Company Summary

| Founded in | 2001 |

| Headquarters | Seychelles |

| Regulated by | ASIC, FCA, CySEC, FSA (Offshore) |

| Trading instruments | 2,500+, forex, indices, commodities, ETFs, stocks, cryptocurrencies |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Account Type | Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Zero.MT5 |

| Min Deposit | $25 |

| Leverage | 1:3-1:1000 |

| EUR/USD Spread | Floating around 0.1 pips |

| Trading platform | MT4/5, Trading App, Admirals Platform, StereoTrader |

| Payment Methods | Visa, MasterCard, Skrill, Neteller, Crypto payments, Bank Wire |

| Deposit Fee | ❌ |

| Withdrawal Fee | One free withdrawal request every month, 5 EUR/USD thereafter |

| Inactivity Fee | 10 EUR per month (only charged if the account balance is greater than zero) |

| Customer Support | Live chat, contact form |

| Tel: +2484671940, +3726309306 | |

| Email: global@admiralmarkets.com | |

| Regional Restriction | Belgium |

Admiral Markets Overview

Admiral Markets is a global online trading provider offering trading services in 2,500+ financial instruments, including forex, indices, commodities, ETFs, stocks, and cryptocurrencies. The company was founded in 2001 and is headquartered in Seychelles, with offices in various countries around the world.

Admiral Markets is regulated by several financial authorities, including the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). The company offers a range of trading platforms, account types, and educational resources to its clients.

Admiral Markets is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Admiral Markets acts as an intermediary and takes the opposite position to its clients.

Regulatory Status

Admiral Markets is regulated by several respected financial authorities globally.

In Australia, it is regulated by Australia Securities & Investment Commission (ASIC) under the Market Making (MM) model.

In the United Kingdom and Cyprus, the firm is overseen by the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC) respectively, both also under the Market Making model.

Additionally, it holds a Retail Forex License in Seychelles, further extending its regulatory framework to offshore jurisdictions.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License Number |

| ASIC | Regulated | ADMIRALS AU PTY LTD | Market Making (MM) | 000410681 |

| FCA | Regulated | Admiral Markets UK Ltd | Market Making (MM) | 595450 |

| CySEC | Regulated | Admirals Europe Ltd (ex Admiral Markets Cyprus Ltd) | Market Making (MM) | 201/13 |

| FSA | Offshore Regulated | Admirals SC Ltd | Retail Forex License | SD073 |

Pros and Cons of Admiral Markets

Advantages:

- Wide range of trading instruments and account types to choose from

- Flexible maximum leverage options (1:3-1:1000)

- Multiple payment methods available without deposit fees

- Comprehensive educational resources for traders of all levels

- Customized customer service for different regions and languages

- Access to various trading platforms including MT4/5, Trading App, Admirals Platform, and StereoTrader

- A variety of trading tools and features such as negative balance protection and free VPS

Disadvantages:

- Belgium clients are not accepted

- Only one free withdrawal request every month, 5 EUR/USD thereafter

- Inactivity fee of 10 EUR per month charged if the account balance is greater than zero

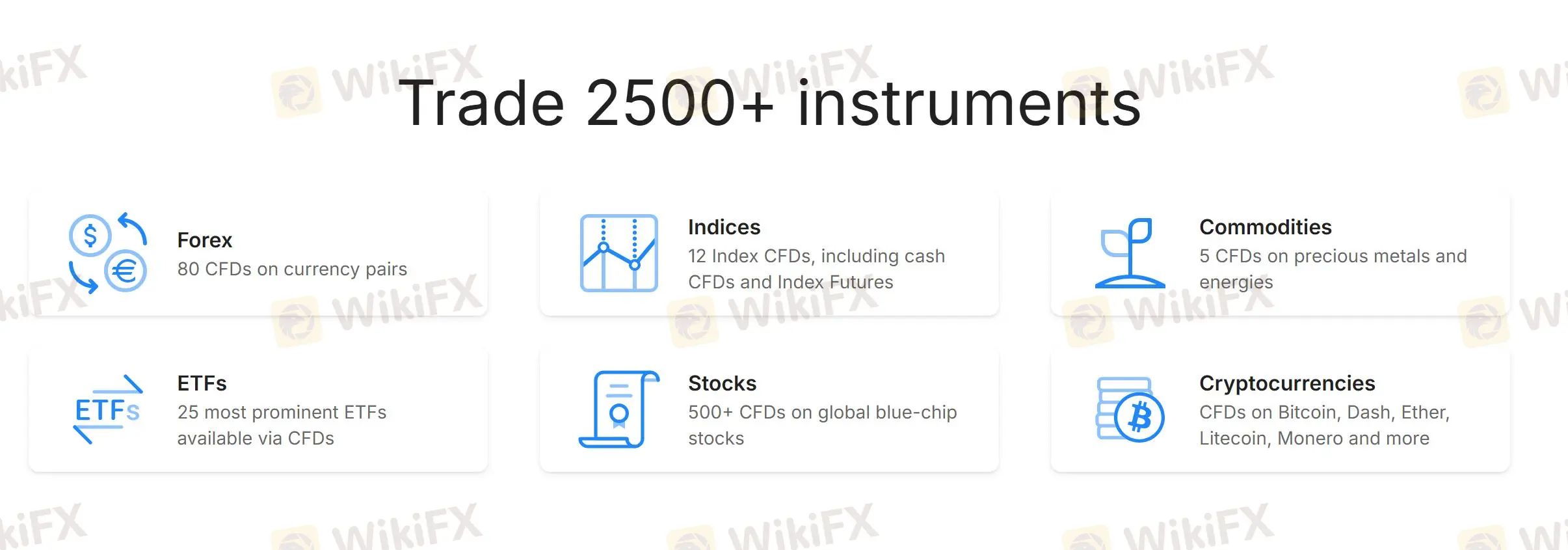

Market Instruments

Admiral Markets offers a diverse range of trading products, encompassing over 2,500 instruments across various asset classes to cater to different investment preferences.

