Company Summary

| Daiichi Premiere Securities Review Summary | |

| Founded | 2005 |

| Registered Country/Region | Japan |

| Regulation | FSA (Suspicious clone) |

| Trading Products | Nikkei 225 Futures, Click 365 (Forex), Commodity Derivatives, Domestic & Foreign Stocks |

| Demo Account | ❌ |

| Trading Platform | Online Trading System (PC, Mobile) |

| Minimum Deposit | / |

| Customer Support | Phone: 03-6778-8700 |

| Email: info@dai-ichi-premiere-sec.co.jp | |

Daiichi Premiere Securities Information

Daiichi Premiere Securities, founded in 2005, purports to be a Japanese investment firm but is identified as a suspicious clone, citing a fraudulent license from Japan's Financial Services Agency (FSA). It trades Nikkei 225 futures, foreign exchange through Click 365, commodities derivatives, and domestic and foreign equities, with a focus on concierge-style advising services.

Pros and Cons

| Pros | Cons |

| Wide range of Japanese and international products | Suspicious cloned FSA liscence |

| Offers concierge-style support | Very high fees, especially for in-person services |

| No info on deposit and withdrawal |

Is Daiichi Premiere Securities Legit?

No, it is not regulated. The licensing information given is for a real Japanese-licensed corporation, however, the company that says it has this license is not the real holder. Daiichi Premiere Securities Co., Ltd. is the legitimate licensed company, although fake platforms have been exploiting this license number or name without permission, typically with a different domain or company registration.

| Regulatory Status | Suspicious clone |

| Regulated by | Japan – Financial Services Agency (FSA) |

| Licensed Institution | 第一プレミア証券株式会社 (Daiichi Premiere Securities Co., Ltd.) |

| License Type | Retail Forex License |

| License Number | 関東財務局長(金商)第162号 |

What Can I Trade on Daiichi Premier Securities?

Daiichi Premier Securities offers a wide range of stock and derivative investment services, with an emphasis on Japanese and worldwide markets. They offer trading in Nikkei 225 futures, currencies through Click 365, commodity-related derivatives, and equities from both the US and other countries. The company also promotes concierge-style help with making investing choices.

| Trading Products | Supported |

| Nikkei 225 Futures | ✔ |

| Click 365 (Forex Derivatives) | ✔ |

| Commodity Derivatives | ✔ |

| Domestic Stocks (Cash & Margin) | ✔ |

| Foreign Stocks | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✘ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✘ |

Daiichi Premiere Securities Fees

Daiichi Premier Securities charges a lot more than most other companies do, especially for concierge (face-to-face) services. In the concierge course, their trading fees for Nikkei 225 and Click 365 are high. In the online course, the rates are more competitive, but still above than average. Commissions for margin and spot stock trading are based on a percentage and can be very high for big contracts. There are also a number of extra expenditures, including as stamp duties, financing fees, and credit management fees.

Futures & FX Commission Fees (One-way, tax included)

| Product | Concierge Course | Online Course |

| Nikkei 225 | ¥33,000 | ¥11,000 |

| Nikkei 225 Mini | ¥4,620 | ¥1,100 |

| Click 365 (FX) | ¥2,444 | ¥1,018 |

Commodity Derivatives (Per 1 Lot, One-way, incl. tax)

| Commodity | New/Close Fee | Round-trip Total |

| Gold | ¥12,223 | ¥24,446 |

| Mini Gold | ¥1,222 | ¥2,444 |

| Silver | ¥9,167 | ¥18,334 |

| Platinum | ¥7,333 | ¥14,666 |

| Palladium | ¥44,003 | ¥88,006 |

| Corn | ¥3,973 | ¥7,946 |

| CME Crude Oil Index | ¥4,620 | ¥9,240 |

| ... | ||

Stock Trading Fees (Domestic & Margin)

