Company Summary

| CGS CIMB Review Summary | |

| Founded | 1944 |

| Registered Country/Region | Singapore |

| Regulation | No Regulation |

| Services | Individual Services, Prime Services, Private Wealth, Asset Management, Institutional Services, Investment Banking |

| Trading Platform | iTrade, CFD ViewPoint, MetaTrader 4, CQG, UP, ProsperUs |

| Customer Support | OPERATING HOURS: 8.30 am to 5.30 pm (Monday - Friday) , Closed on Saturdays, Sundays & Public Holidays |

| Contact form | |

| Phone: 1800 538 9889 / +65 6225 1228 | |

| Fax: +65 6538 9889 | |

| Address: 10 Marina Boulevard #09-01 Marina Bay Financial Centre Tower 2, Singapore 018983 | |

CGS CIMB, an unregulated Singapore-based firm founded in 1944, offers various financial services such as Individual Services, Prime Services, Private Wealth, Asset Management, Institutional Services, and Investment Banking. They also provide multiple trading platforms: iTrade, CFD ViewPoint, MetaTrader 4, CQG, UP, and ProsperUs.

Pros and Cons

| Pros | Cons |

| A wide range of financial services | No regulation |

| MT4 platform available | Unclear fee structure |

| Diverse atrading platforms | |

| Multiple customer support channels |

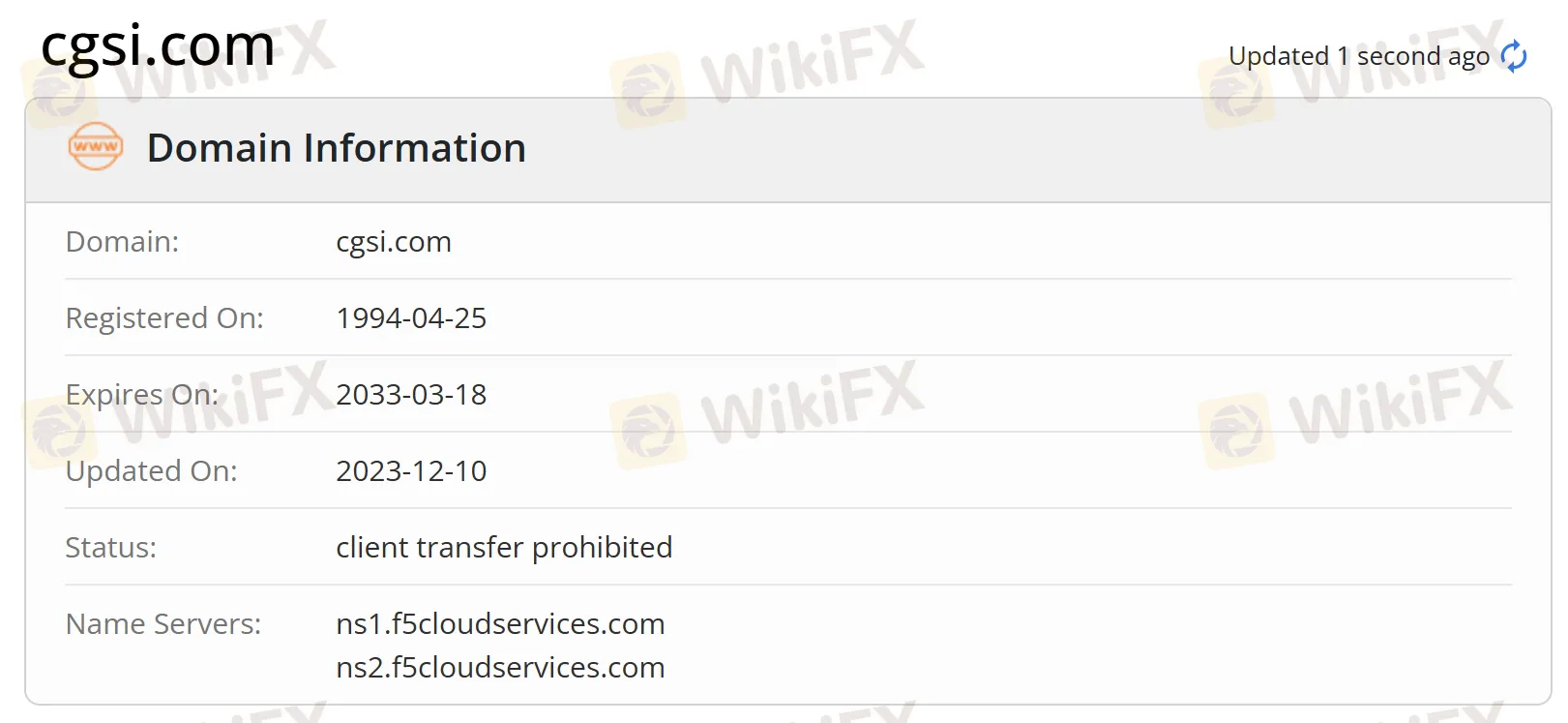

Is CGS CIMB Legit?

