the information provided, Geratsu is currently not regulated by any valid regulatory authority. The regulatory status is listed as “Unauthorized” by the National Futures Association (NFA) in the United States. The NFA license number associated with Geratsu is 0556146. It is important to note that the broker exceeds the business scope regulated by the NFA, and its regulatory status is considered abnormal.

Given the lack of valid regulation and the warning issued, it is advisable to exercise caution when considering trading with Geratsu. Unregulated brokers carry higher risks, as there is no oversight or protection provided by a regulatory authority. It is recommended to choose brokers that are regulated by reputable financial authorities to ensure transparency, security, and fair trading conditions.

Market Instruments

Geratsu offers a wide range of market instruments for traders to choose from. These instruments cover various asset classes, including Forex currency pairs, metals, CFDs on major indices, oil, and cryptocurrencies. Let's explore some of the market instruments provided by Geratsu:

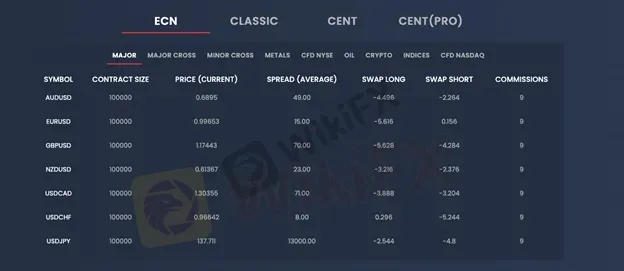

Forex: Geratsu offers a selection of major currency pairs such as AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, and USD/JPY. These currency pairs represent some of the most actively traded pairs in the Forex market. Traders can take advantage of the fluctuations in exchange rates to speculate on price movements and potentially profit from currency trading.

Metals: Geratsu also provides trading opportunities in precious metals like gold and silver. These metals are considered safe-haven assets and are often sought after by investors during times of economic uncertainty. By trading metals, investors can diversify their portfolios and hedge against inflation or market volatility.

CFDs on Indices: Geratsu offers CFDs on major indices, including NYSE and NASDAQ. Trading CFDs on indices allows traders to speculate on the performance of a particular stock market index without owning the underlying assets. This provides flexibility and enables traders to participate in the movement of the broader market.

Oil: Geratsu offers CFD trading on oil, allowing traders to speculate on the price movements of crude oil. As oil is a globally traded commodity, its price can be influenced by various factors such as geopolitical events, supply and demand dynamics, and economic indicators. By trading oil CFDs, traders can take advantage of these price fluctuations.

Cryptocurrencies: Geratsu provides the opportunity to trade cryptocurrencies. Cryptocurrencies like Bitcoin, Ethereum, and others have gained significant popularity in recent years. Trading cryptocurrencies allows investors to benefit from the price volatility in this emerging market.

Each market instrument offered by Geratsu comes with its own contract size, current price, spread (the difference between the bid and ask prices), swap rates for long and short positions, and applicable commissions. Traders can choose the instrument that aligns with their trading strategies and objectives.

| Pros | Cons |

| Diverse range of market instruments | Potential market volatility and associated risks |

| Opportunities to trade major currency pairs | Market fluctuations can result in losses |

| Access to precious metals as safe-haven assets | Commodities market risks and price volatility |

| Trading CFDs on major indices | Market indices can be influenced by various factors |

| Speculating on the price movements of oil | Oil market dynamics and geopolitical events |

| Trading cryptocurrencies with potential high returns | Cryptocurrency market volatility and regulatory uncertainties |

Account Types

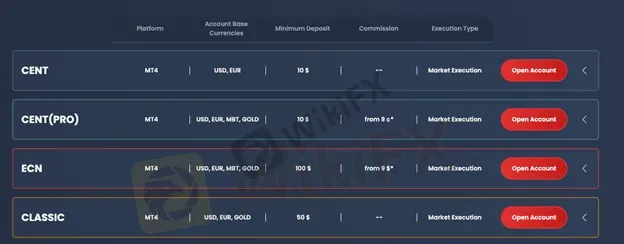

Geratsu offers four types of trading accounts: Cent, Cent (Pro), Classic, and ECN accounts. In addition to these, they also provide demo accounts for practice and learning purposes.

Cent: The Cent account is designed for novice traders who prefer to start with smaller volumes. It requires a minimum deposit of $10 and does not charge any commissions. With this account, traders can execute their trades using market execution and enjoy spreads starting from 1.1. The leverage available for Cent account holders is up to 1:1000, and the contract size is ¢100,000.

