Company Summary

| HUA TAI Review Summary | |

| Founded | 1991 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Market Instruments | Stocks, options, precious metals |

| Services | Asset custody services, operation outsourcing services |

| Account Type | Live Account |

| Leverage | Up to 1:2 |

| Trading Platform | MD5, Zhangle App |

| Payment Method | Bank Transfer |

| Customer Support | Phone: 955597 |

| Email: 95597@htsc.com | |

| Physical Address: No. 228, Jiangdong Middle Road, Nanjing, Jiangsu Province, China | |

HUA TAI Information

HUA TAI, founded in 1991, is a brokerage registered in China. The trading instruments it provides cover stocks, options, precious metals. It is regulated by CFFEX.

Pros and Cons

| Pros | Cons |

| Regulated | No commission information |

| Wide range of trading instruments | No clear information on the minimum deposit |

| Multiple services offered | Limited account types offered |

| No demo account | |

| No MT4 supported |

Is HUA TAI Legit?

HUA TAI is regulated by CFFEX in China. Its current status is regulated.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| China | CFFEX | 华泰期货有限公司 | Futures License | 0011 | Regulated |

What Can I Trade on HUA TAI?

HUA TAI offers traders Stocks, options, precious metals to trade.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Options | ✔ |

| Precious metals | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Futures | ❌ |

