简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. Consumer Momentum Remains Resilient in November, but Sustainability of End-Demand Raises Concer

Sommario:Following the release of key U.S. economic data yesterday (22nd), the U.S. Dollar Index declined, while precious metals extended their rally. Both gold and silver pushed to new highs. We believe this

Following the release of key U.S. economic data yesterday (22nd), the U.S. Dollar Index declined, while precious metals extended their rally. Both gold and silver pushed to new highs. We believe this move is largely driven by growing concerns over the sustainability of end-consumer demand, prompting investors to rotate out of fiat currencies and into precious metals as a defensive hedge.

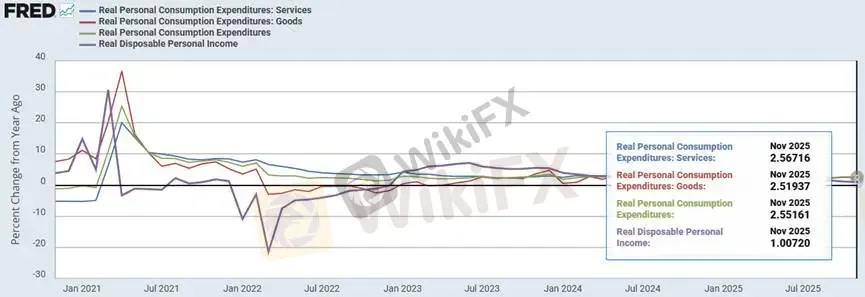

Compared with headline PCE figures, we place greater emphasis on real PCE adjusted for inflation, as it more accurately reflects the underlying condition of U.S. consumption. November real PCE rose by 2.55%, with goods consumption up 2.52% and services consumption increasing 2.56%. While these readings still indicate solid momentum, it is important to note that November data remains backward-looking.

Meanwhile, real disposable personal income in November grew by 1.00%. As disposable income serves as a leading indicator for future consumption, its gradual deceleration and lack of stabilization have heightened our concerns regarding the outlook for end-market sales.

(Chart 1: Real Consumption Expenditure Index – Goods, Services, and Real Disposable Personal Income | Source: FRED)

When cross-referenced with U.S. CPI data, inflation has indeed continued to cool. However, the moderation in inflation has not translated into a meaningful acceleration in disposable income growth. This raises an important question: can current income dynamics genuinely support the seemingly discretionary nature of U.S. consumer spending on a sustainable basis?

Moreover, high-frequency inflation indicators from Truflation suggest that underlying end-market inflation is still trending lower. Against this backdrop, current disposable income growth appears insufficient.

(Chart 2: U.S. CPI Data | Source: M平方 Macro Platform)

(Chart 3: High-Frequency CPI Indicators | Source: Truflation)

Looking ahead, a potential upside catalyst lies in the 2025 tax refund cycle expected in April, which could provide a temporary boost to disposable income. However, this assumes the economy avoids a potential consumption vacuum in Q1. In other words, much of the current resilience in consumption appears driven by seasonal demand and wealth effects. Should a black-swan event emerge, we believe consumers are highly likely to shift into a short-term period of spending restraint.

Following the data release, FedWatch Tool probabilities indicate a 95% likelihood that the Federal Reserve will keep interest rates unchanged at its January meeting. Attention now turns to the Bank of Japan policy meeting today. Although the announcement is scheduled for 11:00 AM Beijing time, political uncertainty has resurfaced after Prime Minister Sanae Takaichi announced plans to dissolve the House of Representatives and call an early general election on January 23, adding another layer of uncertainty to global markets.

Gold Technical Analysis

On the 1-hour timeframe, gold has broken above both the medium-term ascending channel (blue) and the short-term ascending channel (orange). After a pullback to retest the upper boundary, prices surged again to register a new swing high. We continue to view the market as being in an overextended phase, with the short-term structure characterized by higher highs while prior lows remain intact.

From a momentum perspective, the MACD oscillator shows that the H4 timeframe remains overheated, while the H1 timeframe, after a brief consolidation, has resumed expansion.

In such an aggressive short-squeeze environment, investors should avoid attempting to call the top or initiate counter-trend shorts. Historical technical studies suggest that premature short-selling in these conditions carries a high failure rate and significant cost. Discipline and patience are required, allowing price action to offer clearer forward guidance.

Trading Strategy: Stay on the sidelines and remain flat.

Support Levels

SUP1: 4642

SUP2: 4890

Resistance

No clearly defined resistance at record highs

Risk Disclaimer

The above views, analyses, research, prices, or other information are provided solely for general market commentary and do not represent the official position of this platform. All readers assume full responsibility for their own investment decisions and associated risks. Please trade with caution.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

fpmarkets

FXTM

Exness

XM

FOREX.com

D prime

fpmarkets

FXTM

Exness

XM

FOREX.com

D prime

WikiFX Trader

fpmarkets

FXTM

Exness

XM

FOREX.com

D prime

fpmarkets

FXTM

Exness

XM

FOREX.com

D prime

Rate Calc