Basic Information

Argentina

Argentina

Score

Argentina

|

5-10 years

|

Argentina

|

5-10 years

| http://www.arpenta.com.ar

Website

Rating Index

Influence

C

Influence index NO.1

Argentina 3.17

Argentina 3.17 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

Argentina

Argentina arpenta.com.ar

arpenta.com.ar Brazil

Brazil

| ARPENTAReview Summary | |

| Founded | 5-10 years |

| Registered Country/Region | Argentina |

| Regulation | Unregulated |

| Market Instruments | Mutual Funds, CEDEARs, ETFs, Bonuses, and Options |

| Demo Account | ❌ |

| Trading Platform | ARPENTA+ |

| Min Deposit | $150 |

| Customer Support | Phone: contacto@arpenta.com.ar |

| Phone: +54(11) 5705-7400 | |

| Phone: +54(11) 4103-7400 | |

ARPENTA is a trading platform established 5-10 years ago and registered in Argentina. It offers a variety of trading products, three portfolio types, and the ARPENTA+ platform. However, it lacks regulation and does not provide information on deposit and withdrawal methods.

| Pros | Cons |

| Offers more than five trading products | Unregulated |

| Provides three portfolio types | No information available on deposit/withdrawal methods |

| Provides the ARPENTA+ trading platform |

ARPENTA's domain arpenta.com was registered on December 27, 1999, with an expiration date of December 27, 2025. It is not regulated by any financial authorities.

ARPENTA offers more than 5 types of trading products, including Mutual Funds, CEDEARs, ETFs, Bonuses, and Options.

| Tradable Instruments | Supported |

| Mutual Funds | ✔ |

| CEDEARs | ✔ |

| ETFs | ✔ |

| Bonuses | ✔ |

| Options | ✔ |

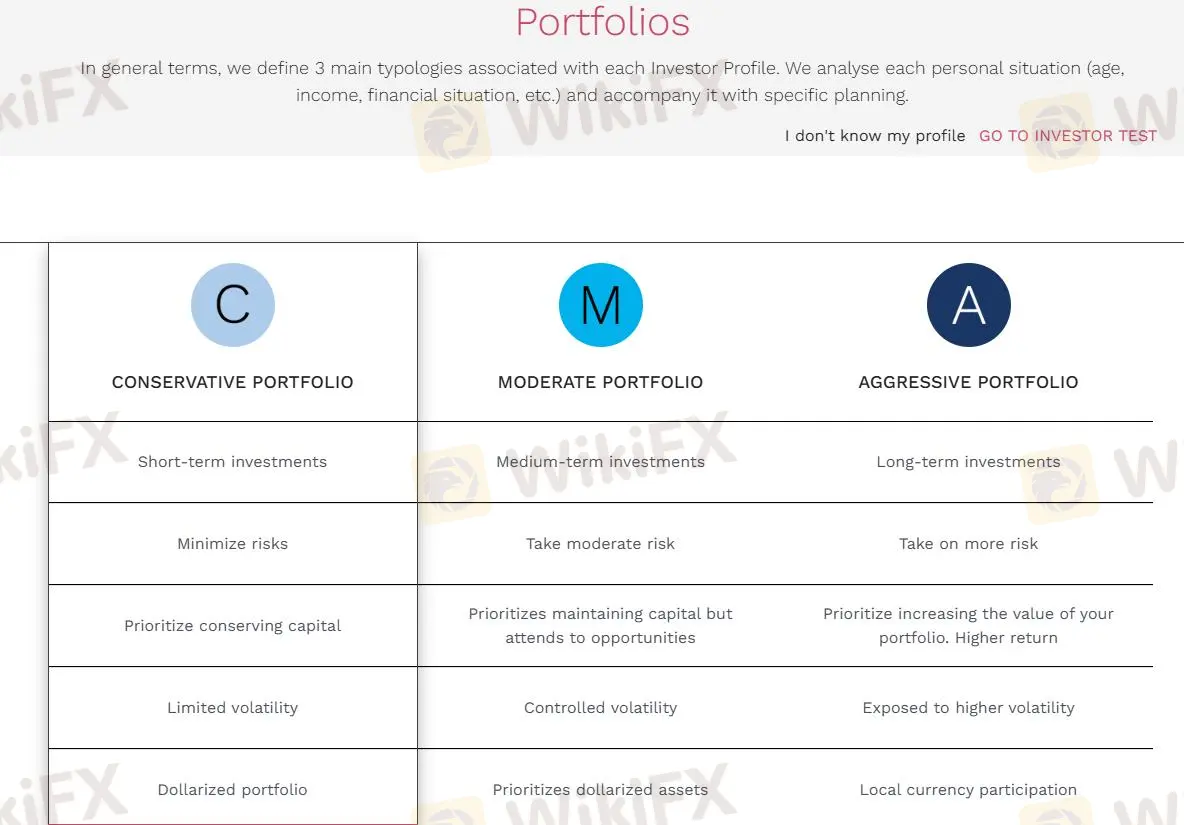

ARPENTA offers three main portfolio types: Conservative Portfolio, Moderate Portfolio, and Aggressive Portfolio.