| Asset Class | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| ETFs | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Ooptions | ❌ |

Trading Accounts/Fees

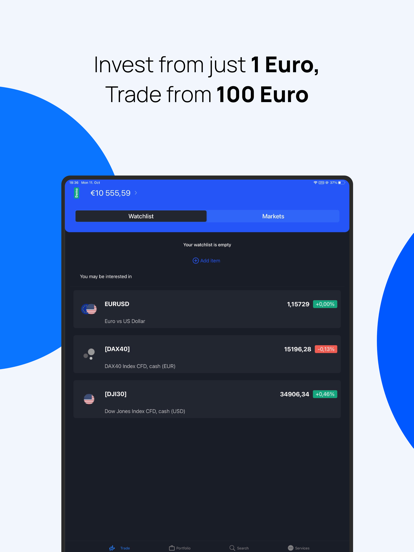

Admiral Markets offers five account types: Trade.MT4, Zero.MT4, Trade.MT5, Zero.MT5, and Invest.MT5.

The Invest.MT5 account has the lowest minimum deposit requirement, starting at just $1 USD/EUR, and offers the widest range of trading instruments including over 4500 stocks and more than 400 ETFs; however, it does not support leverage trading.

Only the Trade.MT5 account offers the option for an Islamic account.

For more detailed differences among the account types offered by Admiral Markets, please refer to the table below:

| Account Type | Trade.MT4 | Zero.MT4 | Trade.MT5 | Zero.MT5 | Invest.MT5 |

| Min Deposit | 25 USD/EUR, 100 BRL, 500 MXN, 20 000 CLP, 50 SGD, 1000 THB, 500 000 VND, 25 AUD | 1 USD/EUR | |||

| Trading Instruments | 37 currency pairs, 5 cryptocurrency CFDs, 2 metal CFDs, 3 energy CFDs, 12 cash index CFDs, 200+ stock CFDs | 80 currency pairs, 3 metal CFDs, 8 cash index CFDs, 3 energy CFDs | 80 currency pairs, 18 cryptocurrency CFDs, 2 metal CFDs, 3 energy CFDs, 12 cash Index CFDs, 2,300+ stock CFDs, 350+ ETF CFDs | 80 currency pairs, 3 metal CFDs, 8 cash index CFDs, 3 energy CFDs | 4,500+ stocks, 400+ ETFs |

| Leverage (Forex) | 1:3-1:1000 | ❌ | |||

| Leverage (Indices) | 1:10-1:500 | ❌ | |||

| Spread | From 1.2 pips | From 0 pips | From 0.6 pips | From 0 pips | |

| Commission | Single Share & ETF CFDs - from 0.02 USD per share | Forex & Metals - from 1.8 to 3.0 USD per 1.0 lots | Single Share & ETF CFDs - from 0.02 USD per share | Forex & Metals - from 1.8 to 3.0 USD per 1.0 lots | Stocks & ETFs - from 0.02 USD per share |

| Other instruments - no commissions | Cash Indices - from 0.15 to 3.0 USD per 1.0 lots | Other instruments - no commissions | Cash Indices - from 0.15 to 3.0 USD per 1.0 lots | ||

| Energies - 1 USD per 1.0 lots | Energies - 1 USD per 1.0 lots | ||||

| Islamic Account | ❌ | ❌ | ✔ | ❌ | ❌ |

Leverage

Admiral Markets offers a range of leverage options from 1:10 to 1:1000, allowing traders to select the level that aligns with their strategy and risk tolerance. While higher leverage can amplify profits from smaller investments, it also increases the potential for significant losses.

