简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. September PCE Released Tonight: Will Consumer Behavior Start to Shift?

Sommario:The U.S. will release its September Personal Consumption Expenditures (PCE) report tonight, and markets are watching closely to see whether consumer behavior is beginning to change.The data will help

The U.S. will release its September Personal Consumption Expenditures (PCE) report tonight, and markets are watching closely to see whether consumer behavior is beginning to change.

The data will help investors gauge whether personal consumption—currently the primary engine of U.S. economic momentum—can remain resilient. A key concern is whether persistent price pressures are eroding disposable income enough to trigger a pullback in household spending.

Thus far, equity market strength has been supported largely by robust goods-related consumption. If consumers remain willing to spend on non-essentials, we believe the economic downside remains limited. With the Thanksgiving shopping season now underway, holiday demand may continue to support fourth-quarter economic performance.

According to The Economist, prices for daily essentials have risen sharply, raising questions about whether higher costs for necessities will crowd out spending on discretionary goods—an issue investors should watch closely.

A weaker-than-expected PCE reading would likely raise market expectations for a Federal Reserve rate cut at the December meeting.

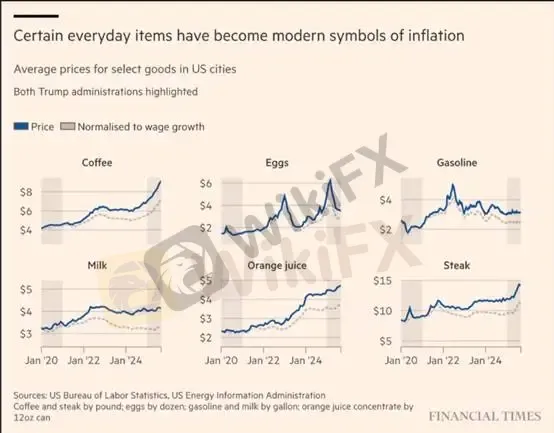

Chart Interpretation: Daily Essentials Outrunning Wage Growth

Prices for coffee, eggs, milk, orange juice, and steak have risen dramatically faster than average wages, sharply reducing consumers purchasing power.

(Chart 1: “Daily essentials as a driver of modern inflation”; Source: Financial Times)

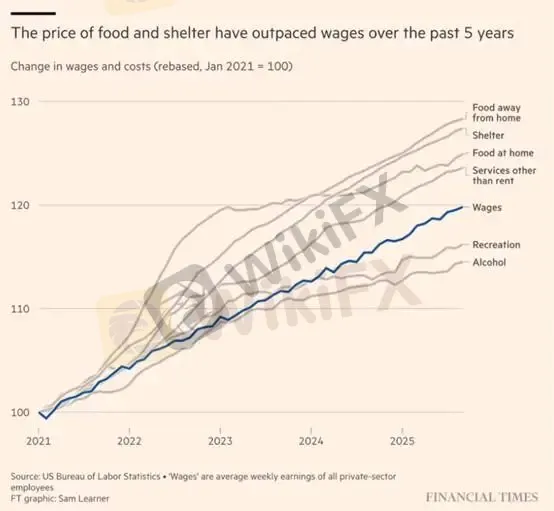

Meanwhile, dining out now costs roughly 30% more than before, and even home-cooked food has seen cost inflation well above average wage gains. In response to growing consumer dissatisfaction, media reports indicate that President Trump is considering cutting import tariffs on coffee, bananas, beef, and other food items to ease household burdens.

Chart 2 shows that living costs in the U.S. have surged—dining out has reached an index level of 129, while housing inflation ranks as the second-highest cost increase, making rent and shelter one of the largest financial challenges for households.

(Chart 2: “Past five-year wage growth – blue line vs. food and rent burden – gray line”; Source: Financial Times)

Although September‘s PCE is already in the rear-view mirror, the trend remains a critical input for the Fed’s December policy decision, which in turn will significantly influence gold prices.

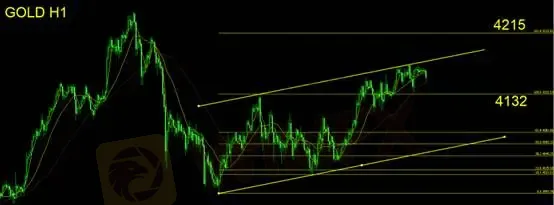

Gold Technical Analysis

Building on yesterdays analysis, gold has broken above the $4,150/oz Fibonacci 61.8% retracement, shifting the technical outlook decisively toward the bullish side.

We have redrawn the Fibonacci extension projection:

Upside target (Fibonacci extension): $4,215/oz

Key support: $4,132/oz

If gold holds firmly above $4,132, prices may continue to gravitate toward the $4,215 upside target.

We also outlined an ascending channel to monitor gold‘s upward momentum. A breakdown below $4,132 would signal weakening bullish commitment, shifting the trend into a fragile upward grind and opening a retest of the channel’s lower boundary.

📌 Trading Strategy

Bullish above: $4,132

Bearish below: break below $4,132 triggers short positions

Recommended stop-loss: $15

Support: 4,132

Resistance: 4,215

Risk Disclaimer

The views, analysis, research, price levels, and other information provided above are for general market commentary only and do not represent the official position of this platform. All readers should evaluate risks independently and exercise caution when trading.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Vantage

JustMarkets

octa

IC Markets Global

HFM

FXCM

Vantage

JustMarkets

octa

IC Markets Global

HFM

FXCM

WikiFX Trader

Vantage

JustMarkets

octa

IC Markets Global

HFM

FXCM

Vantage

JustMarkets

octa

IC Markets Global

HFM

FXCM

Rate Calc