Company Summary

| ICE FXReview Summary | |

| Founded | 2017-10-28 |

| Registered Country/Region | United Kingdom |

| Regulation | Exceeded/Suspicious Clone |

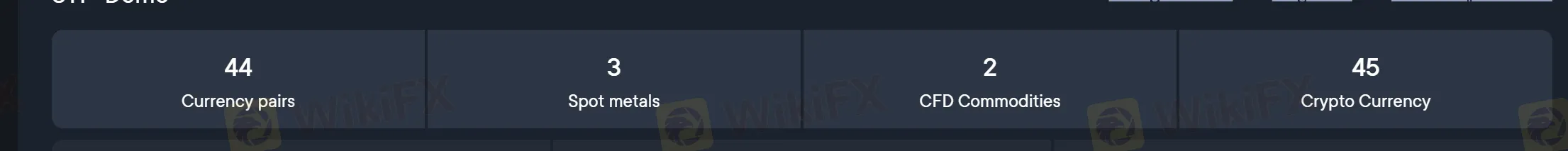

| Market Instruments | 44 Forex, 2 CFD commodities, 45 Cryptocurrencies, and 3 Spot metals |

| Demo Account | ✅ |

| Leverage | Up to 1:300 |

| Spread | From 0.0 pips |

| Trading Platform | MT4 (Windows、macOS, and iOS/Android) |

| Min Deposit | $30 |

| Customer Support | +44 20 8089 7867 |

| support@ice-markets.com | |

| Live Chat | |

ICE FX Information

ICE Markets (full name ICE FX) is an online trading and investment services platform headquartered in the UK, offering a variety of trading instruments such as foreign exchange, precious metals, cryptocurrencies, and CFD commodities, and supporting the MetaTrader 4 (MT4) platform. The platform provides multiple account types suitable for traders and investors at different levels, and launches various promotional activities to attract new clients. ICE Markets are suitable for ordinary traders pursuing transparent trading and diversified instruments, as well as professional investors seeking managed account services.

Pros and Cons

| Pros | Cons |

| Various trading instruments | Exceeded/Suspicious Clone |

| STP-Demo simulated account available | Lower cryptocurrency leverage (1:10 for STP accounts) |