Cent (Pro): The Cent (Pro) account is similar to the Cent account but caters to more confident traders who want to engage in professional trading. It has the same minimum deposit requirement of $10 and does not charge commissions. The execution type is market execution, and the spreads start from 0.0. Like the Cent account, the leverage is up to 1:1000, and the contract size is ¢100,000.

Classic: The Classic account is aimed at professional traders. It does not require any commission payments, and the minimum deposit is $50. The platform provided for trading is MT4, a popular choice among traders. The account base currencies available are USD and EUR. Traders using the Classic account can execute trades through market execution and experience spreads starting from 1.1. The leverage offered is up to 1:1000, and the contract size is $100,000.

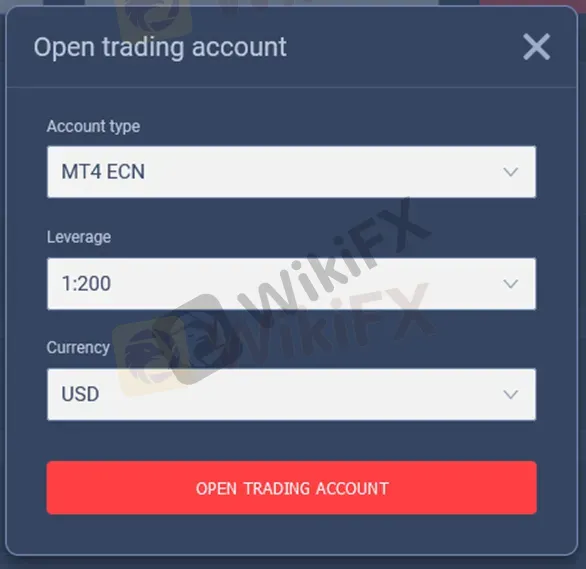

ECN: The ECN account is also designed for professional traders but comes with the advantage of low spreads. To open an ECN account, traders need to deposit a minimum of $100. It supports multiple account base currencies, including USD, EUR, and MBT. Traders using the ECN account can take advantage of market execution, spreads starting from 0.0, and leverage of up to 1:1000. It also offers a contract size of $100,000. Notably, the ECN account requires a commission payment, starting from $9 per round turn lot.

Overall, Geratsu offers a range of account types catering to different trading preferences and experience levels. From beginners with smaller volumes to confident professionals seeking low spreads, traders can choose the account type that suits their needs and start trading with varying deposit amounts and features.

| Pros | Cons |

| Diverse account options catering to different trading needs | Limited platform options (MT4 available, MT5 not available) |

| Varied minimum deposit requirements | Higher spreads compared to some competitors |

| No commission charges (except for ECN account) | Limited base currency options |

| High leverage options | Commission fees for ECN account |

| Suitable for both novice and professional traders | Limited features or benefits for advanced traders |

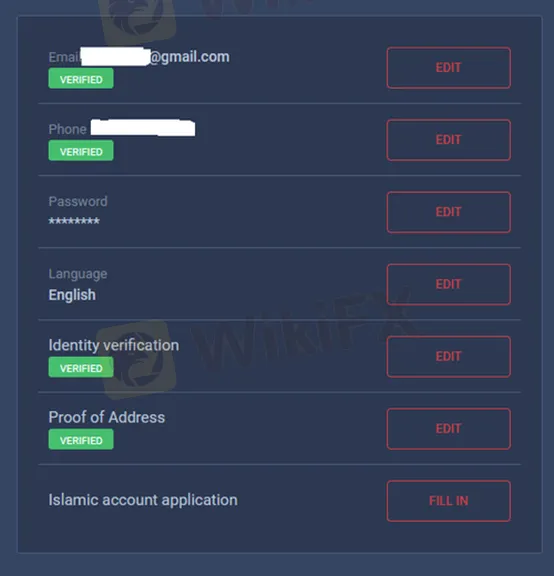

How to open an account?

To open an account with Geratsu, you need to follow a few simple steps. Here is a brief overview of the account opening process:

Registration: Start by visiting the Geratsu website and clicking on the “Register” button to create a Client's Cabinet. Fill in the registration form with the required information, such as your personal details. Choose a unique nickname and create a strong password for your account. Read and accept the Clients Agreement before proceeding.

Verification: Verification is a mandatory step to confirm the accuracy of your personal data. To fully verify your profile, log into your Client's Cabinet and go to the “Verification” tab. Follow the instructions to provide the necessary documents for verification, which may include your identity proof, address proof, phone number, and email verification. Ensure that the uploaded documents meet the specified requirements.

