Company Summary

| easyMarketsReview Summary | |

| Founded | 2003-12-06 |

| Registered Country/Region | Australia |

| Regulation | ASIC and CYSEC Regulations, FSA and FSC Offshore Regulations |

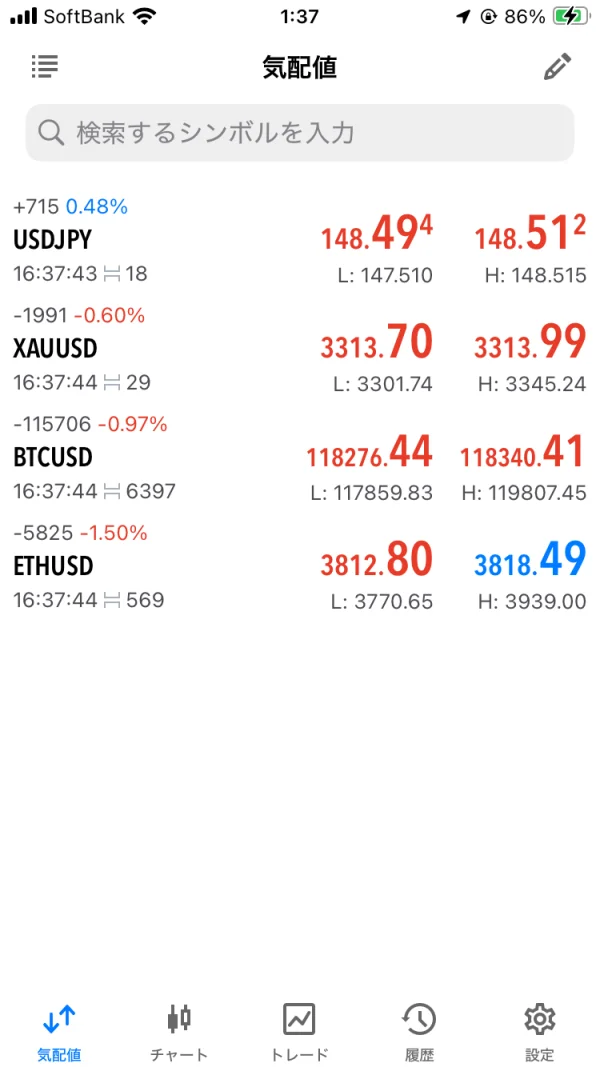

| Market Instruments | Forex, Commodities, Indices, Cryptocurrencies, Precious Metals, Shares |

