Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 1-2 years |

| Company Name | SPARK-CAPITAL INTERNATIONAL LLC. |

| Regulation | Operates without strict regulatory oversight |

| Minimum Deposit | $250 |

| Maximum Leverage | 2:1 (for margin trading) |

| Spreads | 0.05% to 0.25% |

| Trading Platforms | Algorithmic Trading Platform, Mobile Trading Platform |

| Tradable Assets | Equity, Debt, Derivative, Venture Capital |

| Account Types | Individual Account, Institutional Account, Sophisticated Investor Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Twitter account: @Sparkcapitaluk |

| Payment Methods | ACH transfers, Wire transfers, Credit cards, Debit cards, Cash |

| Educational Tools | Not specified |

Overview of Spark Capital

Spark Capital International LLC is a United Kingdom-based company that operates with limited types of market instruments, including equity, debt, derivative, and venture capital offerings. They provide individual, institutional, and sophisticated investor accounts, each with different minimum investment requirements and access to the firm's funds. The company offers margin trading with a maximum leverage of 2:1 and charges spreads and commissions for their services. They have algorithmic and mobile trading platforms available to investors, but customer support is primarily offered through their Twitter account.

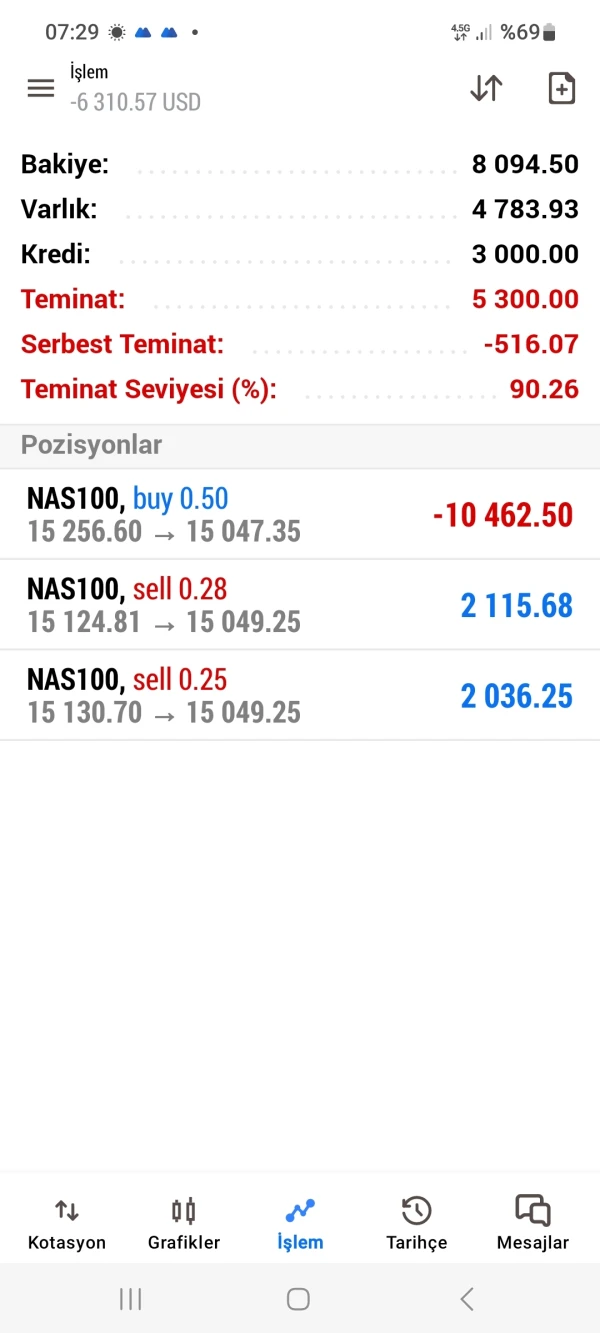

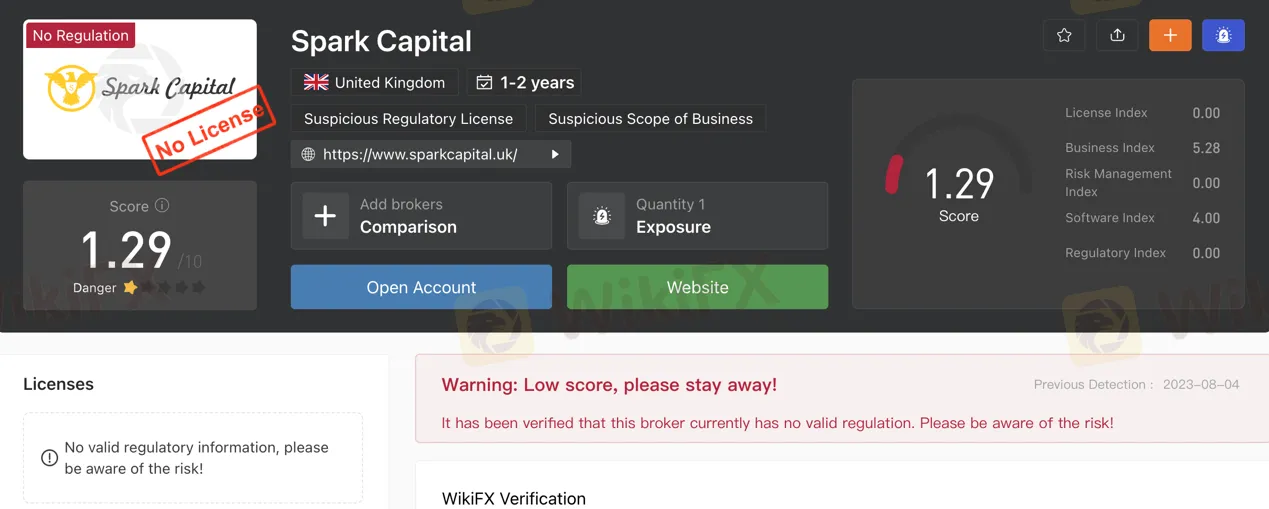

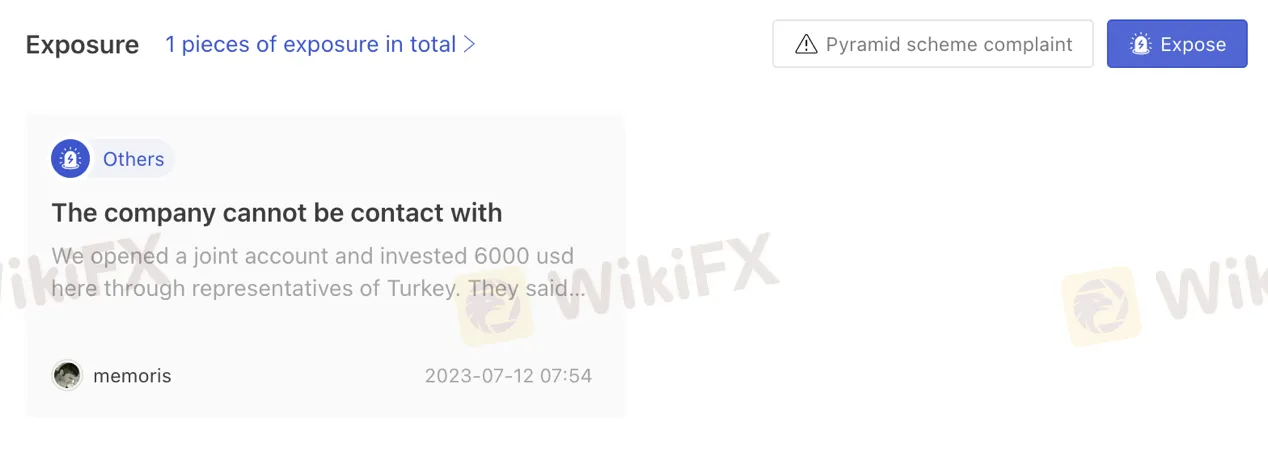

