简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ETO Markets Global Pulse: Gold Jumps 2%, Hits New High

Sommario:Market ReviewAccording to ETO Markets monitoring, on January 12 (Monday), spot gold surged sharply, rising nearly 2% on the day to close at USD 4,597.21 per ounce. Prices briefly touched an intraday h

Market Review

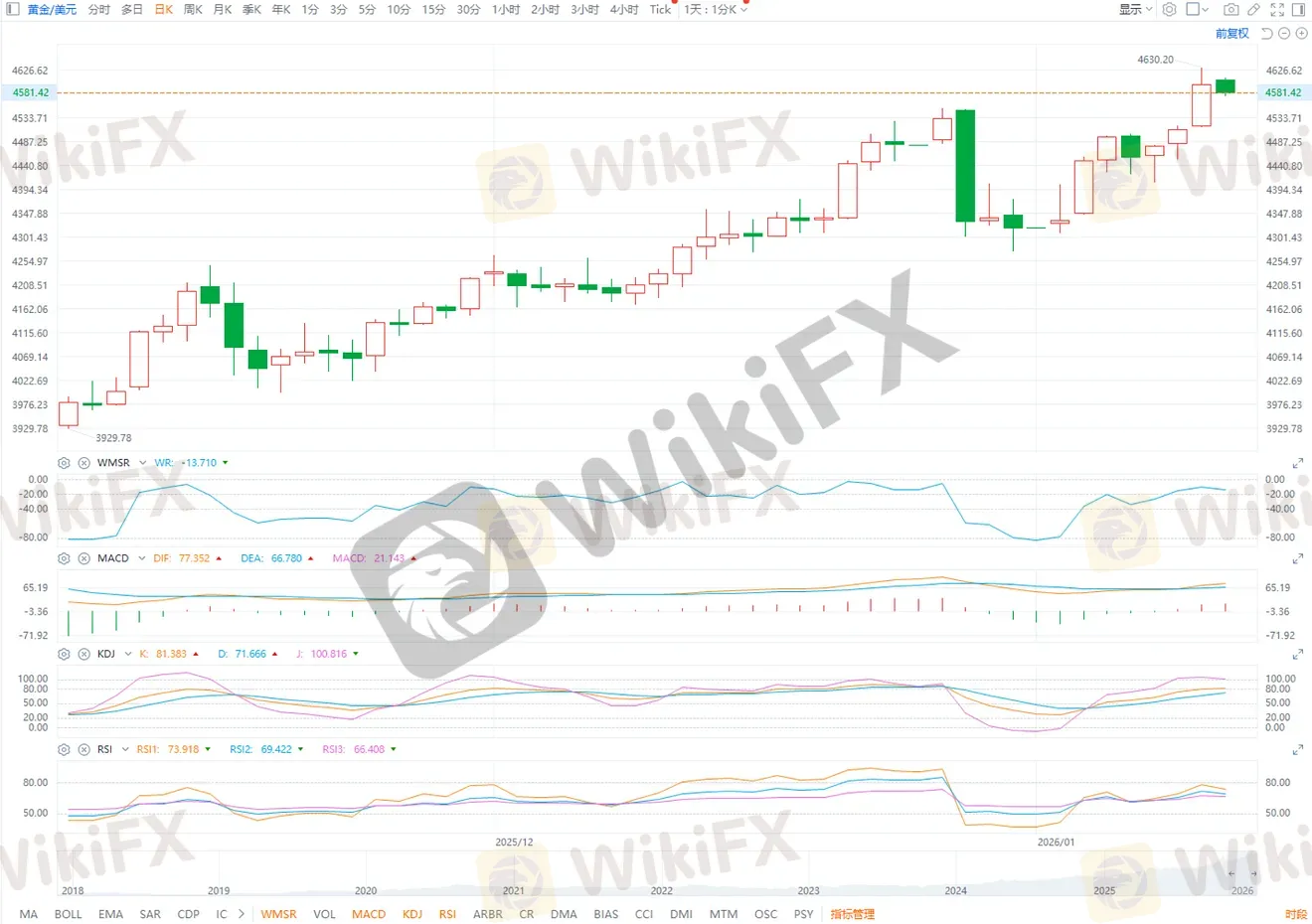

According to ETO Markets monitoring, on January 12 (Monday), spot gold surged sharply, rising nearly 2% on the day to close at USD 4,597.21 per ounce. Prices briefly touched an intraday high of USD 4,630.08, setting a fresh record. At the same time, U.S. February gold futures gained around 2.5%, settling at USD 4,614.70.

During the Asian session on January 13 (Tuesday), spot gold consolidated at elevated levels and is currently trading near USD 4,590 per ounce, remaining firmly within a strong bullish range.

Global Headlines

1) Trump Interviews FED Chair Candidates

On Monday, U.S. media reported that President Trump will interview Rick Rieder, Global CIO of Fixed Income at BlackRock, at the White House on Thursday as a potential candidate for FED Chair. This round is seen as the final stage in selecting Powells successor. Other candidates reportedly include Kevin Warsh, Kevin Hassett, and Christopher Waller. Trump said a final decision will be made later in January.

2) Powell Investigation Shakes Confidence

On Monday, reports emerged that U.S. federal prosecutors have launched a criminal investigation into FED Chair Jerome Powell, related to the renovation of FED headquarters. Powell dismissed the allegations as “a pretext.” Analysts noted rising concerns over political pressure on monetary policy, weakening confidence in FED independence.

3) Trump Announces Iran-Related Tariffs

On Monday, President Trump said the U.S. will impose a 25% tariff on goods from countries engaged in trade with Iran, effective immediately. While details remain unclear, markets see the move as increasing economic pressure while potentially reducing the risk of direct U.S.-Iran military confrontation in the near term.