| Demo Account | ✅ |

| Leverage | Up to 1:2000 |

| Spread | 0.7 pips for EUR/USD |

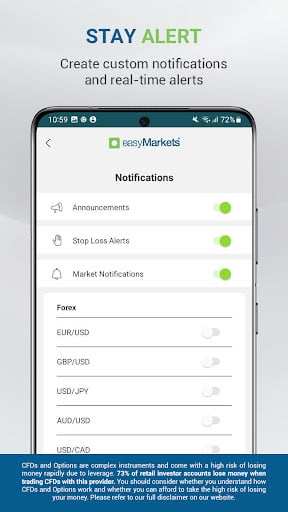

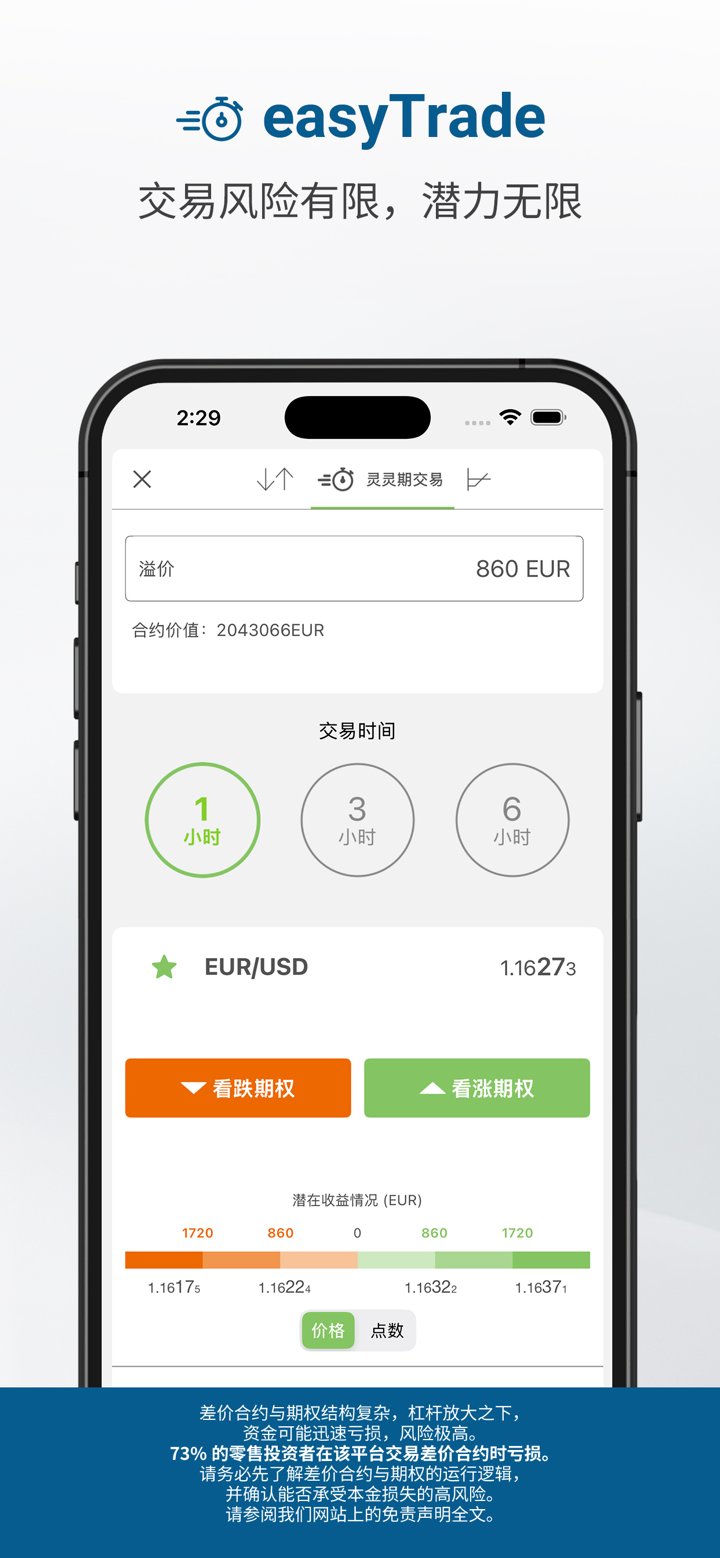

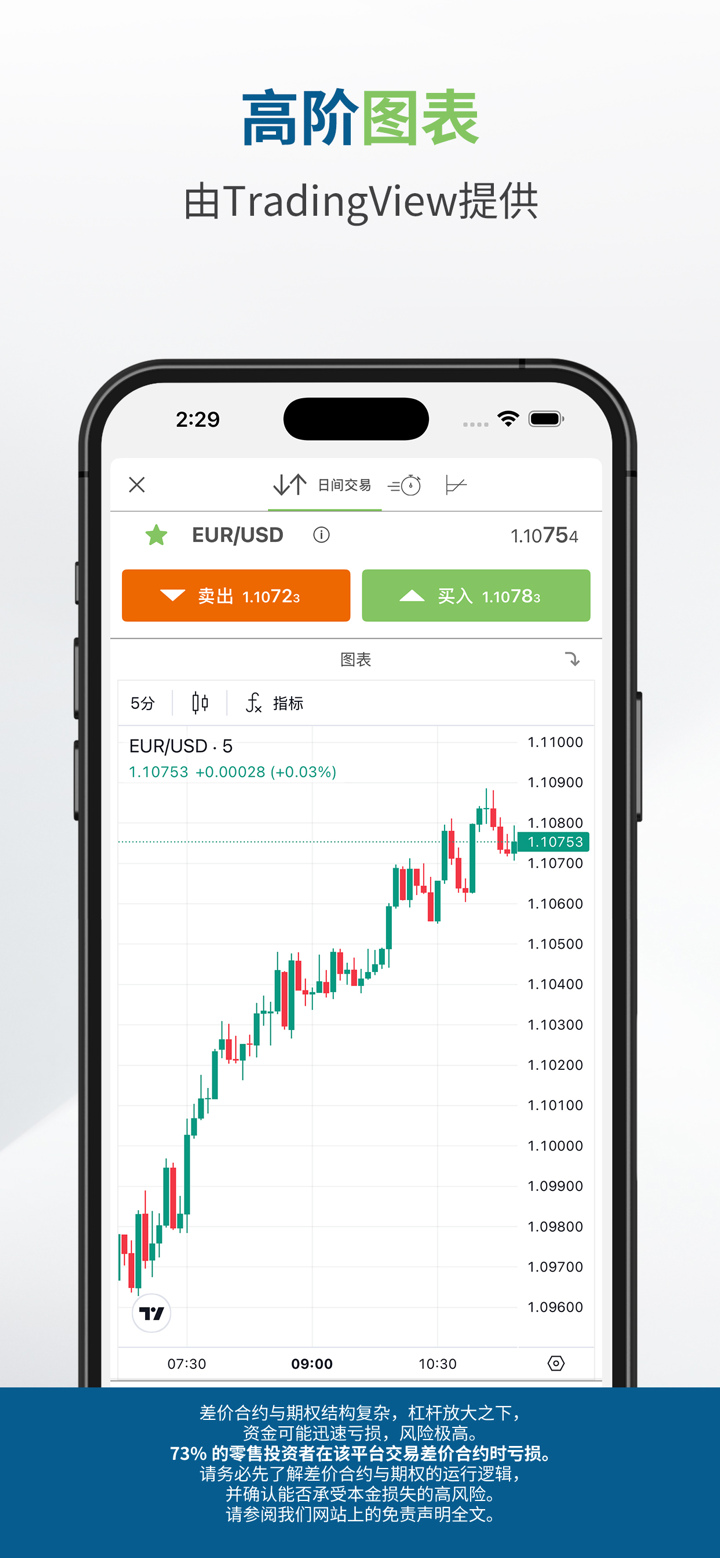

| Trading Platform | easyMarkets Web/App, MT4, MT5 (Desktop Web, iOsAndroid), TradingView (Desktop Web, Mobile) |

| Min Deposit | 25 USD |

| Customer Support | support@easymarkets.com |

| Live Chat | |

| Facebook, Twitter, Weibo, LinkedIn, YouTube, Instagram | |

| CT House, Office No.8F, Providence, Mahe, Seychelles | |

easyMarkets Information

What is easyMarkets? Founded in 2001 as “easy-forex” and rebranded to easyMarkets in 2016, the broker has stuck to its “Simply Honest” philosophy for over 20 years. A global multi-asset trading platform, it serves traders of all skill levels via innovative tools, diverse platforms, and transparent terms, standing out as stable and innovative with multi-country regulation and a strong reputation.

Its development includes launching forex trading in 2001, introducing “Guaranteed Stop Loss” in 2003, expanding to stocks/cryptocurrencies post-2016, partnering with Real Madrid in 2020, and holding 5-star Trustpilot ratings plus industry awards. Regulated by CySEC, ASIC, FSCA, and FSC, it segregates client funds in banks like Barclays/HSBC. Focused on “simpler, transparent trading,” it offers 275+ instruments and multi-terminal support.