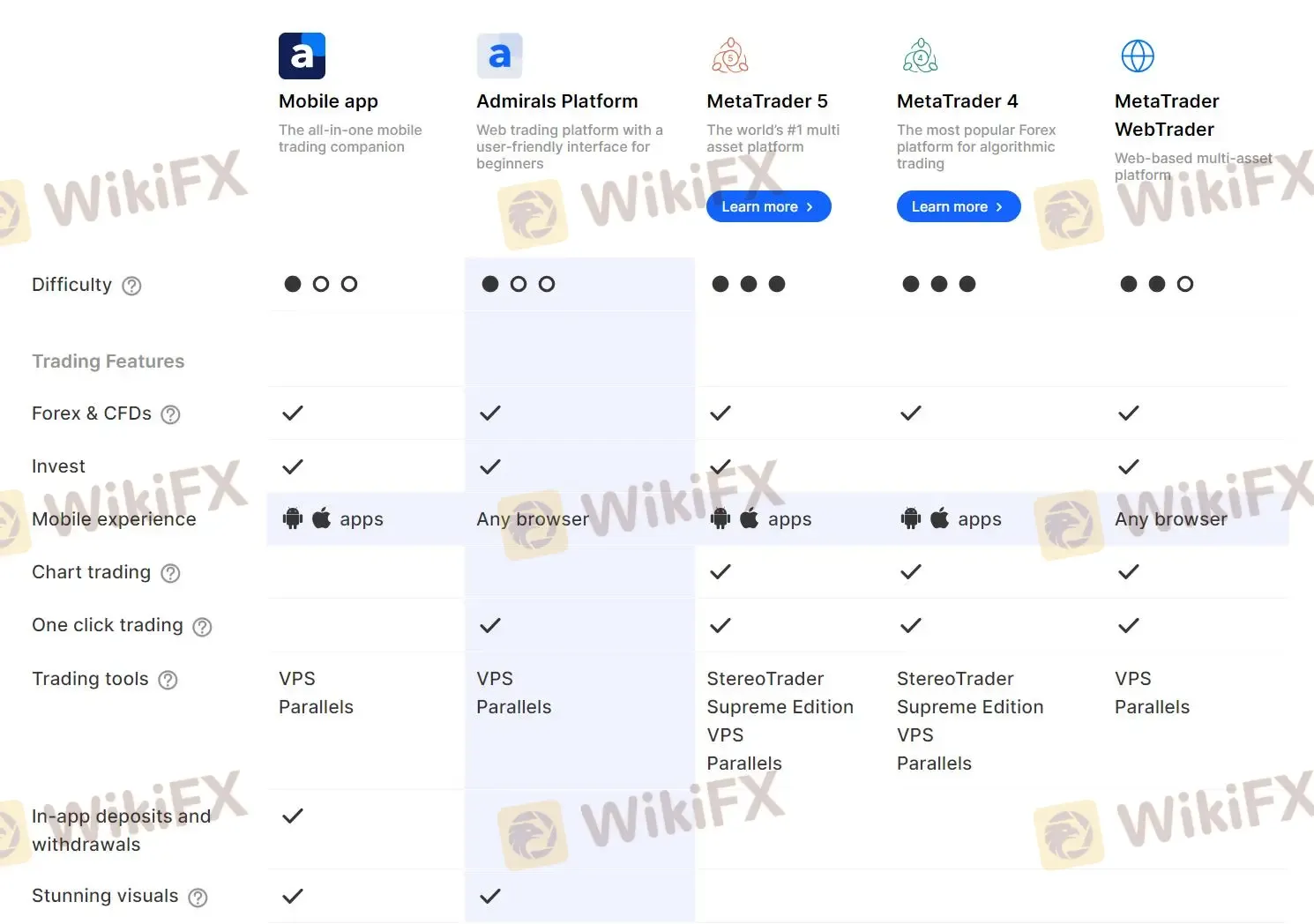

Trading Platforms

Admiral Markets offers a comprehensive suite of trading platforms to cater to various trading needs:

- MetaTrader 4 (MT4): Known for its reliability and powerful analytical tools, MT4 is available for Windows and offers advanced trading capabilities in a secure environment. It supports Forex and CFD trading.

- MetaTrader 5 (MT5): Available for Windows, Android, iOS, and Mac, MT5 is a multi-asset platform favored globally for trading Forex, CFDs, exchange-traded instruments, and futures. It features advanced charting tools, automated trading options, and mobile apps that allow trading on the go.

- Admirals Mobile App: Developed in-house, this mobile app provides a user-friendly interface for trading CFDs on various instruments. Available for mobile devices, it ensures trading accessibility anytime, anywhere.

- StereoTrader: An advanced MetaTrader panel that enhances trading with strategic order types, stealth modes, and intelligent automation. It's designed for traders looking for precision and flexibility in their strategies.

Deposit and Withdrawal

Admiral Markets accepts deposits and withdrawals via Visa, MasterCard, Skrill, Neteller, Crypto payments, and Bank Wire.

All deposits are free of charge, while only one free withdrawal request every month, and 5 EUR/USD thereafter.

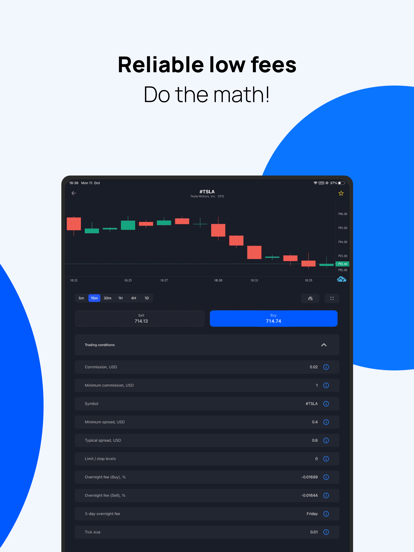

Fees

In addition to commissions and withdrawal fees that we have mentioned before, some other fees may be charged, as follows:

Internal transfer

| Between a client's separate trading accounts | |

| Accounts with the same base currency | ❌ |

| Accounts with different base currencies | 1% of the amount |

| Between a client's separate wallets, wallet and trading account | |

| Wallets, wallet and account with the same base currency | ❌ |

| Wallets, wallet and account with different base currencies | 5 free transfers, 1% of the amount thereafter (min 1 EUR) |

