Company Summary

| Aspect | Information |

| Company Name | VT Capital Market Private Limited |

| Registered Country/Area | India |

| Founded Year | 2-5 years |

| Regulation | Not regulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable |

| Trading Platforms | MetaTrader 4 |

| Tradable Assets | Cryptocurrencies |

| Account Types | Standard, ECN |

| Customer Support | 24/5 live chat and email support |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Cards, E-Wallets, Cryptocurrency |

| Educational Resources | Lack of comprehensive educational resources |

Overview of VT

VT is a trading service provider based in India. With a history spanning 2-5 years, the company offers access to cryptocurrency trading, catering to investors looking to engage in this emerging digital asset class. It's important to note that VT operates without specific regulation, which can raise concerns for traders who prioritize regulatory oversight.

To begin trading with VT , a minimum deposit of $100 is required, providing accessibility to a wide range of traders. One of the key features that might attract traders is the substantial maximum leverage of up to 1:500, which allows traders to control larger positions relative to their initial deposit.

The brokerage offers variable spreads, which can fluctuate based on market conditions. Traders can access the MetaTrader 4 (MT4) trading platform, a well-known and user-friendly software that offers various tools and features for cryptocurrency trading.

Is VT legit or a scam?

VT is not subject to regulation by any official governing body, a factor that may give rise to concerns regarding the transparency and oversight of the exchange. Unregulated exchanges operate without the beneficial oversight and legal protections provided by regulatory authorities, resulting in potentially higher risks related to fraud, market manipulation, and security breaches.

In the absence of proper regulation, users may encounter difficulties in seeking recourse and resolving disputes. Furthermore, the lack of regulatory oversight can contribute to a less transparent trading environment, posing challenges for users when it comes to assessing the legitimacy and reliability of the exchange.

Pros and Cons

| Pros | Cons |

| High Leverage (1:500) | Lack of Regulatory Oversight |

| Variable Spreads | Limited Educational Resources |

| Wide range of cryptocurrencies available | Not available in some countries or regions |

| 24/5 Customer Support | Limited market analysis and insights |

Pros:

High Leverage (1:500): VT offers high leverage, allowing traders to control larger positions with a relatively small capital investment. This can amplify potential profits, but it also comes with higher risk. Traders should exercise caution when using high leverage.

Variable Spreads: The broker provides variable spreads, which can be beneficial as they may tighten during times of high liquidity or widen during periods of lower liquidity. Variable spreads can result in cost savings for traders.

Wide Range of Cryptocurrencies Available: VT offers a diverse selection of cryptocurrencies for trading. This variety allows traders to explore different digital assets and potentially diversify their portfolios.

24/5 Customer Support: VT provides 24/5 customer support, which means traders can access assistance through live chat and email during regular business hours on weekdays. Responsive customer support is essential for addressing inquiries and resolving issues promptly.

Cons:

Lack of Regulatory Oversight: VT operates without regulatory oversight. The absence of regulation can raise concerns about transparency, security, and the protection of traders' interests. Unregulated brokers may not offer the same level of safety as regulated ones.

Limited Educational Resources: VT lacks comprehensive educational resources, including a user guide, video tutorials, live webinars, and informative blogs. This deficiency can make it challenging for new users to learn how to use the platform and trade cryptocurrencies effectively.

Not Available in Some Countries or Regions: VT may not be available for traders in certain countries or regions. Users should check the broker's availability in their specific location before considering it as a trading platform.

Limited Market Analysis and Insights: The broker provides limited market analysis and research tools. Comprehensive research tools, economic calendars, and market insights can be essential for making informed trading decisions. The lack of these resources may hinder traders' ability to analyze markets effectively.

Market Instruments

VT provides a diverse range of trading assets, including:

Forex (Foreign Exchange): With access to the Forex market, VT enables traders to participate in currency trading. This involves speculating on the exchange rates of various currency pairs, such as EUR/USD, GBP/JPY, or USD/JPY, offering opportunities to profit from currency fluctuations.

CFDs on Stocks: VT allows traders to engage in Contracts for Difference (CFDs) on individual company stocks. This means traders can speculate on the price movements of specific stocks without actually owning the underlying shares. It provides flexibility for both long and short positions in stock trading.

