Basic Information

India

India

Score

India

|

5-10 years

|

India

|

5-10 years

| https://www.aiwinmoney.com/index.php

Website

Rating Index

Influence

D

Influence index NO.1

Netherlands 2.51

Netherlands 2.51 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

India

India aiwinmoney.com

aiwinmoney.com United States

United States| Aiwin Review Summary | |

| Founded | 2015 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Trading Products | Commodities, equities, mutual funds, currency derivatives |

| Demo Account | ❌ |

| Trading Platform | Aiwin (Pro, Web, Mobile) |

| Minimum Deposit | / |

| Customer Support | Phone: +91 89250 89250 (Mon-Fri, 9:00 AM - 6:00 PM) |

| WhatsApp: +91 89250 89250 (Send “Hi”) | |

| Email: grievance@aiwinmoney.com | |

| Address: No:23E, 1st Floor, West Park Road, Shenoy Nagar, Chennai-600030, India | |

Aiwin is a financial services company in India that offers a wide range of goods, such as commodities, stocks, mutual funds, and currency derivatives. Their trading software works on desktops, the web, and mobile devices. Aiwin focuses on making tools that are easy to use and prices that are competitive to enable traders make quick, educated decisions.

| Pros | Cons |

| Wide product range | Unregulated broker |

| Transparent fee info | No demo accounts |

| No info on deposit and withdrawal |

No. Aiwin operates without formal regulation from a recognized financial authority. Please be aware of the risk!