Pros and Cons

| Pros | Cons |

| Regulated | Max 1:2000 leverage |

| Negative Balance Protection | “Guaranteed Stop Loss” only on proprietary Web/App |

| Fixed spreads from 0.7 pips for EUR/USD | MT4 lacks variable spreads |

| Zero trading commissions | 1-2 weeks adaptation recommended |

| EA (Expert Advisor) download | |

| 24/5 phone and live chat support |

Is easyMarkets Legit?

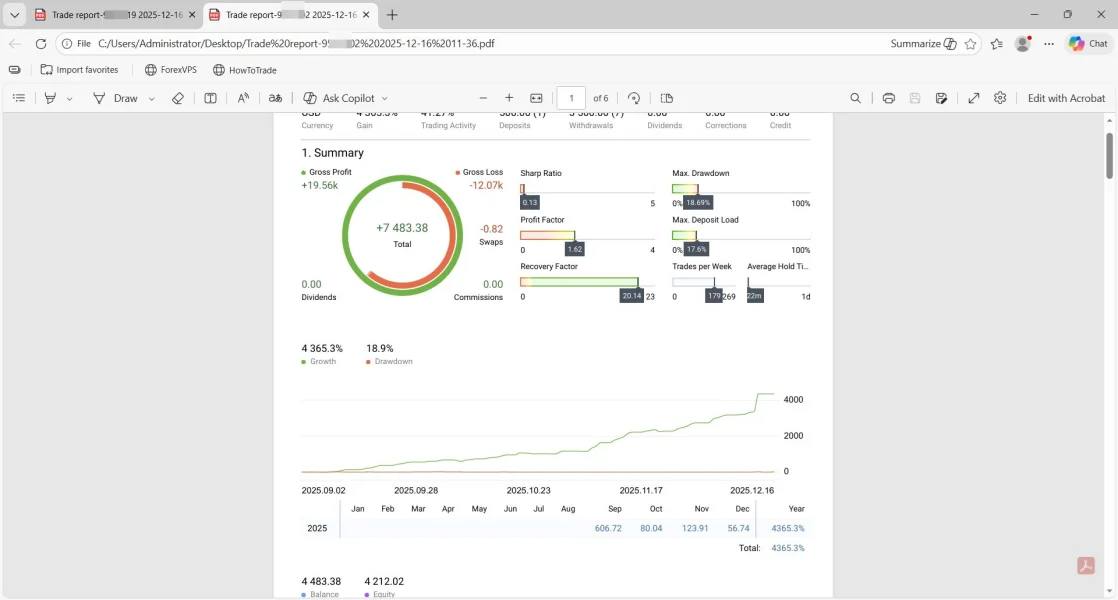

easyMarkets is a fully legitimate and compliant broker, as it holds licenses from authoritative global regulators like CySEC (≥200% capital adequacy ratio), ASIC, and FSCA (trades supervised, no compliance disputes); publishes transparent trading terms (spreads, leverage, fees) on its official website, releases regular account reports, supports third-party audits, and proactively discloses critical info to meet “investor suitability” requirements; implements a “client fund segregation system” (funds in separate bank accounts, no historical losses); and has over 20 years of operation with no major compliance issues, won awards like TradingViews “Best Forex/CFD Broker,” serves 1M+ global traders, and has above-average user retention and reinvestment rates.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| ASIC | Regulated | EASYMARKETS PTY LTD | Australia | Market Maker (MM) | 246566 |

| CYSEC | Regulated | Easy Forex Trading Ltd | Cyprus | Market Maker (MM) | 079/07 |

| FSA | Offshore Regulated | EF Worldwide Ltd | Seychelles | Retail Forex License | SD056 |

| FSC | Offshore Regulated | EF Worldwide Ltd | The Virgin Islands | Retail Forex License | SIBA/L/20/1135 |

What Can I Trade on easyMarkets?