CFDs on Indices: Similar to stock CFDs, VT provides the opportunity to speculate on the price movements of entire stock market indices like the S&P 500, NASDAQ, or FTSE 100. This allows traders to take positions on broader market movements.

CFDs on Commodities: Traders can participate in CFDs on commodities such as gold, oil, or agricultural products. These contracts permit speculation on the price changes of physical commodities without the need to physically own them.

Cryptocurrencies: VT offers traders the ability to trade various cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading involves speculating on the price movements of these digital assets, allowing traders to participate in the cryptocurrency market.

Account Types

VT offers two distinct account types: Standard and ECN, each catering to different trading preferences and objectives.

The Standard account provides traders with leverage of up to 1:500, offering the potential for amplified positions. It features variable spreads, making it suitable for traders who are comfortable with the fluctuations in spread costs. Notably, this account type does not charge any commissions, which can be advantageous for traders looking to avoid additional trading costs. The minimum deposit required to open a Standard account is $100, providing accessibility to a range of traders. Withdrawals from this account are free of charge, and users have the option to practice and test their strategies with a demo account.

On the other hand, the ECN account also offers leverage of up to 1:500, allowing for substantial trading power. Like the Standard account, it features variable spreads, which can appeal to traders who are comfortable with spread fluctuations. However, the ECN account differs in that it charges a commission of $5 per lot traded. This commission structure is common for ECN accounts and is used to compensate for the direct access to the market provided. The minimum deposit requirement is $100, making it accessible to a wide range of traders.

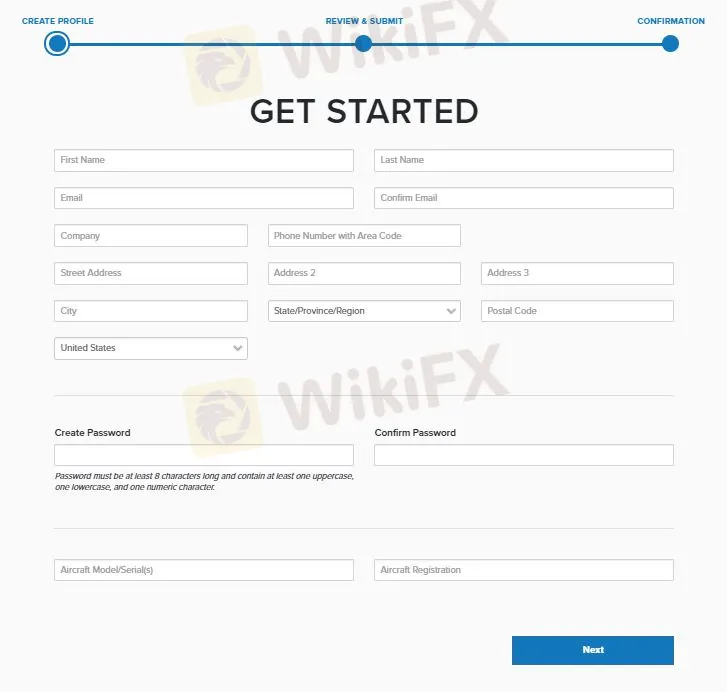

How to Open an Account?

Opening an account with VT is a straightforward process that can be broken down into six clear steps:

Visit VT 's Website: Start by visiting the official website of VT Private Limited. You can do this by typing the web address into your browser or by searching for VT using a search engine.

Select “Open an Account”: Once on the website, look for an option that allows you to open a new trading account. This is typically found in the top menu or on the homepage. Click on the “Open an Account” or similar button.

Choose Your Account Type: VT offers different account types, such as Standard and ECN. Select the account type that best suits your trading preferences and click on it to begin the account opening process.

Fill in Your Information: You will be asked to provide personal information, including your full name, email address, phone number, and sometimes your residential address. Ensure that the information you provide is accurate.

Verify Your Identity: To comply with regulatory requirements, you may need to complete a Know Your Customer (KYC) verification. This often involves submitting identification documents, such as a passport or driver's license, as well as proof of address, like a utility bill.

Fund Your Account: After your identity is verified, you'll need to fund your trading account. VT typically provides various deposit methods, such as bank transfers, credit cards, and online payment systems. Choose your preferred method and follow the instructions to deposit the minimum required amount, which varies based on the chosen account type.