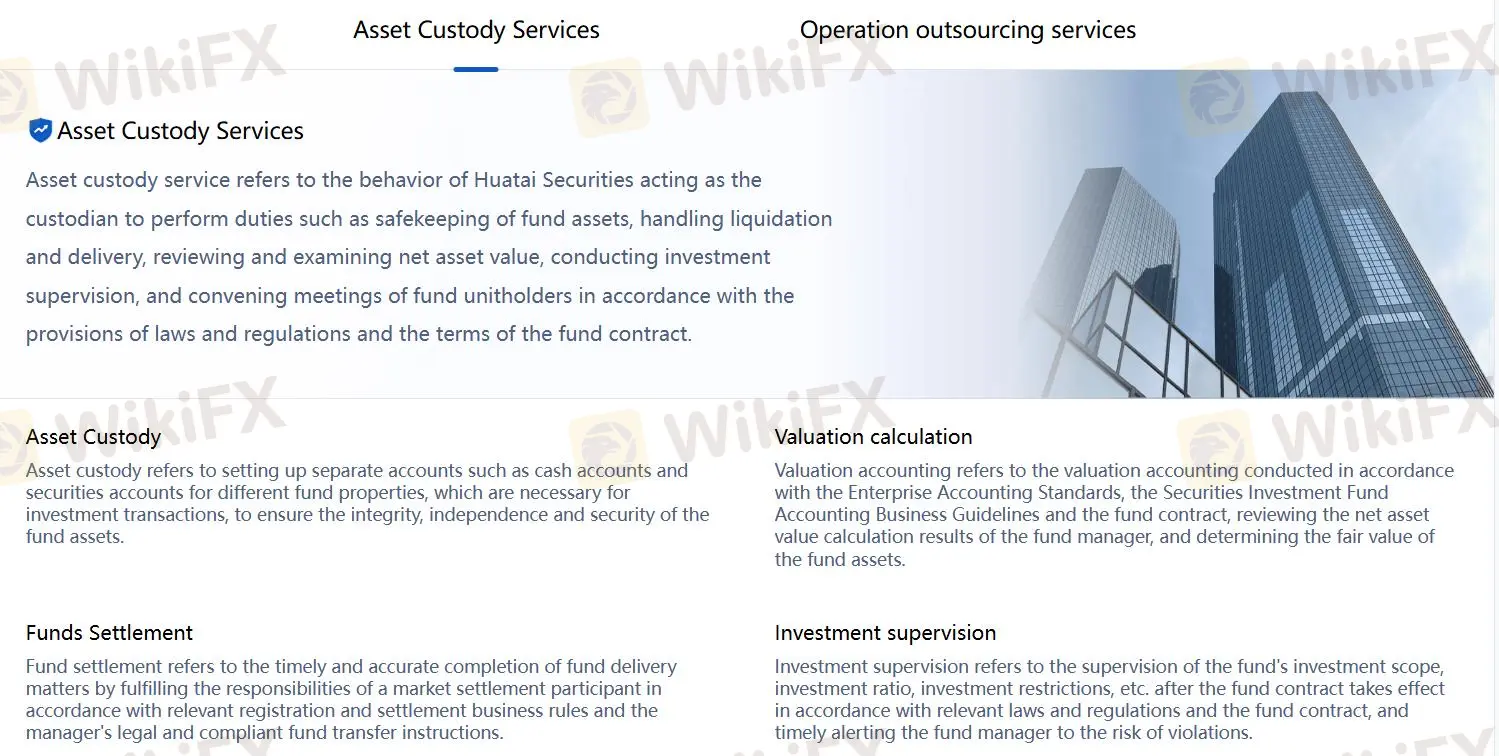

Services

HUA TAI I provides asset custody services, operation outsourcing services. The asset custody services include asset custody, valuation calculation, investment supervision, funds settlement. Operation outsourcing services

include share registration, account supervision, valuation calculation, disclosure of information.

Account Types

HUA TAI offers 1 type of account to traders - Live Account.