Additional fees

| Opening a live or demo trading account | ❌ |

| Inactivity fee | 10 EUR per month |

| Currency conversion fee | 0.3% |

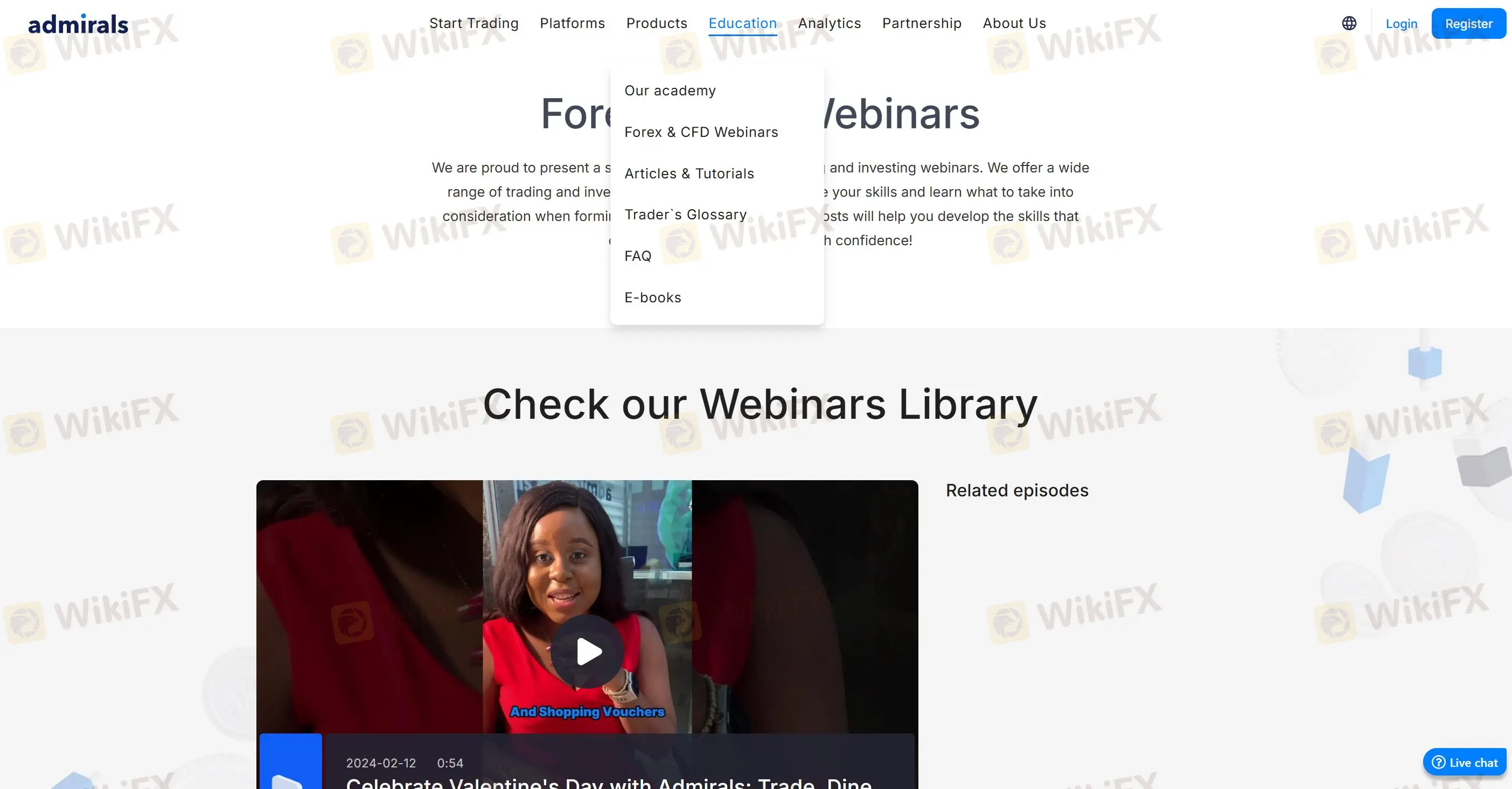

Educational Resources

Admiral Markets offers a robust suite of educational resources suitable for traders of all experience levels. These resources encompass an economic calendar to monitor significant market events, comprehensive market reports, and real-time charts that provide up-to-date market conditions.

Additionally, traders can benefit from a variety of learning formats including video tutorials for practical guidance on trading platforms, interactive webinars and seminars for insights from market experts, as well as eBooks that delve into trading strategies and concepts.

A glossary is also available to help traders familiarize themselves with trading terminology, enhancing their understanding of the financial markets.

Conclusion

Admiral Markets is a well-established online trading broker with over 20 years of industry experience, offering a diverse range of financial instruments, platforms, and account types to traders globally. The broker provides robust tools and educational resources to support informed trading decisions, along with flexible leverage and multiple payment options.

While Admiral Markets stands out for its tailored services across different regions, various fees can't be overlooked.

FAQs

What regulatory bodies oversee Admiral Markets?

Admiral Markets is regulated by ASIC, FCA, CYSEC, and holds an offshore Retail Forex License from the FSA in Seychelles.

What can I trade on Admiral Markets?

The platform offers 2,500+ tradable instruments, including forex, indices, commodities, stocks, bonds, cryptocurrencies, and ETFs.

Which trading platforms does Admiral Markets support?

Admiral Markets supports MT4/5, Trading App, Admirals Platform, and StereoTrader.

Does Admiral Markets provide educational resources?

Yes, it offers webinars, seminars, eBooks, and market analysis.

What account types does Admiral Markets offer?

Available accounts include Trade.MT4, Zero.MT4, Trade.MT5, Zero.MT5, and Invest.MT5.

Are there fees or commissions at Admiral Markets?

Yes. Both withdrawal fee and inactivity fee are charged, as well as some other fees. You can find detailed info above.

How can I manage funds in my Admiral Markets account?

Funds can be deposited or withdrawn via Visa, MasterCard, Skrill, Neteller, Crypto payments, and Bank Wire.

Hafiza Aliyuu

United States

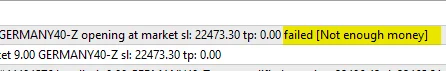

What an absolute joke Admiral Markets is. Removed my professional status without notification, reduced my leverage to 1:30. Just missed a dax long this morning across all of my funding. 20 grand down the drain. Absolutely fuming.

