Basic Information

South Africa

South Africa

Score

South Africa

|

5-10 years

|

South Africa

|

5-10 years

| https://www.randswiss.com/

Website

Rating Index

Influence

C

Influence index NO.1

South Africa 2.93

South Africa 2.93 Licenses

LicensesLicensed Entity:RAND SWISS (PTY) LTD

License No. 45837

South Africa

South Africa randswiss.com

randswiss.com United States

United States| RAND SWISSReview Summary | |

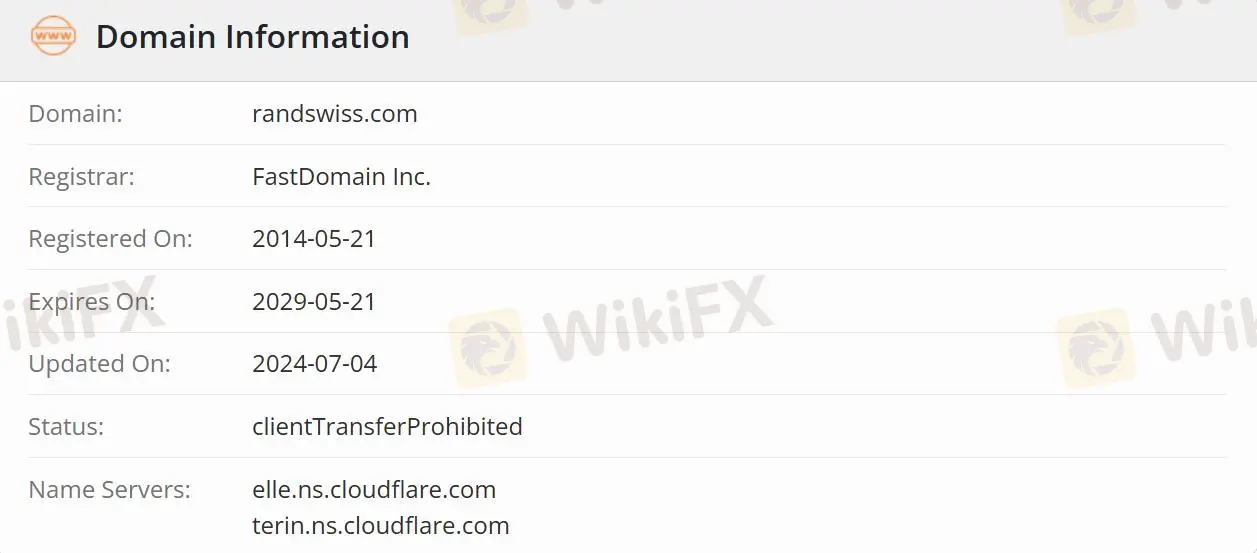

| Founded | 2014-05-21 |

| Registered Country/Region | South Africa |

| Regulation | Suspicious Clone |

| Services | Securities Broking/Custody Solutions/Wealth & Advisory |

| Min Deposit | R25,000 |

| Customer Support | Email: info@randswiss.com |

| Phone:+27(11)781 4454 | |

| YouTube, Twitter, LinkedIn, WhatsApp | |

RAND SWISS is a South African based broker-dealer specializing in securities broking, custody solutions, and wealth and advisory.

Securities brokerage covers accounts, foreign exchange trading, and platform login content. Custody solutions include model portfolios such as the Global Equity Portfolio, South African Equity Portfolio, and Future Tech AI Portfolio, structured products like the Offshore Core Global Growth Report and the Worst Triple Index Auto-Subscription, and custody, including Citibank, Fidelity, and Swissquote Bank.

Wealth and Advisory encompasses investments such as offshore and local investments, pre-retirement and post-retirement planning, Tax-Free Savings Accounts (TFSA), tax wrapping, estate planning like wills, trusts, and fiduciary services, and risk and protection such as income protection - life insurance and business risk.

Financial Sector Conduct Authority(FSCA) regulates RAND SWISS with license number 45837 and License Type Retail Forex License. However, the 'Suspicious Clone' current status is not as safe as the regulated one.

RAND SWISS offers both Private Brokerage and Active Trading accounts. The minimum deposit for an Active Trading account is R25,000. Clients can trade forex, commodities, indices, and local and offshore stock CFDs from one account. Long-term equity investors who wish to invest locally and overseas in local or foreign currencies can open a Private Brokerage account with a minimum deposit of R2 million.

| Account Type | Private Brokerage | Active Trading |

| Minimum Deposit | R2 million | R25,000 |

| Products | Local or Foreign Currencies | Forex/Commodities/Indices/Local and Offshore Stock CFDs |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now