At present, CGS CIMB lacks valid regulation. Its domain was registered on April 25, 1944, and the current status is “client Transfer Prohibited”. Please pay high attention to the safety of your funds if you choose this broker.

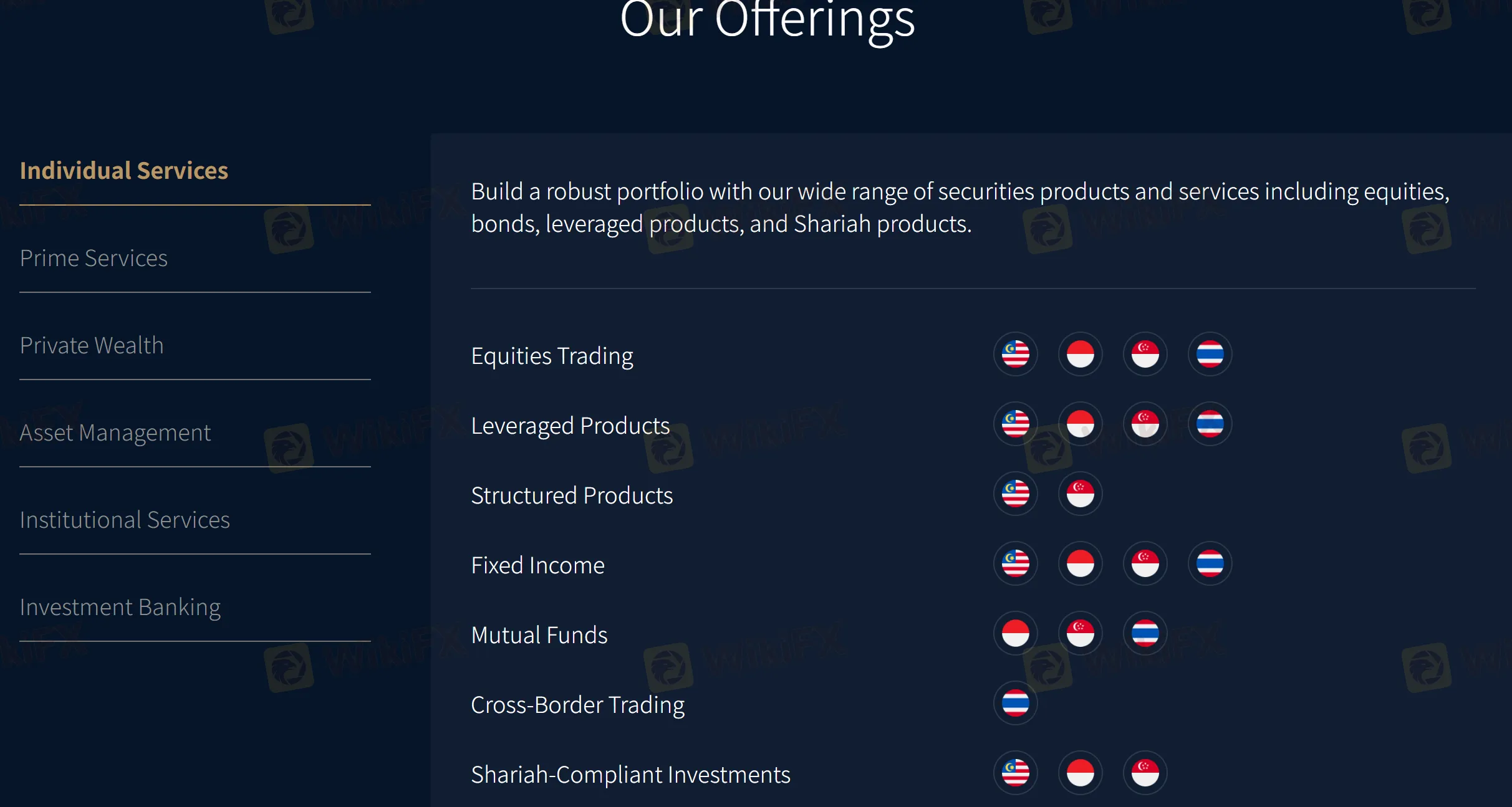

Services

CGS CIMB provides clients withfinancialservices like Individual Services, Prime Services, Private Wealth, Asset Management, Institutional Services, Investment Banking.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, iOS, Android | Beginners |

| iTrade | ✔ | Web, iOS, Android, desktop | / |

| CFD ViewPoint | ✔ | Web, iOS, Android | / |

| CQG | ✔ | Desktop, iOS, Android | / |

| UP | ✔ | iOS, Android | / |

| ProsperUs | ✔ | iOS, Android | / |

| MT5 | ❌ | / | Experienced traders |