Exposure

福特

Hong Kong

There is lowdown on the quotation of the crude oil since it differs sharply from the real trend.

Exposure

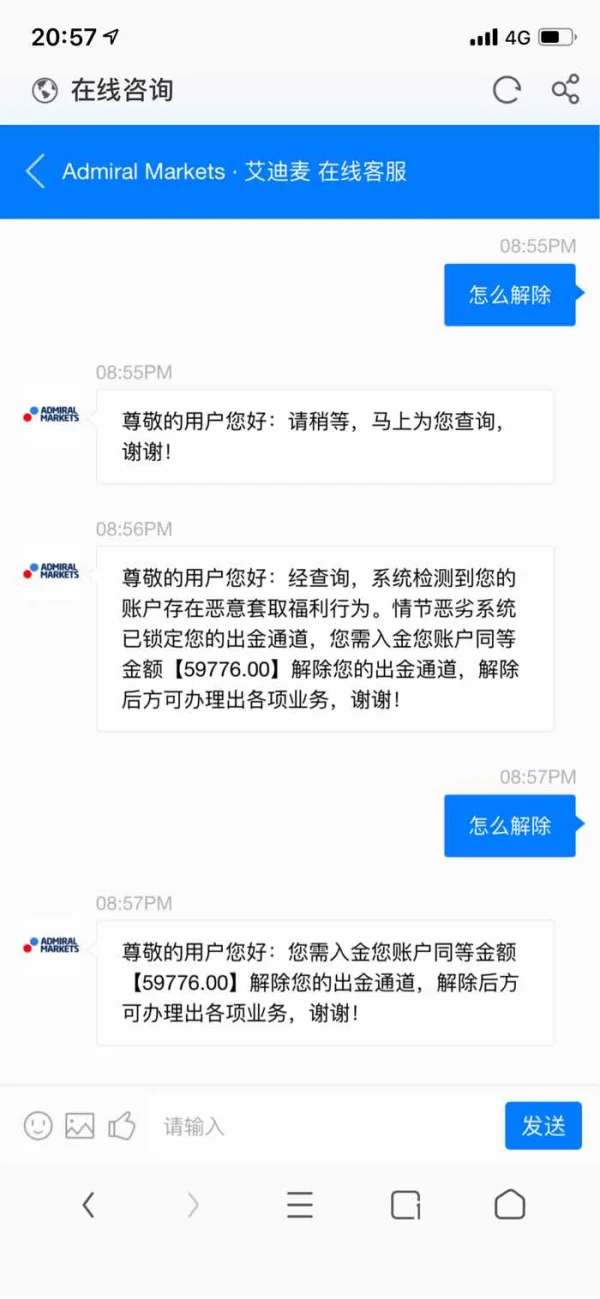

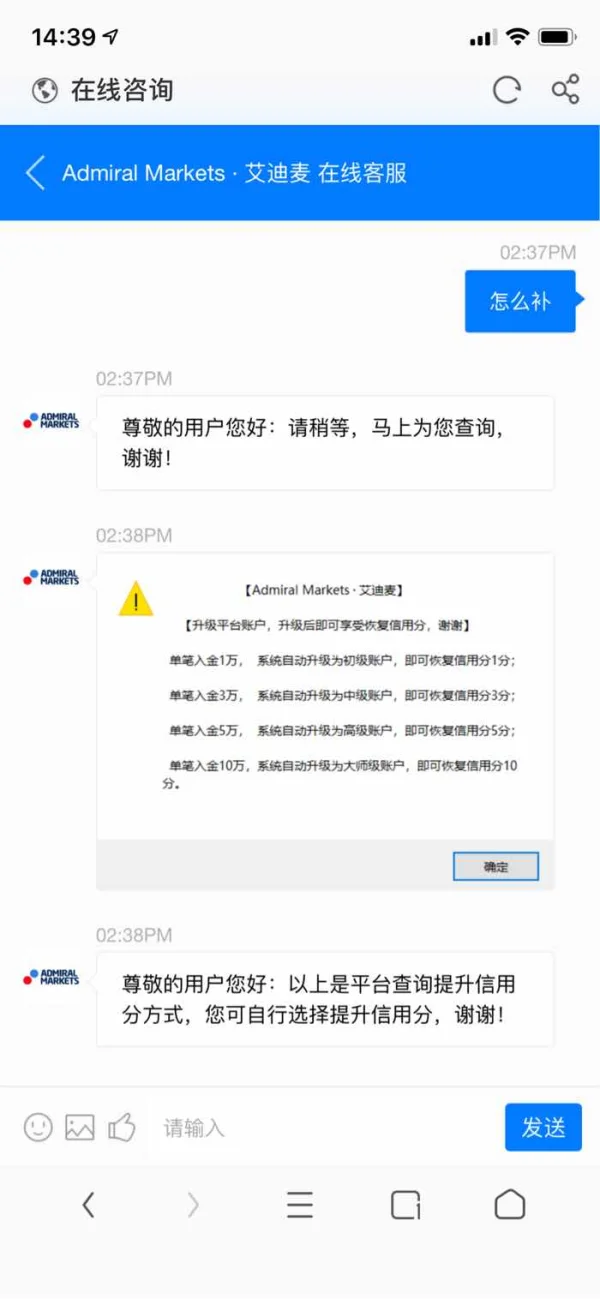

FX3056304711

Hong Kong

I’m unable to withdraw. It is just a behavior of deception. I’ve been deceived for many times!