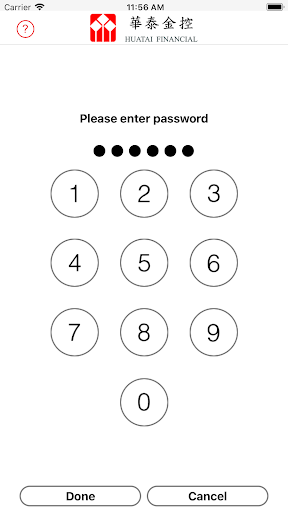

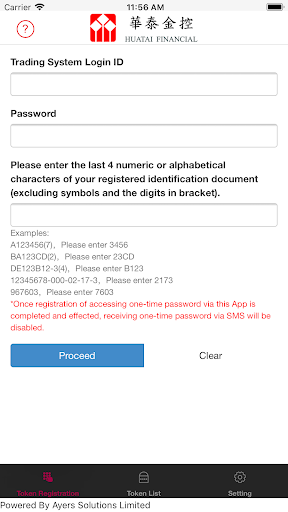

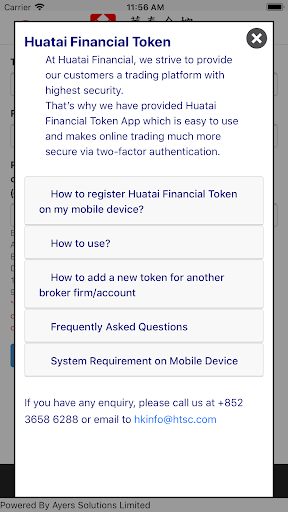

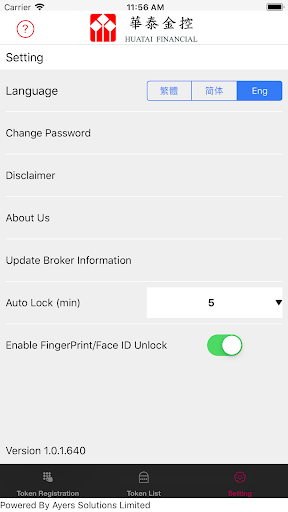

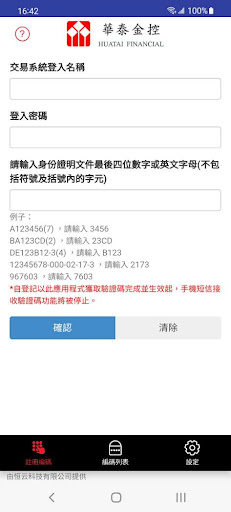