| Portfolio Type | Investment Horizon | Risk Level | Focus | Volatility | Currency Exposure |

| Conservative Portfolio | Short-term investments | Minimized risk | Focus on preserving capital | Low | Dollarized portfolio |

| Moderate Portfolio | Medium-term investments | Moderate risk | Balance between capital preservation and opportunities | Controlled | Dollarized assets |

| Aggressive Portfolio | Long-term investments | Higher risk | Prioritize portfolio growth with higher potential returns | High | Local currency participation |

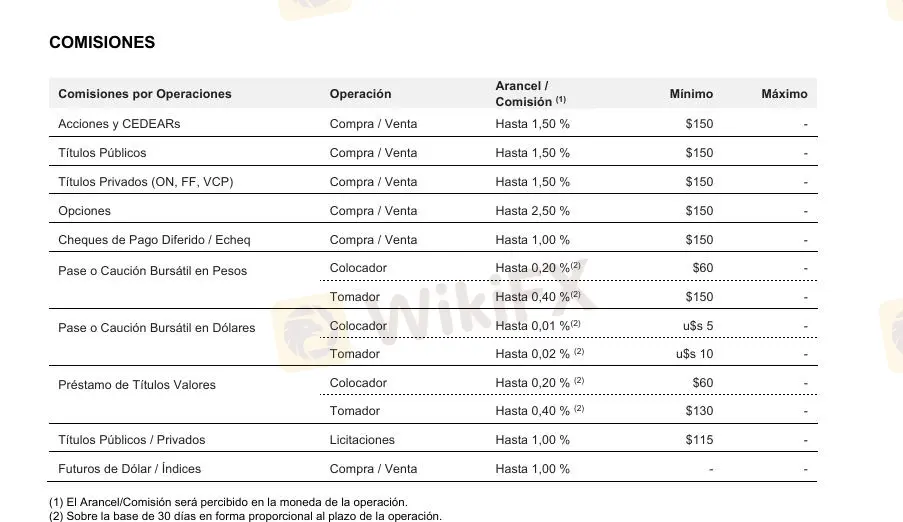

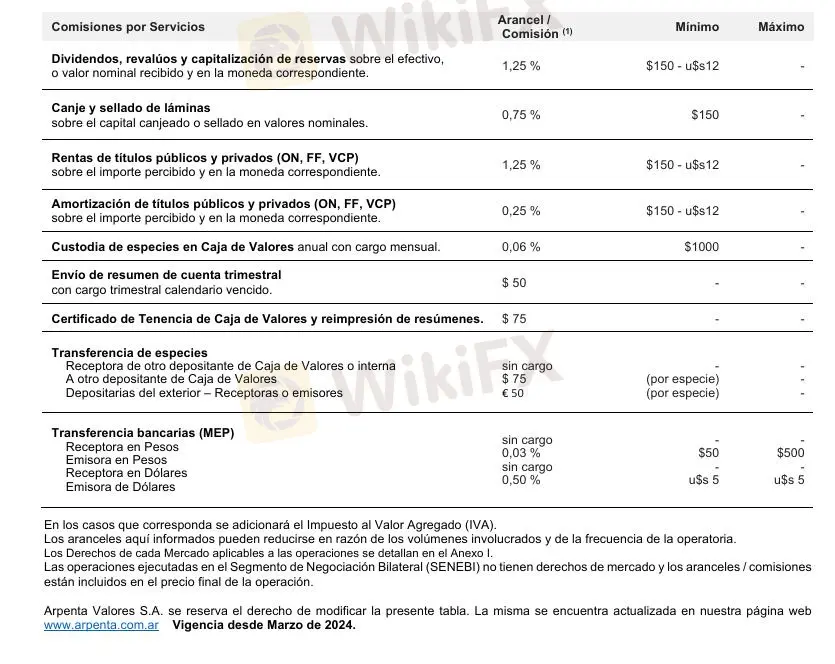

ARPENTA charges different fees for its services and transactions. Commissions for buying and selling stocks, CEDEARs, and securities can be up to 1.5%, with a minimum fee of $150. The commission for options transactions can go up to 2.5%. Bond transaction commissions are also up to 1.5%. Other services, such as dividend handling and account statements, typically incur commissions ranging from 0.25% to 1.25%.

ARPENTA offers a trading platform accessible through both a downloadable app (ARPENTA+) and a web version, but does not support MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| ARPENTA+ | ✔ | Mobile and Web | Beginner |

| MT5 | ❌ | Mobile and Desktop(Windows & macOS) | Experienced Trader |

| MT4 | ❌ | Mobile and Desktop(Windows & macOS) | Beginner |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now