Company Summary

General Information

| E-Global Review Summary in 10 Points | |

| Founded | 2016 |

| Registered Country/Region | Luxembourg |

| Regulation | FSC (suspicious clone) |

| Market Instruments | N/A |

| Demo Account | N/A |

| Leverage | N/A |

| EUR/USD Spread | N/A |

| Trading Platforms | N/A |

| Minimum deposit | N/A |

| Customer Support | Phone, email |

What is E-Global?

E-Global Trade & Finance Luxembourg S.A. was granted its PSF license to act as a broker to customer trades in financial instruments in 2016. The Luxembourg entity was the logical extension of the Groups business to Europe with products such as Forex4you, Trade4you and Share4you.

Pros & Cons

Global offers a wide range of market instruments, providing potential opportunities for investors. The availability of copy trading and mobile trading may be appealing to those seeking convenience and alternative trading options.

However, there are concerns regarding E-Global's regulatory status, with reports indicating an unregulated and suspicious clone license. Limited information on the website further raise doubts about the credibility and reliability of E-Global as a financial service provider.

| Pros | Cons |

| • Availability of copy trading and mobile trading | • Suspicious clone FSC license |

| • Concerns regarding regulatory status and scam reports | |

| • Limited info on the website |

Is E-Global Safe or Scam?

E-Global's license from the British Virgin Islands Financial Services Commission (FSC, License No. SIBA/L/12/1027) raises suspicions of being a clone or unauthorized entity. Additionally, the report of a scam and the lack of sufficient information on their website are red flags. Therefore, it is advisable to exercise caution and consider E-Global as potentially unsafe. It is crucial to conduct thorough research and due diligence before engaging with any unregulated or suspicious financial entity to protect your investments and personal information.

Market Instruments

E-Global presents itself as a platform that offers real estate and investments on global markets.

Copy trading & Mobile trading

Global states on their website that they offer copy trading and mobile trading services to their clients. Copy trading typically allows investors to automatically replicate the trades and strategies of experienced traders, enabling them to potentially benefit from their expertise. However, since E-Global does not provide further details about their copy trading service, it is important for potential users to seek more information directly from the company.

Mobile trading, on the other hand, suggests that E-Global provides a platform or app that allows clients to access and manage their trading accounts using their mobile devices. This can offer convenience and flexibility for traders who prefer to monitor and execute trades on the go.

Customer Service

E-Global provides customer service through phone: +352 26 374 964 and email: info@eglobal-group.com, allowing clients to reach out for assistance or inquiries. Additionally, the company address: 53 Boulevard Royal, 2449 Luxembourg – Eich, Luxembourg – Luxemburg listed in Luxembourg provides a physical location for clients to visit or send correspondence if needed.

| Pros | Cons |

| • Phone & email support | • No 24/7 customer support |

| • No live chat support | |

| • No social media support | |

| • Unclear support hours |

Note: These pros and cons are subjective and may vary depending on the individual's experience with E-Global's customer service.