Leverage

VT offers a maximum leverage of up to 1:500. This means that for every unit of your own capital invested, you can control a trading position worth up to 500 times that amount. High leverage like this can magnify both potential profits and losses in your trading activities.

It's important to use this level of leverage with caution and employ effective risk management strategies to mitigate the increased risk associated with higher leverage. Additionally, it's worth noting that the availability of leverage may vary depending on the financial instrument you are trading and the specific account type you have with VT .

Spreads & Commissions

VT offers variable spreads and different commission structures based on the account type:

Standard Account:

Spread: The spread in the Standard account is variable, meaning it can fluctuate based on market conditions. Variable spreads may tighten during periods of high liquidity or widen during lower liquidity periods.

Commission: There is no commission charged for trades in the Standard account. Instead, the cost of trading is primarily covered by the spread.

ECN Account:

Spread: Similar to the Standard account, the ECN account features variable spreads. These spreads can vary depending on market conditions, but they often tend to be relatively tighter than those in the Standard account.

Commission: In the ECN account, traders are charged a commission of $5 per lot traded. This means that for each standard lot (a specific unit size of a financial instrument), you will incur a $5 fee in addition to the spread.

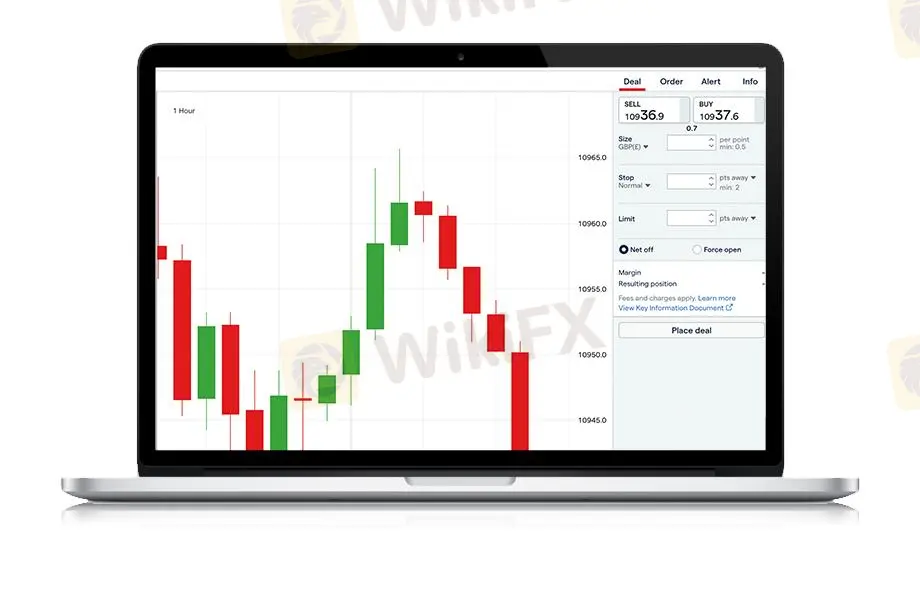

Trading Platform

VT provides traders with the popular and versatile trading platform, MetaTrader 4 (MT4). Here's an overview of the trading platform offered by VT :

MetaTrader 4 (MT4):

Technology: MetaTrader 4 is a widely recognized and trusted trading platform developed by MetaQuotes Software. It's known for its advanced technology and features, making it a popular choice among traders worldwide.

Asset Variety: MT4 allows traders to access a wide range of financial instruments, including Forex, CFDs on stocks, indices, commodities, and cryptocurrencies. This diversity enables traders to build diversified portfolios and explore various markets.

User-Friendly Interface: MT4 features an intuitive and user-friendly interface, making it accessible to both beginners and experienced traders. The platform's design is well-organized and offers multiple customization options.

Charting and Analysis: MT4 offers an extensive selection of technical indicators, charting tools, and timeframes for in-depth technical analysis. Traders can conduct comprehensive market analysis using these resources.

Algorithmic Trading: The platform supports algorithmic trading through the use of Expert Advisors (EAs) and automated trading strategies. Traders can develop their own EAs or choose from a library of existing ones.

Mobile and Web Trading: MT4 is available for desktop, mobile (iOS and Android), and web-based platforms, offering flexibility and accessibility for trading on the go.

