Company Summary

| MAXWELL | Basic Information |

| Company Name | Maxwell Global Trading |

| Founded | 2013 |

| Headquarters | United Kingdom |

| Regulations | Unregulated |

| Tradable Assets | Forex pairs, spot metals, CFDs, oil, indices |

| Account Types | Personal, Corporate |

| Minimum Deposit | Not specified |

| Maximum Leverage | 1:100 |

| Spreads | EURUSD spread fixed at 3 pips |

| Commission | USD 30 per traded lot |

| Deposit Methods | Not specified |

| Trading Platforms | MetaTrader 4 (MT4) |

| Customer Support | Email, phone |

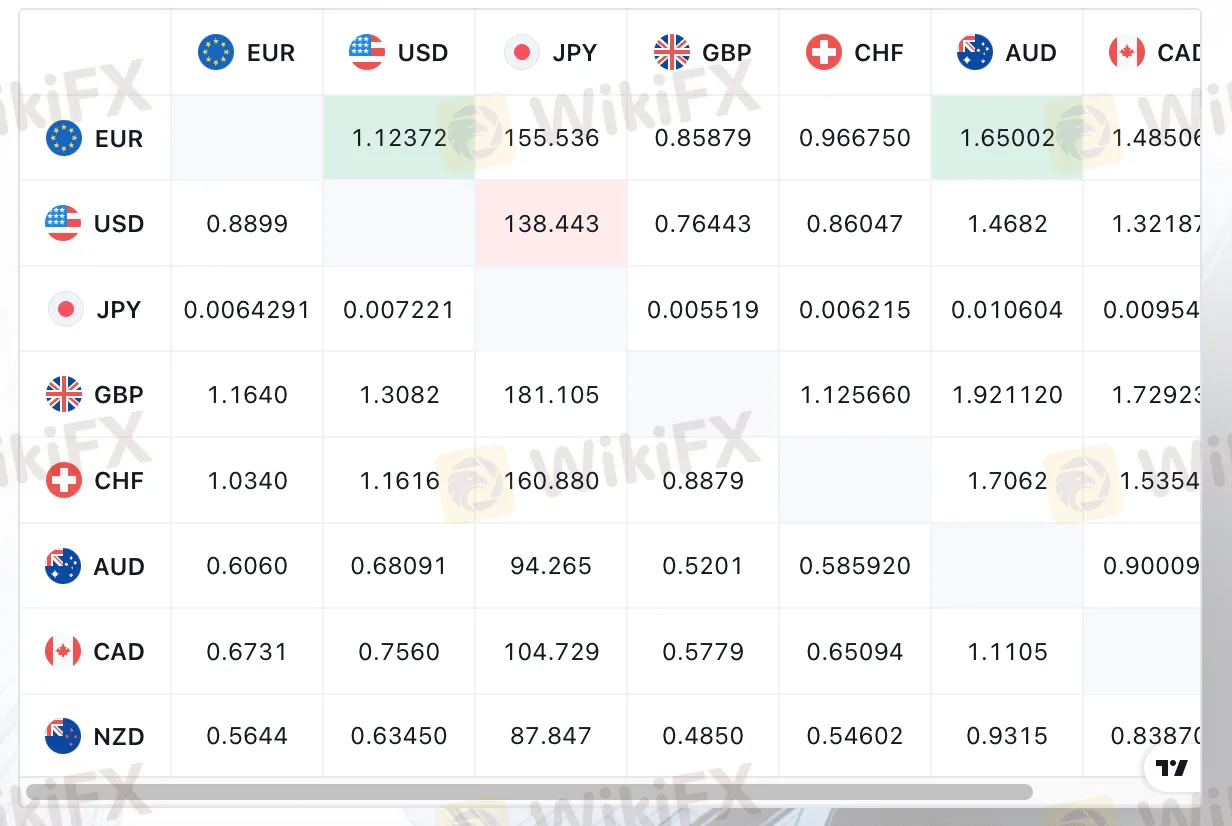

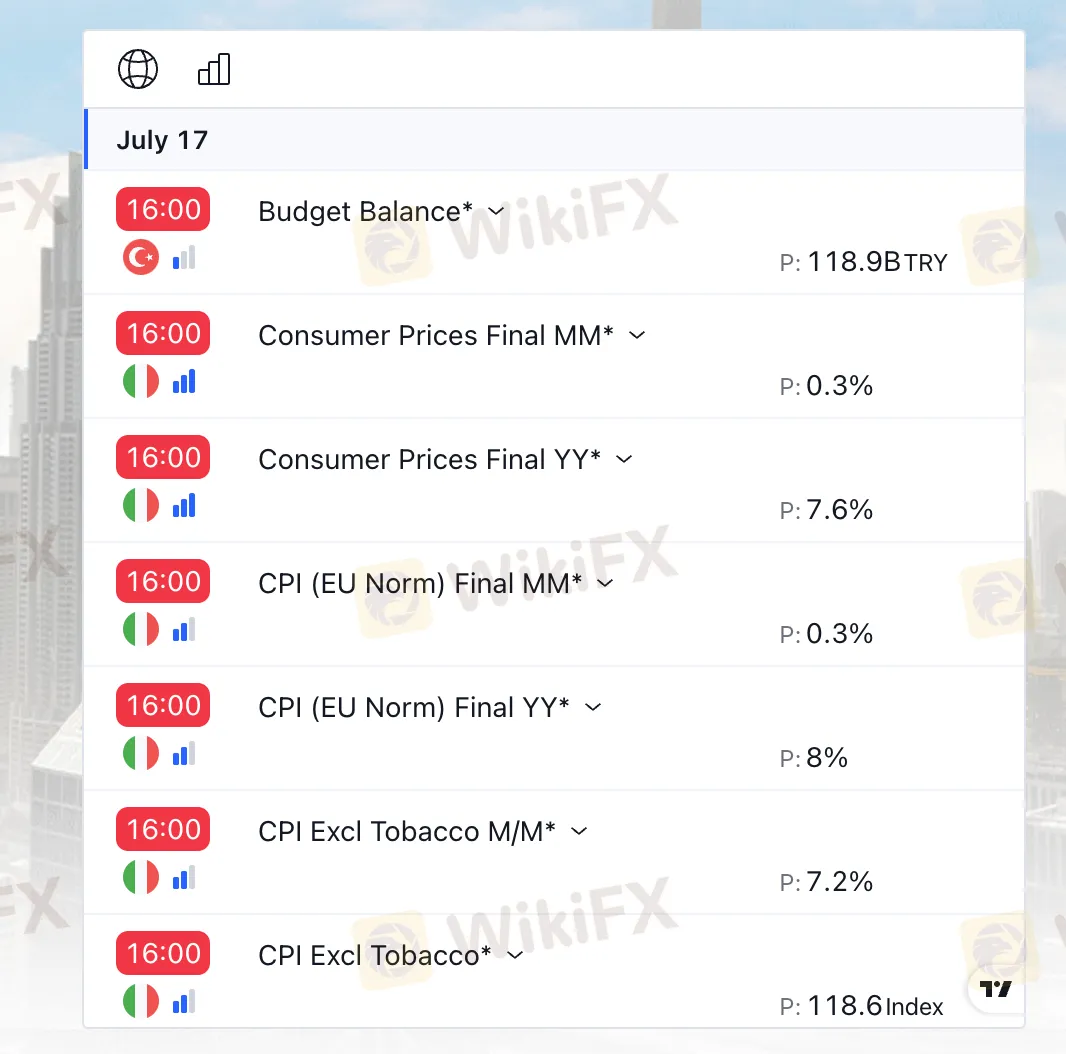

| Education Resources | News, live prices, economic calendar |

| Bonus Offerings | None |

Overview of MAXWELL

MAXWELL is an online trading broker established in 2013, operating from the United Kingdom. However, it is essential to note that MAXWELL is not regulated by any recognized financial authority, which raises concerns about the safety and security of funds. The broker offers a relatively limited range of tradable assets, primarily focused on 28 forex pairs, with a few exotic currencies included. Traders can also access CFDs on spot metals, oil, and a couple of indices like Nikkei and Hang Seng Index, providing some diversity in trading options.

