Basic Information

Hong Kong

Hong Kong

Score

Hong Kong | 2-5 years |

Hong Kong | 2-5 years |--

Website

Rating Index

Forex License

Forex License No forex trading license found. Please be aware of the risks.

Hong Kong

Hong Kong

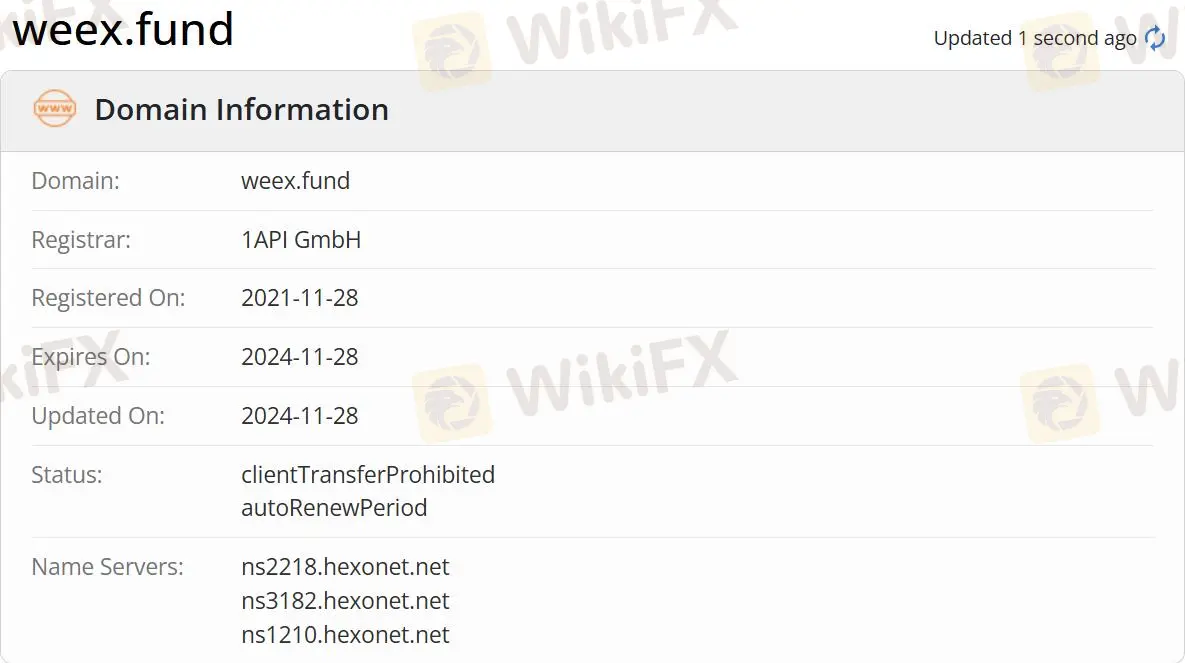

Note: WEEX's official website - https://www.weex.fund/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| WEEX Review Summary | |

| Founded | 2021 |

| Registered Country/Region | China Hong Kong |

| Regulation | No regulation |

| Market Instruments | Forex, indices, commodities, stocks, precious metals, energies, cryptocurrencies |

| Demo Account | / |

| Leverage | 1:100 |

| Spread | From 0.3 pips (Standard account) |

| Trading Platform | MT5 |

| Min Deposit | $10 |

| Customer Support | Email: offical@weex.fund |

Founded in 2021, WEEX is an unregulated broker registered in China Hong Kong. WEEX offers many trading assets, such as forex, indices, commodities, stocks, precious metals, energies, and cryptocurrencies. It also provides MT5 for investors, but the only way to get in touch is by email.

| Pros | Cons |

| Diverse trading products | No regulation |

| Various account types | Only email support |

| Flexible leverage ratios | |

| Tight spreads | |

| MT5 support | |

| Multiple payment options | |

| Low minimum deposit |

No, WEEX is not regulated by regulatory institutions. Regulated status means a safer investment; conversely, an unregulated trader must be aware of investment risks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Precious Metals | ✔ |

