简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Jan 20, 2026

Sommario:Geopolitical Risk Premium: U.S.–EU Trade Tensions Drive Safe-Haven RotationFinancial markets are adjusting to a sudden “Geopolitical Risk Premium” as trade tensions between the U.S. and the EU over Gr

Geopolitical Risk Premium: U.S.–EU Trade Tensions Drive Safe-Haven Rotation

Financial markets are adjusting to a sudden “Geopolitical Risk Premium” as trade tensions between the U.S. and the EU over Greenland escalate. The narrative is shifting from central bank policy to Trade War Volatility, prompting a broad rotation out of risk assets and into traditional safe havens.

The Catalyst: Trade Tensions & Risk Aversion

The primary driver for todays market is heightened uncertainty regarding transatlantic trade. With the potential for 10%–25% tariffs on European allies, market sentiment has turned sharply defensive.

· Impact on Sentiment: Global investors are pricing in potential supply chain disruptions and weaker corporate earnings. This could create a “Sell First, Ask Later” environment, characterized by a flight to liquidity and gold.

· Risk Aversion: Asset classes are diverging. Equities and cryptocurrencies face selling pressure, while the “Uncertainty Premium” provides a direct tailwind for gold.

US Equity Indices: Technical Support Under Siege

Global equity markets came under pressure yesterday, with European indices sliding on Monday. As U.S. markets return from the long weekend, equities face uncertainty on both macro and technical fronts.

US500 Technical Outlook

The S&P 500 is showing signs of technical exhaustion. After breaking below the 6,900 level, the bullish structure is under immediate threat.

US500, Daily Chart

The breakdown of the rising wedge formation suggests a deeper corrective phase may be underway. The previous 6,900 support now acts as resistance, capping upside potential.

Outlook: Continued pressure below 6,900 could confirm a bearish reversal. The next support levels are 6,750 and 6,540, with the latter serving as a major pivot.

UT100 Technical Outlook

Tech stocks may lead the decline as investors hedge against trade-related disruptions. Nasdaq is testing the lower boundary of its recent range—a converging triangle.

UT100, Daily Chart

A decisive break below 25,250 could accelerate selling toward the 25,000 psychological level. The converging triangle increases the likelihood of a near-term bearish breakout.

Outlook: Rising U.S.–EU trade tensions could provide the catalyst for this move. A break below current support may accelerate a decline toward 24,000.

Safe-Haven & Risk Asset Rotation

If the sentiment got worsen, especially if the US-EU trade tension escalated further if both side refuse to step down, we could potentially see a clear rotation on two major asset classes.

Gold (XAU/USD) Outlook

Gold stands out as the primary beneficiary of geopolitical instability, acting as the safe-haven of choice.

XAU/USD, H4 Chart

Price is currently testing the $4,700 psychological barrier following yesterdays record high of 4,690. As long as trade war headlines dominate, institutional “buy-the-dip” appetite remains strong.

Outlook: Watch the 4,630–4,690 range, with 4,550 serving as key support. Gold is likely to extend beyond 4,700 if market pressures intensify.

Bitcoin Outlook

Unlike gold, Bitcoin is currently tracking risk assets lower and failing to act as a hedge in this geopolitical context.

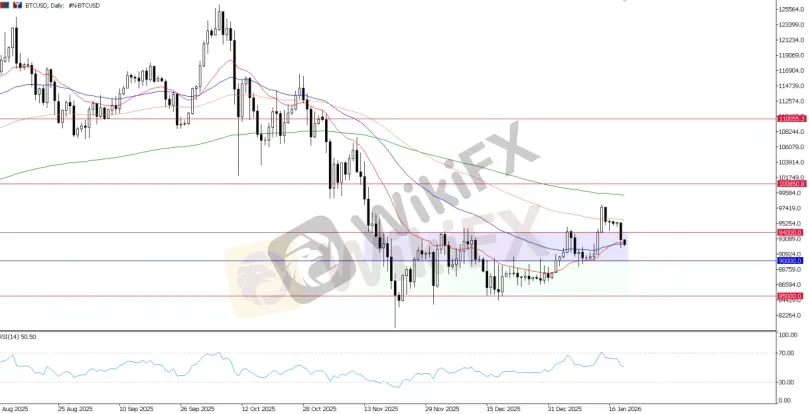

BTCUSD, Daily Chart

BTC has dropped below the $94,000 support as liquidity is pulled from speculative assets, temporarily invalidating the bullish reversal setup. The market is testing the strength of the $90,000 base.

Outlook: Falling below 94,000 keeps BTC under pressure within the 85,000–94,000 consolidation range. The $90,000 level remains a key psychological floor.

Bottom Line: Positioning for Volatility

Todays market is defined by a Defensive Pivot. Technical breakdowns in the S&P 500 and Nasdaq suggest near-term downside for equities, while gold remains the preferred vehicle for capital preservation.

· Equity Traders: Monitor 6,820 (US500) and 25,000 (UT100). Breaching these levels may confirm a broader trend reversal.

· Gold Traders: A daily close above $4,700 would signal the next leg of the safe-haven rally.

· Bitcoin Traders: Exercise caution as long as BTC remains correlated with the declining Nasdaq.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

WikiFX Trader

Rate Calc