| Leverage up to 1:300 | Leverage restrictions for high-net-worth clients |

| Up to 6% deposit bonus | Complex fee structure (0.0025%-0.05%) |

| Managed Accounts available |

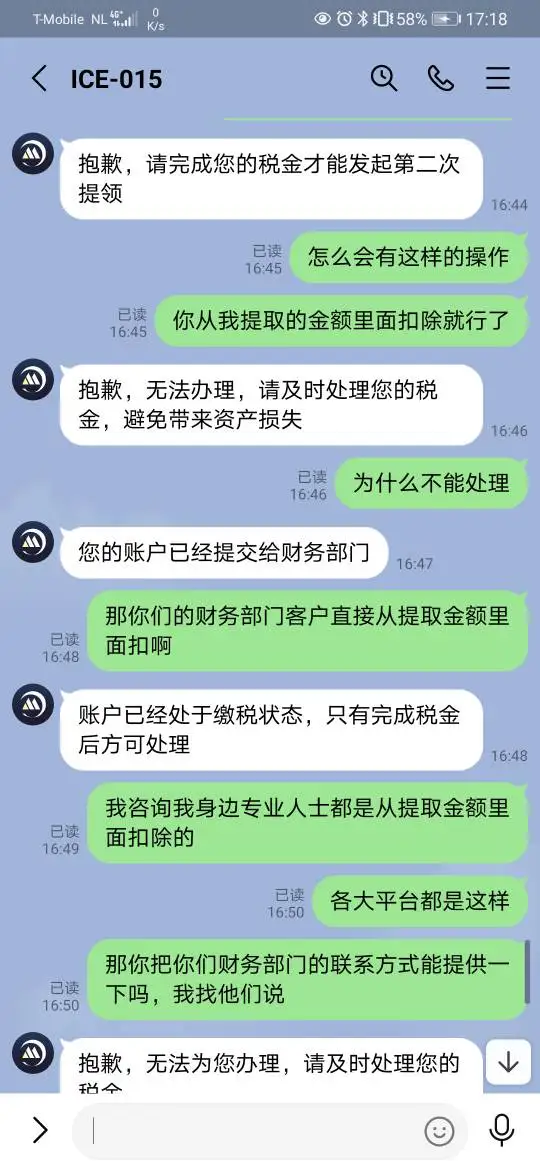

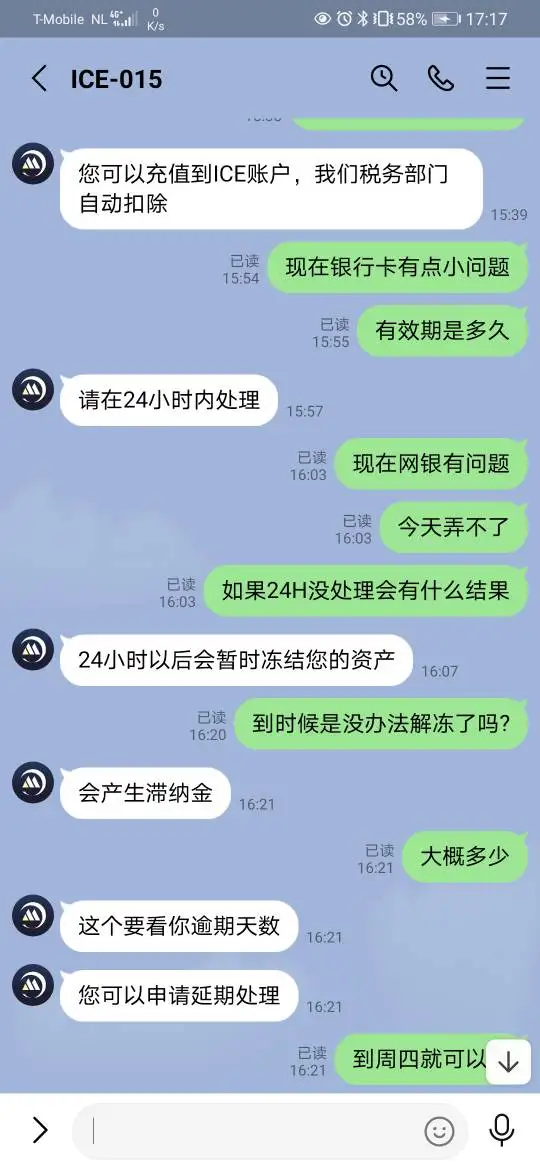

Is ICE FX Legit?

ICE Markets are unregulated. It can be found that the timeliness of the FCA's regulation of ICE Markets has exceeded, and the regulatory status of the LFSA for ICE Markets is suspected clone. Note that cryptocurrency trading may have legal restrictions in some countries/regions.

What Can I Trade on ICE FX?

ICE Markets offers 5 major categories of trading instruments, including 44 forex (FX) pairs, 3 spot metals, 45 cryptocurrencies, CFD commodities, and CFDs.

Specific products include 36 major currency pairs (such as EUR/USD, GBP/JPY) and 8 exotic currency pairs (such as USD/TRY, EUR/ZAR). The precious metals category covers gold (XAU/USD), silver (XAG/USD), and gold against the euro (XAU/EUR). The cryptocurrency offering includes mainstream coins (such as BTCUSD, ETHUSD) and niche tokens (such as DOTUSD, SOLUSD).

- Additionally, there are 2 energy futures (WTI crude oil, BRN Brent crude oil). Some instruments are traded as CFDs, allowing leveraged trading and short-selling.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFD commodities | ✔ |

| Cryptocurrencies | ✔ |

| Spot metals | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

| Account Type | STP-Demo Simulated Account | STP Real Account | STP-MA Managed Account |

| Minimum Deposit | $0 (simulated funds) | $30 | $300 |

| Leverage Range | Fixed 1:100 | 1:1-1:300 (floating) | 1:1-1:100 (floating) |

| Commission Rate | 0.0025%-0.25% (one-way) | 0.0025%-0.05% (one-way) | 0.004%-0.05% (one-way) |

| Primary Purpose | Simulated trading, platform familiarization | Individual autonomous trading | Professional managers managing investor funds |

| Special Features | Instant order execution | Access to Soft-FX liquidity aggregator | Support for PAMM/LAMM/MAM technologies |

ICE FX Fees

| Cost Type | Account Type/Trading Instrument | Rate Description |

| Commission | STP Real Account - Major FX Pairs | 0.0025% (one-way) |

| STP Real Account - Cryptocurrencies | 0.05% (one-way) | |

| STP-MA Account - Major FX Pairs | 0.004% (one-way) | |

| STP-MA Account - Precious Metals | 0.05% (one-way) | |

| Spread | FX Currency Pairs | Starting from 0.0 pips |

| Cryptocurrencies | Potentially higher spreads | |

| Swap Fee | All overnight positions | A tripled rate is applied when rolling over positions from Wednesday to Thursday |

Leverage

| Trading Instruments | Account Type/Conditions | Leverage Ratio |

| Foreign Exchange (FX) | STP Real Account (Deposit < $3,000) | Major currency pairs: 1:300; Exotic currency pairs: 1:200 |

| High-Net-Worth Clients (Deposit > $500,000) | Uniform leverage: 1:50 | |

| Cryptocurrencies | STP Account | 1:5 - 1:10 |

| STP-MA Account | 1:10 | |

| Precious Metals/CFDs | Spot Metals | Up to 1:150 |