| Trading Products | Supported |

| Commodities | ✔ |

| Equities | ✔ |

| Mutual Funds | ✔ |

| Currency Derivatives | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

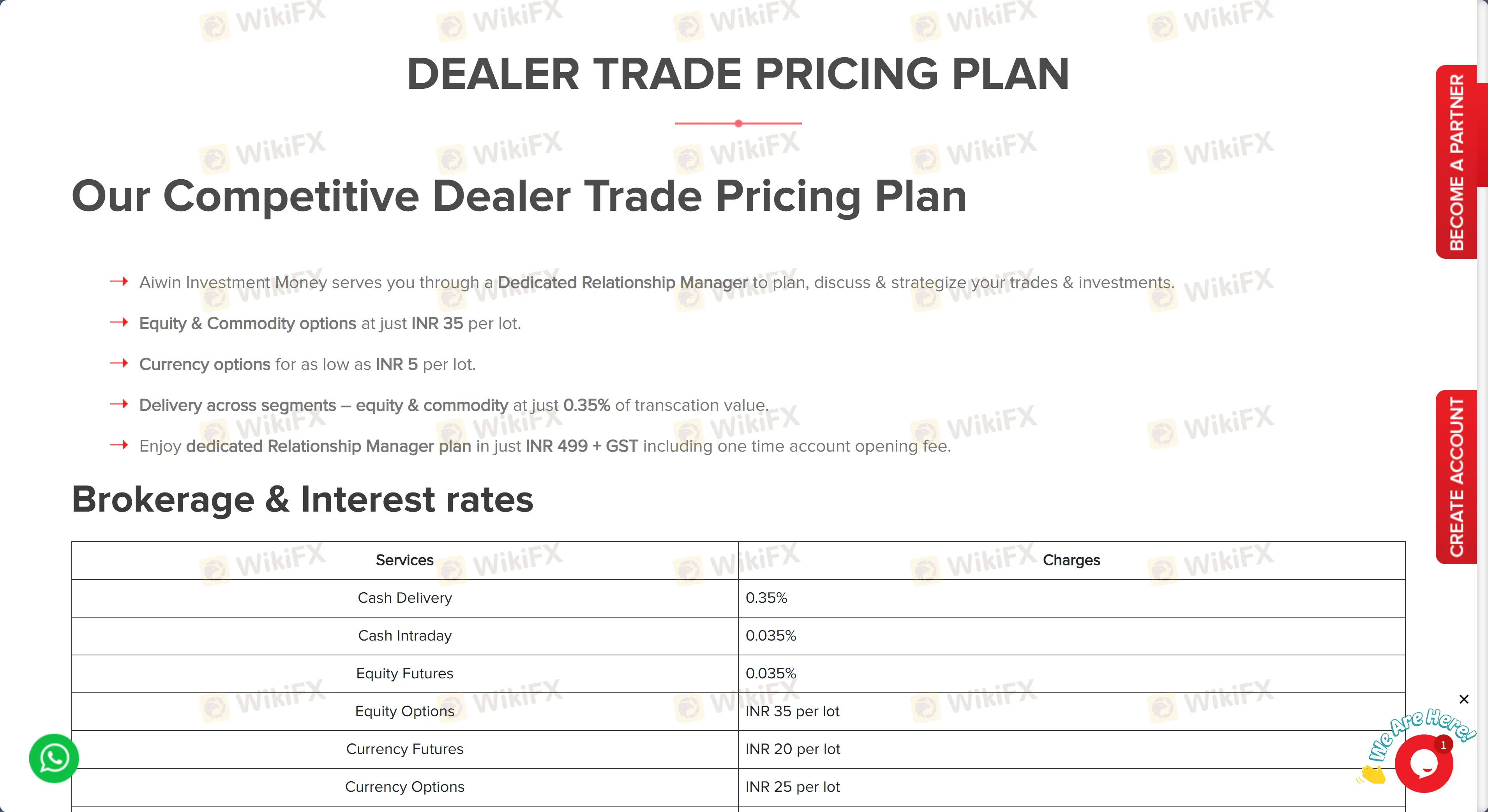

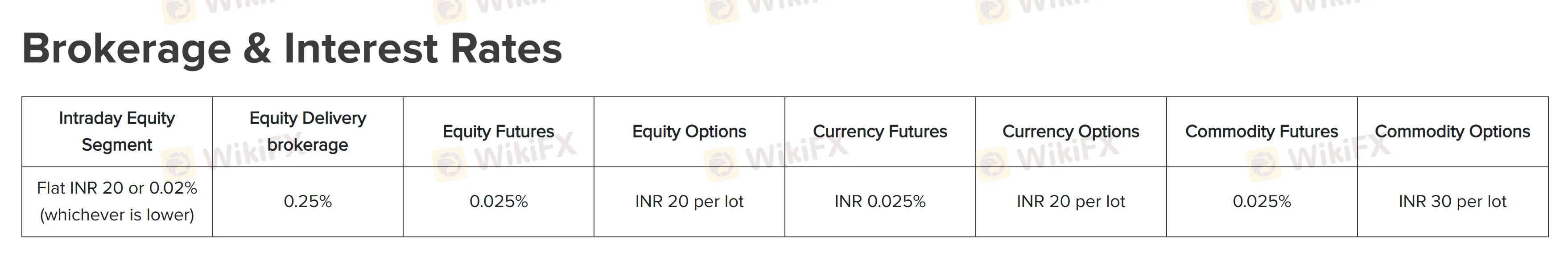

| Pricing Plan | Details |

| Free Trade Plan | - Intraday Equity: Flat INR 20 or 0.02% per order (whichever is lower) |

| - Equity & Commodity Delivery: 0.25% of transaction value | |

| - Free account opening | |

| Dealer Trade Pricing Plan | - Dedicated Relationship Manager service |

| - Equity & Commodity Options: INR 35 per lot | |

| - Currency Options: INR 5 per lot | |

| - Delivery (Equity & Commodity): 0.35% of transaction value | |

| - Relationship Manager plan: INR 499 + GST (includes one-time account opening fee) |

| Fee Type | Rate |

| Cash Delivery Brokerage | 0.35% |

| Cash Intraday Brokerage | 0.04% |

| Equity Futures Brokerage | 0.04% |

| Equity Options Brokerage | INR 35 per lot |

| Currency Futures Brokerage | INR 20 per lot |

| Currency Options Brokerage | INR 25 per lot |

| Commodity Futures Brokerage | 0.04% |

| Commodity Options Brokerage | INR 35 per lot |

| Minimum Brokerage | INR 21 per executed order (max 2.5% contract value) |

| Brokerage on Options | Max 2.5% premium or INR 100 per lot (whichever higher) |