3. Profile Completion: Fill in all the required information in your profile, including your personal data, contact details, and any additional information requested. Make sure to enter accurate and up-to-date information.

By completing these steps, your account with Geratsu will be created, and you can access various features and services offered by the platform. It is important to note that profile verification is crucial for security, compliance, and to enjoy the full benefits of your trading account.

Leverage

Geratsu provides traders with the option to utilize leverage in their trading activities. Leverage allows traders to control a larger position in the market with a smaller amount of capital. It is expressed as a ratio, such as 1:200, which means that for every unit of capital the trader has, they can control 200 units in the market.

By offering leverage of up to 1:200, Geratsu provides traders with the opportunity to amplify their potential profits. When used effectively, leverage can enhance trading returns and allow traders to take advantage of market opportunities that would otherwise be inaccessible with their available capital alone.

However, it's important to understand that leverage also increases the level of risk associated with trading. While it can magnify gains, it can also amplify losses by the same factor. Trading with leverage requires careful risk management and a thorough understanding of the potential risks involved.

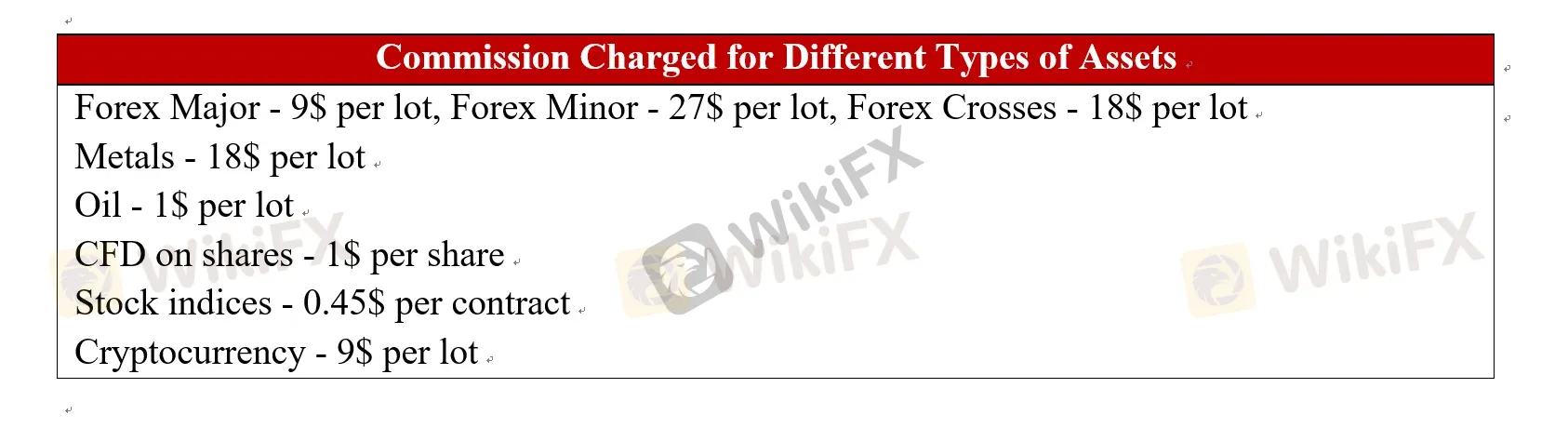

Spreads & Commissions

Geratsu offers different types of trading accounts with varying spreads and commissions to cater to traders with different experience levels and preferences.

Cent Accounts: Designed for novice traders, Cent accounts have moderate spreads starting from 1.1 pips. These accounts do not charge any commissions, making them suitable for those starting with smaller volumes.

Cent (Pro) Accounts: Similar to Cent accounts, Cent (Pro) accounts cater to more confident traders. They offer tighter spreads starting from 0.0 pips and do not charge any commissions, providing a favorable trading environment.

Classic Accounts: Aimed at professional traders, Classic accounts have spreads starting from 1.1 pips and do not require any commission payments. They provide access to the popular MetaTrader 4 (MT4) trading platform, making them a preferred choice for many traders.

ECN Accounts: Designed for professional traders seeking low spreads, ECN accounts offer market execution with spreads starting from 0.0 pips. However, unlike the other account types, ECN accounts do require commission payments, starting from $9 per round turn lot.

Overall, Geratsu's account offerings provide traders with a range of choices based on their trading preferences and experience levels. From accounts with moderate spreads and no commissions for beginners to accounts with tight spreads and commission charges for experienced traders, Geratsu aims to accommodate a diverse range of traders.