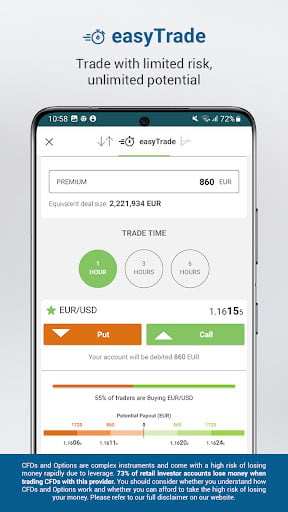

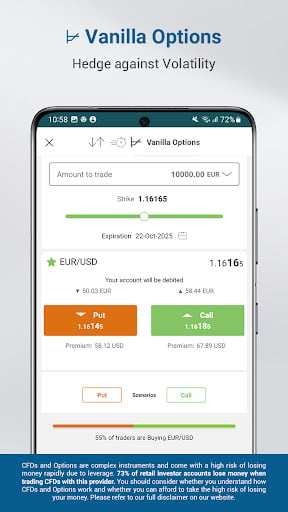

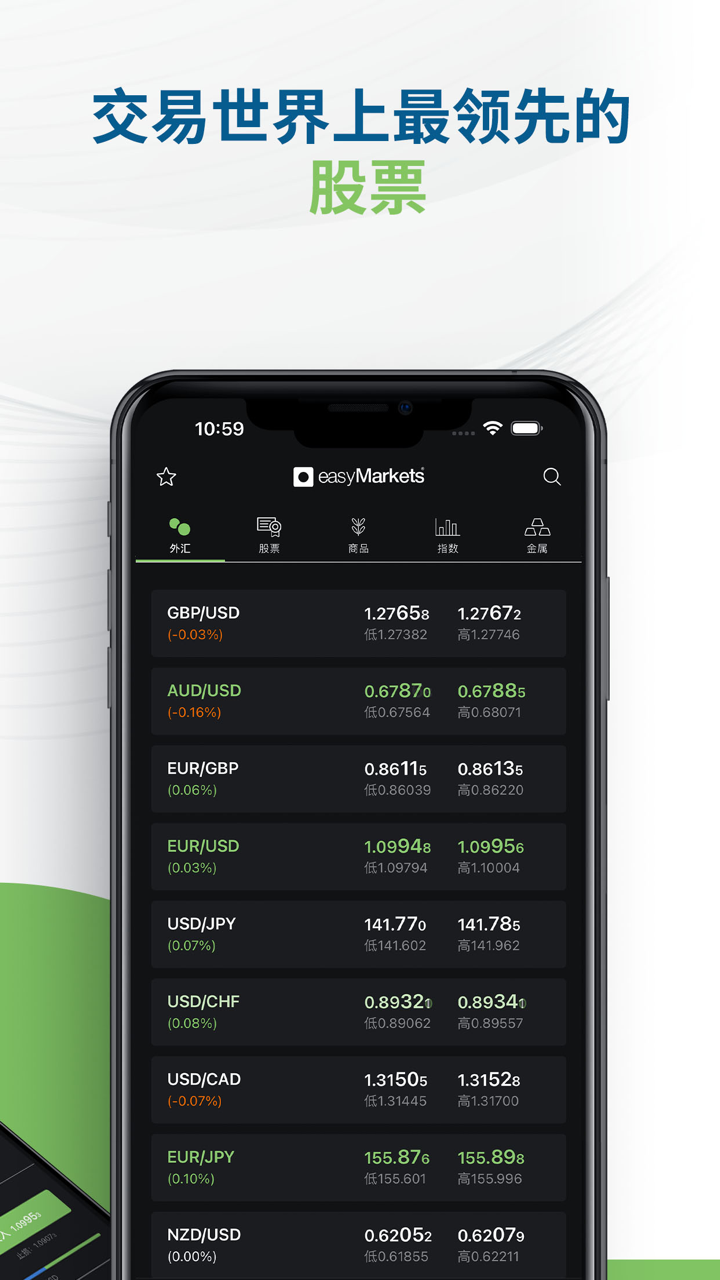

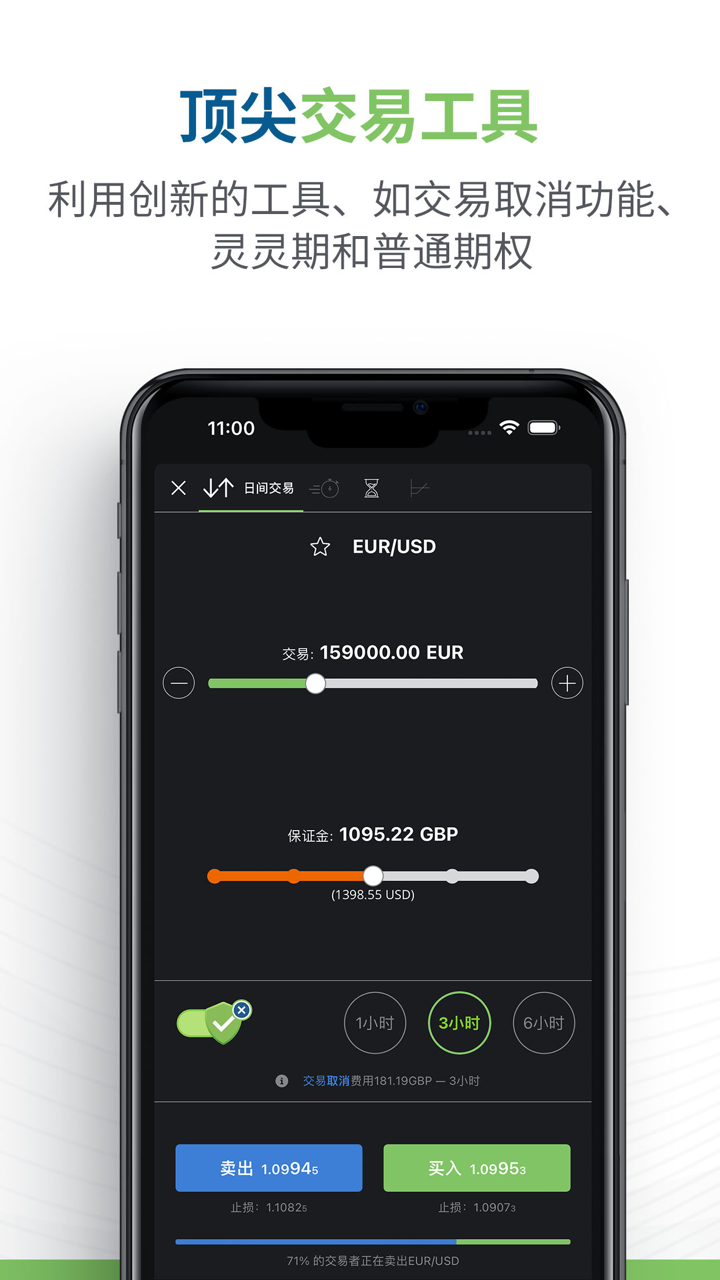

easyMarkets offers 7 asset classes and over 275 tradable instruments, spanning forex (95+ pairs like EUR/USD, 0.7-200 pips spreads), global shares (U.S./European/Australian/Hong Kong stocks like Apple, Tencent, T+0 trading), cryptocurrencies (20+ coins like BTC/ETH, 24/7 trading, MT5 max 1:400 leverage), metals (Gold XAU/USD, 0.2-0.45 USD spreads for inflation hedging), commodities (Crude Oil/Gas, MT5 max 1:400 leverage for supply-demand tracking), indices (Nasdaq/Dow Jones/Hang Seng, with multiplier-based contract value), and Vanilla Options (for currency pairs/precious metals, fixed risk for volatility hedging).