Exposure

zara shuraim

United Kingdom

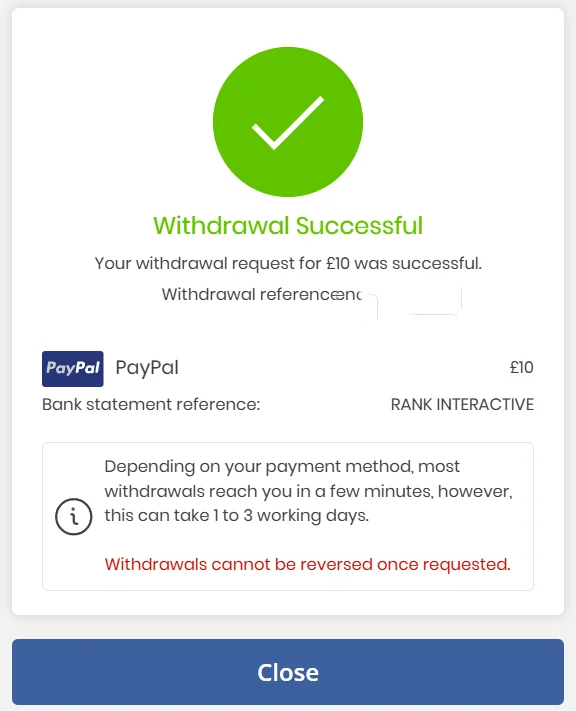

Am really happy with this broker 😄 they always deliver well when it comes to withdrawal 🥰

Positive

Umar bin halid

United States

Admirals (Admiral Markets) is a global forex and CFD broker, which is regulated by several authorities, including the top-tier FCA in the UK and ASIC in Australia. and I truly like how it operates everything looks smooth

Positive

Nicolas Navarro

Argentina

Admiral Markets offers a reliable and easy-to-use platform for trading in the financial markets. It stands out for its solid regulation, variety of instruments, and good customer service.

Positive

FX2773816652

Netherlands

this is a good broker

Positive

FX1831818691

India

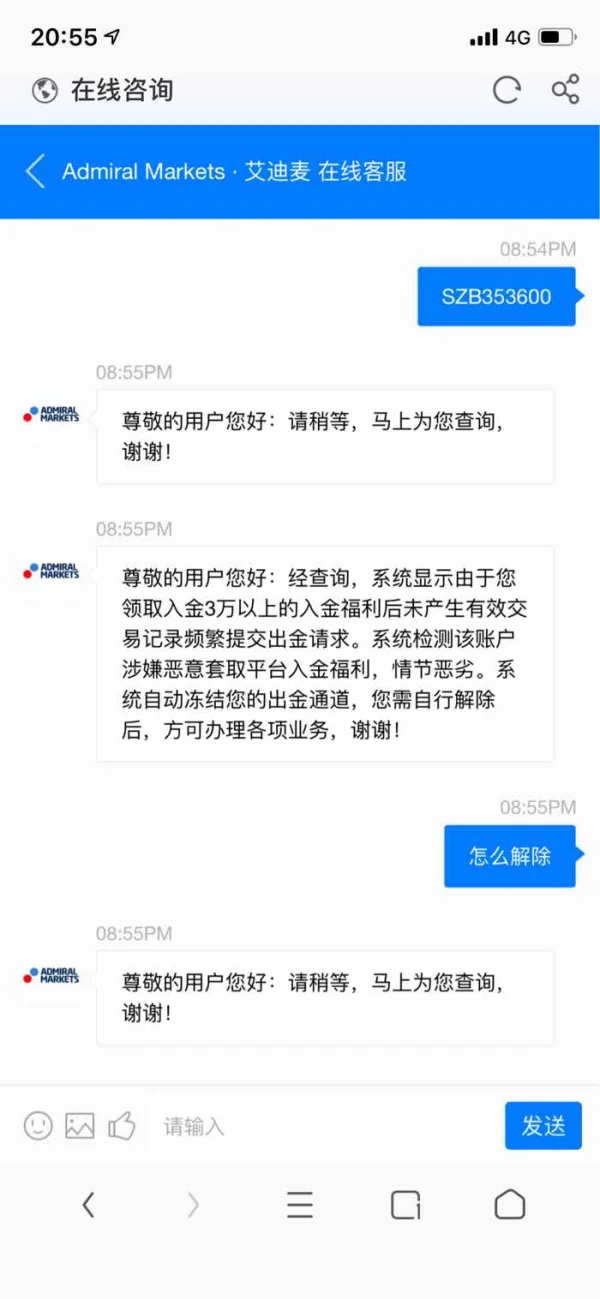

I HAD REQUESTED FOR WITHDRAWAL DURING JUNE 2024 AND PAID TAX, WITHDRAWAL CHARGES, WITHDRAWAL DEPOSITS, INSURANCE DEPOSIT BUT THE WITHDRAWAL WAS NOT PROCESSED. WHILE FOLLOWING UP ASKED FOR ADDITIONAL DEPOSIT WHICH WAS NOT LEGIMATE. AFTER REGULAR FOLLOWUP, THE CUSTOMER CARE STOPPED RESPONDING AND NOW BLOCKED ON TG. MAILED THE MAIN CONTACT DETAILS OF ADMIRAL AND RECEIVED REPLIED THAT UID NO DOES NOT BELONG TO THEN AND IT MAY BE A SCAM. IF ANY BODY CAN GUIDE TO CONTACT ADMIRAL OPERATING IN INDIA

Exposure

Monicar

United States

Admiral Markets offers flexible leverage, fitting all trading needs. And with multiple legit regulators, it's safe and user-friendly!

