Company Summary

| AGORA direct Review Summary | |

| Founded | 2005 |

| Registered Country/Region | Germany |

| Regulation | FCA (Suspicious clone) |

| Trading Products | Shares, ETFs, Options, Futures, CFDs, Bonds, Commodities, Cryptos, Funds |

| Demo Account | ✅ |

| Leverage | / |

| Trading Platform | Trader Workstation |

| Minimum Deposit | €0 |

| Customer Support | Phone: +49 30 789 59 750 |

| Email: info@agora-direct.de | |

AGORA direct Information

In 2005, AGORA direct was founded in Germany. It gives you access to more than 150 global exchanges and a comprehensive choice of trading tools, such as stocks, ETFs, CFDs, options, futures, and cryptocurrencies. The company says it is authorized by the UK's Financial Conduct Authority (FCA), but the real licensed institution is different. AGORA direct is categorized as a suspicious clone, which means it falsely pretends to be regulated. The company does, however, stress cheap fees, openness, and wide trading access through its Trader Workstation platform.

Pros and Cons

| Pros | Cons |

| Access to 150+ global exchanges | Suspicious FCA clone license |

| Multiple account types | No support for Islamic accounts |

| Low and transparent fees with no inactivity charges | Complex fee structure |

| Professional trading platform (Trader Workstation) | No MT4/MT5 |

| No minimum deposit | Limited payment methods |

| No deposit fees |

Is AGORA direct Legit?

The UK's Financial Conduct Authority (FCA) lists Agora–Direct Limited as a regulated business with license number 706273. However, the company shown now has the status of “Suspicious Clone.”

| Regulatory Status | Suspicious clone |

| Regulatory Authority | Financial Conduct Authority (FCA) |

| Regulated by | United Kingdom |

| Licensed Institution | Agora–Direct Limited |

| License Type | Investment Advisory License |

| License Number | 706273 |

What Can I Trade on AGORA direct?

AGORA direct has a lot of different financial goods and services, such as shares, ETFs, options, CFDs, futures, and funds. The company stresses that trading should be open and cheap, with no hidden costs and access to more than 150 exchanges around the world.