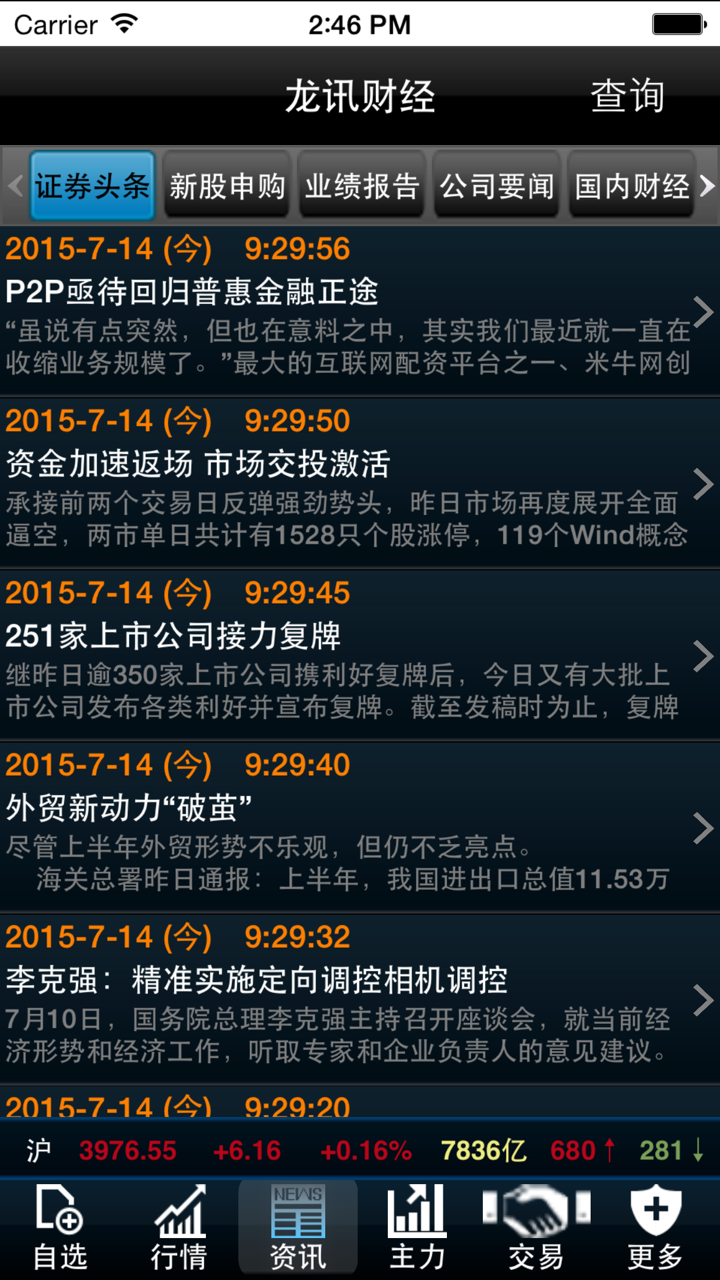

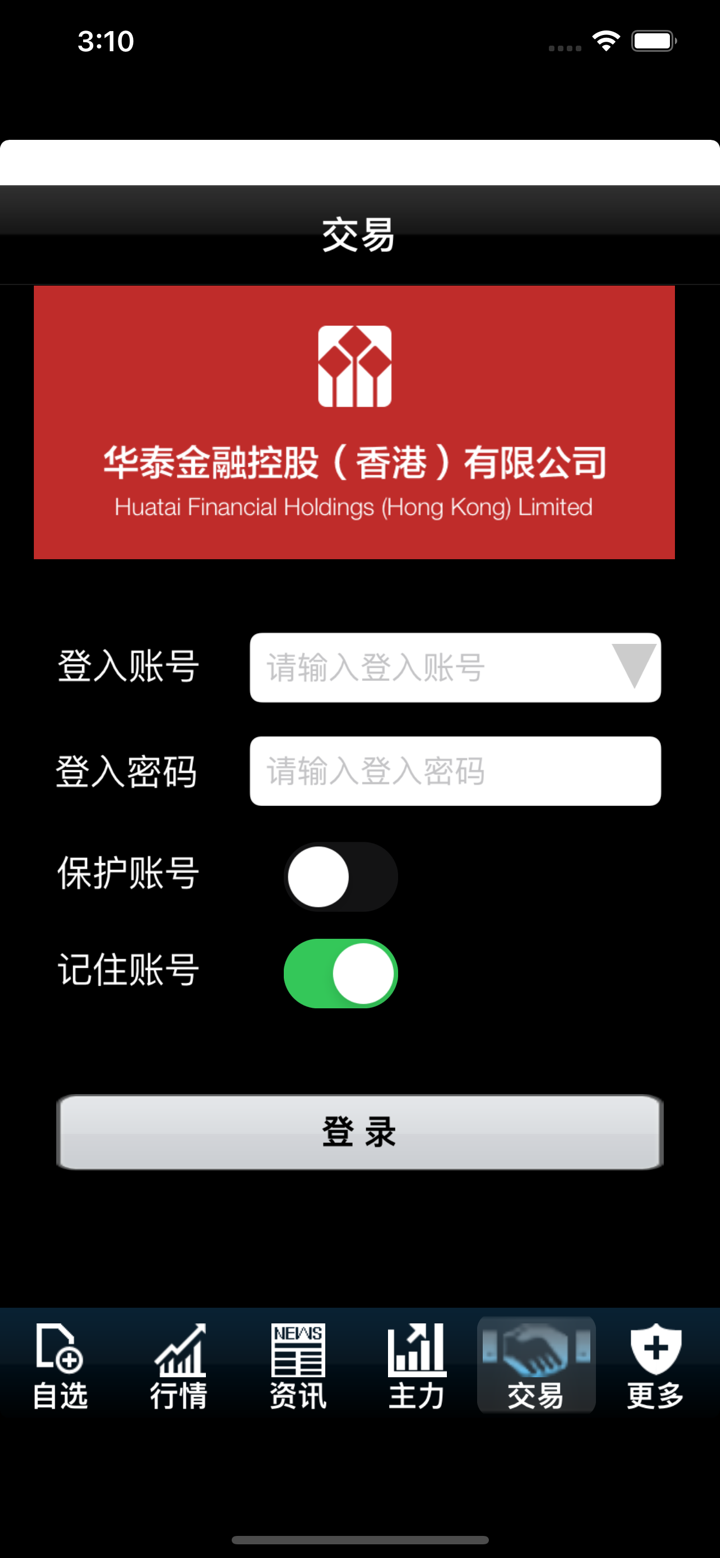

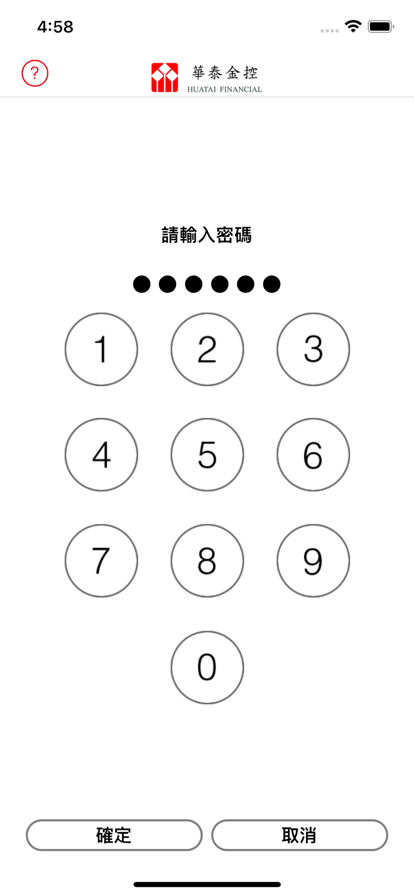

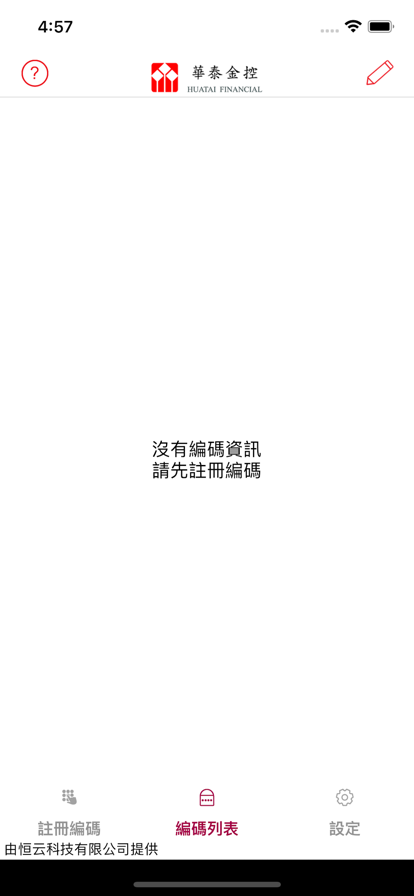

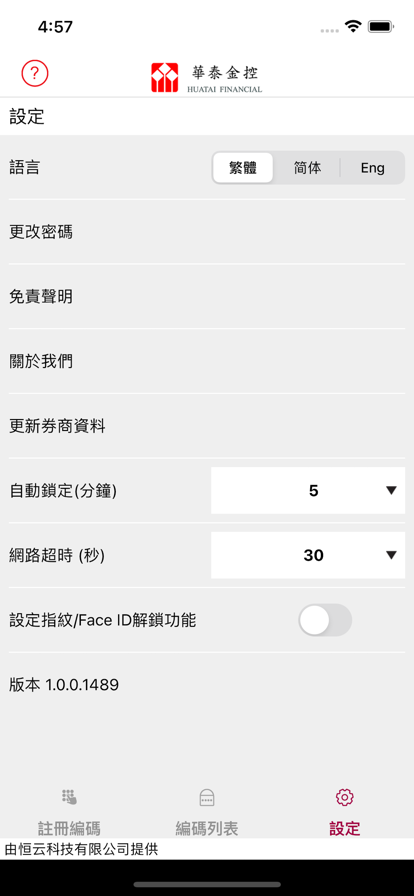

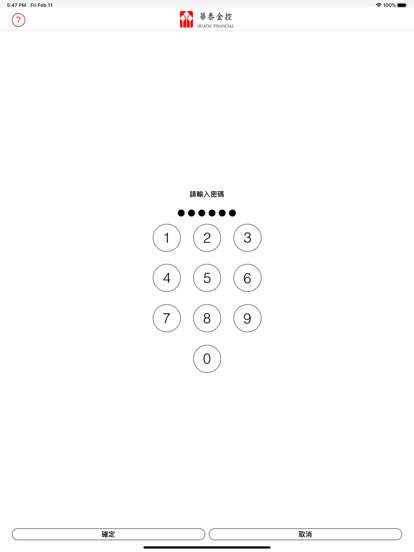