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Precious Metals | ✔ |

| Shares | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

Account Type

What account types does easyMarkets offer? easyMarkets offers 3 account types, with core differences based on “capital size, spread type, and leverage limit” to suit diverse trader needs:

| Feature Category | VIP Account | Standard Account | MT5 Account |

| Minimum Deposit | 10,000 USD | 25 USD | 25 USD |

| Spread Type | Fixed | Fixed | Variable |

| Max Leverage | 1:400 | 1:400 | 1:2000 |

| Core Features | Low fixed spreads (from 0.7 pips for EUR/USD)Dedicated premium account managerPriority customer supportCustomized strategy advice | Basic trading toolsControllable fixed costsDemo account accessBeginner-friendly learning resources | Variable spreads (from 0.9 pips for GBP/USD)Dynamic leverage21 chart timeframes38 built-in indicators |

| Target Users | High-net-worth clientsInstitutional tradersSeasoned individual traders | BeginnersRegular retail tradersUsers with small capital | Advanced tradersEA usersThose seeking low variable spreads |

Common Features: All accounts have no commissions or account fees, support 18 account currencies (including CNY, USD, EUR, JPY), and include the platforms core risk tools (Negative Balance Protection) and customer support services.

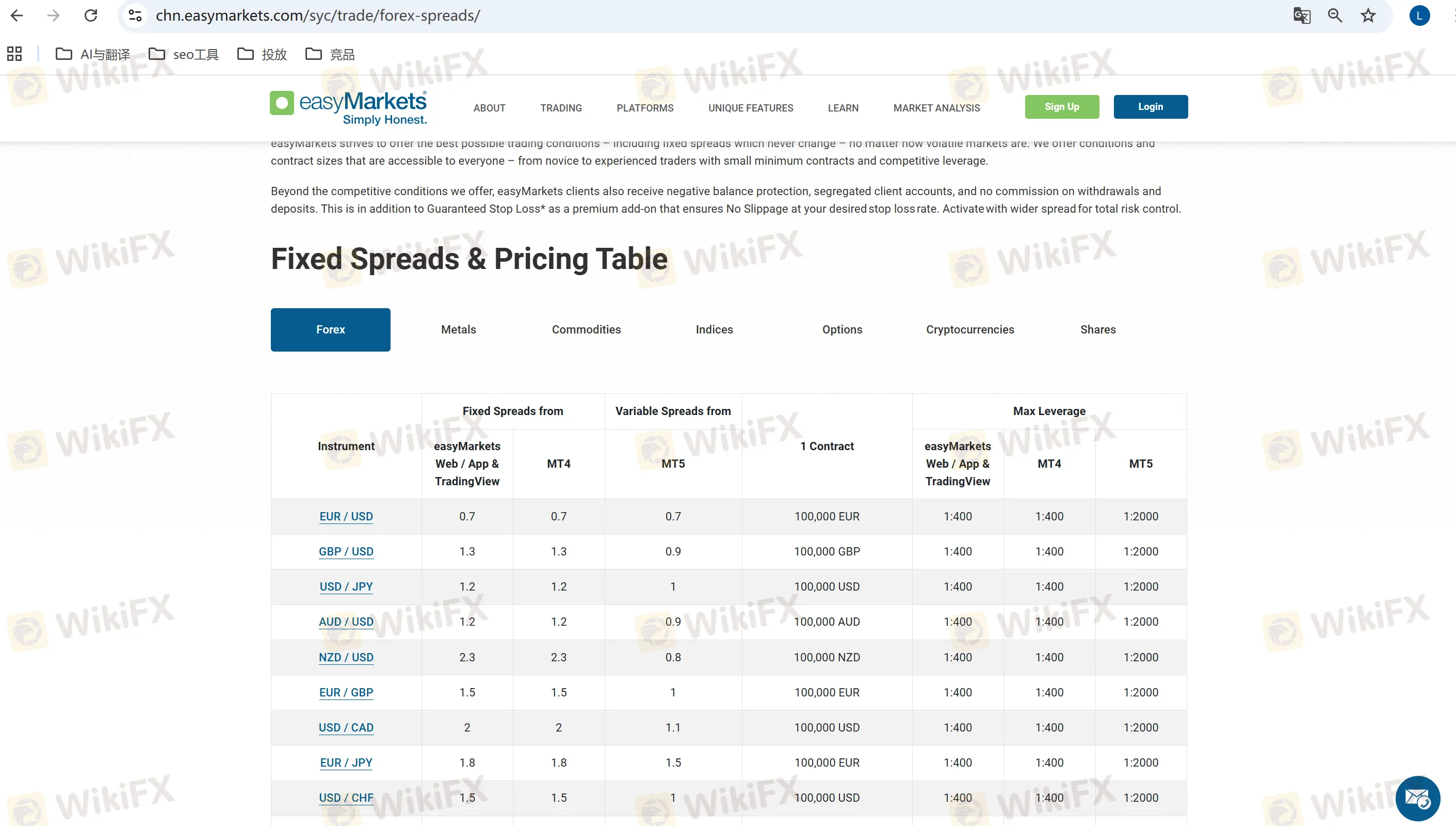

easyMarkets Fees

easyMarkets focuses on “no hidden fees,” with costs limited only to spreads and no additional charges in other processes. It has no trading commissions—fixed spreads (available on MT4, Web/App, and TradingView) range from 0.7–2.5 pips for major currency pairs (e.g., 0.7 pips for EUR/USD) and 7–200 pips for exotic pairs (e.g., 200 pips for USD/MXN), staying stable during market volatility; variable spreads (MT5 only) range from 0.7–1.5 pips for major pairs (e.g., 1 pip for USD/JPY) and 4.9–44.1 pips for exotic pairs (e.g., 11 pips for USD/CNH), adjusting dynamically with market liquidity.