| Trading Products | Supported |

| Shares | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Futures | ✔ |

| CFDs | ✔ |

| Bonds | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Funds | ✔ |

| Forex | ❌ |

| Indices | ❌ |

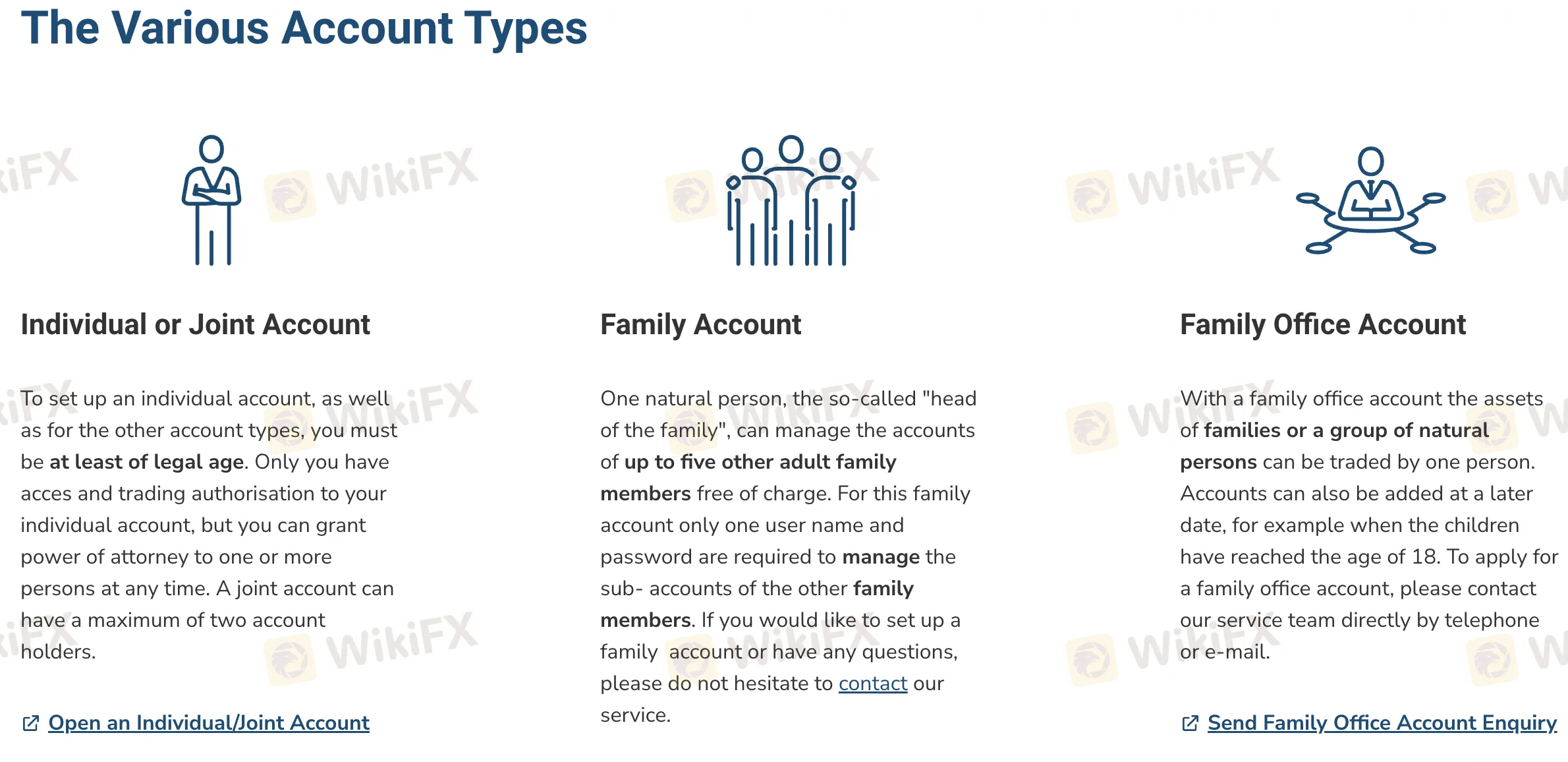

Account Type

AGORA direct has a number of real account types that are designed for different types of clients. It also has a demo account for practicing, but it doesn't have Islamic accounts.

| Account Type | Suitable for |

| Individual / Joint Account | Retail traders, investors |

| Corporate / Institutional | Companies, funds, financial institutions |

| Fund Account | Investment and mutual funds |

| Asset Manager / Advisor | Portfolio managers and financial consultants |

| Family / Family Office | Family asset managers and UHNW individuals |

| Prop Trader Account | Professional proprietary traders |

AGORA direct Fees

AGORA direc has straightforward and low-cost fee structures that are much lower than those of many other companies in the same field. There are no costs for inactivity or administration, and you can make free deposits and your first SEPA withdrawal per month.

| Fees | Amount |

| Account Management | 0 |

| Inactivity Fee | 0 |

| Minimum Deposit | 0 |

| Deposits (SEPA) | 0 |

| First Withdrawal (SEPA/month) | 0 |

| Additional Withdrawals (SEPA/month) | May incur a fee; varies |

| Currency Conversion | Currency-neutral trading supported (no forced FX) |

| Dividend & Corporate Actions Processing | Mostly free; exceptions have pass-through or third-party fees |

| Depository Receipt Fees | Up to USD 0.03/share (ADR, GDR, etc.) |

| Conversion of Depository Receipts | Up to USD 500, depending on timing |

| Trade Amendments | Generally free |

| Option & Future Exercise | No AGORA fee; minor exchange/3rd-party charges may apply |

| Failed Trades / Trade Reversals | Exchange pass-through fees, up to USD 900 |

| Monthly / Annual Reports | Free (up to 7 years); archive access may incur fees |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Trader Workstation | ✔ | Desktop, Tablet, Mobile, Browser | Professional and active traders |

| MetaTrader 4 | ✘ | – | Beginners |

| MetaTrader 5 | ✘ | – | Experienced traders |

Deposit and Withdrawal

There are no fees for deposits with AGORA direct™, and the minimum deposit amount is €0. Clients can add money to their account by making bank transfers, even from other institutions' existing custodial accounts.

| Payment Method | Minimum Deposit | Deposit Fees | Deposit Time |

| Bank Transfer (SEPA) | €0 | 0 | Typically 1–2 business days |

| Custody Account Transfer | Varies by originating bank |