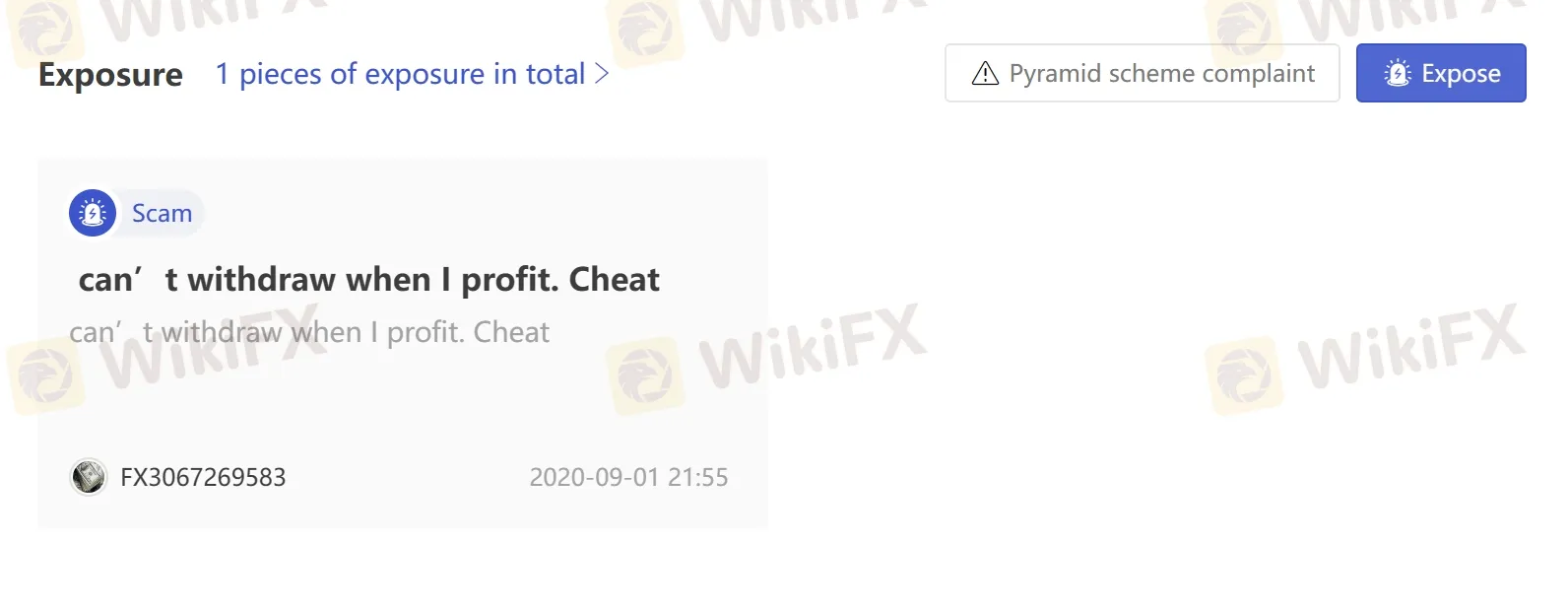

User Exposure on WikiFX

On our website, you can see that a report of scam. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In conclusion, E-Global raises significant concerns regarding its regulatory status, with reports suggesting it operates with an unregulated and suspicious clone license. The limited information available on its website, particularly regarding market instruments and trading platforms, adds to the lack of transparency and raises doubts about the company's credibility. Additionally, the absence of clear details on copy trading and mobile trading further hampers its reputation. It is advisable for traders to exercise caution and explore alternative regulated options in the market.

Frequently Asked Questions (FAQs)

| Q 1: | Is E-Global regulated? |

| A 1: | No. E-Global British Virgin Islands Financial Services Commission (FSC, License No. SIBA/L/12/1027) license is a suspicious clone. |

| Q 2: | Is E-Global a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of lack of transparency. |

