简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Jan 12, 2026

Sommario:Week Ahead: Inflation Data, Fed, and Geopolitics to Shape Market DirectionThe second full trading week of 2026 begins with a heavy dose of macro reality. After the rare Everything Rally of the new yea

Week Ahead: Inflation Data, Fed, and Geopolitics to Shape Market Direction

The second full trading week of 2026 begins with a heavy dose of macro reality. After the rare "Everything Rally" of the new year, markets are now forced to digest a mixed employment picture and a sudden political shock involving the Federal Reserve.

NFP Recap: The "No Hire, No Fire" Mode

Last Fridays Non-Farm Payroll (NFP) report for December 2025 painted a complex picture of the U.S. labor market, reinforcing a "soft landing" but slow-growth narrative.

· The Numbers: The U.S. economy added 50,000 jobs, missing the consensus forecast of 60,000. Furthermore, October and November figures were revised downward by a combined 76,000.

· The Silver Lining: Despite the soft headline, the Unemployment Rate dropped to 4.4% (from 4.6% in November), beating expectations. Additionally, Average Hourly Earnings rose to 3.8% (vs. 3.5% prior), suggesting that while hiring is stagnant, wage pressure remains resilient.

Markets are viewing this as a "No Hire, No Fire" environment. This "Good/Bad" mix prevented a clear directional bet. The Fed isn't forced to panic-cut because unemployment remains low, but they cannot be aggressively hawkish because hiring is stalling. This creates a policy deadlock heading into late Q1.

US Dollar: The Powell Shock & Weekly Outlook

The Dollar Index remains the pivot point for global liquidity, currently hovering near the 98.90–99.00 mark.

The US Dollar initially rose after the NFP due to the lower unemployment rate, which priced out aggressive rate cuts. However, as of this morning (Monday, Jan 12), the Greenback is facing fresh pressure following reports of a criminal investigation into Fed Chair Jerome Powell.

While the political noise regarding Fed independence is a temporary drag, the Dollar is fundamentally supported by the “soft-landing” narrative at this point.

USD Index, H4 Chart

This week, watch 98.40 as primary support while 99.00 as major resistance. A pullback but supported above 98.40 would still validate the recent bullish momentum, keeping the bullish structure intact.

A break above 99.00 would be challenging and require strong catalysts, but we expect consolidation in the Dollar until the CPI release tomorrow.

Outlook: Expect near-term pullback risk, while 98.40 remains a key support; breaking 99.00 would need a stronger catalyst.

Commodities Outlook: Geopolitical Premiums in Gold & Oil

The "unrest premium" remains the dominant driver for the commodity complex as we enter 2026. Especially, under the geopolitical risk remain heighten in the Venezuela and the Middle east.

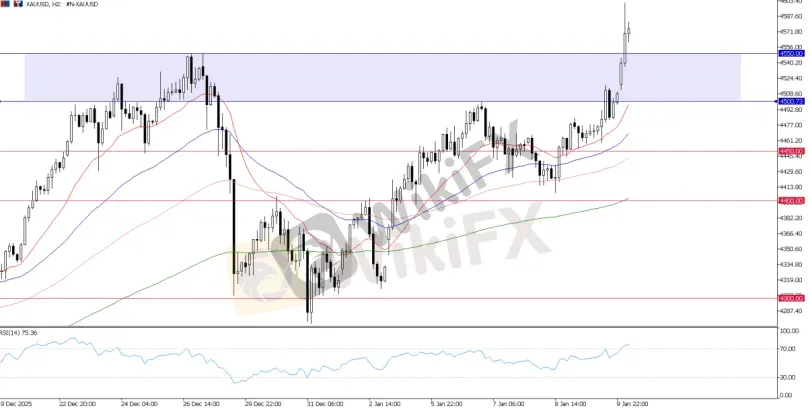

Gold (XAU/USD): The $4,500 Frontier

Gold is taking another shot at the $4,500 psychological barrier and broke above $4,600 record breaking in Mondays opening. As covered earlier, gold remains bullish overall, this outlook remains unchanged.

XAU/USD, H4 Chart

After the breakout, 4550 (previous record high) and 4500 (major psychological level) now serve as major support zones. Any pullback holding above this support would still validate the gold bullish trend.

Crude Oil (WTI/Brent)

Markets are still digesting the "Venezuela shock." While the U.S. move to control Venezuelan assets suggests more supply in the long term, short-term friction in rerouting global heavy crude (away from China/Russia) is supporting prices.

UKOIL (Brent), H4 Chart

USOIL (WTI), H4 Chart

Recent UKOIL breakout above $62 and the downtrend structure suggest a potential bullish reversal for both UKOIL and USOIL.

CPI Impact & Q4 Earnings Season Kick-off

This week marks the true "fundamental" start of the year with two major catalysts:

· CPI (Tuesday, Jan 13): Tomorrow‘s inflation data is the ultimate gauge. November CPI was 2.7%. If December’s data shows further cooling toward 2.5%, it will solidify the case for a Fed rate cut in Q1, potentially weakening the Dollar and boosting Gold.

· Q4 Earnings Season: Major banks (JPMorgan, Wells Fargo, Citigroup) begin reporting this week.

Bottom Line: Three Key Focus This Week

This week is likely to be volatility-driven, with multiple uncertainties influencing markets. Key focus areas:

1. Fed outlook: policy path & Powell investigation Markets are monitoring the Fed closely, balancing mixed labor data with political developments surrounding Chair Powell. This creates uncertainty over the timing and magnitude of any rate changes.

2. Geopolitical uncertainty: Venezuela and Middle East Heightened tensions in Venezuela and the Middle East continue to underpin safe-haven demand, particularly in gold and oil, while adding risk of sudden market swings.

3. CPI data & Q4 growth: testing the soft-landing narrative Tuesdays CPI release and the start of Q4 earnings season will test the soft-landing story. Cooling inflation would support a potential rate cut and risk assets, whereas sticky inflation could trigger volatility across equities, FX, and commodities.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IC Markets Global

HFM

XM

AVATRADE

D prime

EC markets

IC Markets Global

HFM

XM

AVATRADE

D prime

EC markets

WikiFX Trader

IC Markets Global

HFM

XM

AVATRADE

D prime

EC markets

IC Markets Global

HFM

XM

AVATRADE

D prime

EC markets

Rate Calc