简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Jan 29, 2026

Sommario:Fed “Hawkish Hold”; Golds New Frontier at $5500 Dollar, Precious Metal Oil OutlookGlobal markets are reacting to a significant divergence in sentiment following the January FOMC decision. While the F

Fed “Hawkish Hold”; Gold's New Frontier at $5500 Dollar, Precious Metal & Oil Outlook

Global markets are reacting to a significant divergence in sentiment following the January FOMC decision. While the Fed opted for stability, the US Dollar failed to gain much on the hawkish hold, meanwhile the precious metals market has entered uncharted territory.

FOMC Update: The Fed Stays Put

The Federal Reserve maintained the federal funds rate at 3.50%–3.75%, a move supported by a 10:2 vote. The policy statement and the Press conference are what the market focused on most.

Key Takeaways from the Fed January Statement:

· Economic Assessment: The statement upgraded its description of the US economy from “expanding at a moderate pace” to “expanding at a solid pace.”

· Labor Market: The Fed removed the phrase warning of “rising downside risks to employment.” Instead, they noted that the unemployment data has shown “signs of stabilization.”

· Inflation Stance: The statement reiterated that inflation remains “somewhat elevated” and that the committee remains “highly attentive to inflation risks.”

In the post-meeting press conference, Chair Powells messaging was clear: there is no pre-set path, and the committee remains in a “wait-and-see” mode at least until June.

Powell also attributed recent inflation stickiness to tariff effects rather than consumer demand, suggesting that price pressures might naturally ease by mid-year.

Dollar Impact: Post-FOMC Reality

The US Dollar Index (DXY) successfully defended the 96.00 psychological level, supported by rising Treasury yields. With a short-term pivot now officially off the table, the Dollar has found a temporary base for a potential corrective rebound.

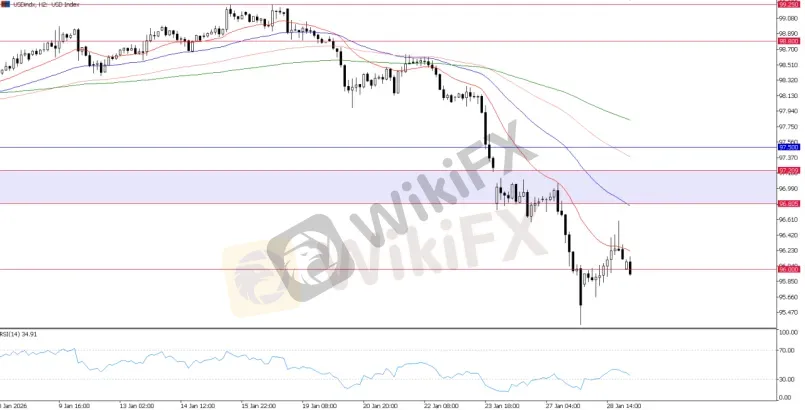

USD Index, H2 Chart

Technically, the US Dollar price action post-FOMC suggests the rebound has yet to find sustainable momentum, given that the market largely sees a broader dollar downtrend.

· Intraday: The Fed tailwind could provide support, but we need to see a clear gain on the 96.00 support to validate that a rebound may step in near-term.

· Outlook: The broad term remains under pressure, especially if it stays below 96.80. The “sell-the-rally” narrative remains, though a short-term rebound is expected if 96.00 holds.

Precious Metals: The “$5,500 Era” Has Arrived

In a historic move during the Thursday Asian session, Gold (XAU/USD) surged past the $5,500 mark, recording an all-time high of $5,597. This rally is fueled by a potent cocktail of neutral Fed policy, currency debasement, and strong sentiment.

Gold Outlook

Gold has officially entered a new price regime. While extreme momentum may invite technical pullbacks, the structural “buy the dip” sentiment remains strongly intact.

XAUUSD, H1 Chart

· Pivot Level: $5,500 is now the psychological pivot. A daily move below this could signal a “false breakout” and trigger a wash-out.

· Support/Target: The $5,300 – $5,240 zone remains validated bull trend support. $5,600 is the next measured move target if the rally resumes.

Outlook: The backdrop for Gold remains promising with momentum strengthening; However, headwind risk would be if the dollar rebounds on the near-term, the gold on overbought territory could face pullback risk.

Silver Outlook

Following Gold's lead, Silver (XAG/USD) shattered its previous highs to reach $119.3/oz. The industrial scarcity narrative combined with safe-haven demand continues to push Silver toward the $120 milestone.

XAGUSD, H1 Chart

From a technical perspective, the uptrend channel upper resistance was reached with the price action seeing pressure near the 117.40 previous record high. If failed to sustain above, this could also lead to a short-term pullback risk, keeping the silver on its channel play.

Energy Volatility on Trumps Comment

Beyond the Fed and Metals, the oil market also stages significant trading opportunities. Oil markets are on edge after Donald Trumps comments regarding a “large fleet heading toward Iran.” This has introduced a fresh geopolitical risk premium to Crude Oil, countering the usual bearish supply narratives.

USOIL, Daily Chart

Over the USOIL technical outlook, as we covered earlier, the potential of a bullish reversal was formed and has now reversed into a bullish momentum with USOIL breaking above the 200-day moving average. This could now lead to a potential bullish continuation.

USOIL, H4 Chart

Over the near-term trend, an uptrend formation has formed. Continue to watch for “buy the dip” for the oil market unless we see a clear break below 62.20 that would validate the USOIL uptrend.

Bottom Line

Overall Outlook: Metals remain strong, the Dollar is under pressure, and oil favors dip-buying. Near-term market conditions suggest selective risk-on opportunities, but investors should watch for Dollar rebounds or technical pullbacks in metals that could create short-term volatility.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

GO Markets

EC markets

IC Markets Global

D prime

FXTM

octa

GO Markets

EC markets

IC Markets Global

D prime

FXTM

octa

WikiFX Trader

GO Markets

EC markets

IC Markets Global

D prime

FXTM

octa

GO Markets

EC markets

IC Markets Global

D prime

FXTM

octa

Rate Calc