FX3067269583

Vietnam

can’t withdraw when I profit. Cheat

Exposure

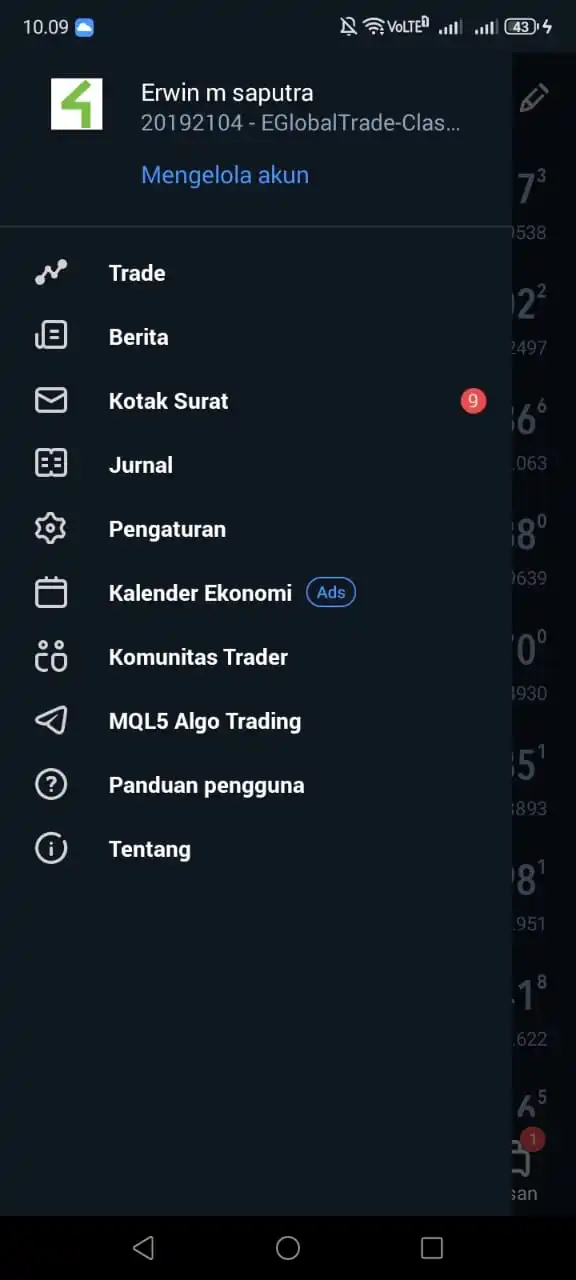

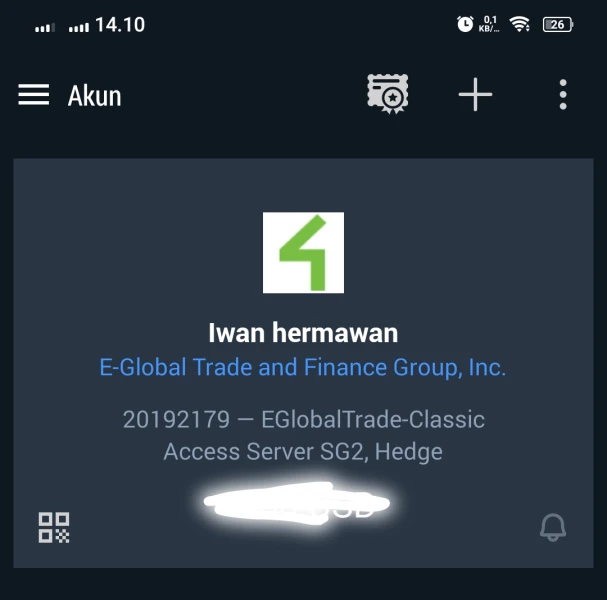

erwinmsaputra

Indonesia

Since I started using this broker, I have really liked it. Besides offering many account type options, this broker has low spreads, fast market execution, friendly and responsive customer service, and various attractive promotions. I recommend this broker as one of the best choices for traders. MT5 ID: 20192104

Positive

Iwan Corpsporations

Indonesia

The experience at this agency, lots of promotions and gifts every month, for beginners there is also trading education, highly recommended.

Positive

Iwan Corpsporations

Indonesia

many events and promotions at this broker, there are also monthly rewards, awesome

Neutral

Dyshmliy

United Kingdom

E-Global’s copy trading sucks. I thought it would save my energy and time, but actually I lost all my invested funds on copy trading. They are very unprofessional!

Neutral

FX1200822639

Spain

e-global is an unregulated company. Although we can open your website and see the contents, it seems to me an unwise decision to invest here.

Neutral

FX1182125724

United States

Cannot withdraw my own money. Have attempted to withdraw funds and it sticks on "pending". Any email sent to support is ignored and my account advisor or whatever does not respond to emails.

Neutral