MAXWELL offers two main types of trading accounts: Personal and Corporate. The maximum leverage available is 1:100, providing traders with the potential to control larger positions with a relatively smaller amount of capital. However, the spreads are fixed and relatively high, with EURUSD spreads at 3 pips, and traders are additionally charged a commission of $30 per traded lot, resulting in a total spread of 6 pips for EURUSD.

The broker supports the popular MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and comprehensive analytical tools. While MAXWELL provides some educational resources like market news, live prices, and an economic calendar, traders should be cautious due to the lack of regulation and limited information on deposit and withdrawal methods. It's advisable for potential traders to conduct thorough research and consider regulated alternatives before deciding to trade with MAXWELL.

Is MAXWELL Legit?

MAXWELL is not regulated by any recognized financial authority. This means that the broker operates without the oversight and supervision that regulation provides. Trading with an unregulated broker like MAXWELL exposes traders to significant risks, as there are no guarantees regarding the safety of funds, fair trading practices, or proper handling of client complaints. Regulated brokers, on the other hand, are subject to strict regulations and are required to adhere to certain standards and guidelines to protect the interests of their clients. It is generally advisable to choose a regulated broker to ensure a higher level of security and accountability in the trading process.

Pros and Cons

MAXWELL offers some advantages, such as supporting the widely acclaimed MetaTrader 4 (MT4) platform, which provides a user-friendly interface and a variety of analytical tools for traders. Additionally, the broker allows for leverage of up to 1:100, providing the potential for larger trading positions. However, there are significant concerns as well, such as MAXWELL being an unregulated broker, which can pose risks to traders' funds and overall trading experience. The spreads offered by MAXWELL are fixed and relatively high, which can impact traders' profitability, especially for short-term strategies. Moreover, the lack of specific information about deposit and withdrawal methods raises transparency issues, making it difficult for potential clients to evaluate the available options and associated fees.

| Pros | Cons |

| Supports MetaTrader 4 platform | Unregulated broker, posing risks to funds |

| Offers leverage of up to 1:100 | Fixed and relatively high spreads |

| Lack of transparency regarding deposit and withdrawal methods |

Trading Instruments

MAXWELL offers a concise selection of trading instruments, primarily centered around forex pairs. Traders have access to a total of 28 forex pairs, which includes major currencies as well as a few exotic options like the Hong Kong dollar, Singapore dollar, and South African Rand.

Apart from forex, MAXWELL provides CFDs on spot metals, offering trading opportunities in precious metals such as platinum, palladium, silver, and gold. This caters to those interested in diversifying their portfolios with commodities.

Furthermore, the broker allows CFD trading on oil, enabling traders to participate in the energy market and take advantage of oil price fluctuations. Additionally, clients can access CFDs on a couple of indices, specifically the Nikkei and the Hang Seng Index, representing the Japanese and Hong Kong equity markets, respectively.

While the selection of trading instruments at MAXWELL covers the essential categories, it may be considered limited compared to some other brokers with more extensive offerings. Traders looking for a wider variety of financial instruments to trade may need to explore alternative brokerage options.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| MAXWELL | Yes | Yes | Yes | Yes | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