Real-Time Market Data: Traders can access real-time market data, news feeds, and economic calendars within the platform to stay informed about market developments.

The MetaTrader 4 platform is well-regarded for its reliability, functionality, and the vast array of tools it offers to assist traders in making informed decisions and executing trades efficiently. It's particularly popular among traders for its user-friendly interface and advanced charting capabilities.

Deposit & Withdrawal

VT offers a variety of payment methods for deposits and withdrawals, along with specific minimum deposit requirements and estimated payment processing times. Here's an overview of these important aspects:

Payment Methods:

VT provides multiple payment methods to accommodate the preferences of its clients. These payment methods typically include:

Bank Wire Transfer: Traders can fund their accounts or withdraw funds through bank wire transfers. This method is often used for larger transactions and may take a few business days to process.

Credit/Debit Cards: Credit and debit cards are commonly accepted for both deposits and withdrawals. They offer a convenient and faster payment processing option.

E-Wallets: VT may support popular e-wallets such as PayPal, Skrill, Neteller, or other similar platforms. E-wallets often offer fast transaction processing.

Cryptocurrency: Some brokers also accept cryptocurrency deposits and withdrawals. Cryptocurrency transactions are known for their speed and security.

Minimum Deposit:

VT specifies a minimum deposit requirement to open a trading account. The minimum deposit amount serves as the initial funding needed to start trading with the broker. In this case, the minimum deposit at VT is $100. This amount can vary depending on the type of account and broker policies, so it's essential to check the specific requirements for the account you intend to open.

Payment Processing Time:

The processing time for deposits and withdrawals can vary depending on the chosen payment method and the broker's internal processes. Generally, bank wire transfers may take a few business days to process, while credit/debit card transactions and e-wallets often offer faster processing times. Cryptocurrency transactions are known for their speed, often processed within a few minutes.

Customer Support

VT offers customer support to assist traders with their inquiries, issues, and account-related matters. The customer support services at VT are designed to provide efficient and responsive assistance. Here's an overview of the customer support features:

24/5 Live Chat: VT provides a 24/5 live chat service, which means traders can access live chat support during regular business hours, five days a week. This feature offers immediate and real-time assistance for a wide range of inquiries, such as account-related questions, technical issues, or general support. Live chat is often the preferred method for resolving urgent issues.

Email Support: In addition to live chat, VT offers email support. Traders can send their inquiries or concerns via email to the broker's support team. Email support is valuable for more complex issues, documentation requests, or when traders prefer a written record of their communication with the broker. This method allows traders to describe their issues in detail and attach relevant documents when necessary.

Educational Resources

VT 's educational resources are limited, which could pose challenges for traders, especially newcomers, who are looking to enhance their knowledge and skills in the financial markets. While the platform does offer some educational materials, it may not provide the depth and variety of resources that some traders require.

Conclusion

In conclusion, VT offers certain advantages, including high leverage, variable spreads, a wide range of cryptocurrencies, and accessible customer support.

However, it is essential to consider the associated disadvantages, such as the lack of regulatory oversight, limited educational resources, restricted availability in some regions, and the absence of comprehensive market analysis tools. Traders should weigh these pros and cons carefully when deciding whether VT aligns with their trading needs and risk tolerance.

FAQs

Q: What is the maximum leverage offered by VT ?

A: VT offers a maximum leverage of 1:500, allowing traders to control larger positions with a relatively small amount of capital.

Q: Does VT provide educational resources for new traders?

A: VT lacks comprehensive educational resources, such as user guides, video tutorials, or live webinars, which can make it challenging for new traders to learn the platform.

Q: What are the available customer support options at VT ?

A: VT offers 24/5 customer support through live chat and email, providing assistance to traders during regular business hours.

Q: Are there any restrictions on the availability of VT in certain regions?

A: VT may not be available in some countries or regions due to regulatory constraints. Traders should check if the platform is accessible in their location.

Q: Are there any fees associated with deposits and withdrawals at VT ?

A: VT typically offers free withdrawals. However, specific fees related to deposits may vary depending on the chosen payment method.

Q: Can I trade a wide range of cryptocurrencies on VT ?

A: Yes, VT provides access to a diverse range of cryptocurrencies, allowing traders to engage in cryptocurrency trading across multiple assets.