Proponents argue that Spark Capital's approach fosters concerns about investor protection and market integrity due to the company's lack of strict regulatory oversight. A single exposure review on WikiFX raises a complaint about the company's unresponsiveness to issues faced by an investor.

Pros and Cons

Spark Capital has several advantages that attract investors, including a wide range of investment instruments such as equity, debt, derivatives, and venture capital options. They also offer tailored account types to suit different investor needs. Moreover, Spark Capital provides margin trading with a 2:1 leverage ratio and features algorithmic and mobile trading platforms for efficient trading. On the downside, the company's main website is unavailable, and there are concerns about its lack of strict regulatory oversight. Additionally, customer support options are limited, and there are relatively high spreads and commissions, raising some investor apprehensions. Despite these drawbacks, Spark Capital stands out for its real-time market data accessibility and no minimum withdrawal requirement.

| Pros | Cons |

| Offers equity, debt, derivative, and venture capital instruments | Limited types of market instruments provided |

| Tailored account types for various investors | Main website unavailable |

| Margin trading available with 2:1 leverage | Lack of strict regulatory oversight |

| Algorithmic and mobile trading platforms | Limited customer support options |

| Real-time market data on mobile platform | Relatively high spreads and commissions |

| No minimum withdrawal amount | Concerns about investor protection and market integrity |

Is Spark Capital Legit?

