Company Summary

| Quam SecuritiesReview Summary | |

| Founded | 1986 |

| Registered Country/Region | Hong Kong |

| Regulation | No regulation |

| Products and Services | Products: options, indices, futures, stocks, securities and other investment toolsServices: institutional research, capital markets services |

| Account Types | Individual and corporate accounts |

| Trading Platform | QPlus/QPlus+, SP Trader and Financial Plus |

| Deposit & Withdrawal | Bank transfer |

| Customer Support | Hong Kong hotline: (852) 2971-5486China toll-free hotline: 400-678-0225 |

| Email: QSeccs@quamgroup.com | |

| Physical Address: 5th Floor, Wing On Centre, 111 Connaught Road Central, Hong Kong | |

Quam Securities Information

Quam Securities, founded in 1986, is a brokerage registered in Hong Kong. The products and services it provides cover securities, options, indices, futures, institutional research and capital markets services. It is unregulated.

Pros and Cons

| Pros | Cons |

| Wide range of trading instruments | No regulation |

| Extensive experience in the financial industry | Demo account unavailable |

| Various trading platforms |

Is Quam Securities Legit?

It is clear that Quam Securities, is currently unregulated and is insecure.

What Does Quam Securities Provide?

Instruments

Quam Securities offers traders the opportunity to trade securities, options, indices, futures and stocks.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Options | ✔ |

| Indices | ✔ |

| Futures | ✔ |

| Stocks | ✔ |

| Commodities | ❌ |

| Cryptocurrencies | ❌ |

Other Investment Tools

Quam Securities also offers clients bonds, mutual funds and structured products.

Services

Quam Securities offers corporate finance services, discretionary/asset management services and high frequency and algorithmic trading.

Account Types

Quam Securities offers 2 different types of accounts to traders - Individual Account and Corporate Account.

Quam Securities Fees

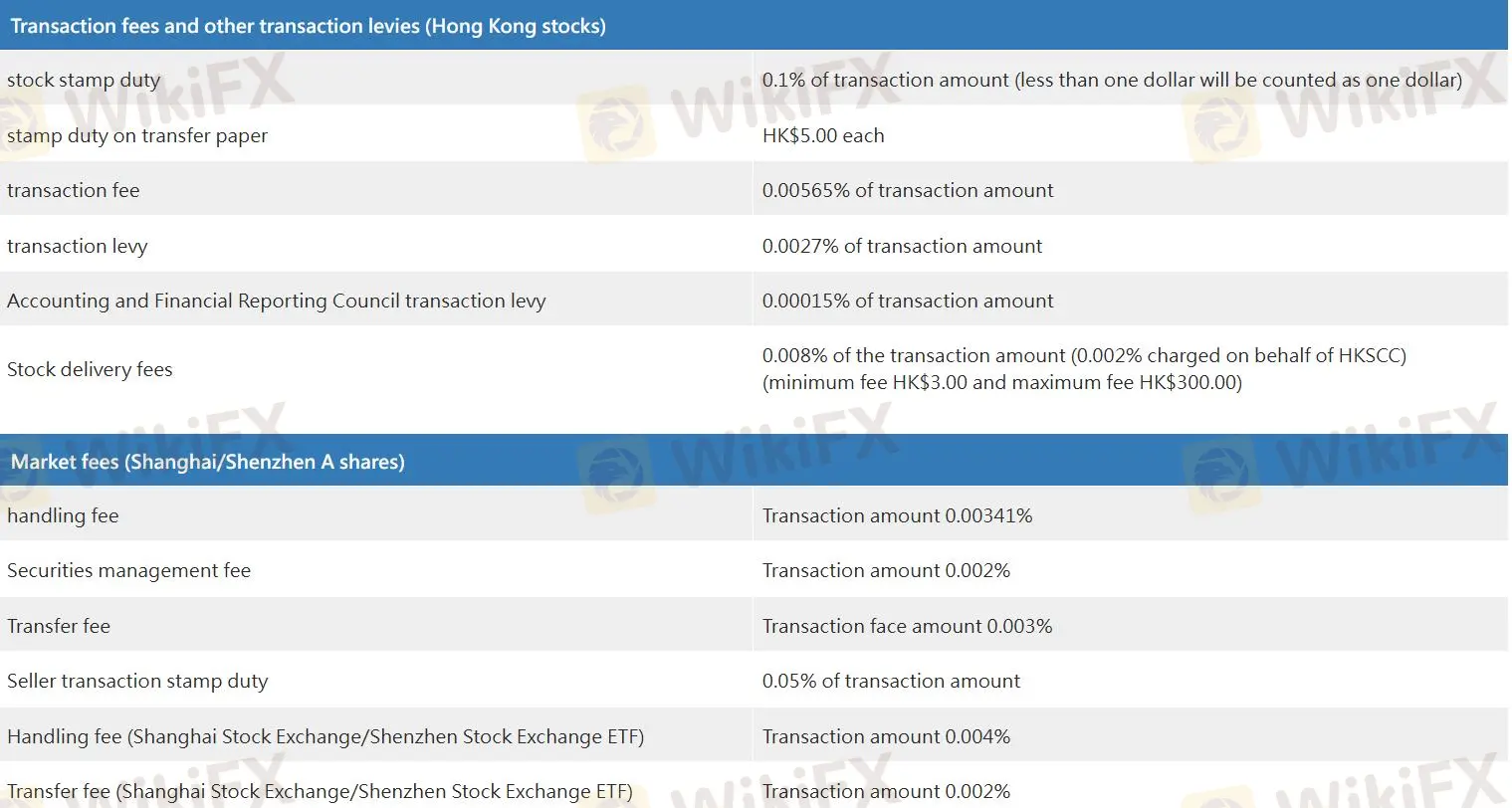

Quam Securities fees contain transaction fees and other transaction levies, market fees, other service charges and other charges.

Trading Platform

Quam Securities's trading platforms are QPlus/QPlus+, SP Trader and Financial Plus. QPlus/QPlus+ supports traders on Android and iOS. SP Trader supports traders on Android, iOS and PC. Financial Plus supports traders on Android and iOS.

| Trading Platform | Supported | Available Devices |

| QPlus/QPlus+ | ✔ | Mobile |

| SP Trader | ✔ | Web, Mobile |

| Financial Plus | ✔ | Mobile |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |

Deposit and Withdrawal

The company provides bank accounts. Customers can deposit funds into the company's bank accounts via bank transfer, telegraphic transfer, check or cash and FPS.

Customers needs to notify their brokers or make a withdrawal request through website before 12:00 PM from Monday to Friday. Requests made after this time will be processed on the next day.

The withdrawn amount will be issued to the customer in the of a check.

Customers can choose to: Have the company deposit the check into their bank accounts with the same name; Come to the company to pick up the check in person; Transfer the amount via telegraphic transfer to their bank account with the same name.