| Stock Margin Interest Rate | 0.025% per day |

| Debit Balance Interest Rate | 0.05% per annum |

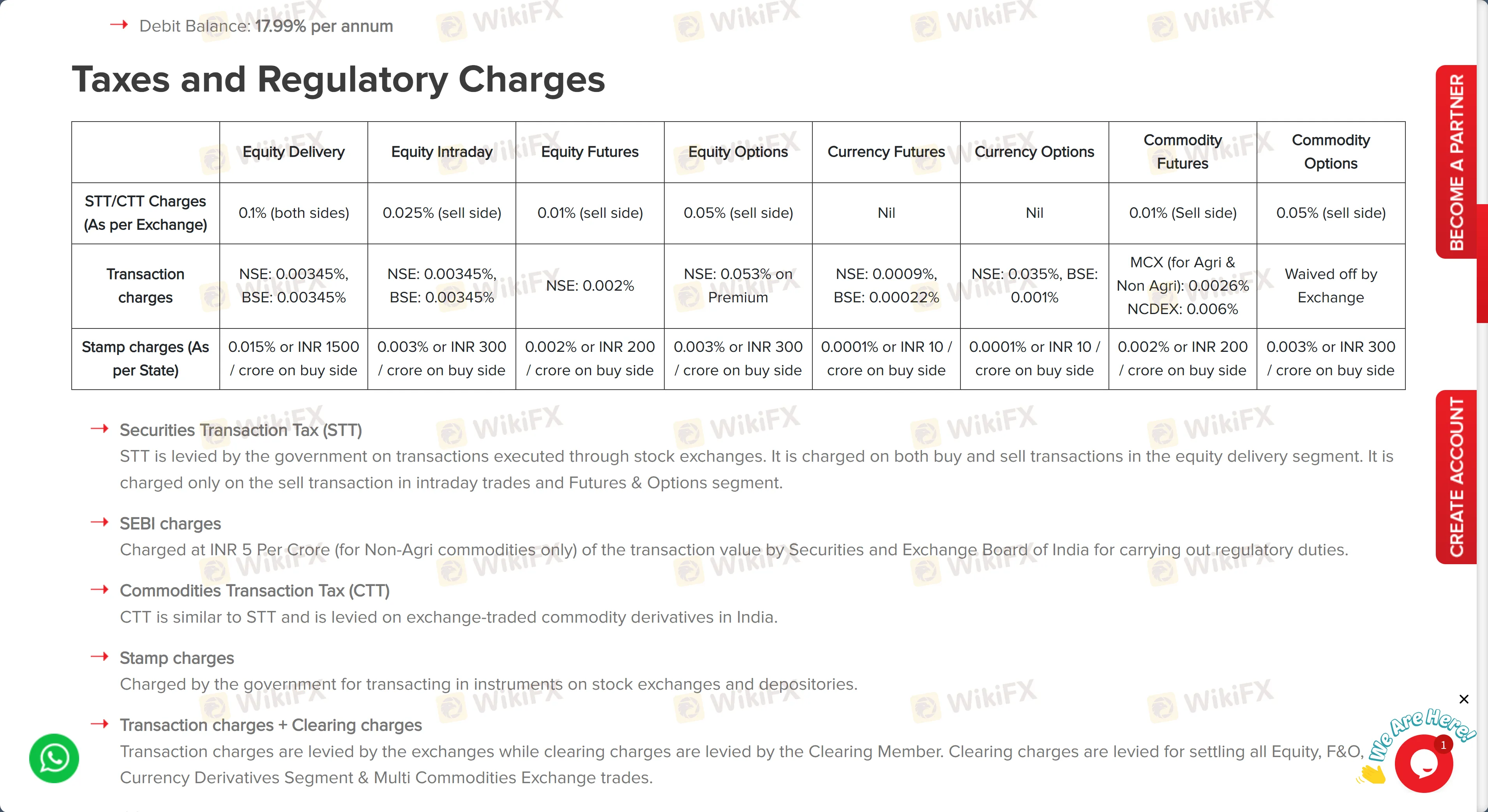

| Taxes & Charges | Details |

| Securities Transaction Tax (STT) | Charged on buying & selling in delivery; only selling in intraday/F&O |