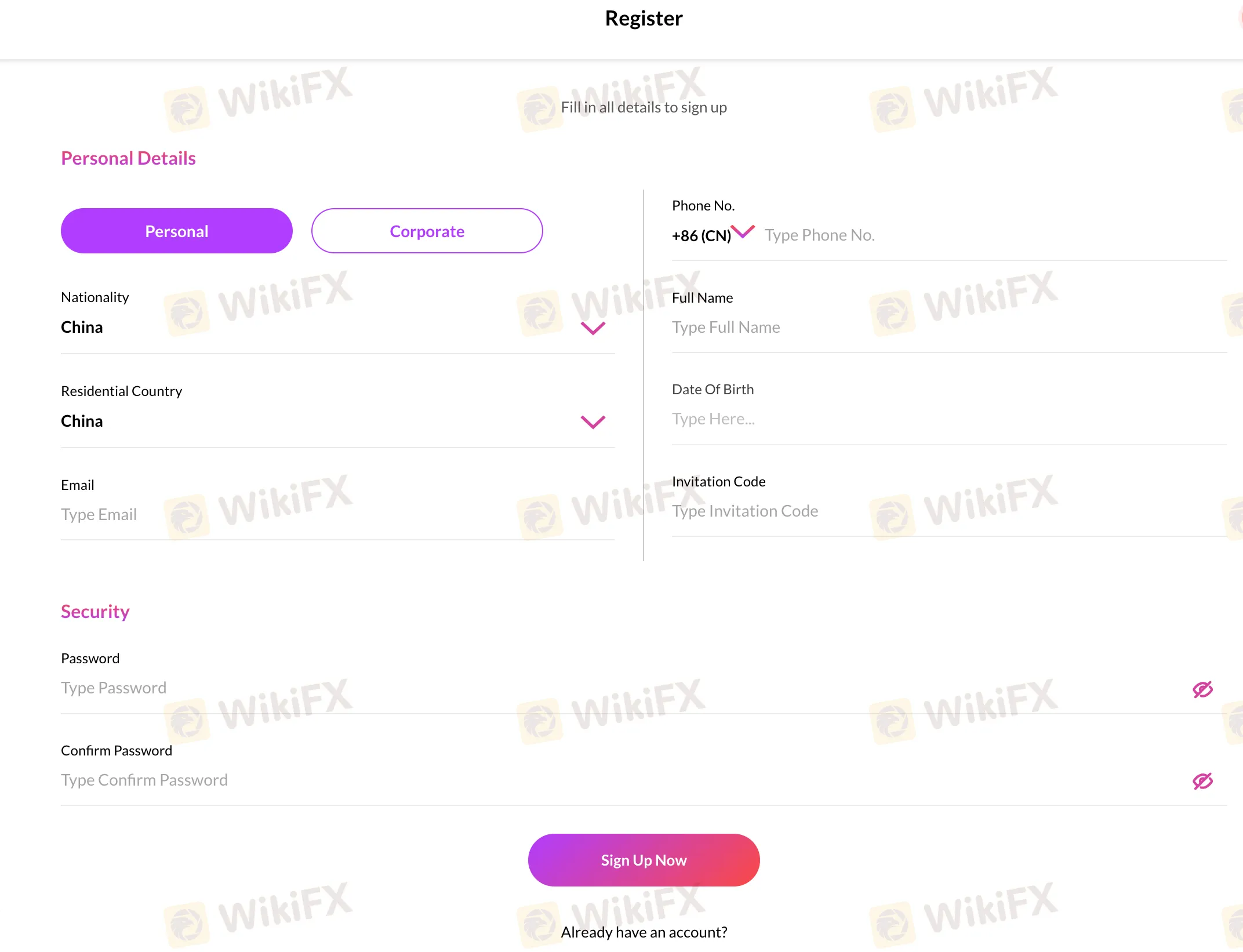

Account Types

MAXWELL offers two main types of trading accounts: Personal and Corporate accounts.

1. Personal Account: The Personal account is designed for individual retail traders who want to engage in forex and CFD trading. This account type is suitable for traders who trade on their own behalf and do not represent any business entity or organization. Personal accounts typically provide access to a range of financial instruments, including forex pairs, spot metals, commodities, and indices. Traders can choose from different leverage options and take advantage of the broker's trading platform to execute trades.

2. Corporate Account: The Corporate account is tailored for businesses and corporate entities that wish to participate in the financial markets. This account type is suitable for companies looking to hedge currency exposure, manage international transactions, or invest surplus funds. Corporate accounts often offer additional features and services to cater to the specific needs of businesses, such as access to corporate treasury tools, multiple user logins, and specialized customer support.

