Company Summary

| BNY MellonReview Summary | |

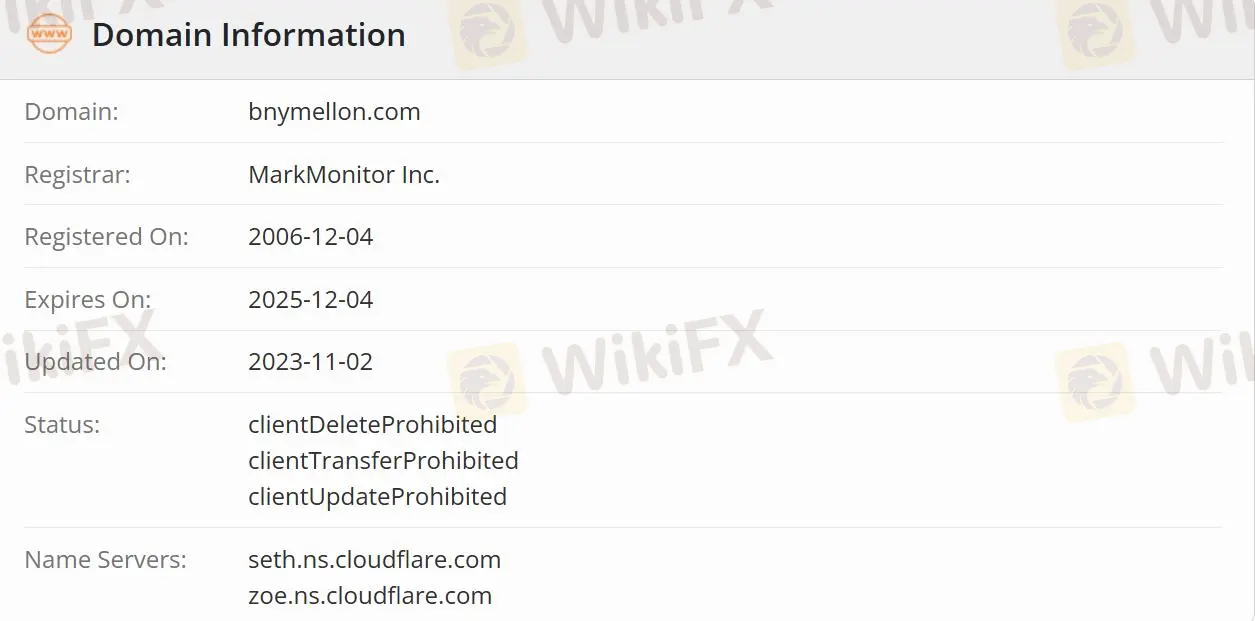

| Founded | 2006-12-04 |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Solutions | Alternative Wealth Technology/Capital Markets & Execution Services/Data & Analytics/Digital Assets/Financing & Liquidity/BNY Investments/Securities Services/Treasury Services/BNY Wealth |

| Customer Support | LinkedIn, Instagram, Twitter, Facebook |

BNY Mellon Information

BNY Mellon is a global financial services company supporting clients across the financial lifecycle by creating, administering, managing, transacting, distributing, and optimizing assets. The finance solutions include Alternative Wealth Technology, Capital Markets & Execution Services, Data & Analytics, Digital Assets, Financing & Liquidity, BNY Investments, Securities Services, Treasury Services, and BNY Wealth.

Is BNY Mellon Legit?

BNY Mellon is authorized and regulated by the FinancialConduct Authority with license No.122467, making it safer than regulated brokers. Australia Securities & Investment Commission. BNY Mellon was previously regulated by ASIC, while the Exceeded status is now.

What solutions does BNY Mellon provide?

The solutions cover Alternative Wealth Technology, Capital Markets & Execution Services, Data & Analytics, Digital Assets, Financing & Liquidity, BNY Investments, Securities Services, Treasury Services, and BNY Wealth.

Alternative Wealth Technology: Alts Bridge is an integrated solution that will make investing in the alternative investment industry simpler.

Capital Markets & Execution Services: differentiated value through BNY Mellon integrated execution solutions and financing and liquidity offerings. Access to various markets including Conventional Debt, Depositary Receipts, Financing & Liquidity, and Securities Lending.

Execution services include Buy-Side Trading Solutions, Equity Sales & Trading, Fixed Income, Foreign Exchange, and iFlow.

Data & Analytics: Focused on the unique needs of financial institutions, the suite of solutions ranges from data management, accounting & performance to risk analytics, compliance monitoring, and reporting for public & private markets.

Digital Assets: using the power of blockchain and asset tokenization technology.

Securities Services: Offers Global Custody Services, Clearance and Collateral Management, and Conventional Debt Solutions.

Treasury Services: Real-time payments and A Digital Disbursement Solution are the featured solutions.

Customer Support Options

Traders can follow the platform on LinkedIn, Instagram, Twitter, and Facebook.

| Contact Options | Details |

| Social Media | LinkedIn, Instagram, Twitter, Facebook |

| Supported Language | English |

| Website Language | English |

| Physical Address | / |