4) Iran Signals Full Preparedness

On Monday, Iran‘s Foreign Minister Araghchi said Iran is prepared for all scenarios and urged the U.S. to make a “rational choice.” He warned that if military action is chosen, Iran’s readiness and response capacity would be stronger than in the past, keeping Middle East risk premiums elevated.

5) EU Warns Over Greenland Risks

On Monday, EU defense commissioner Andrius Kubilius warned that any U.S. military action to seize Greenland would signal the “end of NATO.” The remarks highlighted growing transatlantic security tensions and potential risks to global geopolitical stability.

6) CME Adjusts Precious Metals Margins

On Monday, the Chicago Mercantile Exchange (CME) announced changes to margin calculations for gold, silver, platinum, and palladium contracts. Margins will shift from fixed amounts to percentages of notional value. Documents show gold margins around 5% and silver around 9%. The new rules take effect after the January 13 close and may curb short-term volatility.

ETO Markets Analyst View (Spot Gold)

From a technical perspective, spot gold remains in a strong uptrend after breaking above prior highs. Prices are holding firmly above the USD 4,578 support zone, reinforcing the bullish structure. If strength persists, the market may extend gains toward the USD 4,615 and USD 4,630 areas.

However, if prices fall below USD 4,578, gold may enter a high-level consolidation phase, with support seen near USD 4,550 and USD 4,515. RSI remains in bullish territory but at elevated levels, suggesting upside momentum is slowing and profit-taking risks are rising.

With macro and geopolitical uncertainties still unresolved, gold is more likely to consolidate at high levels to absorb recent gains. Investors should continue to monitor market developments closely.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

STARTRADER

GTCFX

AVATRADE

fpmarkets

OANDA

XM

STARTRADER

GTCFX

AVATRADE

fpmarkets

OANDA

XM

WikiFX Trader

STARTRADER

GTCFX

AVATRADE

fpmarkets

OANDA

XM

STARTRADER

GTCFX

AVATRADE

fpmarkets

OANDA

XM

Rate Calc