| Commodities Transaction Tax (CTT) | Similar to STT for commodity derivatives |

| SEBI Charges | INR 5 per crore on non-agri commodities |

| Stamp Charges | State-wise stamp duty on transactions |

| Transaction + Clearing Charges | Levied by exchanges and clearing members |

| GST | 18% on brokerage + transaction charges |

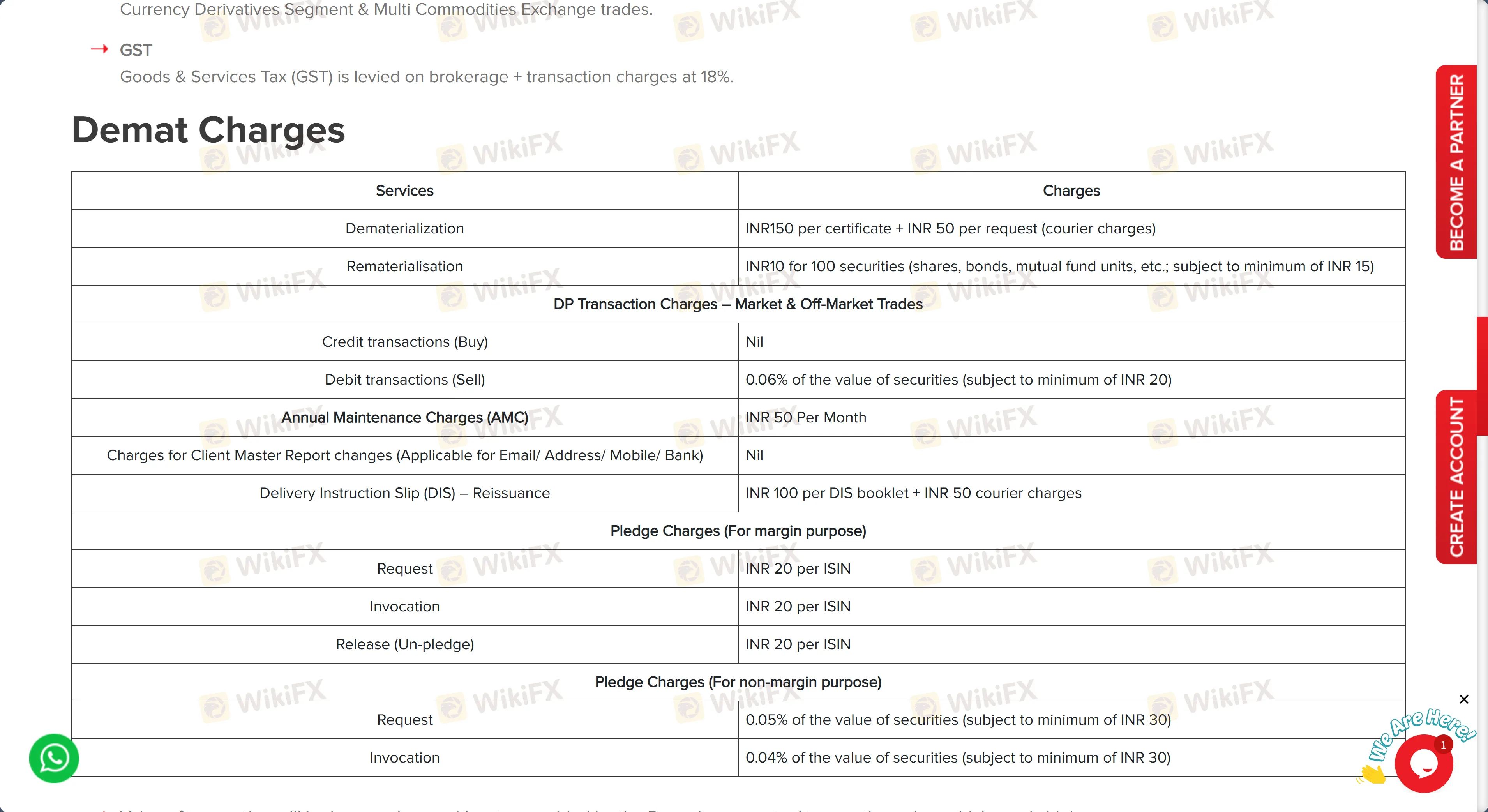

| Other Charges | Rate |

| Dematerialization | INR 5 per certificate + INR 50 courier |

| Rematerialisation | INR 10 per 100 securities (min INR 15) |

| DP Transaction Charges (Sell) | 0.06% (min INR 20) |

| Annual Maintenance Charges | INR 50 per month |

| Delivery Instruction Slip | INR 100 per booklet + INR 50 courier |

