简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Nov 06, 2025

Sommario:BoE Decision Looms: Pound Volatility, Dollar at Resistance, Gold in RangeGlobal equities rebounded on Wednesday after the previous sessions sharp sell-off, with all three major U.S. indices closing hi

BoE Decision Looms: Pound Volatility, Dollar at Resistance, Gold in Range

Global equities rebounded on Wednesday after the previous sessions sharp sell-off, with all three major U.S. indices closing higher — suggesting a temporary easing in market tension.

According to Wednesday‘s data, the U.S. private sector added 42,000 jobs in October, exceeding economists’ expectations of 22,000 and marking the largest increase since July 2025. This also further reinforced Fed Chair Jerome Powell‘s hawkish tone, dampening investors’ expectations for another rate cut in December.

Today, market attention will shift to the Bank of England (BoE), the only major policy event scheduled — expected to spark significant volatility in GBP and USD pairs.

Bank of England Preview

The BoEs policy decision today stands as the key event for global markets, with volatility expected to rise notably for the British Pound and the U.S. Dollar.

Expectations for the November meeting are divided. Some anticipate the BoE will hold rates at 4.00%, given inflations persistence. While, others expect a 25-basis-point cut to 3.75%, citing weak growth momentum and rising unemployment, even though inflation remains around 2.8%, nearly double the 2% target.

The decision could produce two distinct market reactions:

· Hold at 4.00%: Signals the BoE remains focused on combating sticky inflation — the pound may see short-term support.

· Cut to 3.75%: Would likely trigger a sharp sell-off in GBP/USD as markets reprice rate expectations.

Beyond the rate decision itself, markets will closely watch the vote split, the updated economic projections, and the tone of the BoE policy statement, all of which will provide valuable clues about the direction of policy heading into December and the first quarter of 2025.

What to Expect After the BoE Decision

Regardless of the outcome, sentiment toward the British pound is likely to stay cautious. Even if the Bank of England opts for a “dovish hold,” the currency could remain under pressure, as the UK continues to struggle with sluggish growth and persistent inflation — a mix that raises concerns over stagflation and limits the BoEs policy flexibility.

Meanwhile, a rate cut would likely intensify downside momentum in the pound, particularly against the U.S. dollar, which remains supported by resilient U.S. data and widening policy divergence.

GBPUSD, Daily Chart

GBPUSD, H2 Chart

From a technical perspective, GBP/USDs break below the 1.3200 level marks a fresh seven-month low, signaling the start of a broader bearish phase. Unless the pair can quickly reclaim this threshold, further weakness appears likely.

In such a scenario, even if the BoE holds rates steady but strikes a dovish tone, any short-term rebound could still present an opportunity to sell into strength — unless the central bank surprises with a distinctly hawkish message.

US Dollar Strengthen: Technical Level Test

The U.S. Dollar Index is approaching a crucial juncture, as policy-driven strength now faces a major technical test.

USD Index, Daily Chart

The index is currently hovering near the 100 level — a significant psychological and technical resistance zone. Although it briefly broke above this level yesterday, the move was quickly retraced.

From a price action perspective, the pullback appears more technical in nature rather than driven by a shift in fundamentals.

USD Index, H2 Chart

In the near term, the 100 level is likely to act as a resistance area, suggesting a potential consolidation or mild pullback. However, the broader bias remains constructive, supported by the dollars resilient macro backdrop. Immediate support is seen around 99.40, which could serve as a base for renewed bullish momentum if sustained.

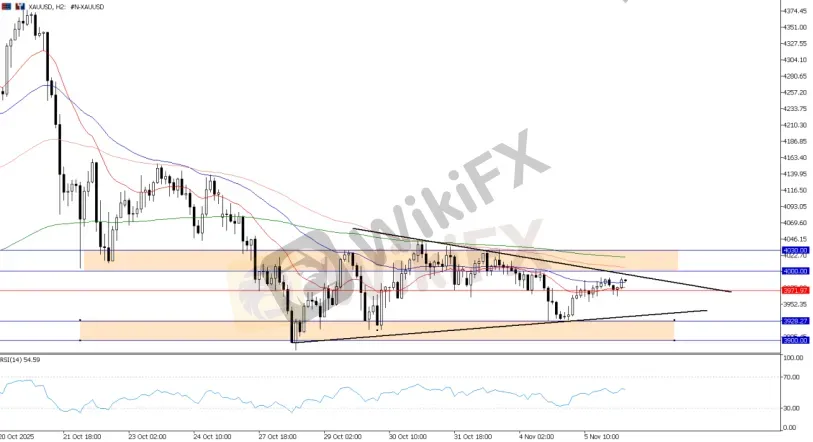

Gold (XAU/USD) Outlook: Floor Founds.

Gold prices have remained relatively subdued in recent sessions, showing limited directional momentum.

However, recent price action suggests that the metal has established a resilient support base around the $3,900–$4,000 zone — an area that continues to attract underlying demand even as price volatility narrows.

XAU/USD, H2 Chart

From a technical perspective, gold remains confined within a defined range, indicating a lack of strong trend-driven momentum for now. Nonetheless, this consolidation phase offers short-term trading opportunities within the established range.

Bottom Line

With limited macro catalysts on the calendar, today‘s market spotlight remains firmly on the Bank of England’s policy decision — the last major central bank event of the cycle and a key driver for GBP and USD volatility.

Beyond that, market participants are expected to shift their attention toward technical developments across key assets, including GBP/USD‘s bearish setup, the U.S. Dollar Index’s test of major resistance, and golds range-bound structure. Price action in these areas will likely dictate short-term sentiment and trading opportunities heading into the weekend.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

XM

GTCFX

HFM

Exness

AVATRADE

Plus500

XM

GTCFX

HFM

Exness

AVATRADE

Plus500

WikiFX Trader

XM

GTCFX

HFM

Exness

AVATRADE

Plus500

XM

GTCFX

HFM

Exness

AVATRADE

Plus500

Rate Calc