| Contract Amount (¥) | Fee Rate (tax incl.) |

| Under 1 million | 1.21% |

| 1–5 million | 0.968% + ¥2,420 |

| 5–10 million | 0.726% + ¥14,520 |

| 10–30 million | 0.605% + ¥26,620 |

| Over 30 million | 0.363% + ¥93,500 |

| Minimum Fee | ¥2,750 |

Other Applicable Fees

| Fee Type | Amount |

| Revenue Stamp (Margin A/C) | ¥4,000 one-time |

| Name Transfer Fee | ¥55/unit (record date) |

| Credit Management Fee | ¥110–1,100/month |

| Reverse Interest | Variable, daily basis |

| Stock Lending Fee | Varies (short sellers) |

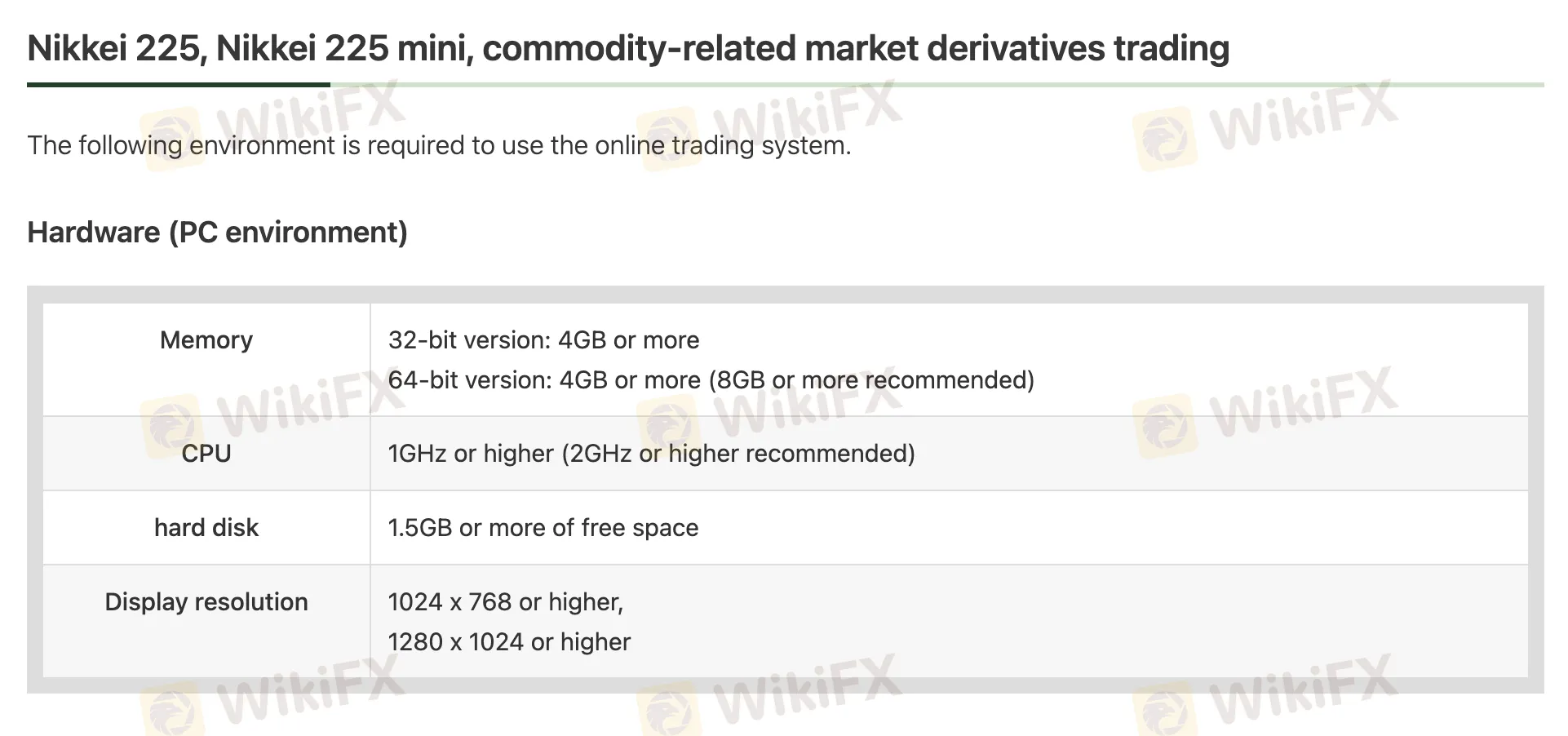

Trading Platform

| Trading Platform | Supported | Available Devices |

| Online Trading System (PC) | ✔ | Windows 10 / 11 (officially supported) |

| Mobile Browser (iOS) | ✔ | iPhone / iPad (iOS 4.3+, Safari) |

| Mobile Browser (Android) | ✔ | Android 4.1+, Chrome browser |