Both Personal and Corporate accounts may have different minimum deposit requirements and trading conditions. It's essential for traders to review the specific features of each account type offered by MAXWELL to ensure it aligns with their trading objectives and requirements. Additionally, corporate clients may need to provide additional documentation to verify their business identity and comply with regulatory requirements.

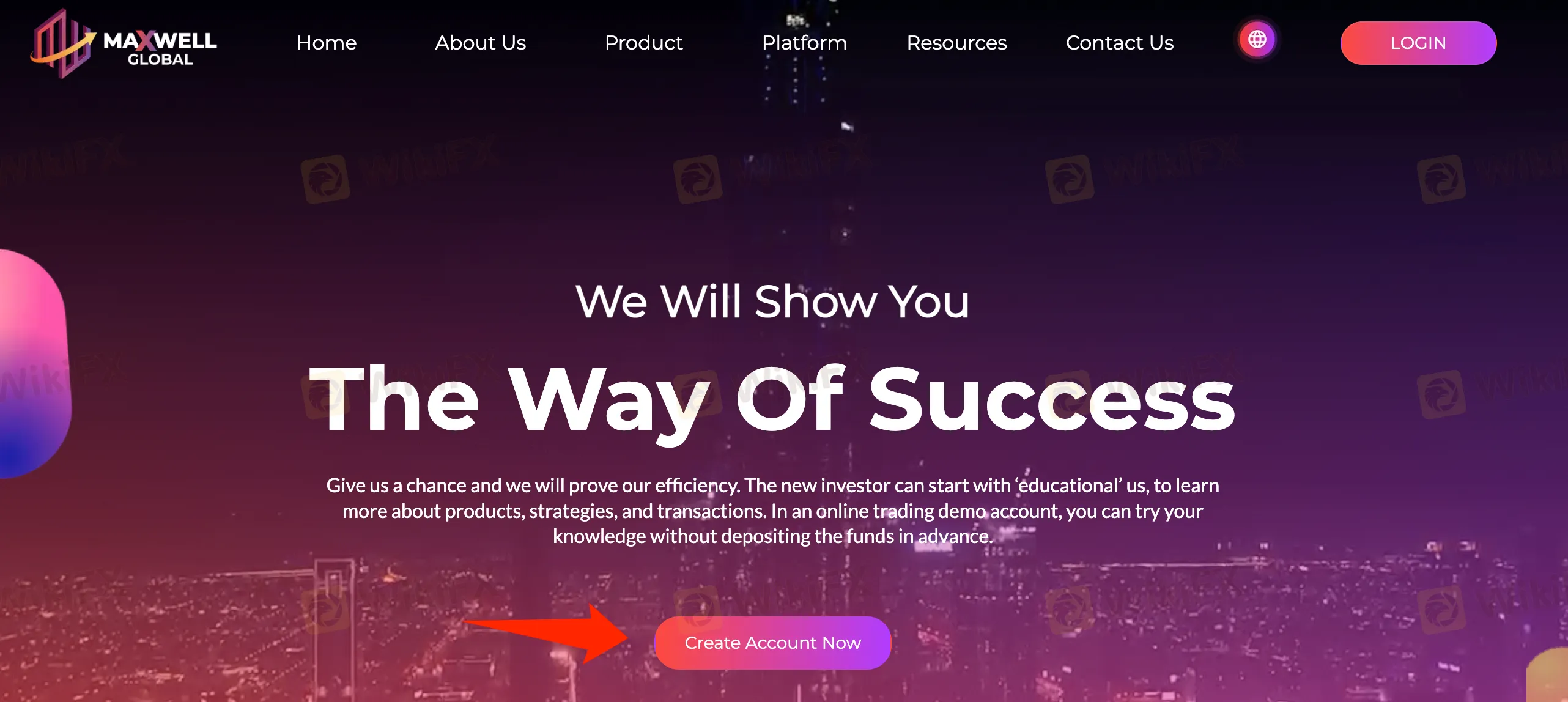

How to Open an Account

To open an account with MAXWELL, follow these steps. However, it's essential to keep in mind that MAXWELL is an unregulated broker. Trading with unregulated brokers carries inherent risks, including potential scams or fraudulent practices. As such, it is crucial to exercise extreme caution and conduct thorough research before deciding to trade with MAXWELL. Potential traders should be aware of the risks involved and consider seeking advice from trusted sources before opening an account with an unregulated broker.