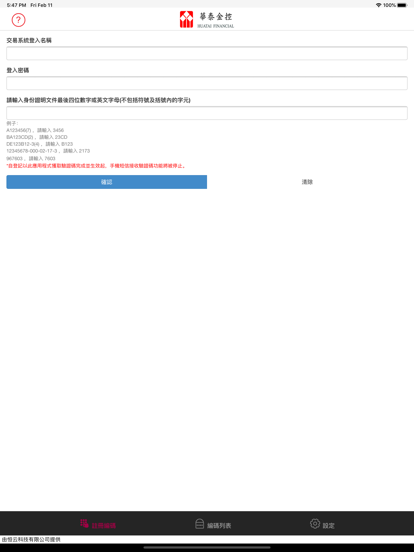

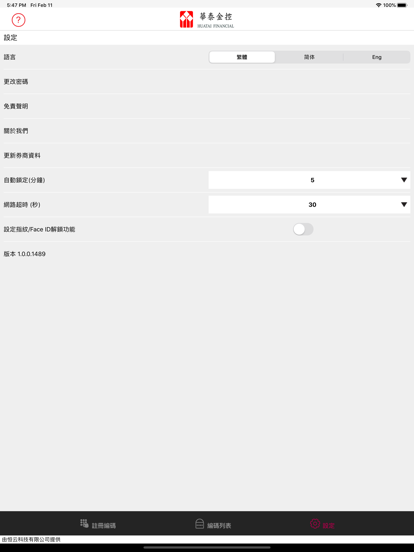

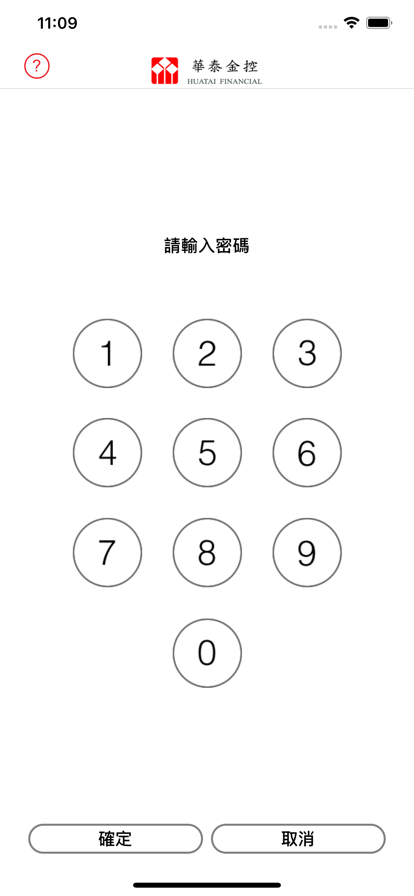

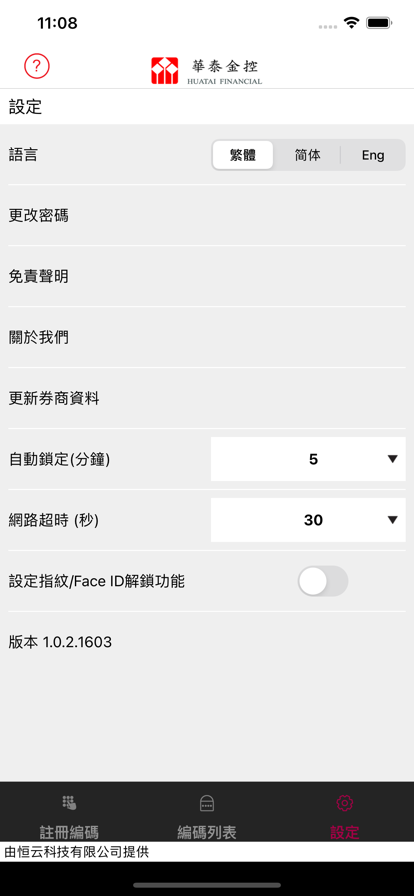

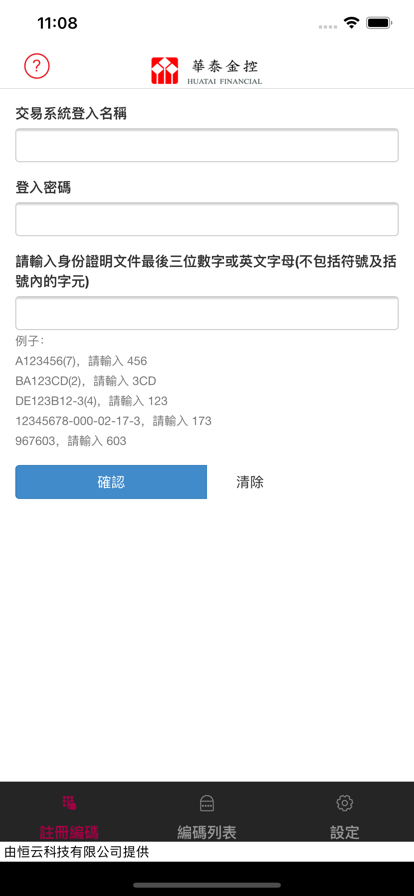