The following is the structure for calculating commissions:

Swap Fees

Each day, if you keep a position open overnight, you will be charged a swap cost. Since the costs associated with various assets are not constant, the following table should be consulted as necessary while developing a sound financial plan. It is important to know that costs are tripled on Wednesdays but waived on weekends.

Trading Platform

Geratsu offers its customers the leading MT4 trading platform that could run on any device Windows, Mac OS X, iOS, Android, or a web browser. Metatrader 4 boasts a speedy connection, an intuitive design, and a wealth of analytical capabilities. All of a client's sensitive information is safe in MT4. Aside from that, it offers up-to-date financial news and helps facilitate automated trading. This terminal is the go-to for Forex traders thanks to its cutting-edge trading and analysis tools.

Trading Tools

Geratsu provides its clients with a variety of trading tools to enhance their trading experience. Here is a brief description of the trading tools offered by Geratsu:

1. Latest Market Analysis and Forecasts: Geratsu clients have access to high-quality analytical materials from the independent agency Claws&Horns. These materials include technical and fundamental market analysis, currency, stocks, and index forecasts, economic calendar, and trading signals. Clients can find these resources in their personal cabinet.

2. Daily Analytics: Geratsu provides relevant information based on the current state of the market. This includes updates on market trends, news, and analysis to help clients make informed trading decisions.

3. Indicators: Geratsu offers analysis of the most popular technical indicators. These indicators provide insights into price patterns, trends, and potential market movements, assisting traders in identifying trading opportunities.

4. Video Reviews: Geratsu provides weekly video reviews that analyze potential market movements. These video reviews offer visual explanations and insights into market trends, helping traders stay informed and adapt their strategies accordingly.

5. Analysis of Trading Instruments: Geratsu offers various types of analysis, including technical, wave, and fundamental analysis. Additionally, they provide reviews of macroeconomic indicators, which can help traders gain a better understanding of the factors influencing market dynamics.

6. Trading Signals: Geratsu offers trading recommendations that indicate entry and exit levels in the Forex market. These signals can be used as guidance by traders in their decision-making process.

7. Economic Calendar: Geratsu provides an economic calendar that lists global economic events that can impact market changes. Traders can stay updated on important economic announcements, such as interest rate decisions, employment data releases, and GDP reports, which can have a significant impact on the financial markets.

These trading tools provided by Geratsu aim to assist traders in analyzing the market, identifying potential trading opportunities, and staying informed about key events and trends that can impact their trading decisions.

Pros and Cons

| Pros | Cons |

| Access to high-quality market analysis and forecasts | Reliance on third-party analysis from Claws&Horns |

| Daily analytics for informed trading decisions | Market analysis tools may require additional understanding and analysis |

| Availability of popular technical indicators | Video reviews may have subjective interpretations |

| Economic calendar to stay informed about key events | Trading signals are not guaranteed and require individual assessment |

Deposit & Withdrawal

No details are given about the minimum deposit required. Deposits can be made to Geratsu with BITCOIN, BITCOIN CASH, LITECOIN, TETHER, VISA, MASTERCARDS, HELP2PAY, THUNDERXPAY, VNPAY, ZOTPAY, BNAK WIRE TRANSFER, LOCAL DEPOSIT. Geratsu offers various deposit and withdrawal methods to cater to its clients' needs.

DEPOSITS: For deposits, clients can use cryptocurrencies such as Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), and Tether (USDT) with no fees and instant processing times. Additionally, deposits can be made using VISA/MasterCard in USD or EUR, with no fees but a small additional charge, and the processing time is 2-5 business days. Other deposit options include Help2Pay, ThunderXpay, VNPay, ZotaPay, bank wire transfers, and local deposit, each with its own supported currencies, fees, and processing times.

WITHDRAWALS: When it comes to withdrawals, Geratsu allows clients to withdraw funds using the same methods as deposits. Withdrawal fees vary depending on the chosen currency, ranging from 0.5% to 2% for cryptocurrencies and 0% to 1.6% for other payment methods. Withdrawals through VISA/MasterCard have no fees but incur an additional charge, and the processing time is 2-5 business days. Help2Pay, ThunderXpay, VNPay, ZotaPay, bank wire transfers, and local withdrawal are also available, with their respective fees and processing times.