Positive

LOU2245

Vietnam

I traded for 1 month; everything went completely normal, and there was no warning from the floor. I also had to deposit money into the floor many times when the order was at a loss and could have stopped out. But when there was a profit and at the end, the floor locked my order and informed me to only withdraw capital. This is dirty and fraudulent behavior from a reputable floor for 20 years. I researched and discovered that many people had the same problem as me when caught. Profitable investment, picture below. They have robbed me of more than a month of work and money, and through many lying emails, they have not provided any evidence of my handover. Wrong translation of the law. Everyone, please help me give a bad review about a platform that scams investors. From Vietnam, they are very afraid of people in the host country and other countries. Only customers from small countries play very dirty tricks because they know I will face many barriers to get them out.

Exposure

Dustin282

Vietnam

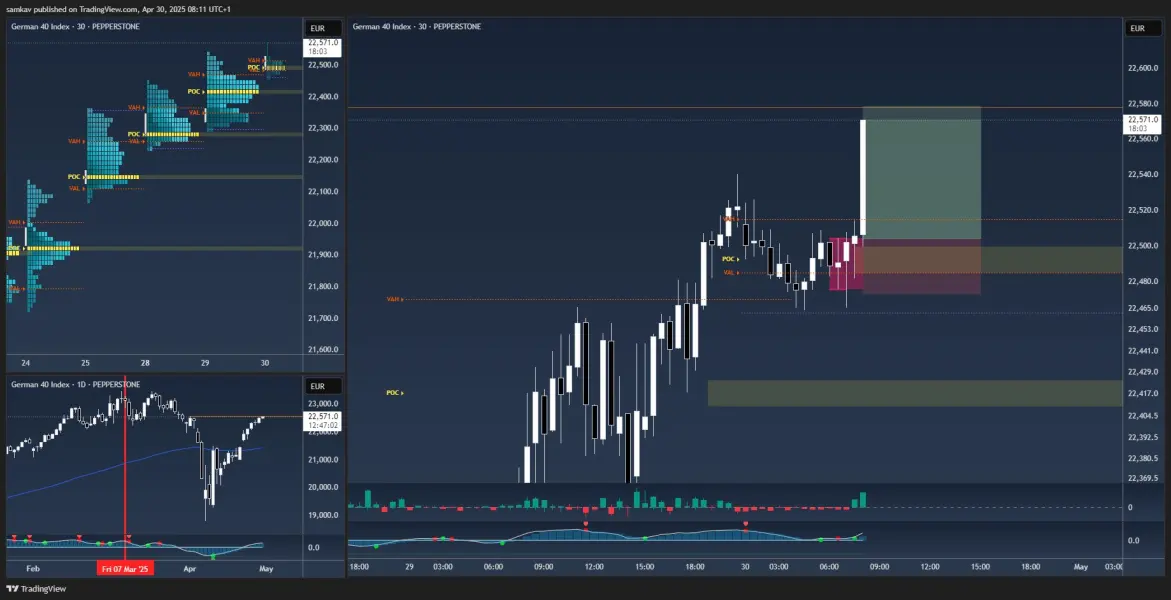

For nearly 2 months, Admiral still cannot prove that I traded with a price error because I traded without a price error, so they could not find proof that I was wrong. But Admiral still tried to take my profit of 9021 USD. Admiral used that profit to do other things without explanation, appropriating profits without cause and without understanding the definition of mispricing. Meanwhile, Admiral blamed the customer for a pricing error that Admiral himself did not understand. Are you looking for an excuse to blame me for making a price mistake, traders? Do you think it's unreasonable? Once there is a price error, Admiral will prove me wrong, and the price is different from other exchanges. But I didn't trade any price errors; I proved that the Admiral price is still the same as on other exchanges. Because Admiral wanted to take my profit of 9,021 USD, he found an excuse to take money like that. I hope someone will stand up and accompany me to eliminate unreasonable strategies that rob traders like me of their money. This was a huge lesson for me when I put my trust in Admiral in the wrong place. Meanwhile, they are defrauding customers who trust them with too much money. I cannot accept to give up and let Admiral take my profits unjustly. I will do everything to restore justice and not be deceived. Thank you, traders, for reading and sharing to gain better information and understand how Admiral deceives customers. These are the proofs I want to show you of what Admiral has done to me and others who are suffering like me. Here, traders, please let me know where I made a mistake in the above price when Admiral blamed me for the price. Please give me feedback and comments.

Exposure

Dustin282

Vietnam

I am a customer of Admiral with the registered Account Number: "83008753 MT5, Account Name: Nguyen Hai Duong. I am from Vietnam. However, on April 25, 2024, they said they needed to review my account. Two days later, they claimed that my account had violated their Terms and Conditions and only allowed me to withdraw the deposited amount, not the profits. I don't understand where I went wrong. Therefore, I suspect that Admirals SC Ltd. Deceived me and seized my property. Website: https://admiralmarkets.com.cy/, with the licensing authority being Admiral Markets UK Ltd. Admiral accused me of violating T&C and attempted to withhold all my profits. I traded normally; I did not engage in price manipulation or scalping. I don't receive any bonuses, I don't trade on gaps, I don't trade freeswaps, I don't trade after-breakouts, I don't trade on scalping, so how does Admiral steal my profits However, they tried to justify seizing my profits by accusing me of violating T&C when I earned profits. Isn't that just an excuse to take my profits? They have held my profits for almost a week now and have automatically deleted my profit, without any explanation. I hope the the community can help me recover the profits they took from me. I have requested evidence of my alleged misconduct, but they have not provided any evidence. Admiral accuses me of not taking profits at the peak, speculating that I traded at different prices, but I proved that day other platforms ran at the correct prices. Admiral is trying every reason to take my profits and those of other traders. The Admiral alleges that I violated policy 5.10. They take advantage of low profit rates, high leverage, swap fees from me, and I trade in very small quantities. What did I violate? Please help me recover my money and others like me, who have faced similar situations where they cannot withdraw profits. They are holding $9021 USD from me. I hope the the community has measures or can help us to recover the money that Admiral has withheld from us. I am the one pleading for help, please, the community, have mercy on us and help us recover the profits that Admiral has taken from us. I only trust that the community is important to us to help me recover the money. Thank you, the community, for reading and considering my plea. Sincerely, Thank you.