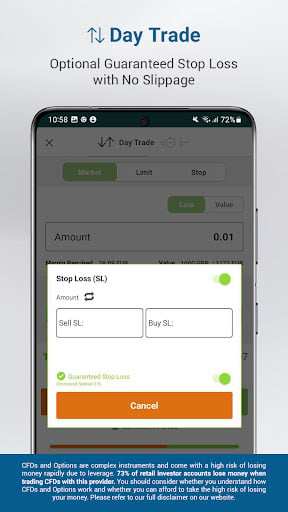

It charges no deposit or withdrawal fees, supporting payment methods like Visa/Mastercard, bank transfers, Skrill/Neteller, and UnionPay (some regional banks may charge small transfer fees not imposed by the platform). There are also no account maintenance fees, rollover fees for overnight positions, or data usage fees, while the optional “Guaranteed Stop Loss with No Slippage” feature requires activation via wider spreads.

| Fee Category | Details | Examples | MT5 Account |

| Trading Fees | No commissions; costs limited to spreads only | 25 USD | |

| Fixed Spreads | Available on MT4/WebApp/TradingViewMajor pairs: 0.7–2.5 pipsExotic pairs: 7–200 pips | EUR/USD: 0.7 pipsGBP/USD: 1.3 pipsUSD/MXN: 200 pipsUSD/CNH: 25 pips | Variable |

| Variable Spreads | MT5 onlyMajor pairs: 0.7–1.5 pipsExotic pairs: 4.9–44.1 pips | USD/JPY: 1 pipEUR/JPY: 1.5 pipsUSD/CNH: 11 pipsUSD/MXN: 44.1 pips | 1:2000 |

| Deposit/Withdrawal | Zero fees (platform charges none)Note: Some banks/e-wallets may impose third-party fees | Supported methods: Visa/Mastercard, Bank Transfer, Skrill/Neteller, UnionPay (China) | |

| Other Fees | No account maintenance feesNo rollover fees (overnight positions free)No data usage fees | “Guaranteed Stop Loss” feature is optional (activated via wider spreads, not mandatory) |

Leverage

What is easyMarkets leverage? easyMarkets'leverage uses a tiered system based on platform type, account equity, and regional regulations: MT4/VIP/Standard Accounts have max leverage of 1:400 (forex), 1:20 (stocks), 1:50–100 (crypto), 1:200 (metals/commodities); MT5 Accounts (unregulated regions) offer up to 1:2000 (forex), 1:40 (stocks), 1:400 (crypto/metals/commodities), plus a 5-tier dynamic mechanism (higher equity = lower leverage) adjusting all instruments margin requirements.