Visit the MAXWELL website. Look for the “Create Account Now” button on the homepage and click on it.

Choose your account type and sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

Leverage

At MAXWELL, traders can access leverage of up to 1:100. Leverage is a powerful tool that allows traders to control larger positions in the market with a relatively smaller amount of capital. With a leverage ratio of 1:100, for every $1 in the trader's account, they can control a position of up to $100 in the market.

Higher leverage can be appealing to traders as it enables them to open larger positions and potentially increase their trading opportunities. However, it's essential to recognize that higher leverage also amplifies the risk of significant losses, especially in volatile market conditions. Traders should exercise prudent risk management and be cautious when utilizing high leverage to avoid overexposure to the market.

Conversely, lower leverage, like 1:100, reduces the risk associated with each trade but also limits the size of trading positions. Lower leverage can be suitable for risk-averse traders or those with smaller trading accounts.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | MAXWELL | eToro | XM | RoboForex |

| Maximum Leverage | 1:100 | 1:400 | 1:888 | 1:2000 |

Spreads and Commissions (Trading Fees)

At MAXWELL, the spreads and commissions can have a significant impact on trading costs. During testing with a Demo Account, it was observed that the EURUSD spread was fixed at 3 pips, which is relatively higher compared to the spreads commonly offered with standard accounts. The 3-pip spread for EURUSD is at least twice as high as what traders would typically expect. However, there was an additional commission charged for each traded lot, which amounted to 30 USD. This commission effectively added another 3 pips to the spread, resulting in a total spread of 6 pips for the base EURUSD pair.

A 6-pip spread for EURUSD is considered exceptionally high and can significantly impact traders' profitability, particularly in short-term and high-frequency trading strategies. The combination of fixed spreads and commissions can lead to higher trading costs and may make it challenging for traders to achieve consistent profitability.

It's essential for traders to carefully assess the trading conditions, including spreads and commissions, before choosing a broker like MAXWELL. Understanding the overall cost structure is vital to making informed trading decisions and ensuring that the chosen broker aligns with traders' trading styles and strategies. Lower spreads and transparent fee structures are generally preferred by traders as they can lead to more competitive trading conditions and a better trading experience overall.

Deposit & Withdraw Methods

The information provided about the deposit and withdrawal methods for MAXWELL is limited. The website does not disclose the minimum deposit requirement to open an account, leaving potential clients in the dark about the initial investment needed to start trading with the broker. Furthermore, there is no specific information about the available deposit and withdrawal options on their web page.

In general, most brokers offer a variety of deposit and withdrawal methods to cater to the diverse needs of their clients. Commonly accepted methods include major credit and debit cards like Visa and MasterCard, popular e-wallets such as PayPal, Skrill, and Neteller, bank wire transfers, and, in some cases, cryptocurrencies like Bitcoin.

However, without explicit information from MAXWELL, it becomes difficult for traders to know which payment methods are supported and whether there are any associated fees or processing times. Transparency in deposit and withdrawal procedures is crucial for establishing trust between the broker and its clients, as it ensures that traders have a clear understanding of how to manage their funds.

Potential clients interested in trading with MAXWELL may need to directly contact their customer support or consult their terms and conditions for comprehensive details about deposit and withdrawal methods. Traders are encouraged to carefully review the available options and any applicable fees to make informed decisions about funding their trading accounts and accessing their profits in the future.