Exposure

EricBui

Vietnam

I deposited and traded on March 26, 2024, until April 24, 2024, when they asked me to prove my income to prove that my deposit was mine. When I emailed them and asked how to prove my income, they suspended my transaction and asked me to cancel it. Next, they refused to allow me to withdraw and publicly deducted $8529 from my account. They said I violated T&C and only allowed me to withdraw my deposit without any profit. I didn't do anything wrong, nor did I make any transactions. Therefore, Admiral SC Ltd. deceived and intentionally confiscated my property without clear reasons. Certification body address: 10.17 CasTeleaGh StreeTm Sydney, New South Wales 2000. The Admiral told me that the T&C error was just one way they intentionally stole my money. I trade completely normally without any skills. I am a long-term trader, and this is the first time I have encountered such a ridiculous situation. Other trading institutions also require me to provide financial proof when depositing and trading with them for a period of time, but when I do so, I can still trade normally. Before I traded on Imperial Markets, they deducted $8526 from my account. I trade and hold long-term orders for a month, and when I make a profit, they start robbing me for no reason? If I make a mistake in the transaction, why don't they notify me of the mistake and remind me? Because they have not yet proven my income, they have suspended my transactions and deducted them from my account.

Exposure

LOU2245

Vietnam

I have been trading on Admiral for 1 month through a recommendation from a friend. Everything has been very normal and I affirm that I have not used any incentives from this floor. After a while, I noticed that I was trading. high profits, they started to play tricks, they changed my account to only for closing orders, and then on April 26, they sent an email saying they would close my account and only let me withdraw numbers. I deposited money but didn't allow any profit to be withdrawn, I asked for proof of anything I did wrong to allow them to act so absurdly, but still haven't had any answers. I don't like it, all I get is just a general rule from them, I am being scammed by them and appropriated an amount of up to 9000 USD. Warn investors to stop trading and stay away from these scammers because once you make a profit, they will immediately steal that money. I affirm that I have not committed any trading errors as they are accusing. If they have any evidence that I have done anything wrong, I accept all forms of punishment.

Exposure

heyjude

Philippines

Withdrawal process was top-notch, super quick! Also got great help from their team. But I had a hard time logging in at one point, and my mails seemed to go unnoticed. A little bit of good, a little bit of not-so-good.

Neutral

sanjay 1951

India

I have done trading with Admiral Markets Global ltd.My wallet balance is $ 10696 as on date.When I was applied for withdrawal of $ 8000,the platform asked me to deposit 30% tax on total profit.I deposited tax . After that they asked to deposit conversion fees10% of withdrawal amount.Afer paying all dues the platform is not refund my withdrawal since 20 days. whenever I asked to refund they always blocking my communication and not responding properly.i have also mailed them many times but they didn't reply.

Exposure

FX7957448762

Jordan

They asked me to transfer money and I transferred them to withdraw the profits. Then they asked for more transfers to complete the task and each time they asked for a larger amount than the last.

Exposure

Leo8921

Mexico

Investing 50 pesos, they gave me 80 and then I won 200, and with that, I took it back with 300. I had to do 5 tasks and they asked me for 600, then 2000 and 5107. With that, I finished the tasks and in the end, they didn't let me withdraw.

Exposure

FX1490773481

Philippines

Navigating the trading seas with Admiral Markets was like sailing with a seasoned captain. Regulated by the big leagues - ASIC, FCA, CYSEC - felt like safety harnesses were on. Their stature in the industry? Solid as a rock. Dived right into global stock markets with zero commission - quite the steal! The availability of MT4 and MT5 was like smooth sailing on familiar waters. But their eclectic mix of 8000+ markets, from forex to ETFs, was like uncharted territory - thrilling! Leverage up to 1:500? A high-speed ride but the low spread from 0.6 pips kept things steady. Their demo account and educational resources were my trusty maps. And their analytics proved to be helpful navigating tools on this trading voyage!

Positive

Mathh

Poland

I was scammed by admirals broker on slippage on VIX futures, the prices quoted by the broker have never occured on futures market on CBOE. The broker ignored my complaints for more than 4 months.This broker is 100% scam you will loose ALL YOUR MONEY, petty thiefs will cheat in any possible way even the smallest amount.

Exposure

nelol

Vietnam

This exchange now withdraws capital, and it has been a week and it has not been processed yet.

Exposure

FX1870890069

Indonesia

This broker is very dangerous.

Exposure

Chun1776

Nigeria

Admiral Markets is a respectable broker offering superb trading conditions. I was introduced to this platform four years ago, and Admiral Markets is helpful friend on the trading road. I am 100% satisfied with this broker.

Positive