简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Jan 15, 2026

Sommario:Bessent‘s Yen Ceiling and Crypto’s Clarity Countdown; Whats Next for USDJPY CryptocurrenciesThe global financial narrative today is defined by the aftermath of “sticky” inflation data and a significa

Bessent‘s Yen Ceiling and Crypto’s Clarity Countdown; Whats Next for USDJPY & Cryptocurrencies

The global financial narrative today is defined by the aftermath of “sticky” inflation data and a significant shift in the regulatory landscape for digital assets.

PPI Recap: The Inflation “Floor” and the Fed's Deadlock

Yesterdays release of the Producer Price Index (PPI) provided definitive confirmation that price pressures at the pipeline level are far from defeated.

· The Numbers: Headline PPI rose 3.0% YoY (surpassing the 2.7% forecast), while Core PPI also climbed to 3.0%. On a monthly basis, goods prices jumped 0.9%—the largest gain in over a year—primarily driven by a surge in energy costs.

· The Narrative: This “hot” print provides the fundamental “muscle” to support the sticky but stable CPI data seen earlier this week. It effectively extinguishes any remaining hope for a January rate cut.

For the Federal Reserve, this creates a policy deadlock: they cannot justify cutting rates if production costs are accelerating, as these risks are eventually passed down to the consumer. This has bolstered the US Dollar Index (DXY), allowing it to successfully regain its footing above the 98.80 – 99.00 pivot zone.

Bessents Verbal Intervention: A Ceiling for USD/JPY?

In a notable development for the Yen, U.S. Treasury Secretary Scott Bessent appears to have joined Japan in a rare display of “verbal intervention.” Following a bilateral meeting in Washington, Japans Finance Minister Katayama stated that Bessent “shares concerns” over the yen's recent “one-sided depreciation.”

USDJPY, Daily Chart

The pair, which was aggressively testing 159.40 (nearing the 160.00 psychological level), pulled back sharply toward 158.00 following the news. This creates a “soft-ceiling” for the pair.

Traders should be wary: the risk of actual BOJ intervention has surged now that the “green light” from Washington has likely been given.

USDJPY, H4 Chart

Despite the pullback, the pair remains in a broad uptrend. We have yet to see a verified shift in selling pressure. Currently, the 159.00–160.00 ceiling acts as technical pressure, while potential intervention serves as the macro catalyst.

Outlook: Technically, we need to see a clear break below the 158.00 – 156.70 zone before expecting real intervention-driven selling pressure to kick in. Until then, the primary upside remains intact.

The Clarity Act: Cryptos Institutional Launchpad

Today, January 15, marks a historic milestone as the Senate Banking Committee begins the markup of the Digital Asset Market Clarity Act of 2025.

· Why it Matters: This bill is the long-awaited “holy grail” for institutional adoption. It clarifies the jurisdictional split between the SEC and CFTC, placing most non-security digital assets under CFTC oversight and defining a clear compliance path for exchanges and custodians.

· Market Sentiment: Recent price action in Bitcoin and Ethereum suggests market optimism is already being priced in.

Outlook for Bitcoin

BTCUSD, Daily Chart

Our outlook remains consistent. BTC successfully smashed through the 94,000 resistance, hitting 97,700 yesterday as investors front-ran the legislative progress.

Reclaiming 94,000 has shifted the market structure from a corrective phase to a confirmed bullish reversal. As long as the 94,000 support holds, the reversal narrative remains intact.

Outlook for Ethereum

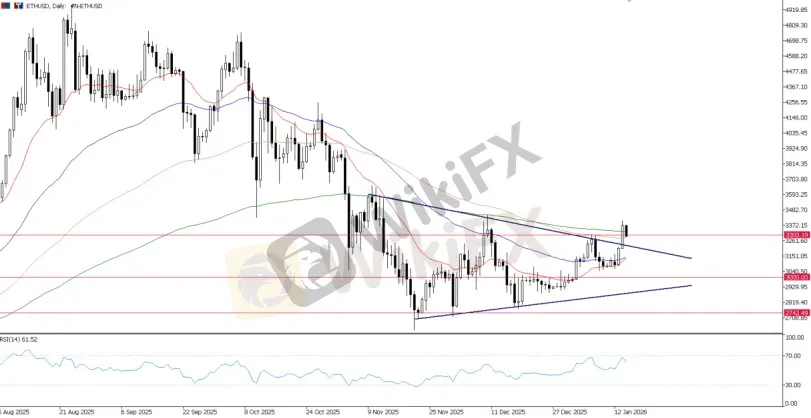

ETHUSD, Daily Chart

ETH is finally seeing a “catch-up” trade after holding firmly above the 3,000 psychological mark. The Clarity Act is particularly bullish for ETH, as it likely cements its status as a digital commodity, removing the “security” overhang that has hindered institutional flows.

ETH is potentially breaking out of its recent converging triangle. A decisive move above 3,300 is needed to confirm this breakout momentum.

Outlook: If the markup eventually goes smoothly, we could see a “buy the news” acceleration. For BTC, the path to 100,000 is now technically wide open as long as the 94,000 base holds; meanwhile, ETH needs to see a clear move above 3,300.

Bottom Line

Todays market is about more than just Fed policy; it is about political impact and regulatory shifts.

· USD & JPY: The Dollar at 99.00 remains the critical level for momentum verification. However, if a Yen intervention truly materializes, the Dollar could face sudden pressure, leading to a sharp USD/JPY correction.

· Cryptocurrency: While the Clarity Act is a massive positive catalyst, it is still subject to short-term “event risk.” If the markup stalls or introduces unexpected restrictions, we could see a “Sell the News” event flushing BTC back toward 92,000. However, as long as technical supports hold, the long-term outlook remains exceptionally strong.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FXCM

IC Markets Global

AVATRADE

EBC

Exness

OANDA

FXCM

IC Markets Global

AVATRADE

EBC

Exness

OANDA

WikiFX Trader

FXCM

IC Markets Global

AVATRADE

EBC

Exness

OANDA

FXCM

IC Markets Global

AVATRADE

EBC

Exness

OANDA

Rate Calc