| Pledge Charges | Request/Invocation/Release: INR 20 per ISIN |

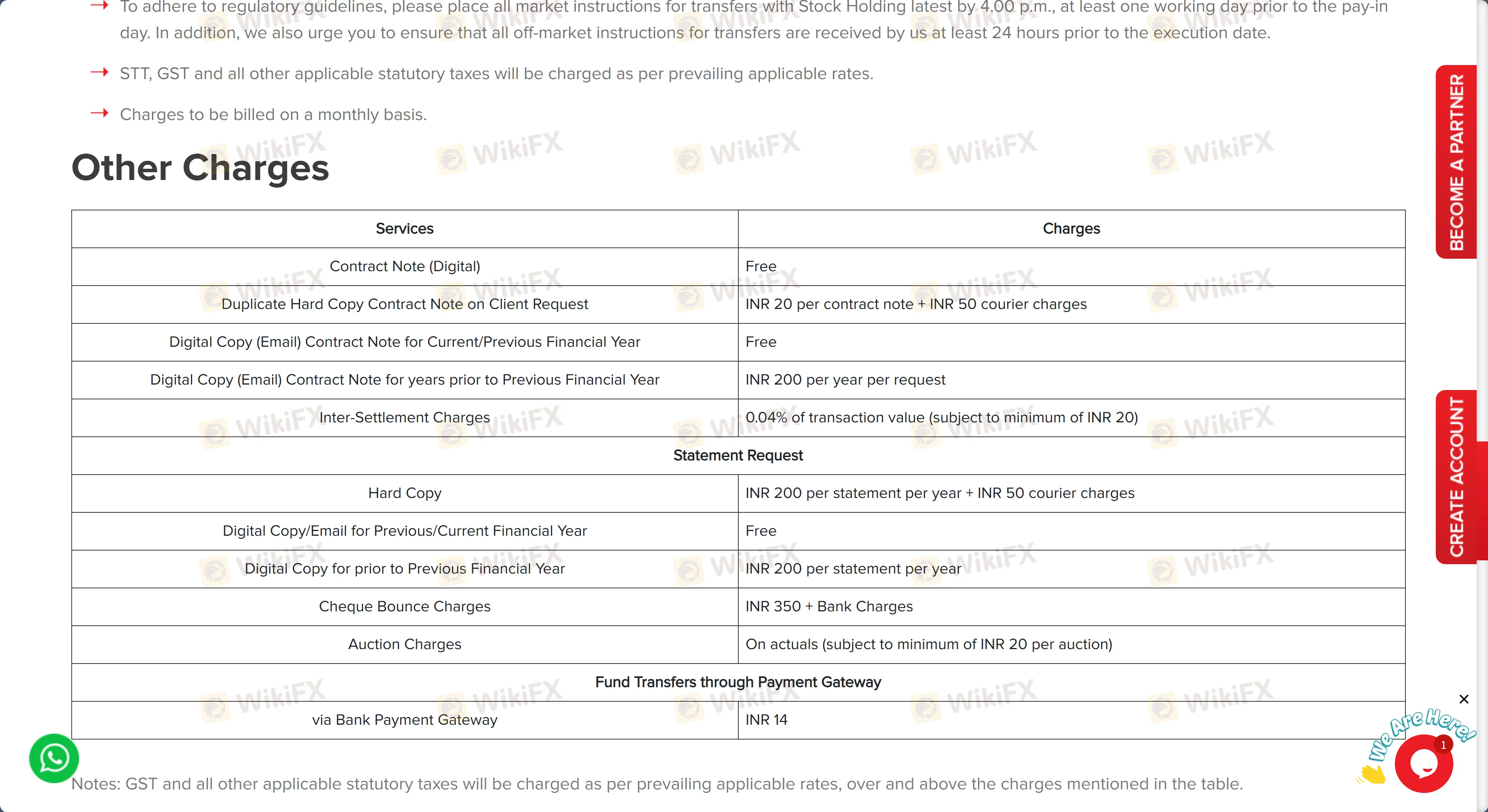

| Contract Note (Digital) | Free |

| Duplicate Hard Copy Contract Note | INR 49 + INR 50 courier |

| Digital Copy Prior Years | INR 99 per year/request |

| Statement Request (Hard Copy) | INR 99 per year + INR 50 courier |

| Cheque Bounce Charges | Online INR 300 + bank charges; Offline INR 500 + bank charges |

| Auction Charges | Actuals (min INR 25) |

| Fund Transfers via Gateway | INR 14 |

| Call and Trade Charges | INR 20 per call |

| Trading Platform | Supported | Available Devices |

| Aiwin | ✔ | Desktop (Windows, Mac), Web, iOS, Android |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now