Spark Capital operates without strict regulatory oversight, leading to concerns about investor protection and market integrity.

Market Instruments

EQUITY

Spark Capital offers equity instruments like common stocks, preferred stocks, and convertible notes, enabling investors to become partial owners of businesses and share in potential profits and losses.

DEBT

Debt instruments utilized by Spark Capital include bonds, debentures, and loans, providing businesses with financing options without diluting ownership.

DERIVATIVE

Spark Capital manages risks and hedges against market fluctuations using derivative instruments like options, futures, and swaps, which derive their value from underlying assets or benchmarks.

VENTURE CAPITAL

As a venture capital firm, Spark Capital specializes in providing funding to startups and early-stage companies with high growth potential through instruments like seed funding, Series A, Series B, and later-stage financing.

Pros and Cons

| Pros | Cons |

| Investors can become partial owners and share in profits/losses | Limited types of market instruments provided |

| Businesses get financing options without diluting ownership | Lack of transparency regarding pricing and liquidity |

| Risk management and hedging against market fluctuations | Limited information on trading volume and market depth |

Account Types

INDIVIDUAL ACCOUNT:

The Individual Account is designed for individual investors seeking to invest in Spark Capital's funds. With a minimum investment requirement of $25,000, this account offers access to the firm's investment opportunities. Investors can stay informed through quarterly updates on their investments and are required to pay an annual fee for the services provided.

INSTITUTIONAL ACCOUNT:

The Institutional Account is tailored for institutional investors looking to allocate significant capital. With a minimum investment threshold of $1 million, this account provides access to Spark Capital's diverse funds. Institutional investors can expect quarterly updates on their investments and are subject to an annual fee for the services rendered.

SOPHISTICATED INVESTOR ACCOUNT:

The Sophisticated Investor Account caters to high-net-worth individuals with substantial investment capabilities. This account requires a minimum investment of $5 million and grants access to Spark Capital's exclusive funds. Quarterly updates on investments are provided, and an annual fee is applicable for managing the account and its associated services.

| Pros | Cons |

| Tailored account types for different investor profiles | Minimum investment requirements may be high for some investors |

| Provides access to diverse investment opportunities Annual fees are applicable for all account types | |

| Quarterly updates keep investors informed Limited information on additional account benefits |

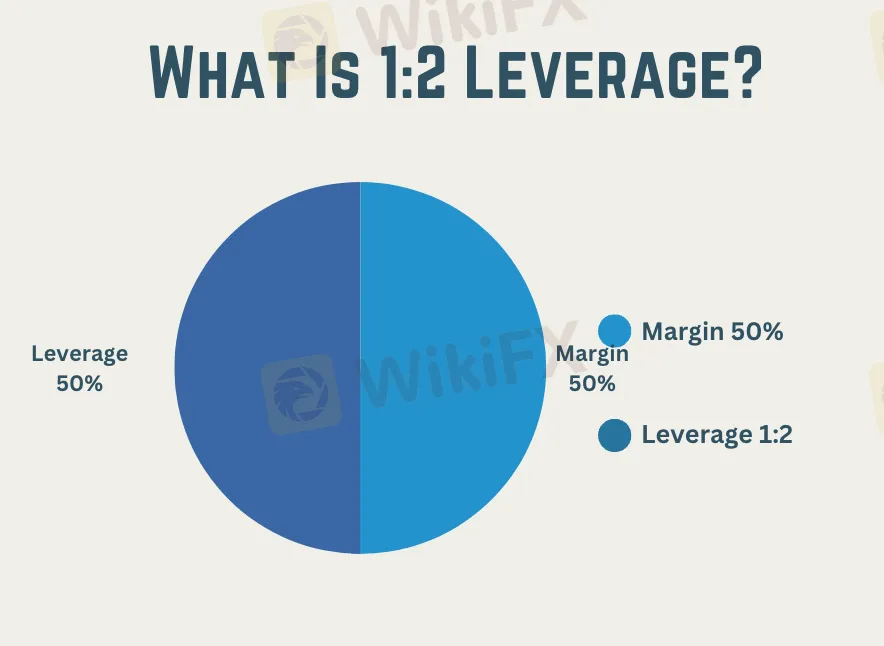

Leverage & Margin

Spark Capital offers margin trading with a maximum leverage of 2:1. This means that for every $1 you deposit, you can borrow $1 to trade with. The interest rate on margin loans is 5% APR.