Trading Platforms

MAXWELL supports the widely acclaimed MetaTrader 4 (MT4) trading platform. MT4 is renowned for its user-friendly interface, interbank liquidity, and fast execution, making it a preferred choice for traders worldwide. The platform offers a plethora of benefits, catering to various trading needs with its diverse range of tools and resources.

Traders using MT4 on MAXWELL's platform can efficiently analyze price dynamics, execute trade transactions, and employ automated trading strategies through Expert Advisors (EAs). The platform provides a well-equipped workspace, empowering traders to delve into market analysis and make informed decisions.

With MT4, traders have access to a wide range of analytical tools, including 9 different timeframes for comprehensive market analysis. The platform allows for detailed examination of quote dynamics, and traders can conveniently view multiple charts simultaneously. Moreover, preprogrammed analytical tools and the ability to overlay analytical objects further enhance the trading experience.

MT4 on MAXWELL boasts an impressive selection of over 50 built-in indicators and tools, providing traders with ample resources to carry out technical analysis and devise effective trading strategies.

Overall, the integration of MetaTrader 4 on MAXWELL's platform equips traders with a powerful and efficient toolset, allowing them to navigate the financial markets with confidence and sophistication. The comprehensive array of analytical tools and resources enhances traders' ability to make well-informed decisions and pursue their trading goals effectively.

Customer Support

MAXWELL provides customer support through various channels to address traders' inquiries and concerns. Traders can reach out to the company's support team via email at happiness@maxwellglobal.ae. Email communication allows traders to provide detailed information about their concerns and receive responses at their convenience.

Additionally, traders can contact the customer support team by phone at +971 4433 2155. Direct communication via phone provides a real-time option for addressing urgent matters or seeking immediate assistance.

The broker's website also features a “Contact Us” form, allowing traders to fill in their details and send their enquiry message directly to the support team. This form serves as an alternative means of communication, and traders can expect a response from the customer support team promptly.

Educational Resources

MAXWELL offers a range of educational resources to enhance traders' knowledge and keep them informed about the financial markets. The broker provides a news section on its website, delivering up-to-date market news and analysis. Traders can access timely information on economic events, geopolitical developments, and other factors influencing the markets. Staying informed about the latest news can help traders make better-informed trading decisions and respond to market changes effectively.

Furthermore, MAXWELL provides live prices for various financial instruments. Real-time price quotes enable traders to monitor market movements and track the performance of their preferred assets. Access to live prices is essential for executing trades at favorable levels and staying ahead of market trends.

Additionally, the broker offers an economic calendar on its platform, which highlights significant upcoming events and economic indicators. The economic calendar provides scheduled releases of economic data, central bank announcements, and other critical events that can impact the markets. Traders can use the calendar to plan their trading strategies and be prepared for potential market volatility triggered by these events.

Conclusion

MAXWELL is an online trading broker established in 2013 and headquartered in the United Kingdom. However, the lack of regulation by any recognized financial authority poses significant risks for traders. While the broker offers a user-friendly interface with MetaTrader 4 (MT4) and a maximum leverage of 1:100, the fixed and relatively high spreads, along with additional commissions, may impact traders' profitability. Furthermore, the limited range of tradable assets, absence of transparent information on deposit and withdrawal methods, and the absence of educational resources on the website are significant disadvantages that traders should carefully consider before choosing MAXWELL as their trading platform.

FAQs

Q: Is MAXWELL a regulated broker?

A: No, MAXWELL is not regulated by any recognized financial authority.

Q: What tradable assets does MAXWELL offer?

A: MAXWELL offers 28 forex pairs, spot metals, CFDs on oil, and a couple of indices.

Q: What types of accounts does MAXWELL provide?

A: MAXWELL offers Personal and Corporate accounts.

Q: What is the maximum leverage offered by MAXWELL?

A: The maximum leverage at MAXWELL is 1:100.

Q: What are the spreads for EURUSD at MAXWELL?

A: The EURUSD spreads are fixed at 3 pips, and an additional commission of USD 30 per traded lot is charged, resulting in a total spread of 6 pips for EURUSD.