| Energies | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

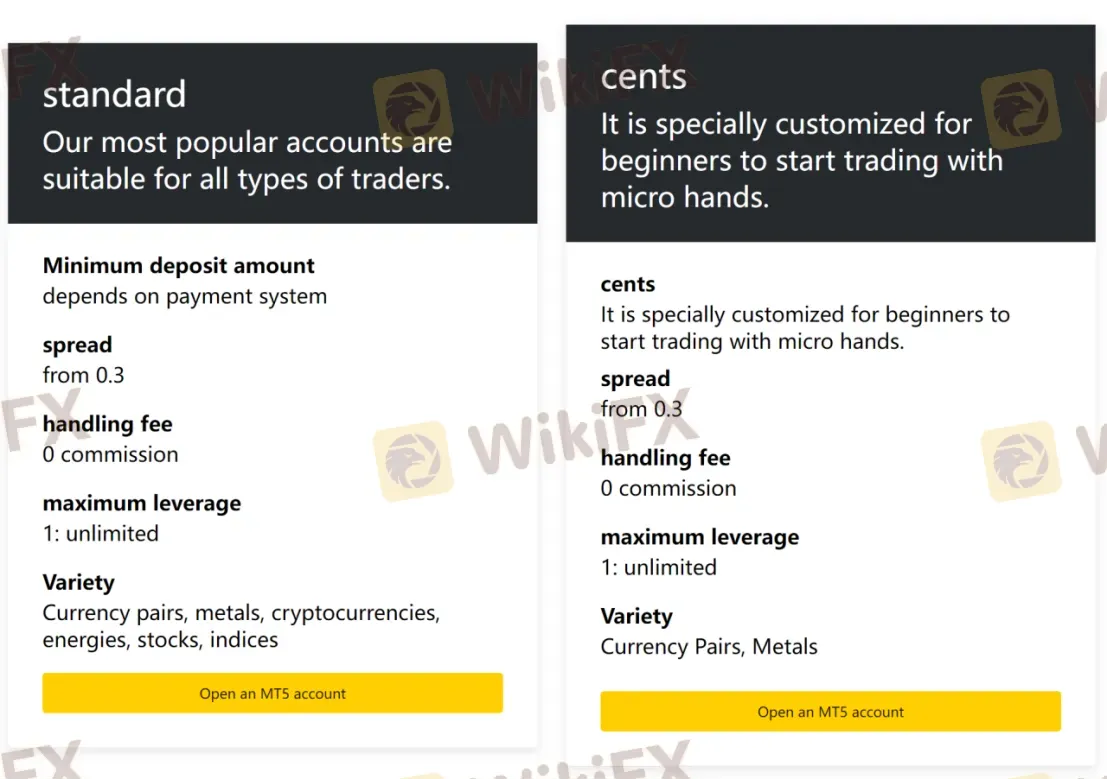

| Account Type | Min Deposit |

| Standard | Depends on payment system |

| Cents | / |

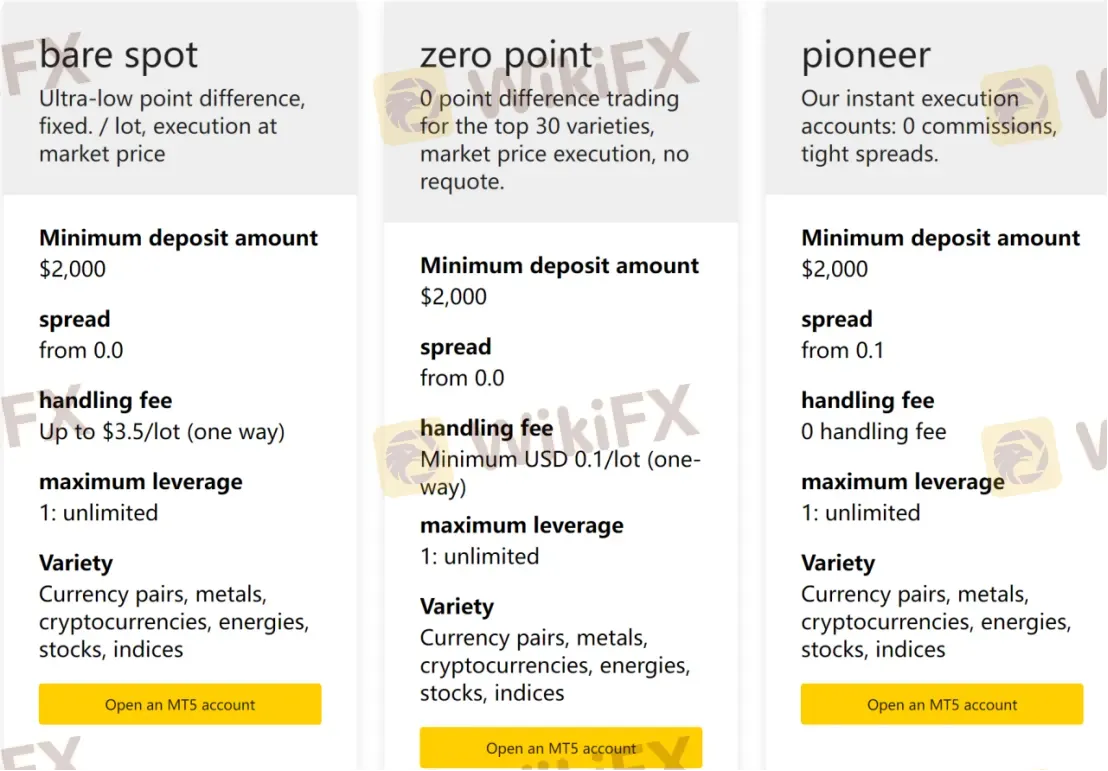

| Bare Spot | $2,000 |

| Zero Point | $2,000 |

| Pioneer | $2,000 |

WEEX offers clients flexible leverage options for all investment products, ranging from 1:1 to 1:100. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Account Type | Spread | Commission |

| Standard | From 0.3 pips | ❌ |

| Cents | ||

| Bare Spot | From 0.0 pips | Up to $3.5/lot (one way) |

| Zero Point | Minimum USD 0.1/lot (one way) | |

| Pioneer | From 0.1 pips | ❌ |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

| Payment Option | Min Deposit | Deposit Time | Min Withdrawal | Withdrawal Time |

| Bitcoin | $10 | Up to 72 hours | $10 | Up to 72 hours |

| Bankcard | Immediate | $3 | ||

| Bitake | $100 | - | - | |

| China UnionPay | $160 | - | - | |

| FlashEx | $350 | $500 | Immediate | |

| Skrill | $10 | $10 | ||

| Neteller | $4 | |||

| otc365 | $85 | $85 | ||

| Perfect Money | $50 | $2 | ||

| SticPay | $10 | $1 | ||

| Tether | Up to 72 hours | $100 | Up to 72 hours | |

| Webmoney | Immediate | $1 | Immediate |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now