Basic Information

Switzerland

Switzerland

Score

Switzerland | 2-5 years |

Switzerland | 2-5 years |https://lst-ic.com/

Website

Rating Index

Forex License

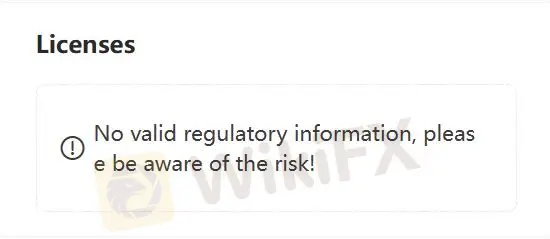

Forex License No forex trading license found. Please be aware of the risks.

Switzerland

Switzerland  lst-ic.com

lst-ic.com  United States

United States NOTE: LST-ICs official site - https://lst-ic.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| LST-IC Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Switzerland |

| Regulation | No Regulation |

| Market Instruments | 200+, Forex, and Cryptocurrencies |

| Demo Account | Unavailable |

| Minimum Deposit | $25,000 |

| Payment Mentohds | Debit Card, Credit Cards, Bank Transfer, Apple Pay |

| Customer Support | Phone Number: +44 1519479602, and +41 225013284 |

| Email: support@LST-ic.info | |

LST-IC, founded in 2022, is a Switzerland-based financial brokerage offering trading services across a wide range of market instruments, including Forex and cryptocurrencies. The firm provides various payment methods, such as debit and credit cards, bank transfers, and Apple Pay.

However, it lacks regulatory oversight, which raises questions about its legitimacy and safety for investors. Another notable aspect of LST-IC is its high minimum deposit requirement, starting at $25,000, with no provision for a demo account. Additionally, its official website is non-functional currently.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Variety of Market Instruments: LST-IC offers a wide range of market instruments, including Forex and cryptocurrencies, providing traders with diverse options for investment.

Modern Payment Methods: The brokerage supports modern payment methods such as debit and credit cards, bank transfers, and Apple Pay, offering convenience to clients in funding their accounts.

Lack of Regulation: LST-IC operates without regulatory oversight, which raises questions about the safety and legitimacy of the brokerage, exposing traders to higher risks.

High Minimum Deposit: With a minimum deposit requirement starting at $25,000, LST-IC deters casual traders who are unable or unwilling to commit such a significant amount of capital.

Transparency Issues: Due to the non-functional website, the brokerage lacks transparency in its trading conditions, such as leverage, spreads, and order execution methods, making it difficult for traders to make informed decisions.

Blacklisted by FINMA: LST-IC has been blacklisted by the Swiss Financial Market Supervisory Authority (FINMA), indicating regulatory violations and further eroding trust in the brokerage's credibility.

No Demo Account: The absence of a demo account restricts traders from testing the platform and familiarizing themselves with its features before committing real funds.

LST-IC raises several red flags that make it appear unlikely to be a legitimate broker. The brokerage lacks regulatory oversight and has been blacklisted by the Swiss Financial Market Supervisory Authority (FINMA). Additionally, transparency issues, a high minimum deposit requirement, and the absence of a demo account contribute to doubts about its legitimacy.

LST-IC boasts a broad selection of trading instruments, including forex and cryptocurrencies. While specifics remain unclear, this suggests access to various currency pairs and digital assets. This diversity entices traders seeking opportunities across multiple markets. However, LST-IC's lack of transparency regarding the full instrument range makes it difficult to assess if they suit your specific trading needs.

LST-IC offers three distinct trading accounts tailored to different types of traders. The Silver account, requiring a minimum deposit of $25,000, is designed for traders looking to start with a moderate investment. The Gold account, with a minimum deposit of $50,000, is targeted at traders seeking enhanced trading features and opportunities. For high-net-worth individuals and institutional clients, LST-IC offers the Platinum account, which requires a minimum deposit of $100,000.

Despite the differences in account types, LST-IC's lack of transparency regarding the specific features, trading conditions, and benefits associated with each account makes it difficult for you to choose a suitable account.

LST-IC supports several modern payment methods for deposits and withdrawals, aiming to provide convenience to its clients. These methods include debit cards, credit cards, bank transfers, and Apple Pay. However, there is no detailed information on the withdrawal process and potential fees.

LST-IC offers customer support through multiple channels, aiming to assist clients with their inquiries and issues. Traders can reach out to the support team via phone and email. The brokerage provides two phone numbers, one based in the UK (+44 1519479602) and the other in Switzerland (+41 225013284), allowing for international reach. Additionally, email support is available at support@LST-ic.info.

LST-IC boasts a variety of trading instruments and modern payment methods. However, these are overshadowed by major red flags. The lack of regulation and blacklisting by a financial authority makes it highly likely to be legitimate. Additionally, the high minimum deposit, non-functional website, and absence of a demo account make it a risky proposition for any investor.

Please avoid LST-IC altogether and choose a well-regulated broker with transparent information about fees and policies. This will increase your chances of finding a safe and legitimate platform to manage your investments.

Is LST-IC safe to use?

Due to the lack of regulation and blacklisting, LST-IC is highly likely to be unsafe.

What is the minimum deposit required to open an account with LST-IC?

The minimum deposit required to open an account with LST-IC starts at $25,000.

Does LST-IC offer a demo account?

No, LST-IC does not offer a demo account.

What market instruments does LST-IC provide?

LST-IC offers over 200 market instruments, including Forex and cryptocurrencies.

What payment methods does LST-IC accept?

LST-IC accepts debit cards, credit cards, bank transfers, and Apple Pay for deposits and withdrawals.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now