简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Dec 03, 2025

Sommario:Risk-On Returns as Fed Hopes Outweigh BoJ Shock; Outlook for Dollar, Cryptocurrency GoldRate-Cut Optimism RestoredGlobal markets staged a decisive return to risk-on sentiment, shrugging off earlier-w

Risk-On Returns as Fed Hopes Outweigh BoJ Shock; Outlook for Dollar, Cryptocurrency & Gold

Rate-Cut Optimism Restored

Global markets staged a decisive return to "risk-on" sentiment, shrugging off earlier-week volatility. Investors recalibrated expectations following the Bank of Japans (BoJ) hawkish pivot, choosing to focus instead on renewed dovish signals from the Federal Reserve.

Recent dovish comments from Fed officials have pushed the implied probability of a December rate cut to near 90%. This surge in easing expectations has overshadowed Governor Uedas rate-hike signal, allowing liquidity to flow back into equities and speculative assets.

Fed “Hopes” Are Back

The resurgence of Fed rate-cut hopes has acted as a green light for risk assets. The prospect of lower borrowing costs heading into 2026 supports high-growth sectors and offsets concerns about a manufacturing slowdown.

Markets are benefiting from the “eased policy” narrative, with investors betting the Fed will intervene to prevent labor-market deterioration or achieve a “soft landing.”

Dollar Outlook: Euro, Pound Testing Gains on Weak Dollar

The U.S. dollar is facing renewed selling pressure as rate-cut bets erode its yield advantage. The USD Index struggles to hold recent gains, encountering resistance near 99.00.

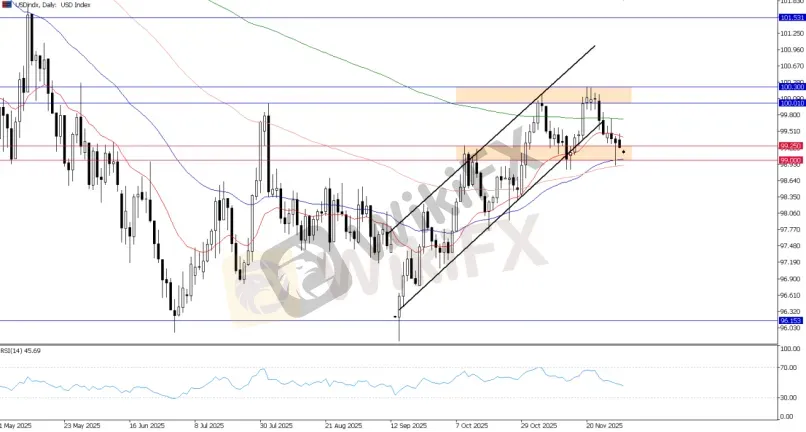

USD Index, Daily Chart

While the index remains near the 99.00 support, price action suggests mounting pressure, with several rebound attempts failing. A double-top pattern is forming, signaling a potential bearish setup. A break below 99 could accelerate the sell-off.

Outlook: Near-term pressure may continue to push the dollar lower, especially if upcoming data reinforces a more dovish Fed outlook next week.

EUR/USD, H4 Chart

Against the dollar, EUR/USD shows resilience, reclaiming the 1.1600 key resistance and forming a converging triangle. A sustained move above this level could pave the way toward previous highs, particularly if the dollar continues to weaken.

GBPUSD, H4 Chart

The GBP/USD, which recently showed a bearish reversal pattern, could now see that pattern invalidated amid a weaker dollar. The pair has reclaimed the key 1.3200 level, signaling potential near-term bullish momentum.

Immediate focus is on the 1.3200–1.3270 range. A sustained move above 1.3200, or a decisive break above 1.3270, would likely trigger a near-term bullish reversal, sending the pair higher.

Outlook: Watch for confirmation above 1.3270 to validate the bullish reversal. Failure to hold above 1.3200 could keep the pair under pressure.

Crypto Stabilization Attempt

In the risk asset space, the crypto market staged a recovery after Mondays sharp sell-off that pushed Bitcoin below $84,000. BTC formed a strong V-shaped rebound, reclaiming the $90,000 level, signaling potential demand and a possible bottom in place.

BTCUSD, Daily Chart

Despite the rebound, upside remains tentative. The $86,000–$90,000 zone now serves as key near-term support, and further stabilization is needed to confirm sustained buying momentum.

Outlook: If Bitcoin consolidates around these levels, it could pave the way for additional upside, particularly if the Fed delivers a dovish rate cut next week.

ETHUSD, Daily Chart

Ethereum has found support near the $2,800 level. Similar to Bitcoin, holding this support zone could set the stage for a potential rebound, with consolidation here key to confirming renewed buying momentum.

Todays Key Focus: US ISM Services PMI

Markets remain broadly positive, but attention turns to the ISM Services PMI ahead of Fridays PCE release. Following the contractionary Manufacturing PMI earlier this week (48.2), the Services PMI acts as a critical "firewall" for the U.S. economy:

· Expansionary reading: Confirms the soft landing narrative and supports risk assets.

· Weak reading: Could reignite recession concerns, pressuring equities while benefiting bonds and gold.

· Too strong: Risks undermining Fed rate-cut expectations by fueling inflation fears.

Traders know that even after today‘s data, Friday’s PCE report remains the decisive factor for December policy decisions.

Conclusion: Market optimism is underpinned by expectations of a Fed cut, but the rallys durability depends on the Services sector holding firm without reigniting inflation concerns.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

TMGM

Ultima

FOREX.com

IC Markets Global

GTCFX

octa

TMGM

Ultima

FOREX.com

IC Markets Global

GTCFX

octa

WikiFX Trader

TMGM

Ultima

FOREX.com

IC Markets Global

GTCFX

octa

TMGM

Ultima

FOREX.com

IC Markets Global

GTCFX

octa

Rate Calc