Spreads & Commissions

Spark Capital charges spreads of 0.05% to 0.25% and commissions of $0.01 to $0.05 per share.

Minimum Deposit

The minimum deposit required to open an account with Spark Capital is $250. This is the same for all account types, including individual, institutional, and sophisticated investor accounts.

Deposit & Withdrawal

Spark Capital offers a variety of deposit and withdrawal methods, including ACH transfers, wire transfers, credit cards, debit cards, and cash. There is no fee for ACH transfers or debit card withdrawals. There is a fee of $25 for wire transfers. There is no minimum withdrawal amount.

| Pros | Cons |

| Multiple deposit and withdrawal methods available | Fee of $25 for wire transfers |

| No fees for ACH transfers or debit card withdrawals | Lack of information on withdrawal processing time |

| No minimum withdrawal amount | Relatively high minimum deposit |

Trading Platforms

ALGORITHMIC TRADING PLATFORM: Spark Capital offers an algorithmic trading platform that leverages sophisticated algorithms for rapid execution of large trades. The platform helps enhance trade efficiency and minimize market impact through data-driven decision-making.

MOBILE TRADING PLATFORM: Spark Capital's mobile trading platform enables investors to access financial markets and manage their portfolios on the go. With real-time market data, trade execution capabilities, and portfolio monitoring features.

| Pros | Cons |

| Algorithmic trading platform with sophisticated algorithms | No information on platform stability or reliability |

| Mobile trading platform for on-the-go access | Limited customer support options |

| Real-time market data and portfolio monitoring | Lack of details on available features and functionalities |

Customer Support

Spark Capital offers customer support primarily through its Twitter account, @Sparkcapitaluk. However, no email address or phone number for direct contact is available.

Reviews

A single exposure review on WikiFX regarding Spark Capital involves a pyramid scheme complaint. The reviewer invested $6000 through representatives from Turkey but faced system issues and server crashes. Communication became difficult as the company was unresponsive to phone calls for five days. The review was posted on July 12, 2023.

Conclusion

Advantages of Spark Capital include offering a diverse range of market instruments like equity, debt, derivatives, and venture capital, catering to various types of investors through individual, institutional, and sophisticated accounts. The algorithmic trading platform enhances trade efficiency and minimizes market impact. The mobile trading platform provides investors to trade on the go. On the other hand, the firm's lack of strict regulatory oversight raises concerns about investor protection and market integrity. Customer support is limited to the Twitter account, and there is a negative review regarding communication and system reliability issues. Prospective investors should weigh these factors carefully before considering Spark Capital.

FAQs

Q: Is Spark Capital a legitimate company?

A: Spark Capital operates without strict regulatory oversight, which raises concerns about investor protection and market integrity.

Q: What types of market instruments does Spark Capital offer?

A: Spark Capital provides equity instruments (common stocks, preferred stocks, convertible notes), debt instruments (bonds, debentures, loans), derivative instruments (options, futures, swaps), and venture capital funding for startups.

Q: What are the different account types available at Spark Capital?

A: Spark Capital offers Individual, Institutional, and Sophisticated Investor accounts with varying minimum investment requirements and access to different funds.

Q: What is the maximum leverage offered for margin trading at Spark Capital?

A: Spark Capital offers a maximum leverage of 2:1 for margin trading.

Q: What are the spreads and commissions charged by Spark Capital?

A: Spark Capital charges spreads ranging from 0.05% to 0.25% and commissions of $0.01 to $0.05 per share.

Q: What is the minimum deposit required to open an account at Spark Capital?

A: The minimum deposit required to open an account with Spark Capital is $250 for all account types.

Q: What deposit and withdrawal methods does Spark Capital support?

A: Spark Capital supports ACH transfers, wire transfers, credit cards, debit cards, and cash for deposits and withdrawals with varying fees.

Q: What trading platforms does Spark Capital offer?

A: Spark Capital provides an algorithmic trading platform for rapid execution and a mobile trading platform for on-the-go access to financial markets.

Q: How can I contact customer support at Spark Capital?

A: Customer support at Spark Capital is primarily available through their Twitter account, @Sparkcapitaluk.

Q: Are there any reviews or feedback available for Spark Capital?

A: There is a single exposure review on WikiFX regarding Spark Capital involving a pyramid scheme complaint.