Pros and Cons

| Pros | Cons |

| Multiple deposit methods to suit client preferences | Potential fees and additional charges for certain methods |

| Availability of various payment methods | Processing time of 2-5 business days for card deposits |

| No fees for cryptocurrency deposits | Withdrawal fees varying depending on chosen currency |

| Option to use VISA/MasterCard for deposits | Additional charge for VISA/MasterCard withdrawals |

Customer Support

Geratsu relies heavily on its Frequently Asked Questions section and chatbot to assist customers. The multilingual support staff is available via phone and email whenever the markets are open. Here are some contact details:

Telephone: +1 844 200 0183

Email: clients@geratsu.com

Online Communication

Registered Company Address: First Floor, First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines

Or you can follow this brokerage on some social media platforms, like Facebook, Telegram, Youtube, Instagram, and Linkedin.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. You can use the leverage to your benefit or to your detriment. Therefore, you should consider carefully whether or not this sort of investment activity is right for you. Please note the information contained in this article is for general information purposes only.

Conclusion:

In conclusion, Geratsu offers a range of market instruments and account types to cater to traders with different preferences and experience levels. The availability of major currency pairs, metals, CFDs on indices, oil, and cryptocurrencies provides traders with diverse trading opportunities. The platform also offers multiple account types, including Cent, Cent (Pro), Classic, and ECN accounts, to accommodate different trading styles. However, it is important to note that Geratsu lacks valid regulation from reputable financial authorities, which poses potential risks for traders. Unregulated brokers may lack oversight and protection, making it crucial to exercise caution when considering trading with Geratsu. Additionally, while leverage and trading tools provided by Geratsu can enhance trading opportunities and analysis, they also come with increased risk and require careful risk management. Overall, traders should carefully consider the advantages and disadvantages before choosing to trade with Geratsu and may opt for regulated brokers for enhanced transparency, security, and fair trading conditions.

FAQs

Q: What are the rules for deposit and withdrawal of funds at Geratsu?

A: The deposit and withdrawal of funds are governed by Geratsu's AML policy, which aims to mitigate transaction risks and ensure the safety of client funds. Withdrawals can only be made to the same system, wallet, and currency used for the initial deposit. If a new wallet is used for deposit, withdrawals can be made proportionally to the amount deposited in each wallet.

Q: What are the working hours of Geratsu's Financial Department?

A: Geratsu's Financial Department operates from Monday to Friday, from 9:00 am to 9:00 pm (GMT+2).

Q: Is there a maximum deposit amount at Geratsu?

A: There is no maximum deposit amount limit for any type of account at Geratsu.

Q: Are there commission fees for depositing funds into a trading account at Geratsu?

A: Geratsu does not charge any commission for depositing funds into a trading account. However, payment systems may apply their own processing fees, which are borne by the client. Geratsu refunds the commission charged by most payment systems for deposit transfers.

Q: What are the commission fees for withdrawals at Geratsu?

A: Withdrawal fees at Geratsu vary depending on the payment system used. The current commission fee amounts for each payment system can be found in the “Finance” section of the website.

Q: I made a deposit through the Client's Cabinet, but my account was not credited. What should I do?

A: If your account was not credited after making a deposit through the Client's Cabinet, please contact the Geratsu finance department with the following information: trading account number, payment system wallet/purse ID, payment amount, transfer date and time (including time zone), and transaction number (if available).

Q: How can I transfer funds from one account to another at Geratsu? What is an Internal Transfer?

A: Clients can transfer funds from one trading account to another within the same profile through the Client's Profile in the “Accounts” section. This type of transaction, called an Internal Transfer, can be carried out instantly by the client without the assistance of the finance department. The number of internal transfers is limited to 50 transactions per day.

Q: How can I withdraw funds from my Geratsu account?

A: You can withdraw funds from your trading account through your Client's Cabinet in the “Finance” section using the same payment systems and wallets used for the initial deposit. Please note that some payment methods may only be available for fully verified profiles. Refer to the AML policy for more details.

Q: Why was my withdrawal request canceled at Geratsu?

A: Withdrawal requests at Geratsu can be canceled for various reasons, including violation of the AML policy, requesting withdrawal through a different payment system than the one used for deposit, requesting withdrawal in a different currency than the deposit currency, using a different wallet for withdrawal than the one used for deposit, or other reasons. Contact the finance department for specific details.

Q: Why is the cryptocurrency amount not immediately credited to my Geratsu account after a deposit?

A: Cryptocurrency deposits at Geratsu require confirmation by the blockchain, which typically takes an average of six confirmations for security reasons. Each confirmation can take up to an hour, and six confirmations are considered sufficient for a secure transaction.