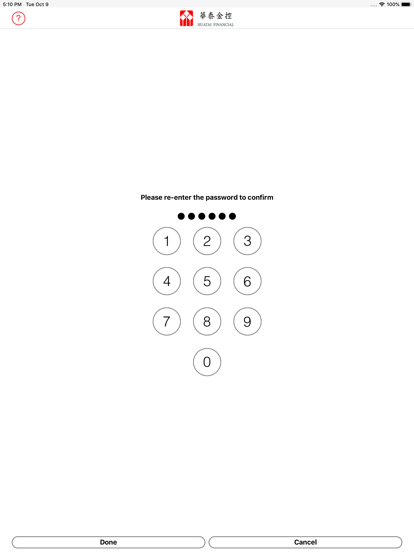

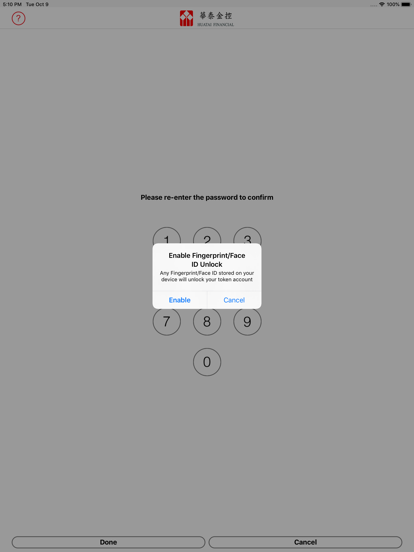

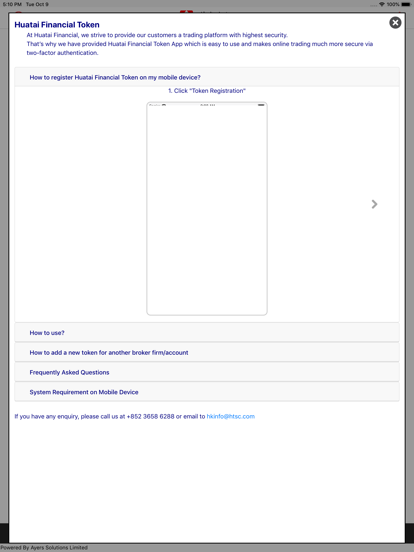

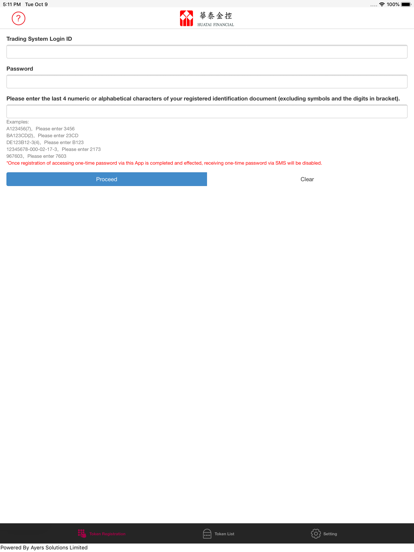

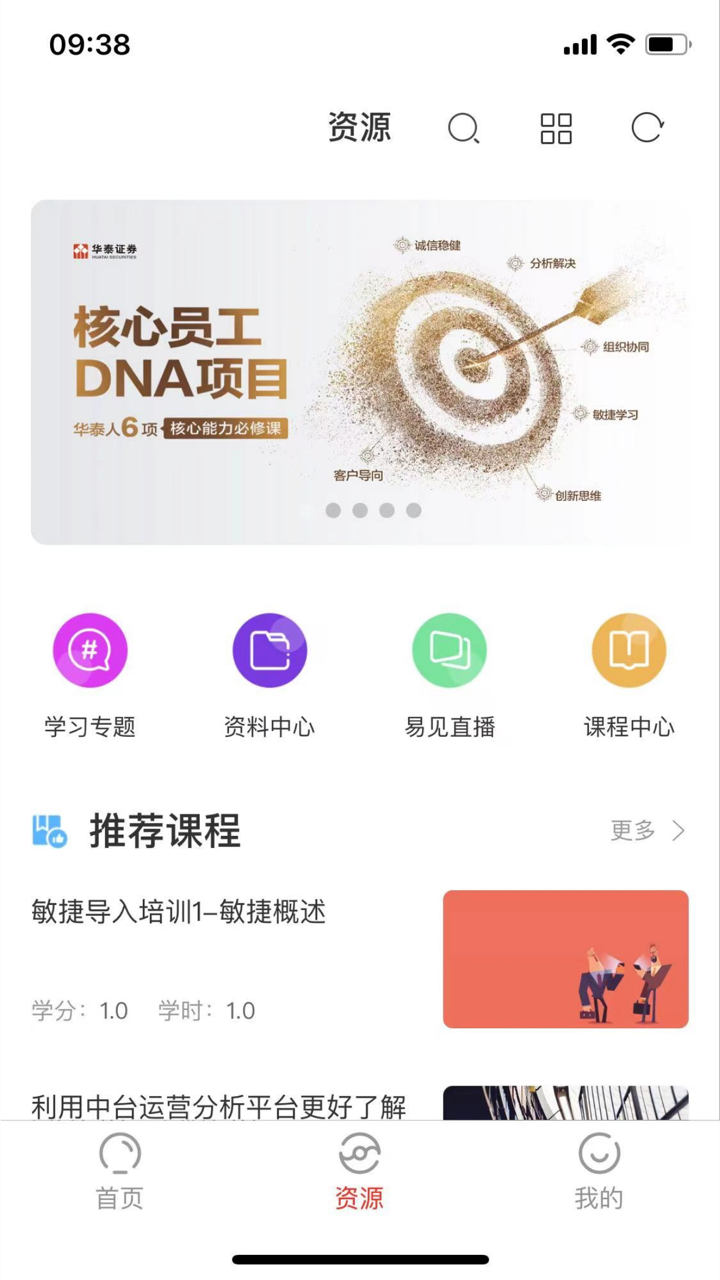

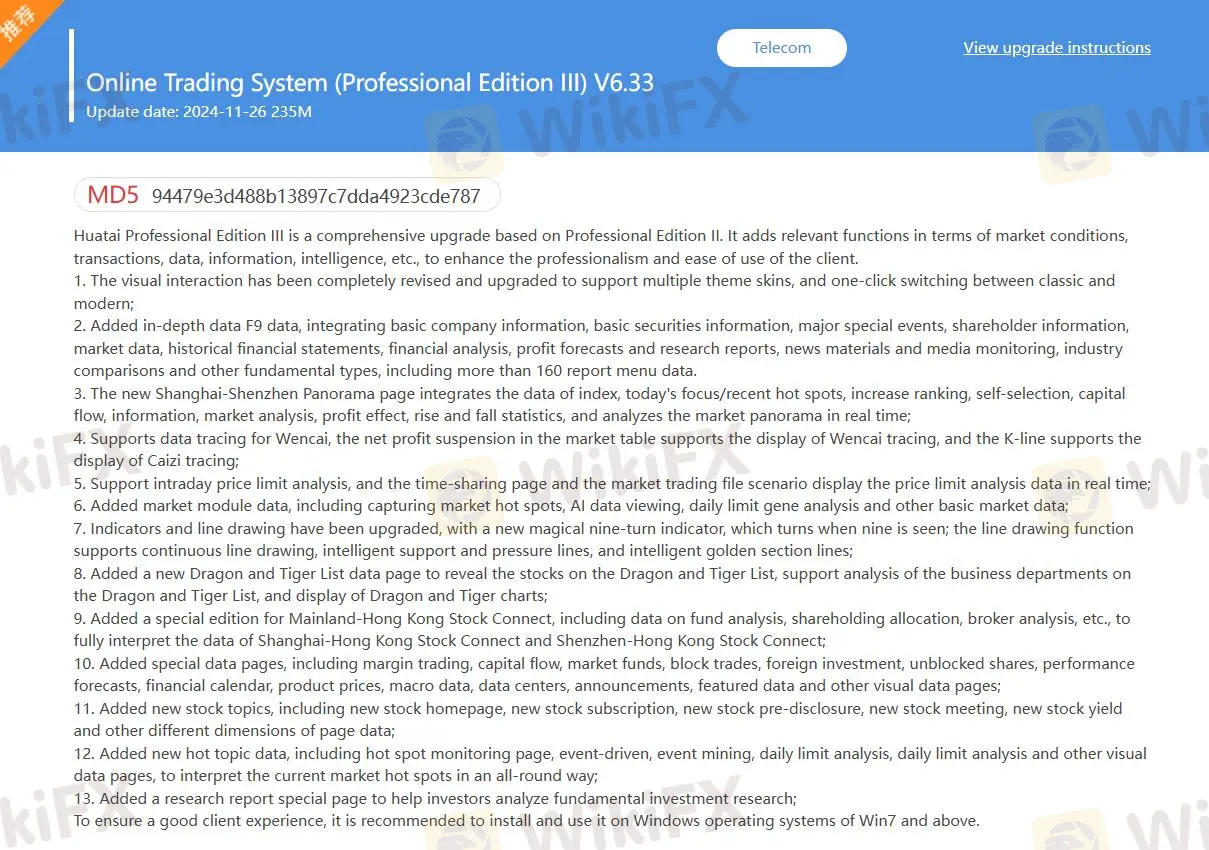