| Equity Tier | Account Equity Range | Max Leverage |

| Tier 1 | 0.00 – 9,999.99 | 1:2000 |

| Tier 2 | 10,000.00 – 49,999.99 | 1:1000 |

| Tier 3 | 50,000 – 249,999.99 | 1:500 |

| Tier 4 | 250,000 – 499,999.99 | 1:200 |

| Tier 5 | 500,000 and above | 1:100 |

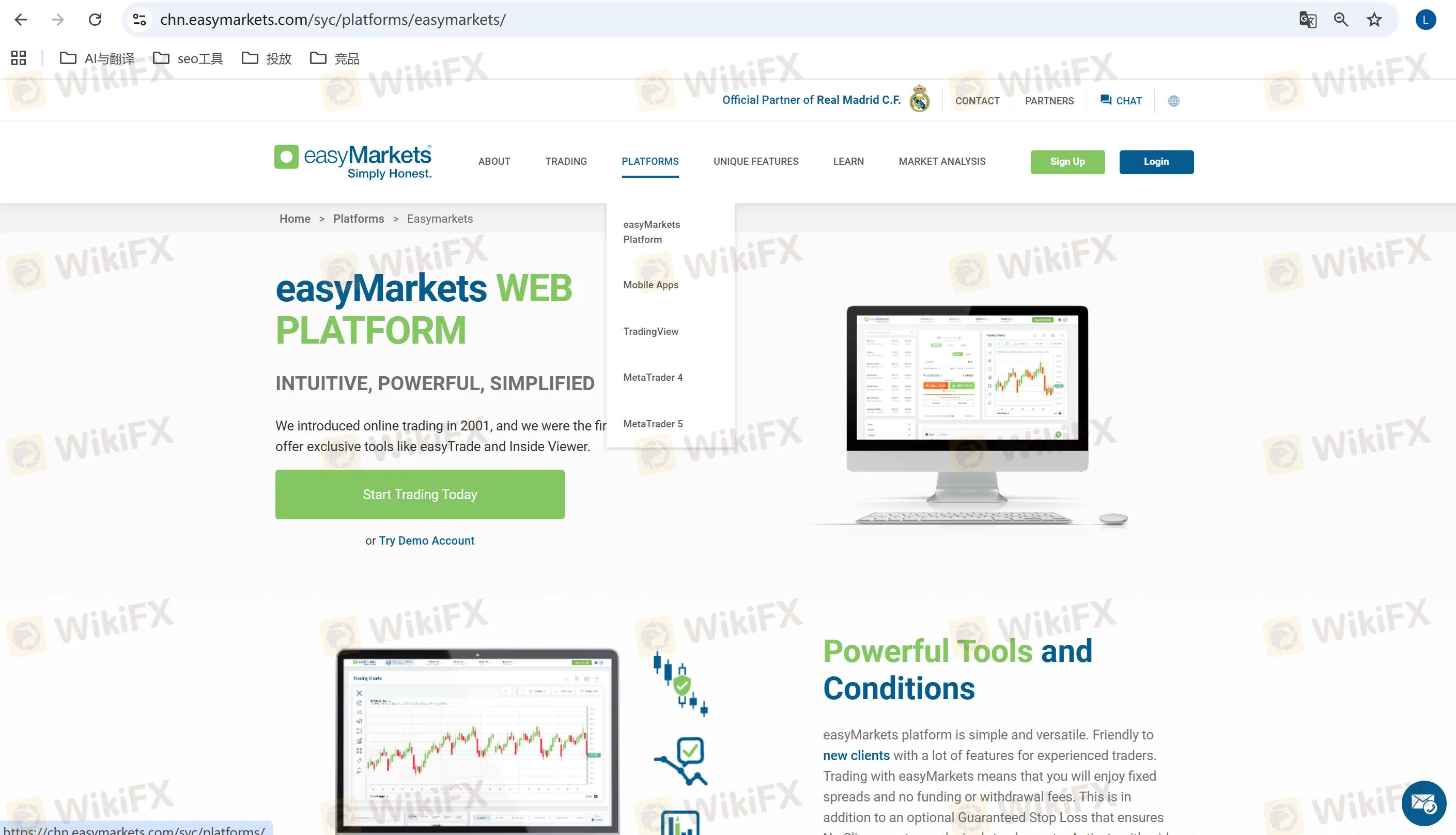

Trading Platform

What easyMarkets Trading Platform is available? easyMarkets offers 4 major trading platforms to suit different operating habits and strategy needs, with key features as follows:

| Trading Platform | Supported | Available Devices | Suitable for |

| easyMarkets Web/App | ✔ | Desktop Web, iOS, Android | Beginners, traders preferring simple operations |

| MT4 | ✔ | Windows, Mac, iOS, Android | Beginners, traders familiar with the MT4 ecosystem |

| MT5 | ✔ | Windows, Mac, iOS, Android | Advanced traders, EA developers |

| TradingView | ✔ | Desktop Web, Mobile | Technical analysis enthusiasts, traders needing community interaction |

Common Features: All platforms support “demo accounts” (risk-free trials with full functionality), real-time position management, and trading signal alerts. Account funds can be managed uniformly via the easyMarkets client portal.