Trading Platform

HUA TAI's trading platforms are MD5, Zhangle App, which support traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MD5 | ✔ | Web |

| Zhangle App | ✔ | Mobile |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |

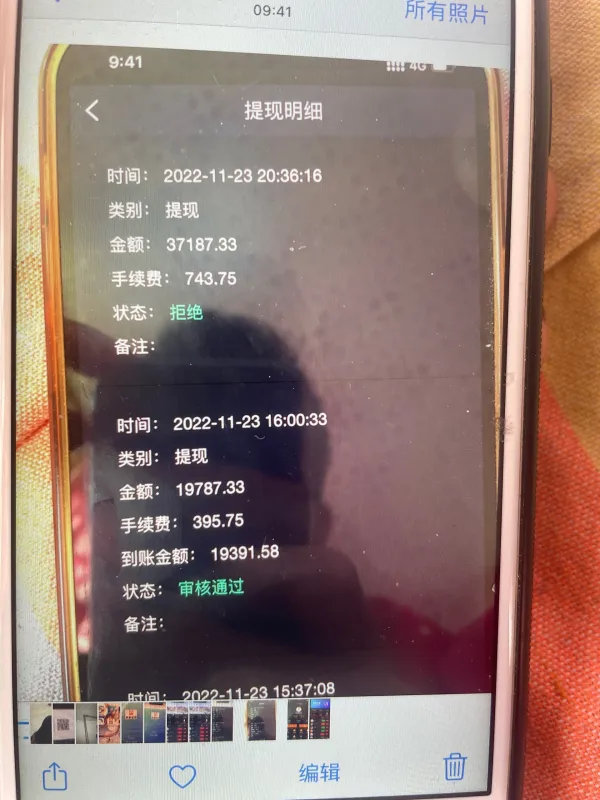

Deposit and Withdrawal

Its deposit and withdrawal method is bank transfer. It supports the following debit cards, such as ICBC card, ABC card, CCB card, BOC card, etc.