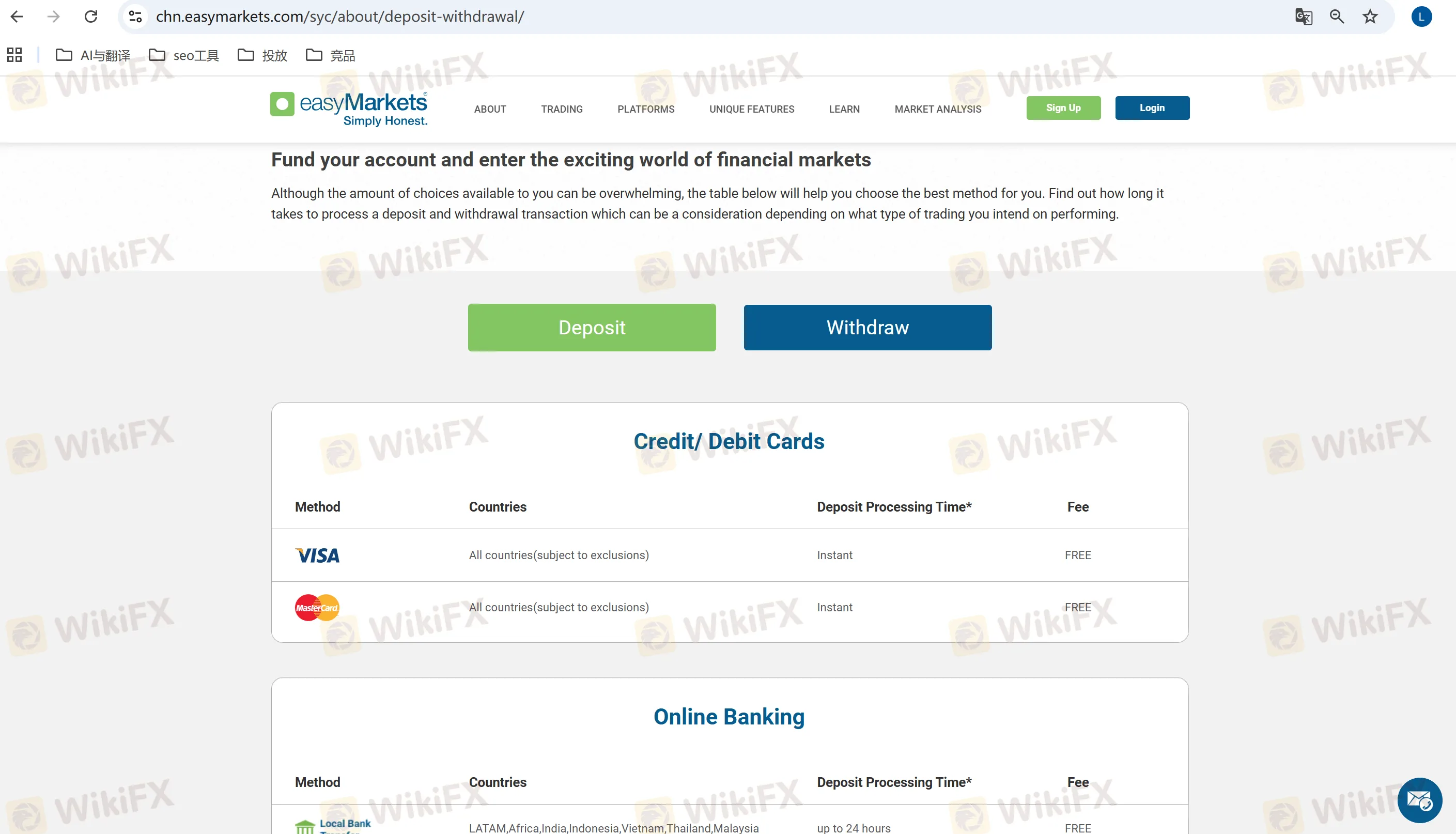

Deposit and Withdrawal

How about easyMarkets Deposit and Withdrawal details? easyMarkets has uniform deposit rules: 25 USD minimum (no max) across platforms, with deposit methods including instant credit cards, 1–5 business day bank transfers, 1–3 day e-wallets (Skrill/Neteller), and 1–2 day local methods (e.g., UnionPay), though deposit currency must match account currency to avoid small exchange costs; withdrawals require matching deposit methods (no min limit), take 1–3 days (e-wallets), 3–7 days (bank transfers) or 1–5 days (credit cards), with requests reviewed in 1–2 days, and client funds are secured in regulated segregated bank accounts.

| Category | Details |

| Minimum Deposit | 25 USD (≈180 CNY, real-time exchange rate) for all account types |

| Maximum Deposit | No upper limit |

| Deposit Methods | Credit cards (instant)Bank transfers (1–5 business days)E-wallets (Skrill/Neteller, 1–3 business days)Local methods (e.g., UnionPay China, 1–2 business days) |

| Deposit Notes | Deposit currency must match account currencyMismatched currencies converted at real-time rates (may incur small exchange costs) |

| Withdrawal Methods | Must match deposit method (anti-money laundering compliance)Bank transfers & e-wallets supportedNo minimum withdrawal limit |

| Withdrawal Processing | E-wallets: 1–3 business daysBank transfers: 3–7 business daysCredit cards: 1–5 business days (subject to issuer policies) |

| Verification Process | Requests reviewed within 1–2 business daysNo manual delays after approval |

| Fund Security | Client funds stored in segregated accounts at top-tier banksReal-time regulatory supervisionThe platform cannot use client funds for operationsSegregated accounts ensure priority fund return in extreme scenarios |

Copy Trading

easyMarkets doesn't have a dedicated “Copy Trading (auto-copy trading)” feature, but offers alternatives: traders can view other users'public trading records/strategies via TradingView integration (manual reference, risk judgment needed), all accounts get daily Trading Central technical analysis emails and fundamental reports (beginners adjust directions with this), and account managers provide personalized strategy advice (e.g., swing trading levels) as “manual copy trading” support for beginners.

Bonus

easyMarkets designs three types of bonus programs around “new client acquisition, existing client retention, and channel promotion,” with transparent rules and no mandatory trading requirements:

First Deposit Bonus:

Rules: New clients receive a 50% bonus on their first deposit.

FX1254699620

Vietnam

Fraudulent brokers close orders and prevent withdrawals from accounts.

Exposure

FX1745353734

Albania

A fake broker who steals traders' money. If you lose, it's okay, but if you win, they freeze your account and steal your profits for no reason, making up absurd excuses. After months of work, I had €7,000 in profit in my account, but they froze everything with a ridiculous excuse. Thieves, don't trust them, don't open an account with them, you can only lose.

Exposure

FX1507982103

Canada

Watching the DJIA on 4 different platforms and the only one with a different price is EasyMarkets- almost $100 USD difference

Exposure

FX1825073414

Japan

It's a long-established broker. I've never heard any bad rumors like withdrawal refusals. That said, if you ask whether there's anything particularly attractive about it, that's a tough question. I think their support is very kind, the spreads aren't that wide, and with leverage up to 2,000x, the specs are certainly not bad. It feels more geared towards beginners, perhaps. It gives the impression of being one of those clean, proper overseas brokers.

Positive

Lady Chiun

Taiwan

Fast small deposits and withdrawals with USDT

Positive

sovesip

India

I had a good experience with this broker as i find their spreads to be lower than others

Positive

Randem

Australia

Regulatory status gives me confidence, but the platform's trading restrictions can be frustrating. Need to stay within the rules.

Neutral

louy0

Malaysia

I've been trading with easyMarkets for a couple of years and appreciate their responsive customer service. The account managers are knowledgeable and genuinely helpful.👍

Positive

FX-Sib

France

I was trading manually on easymarkets, the trading environment is quite good, but I have switched to automated copytrading from Angelite Trading.

Positive

Charlie Edward

United Kingdom

A month in, and I'm impressed! Tight spreads, reasonable commissions, and even free deposits make this broker a breath of fresh air. While there are withdrawal fees, everything's clearly laid out on their website – transparency is key! To top it off, my small test withdrawal arrived in minutes. EasyMarkets might just be the best broker I've encountered!

Positive

tayyab5718

Pakistan

EasyMarkets Trading offers a wide variety of trading instruments, including forex, stocks, and commodities, which is great for those who like to diversify their portfolio. Their trading conditions, such as low spreads and high leverage, are also competitive compared to other brokers.The trading terms and conditions offered were exceptionally advantageous, and their customer service is readily available to assist whenever required.

Positive

Lv不是Lv

New Zealand

easyMarkets is a good broker, user friendly. Very nice and simple for newbies. I’m so happy to trade with these guys.

Positive

FX1167728731

Hong Kong

Trading conditions were extremely favorable, and their customer support always assist when you need any help. They are patience in dealing with their customers. I gave five stars for their dedicated customer service.

Positive

不穿虾皮的皮皮虾大王

Malaysia

Strange, this company seems to be really reliable, the regulatory license is very good, and the score of wikifx is also very high. But I found someone said he was a scam? Although there are only three, I still have to be vigilant. I plan to read more about what people think of him online.

Neutral

FX2010537403

Philippines

how to withdraw thets mony

Exposure

FX1507982103

Canada

Wow 10-15s to close a position. Terrible

Exposure