简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Nov 04, 2025

Sommario:US Market Momentum Clouded; Whats next for US Dollar Equities MarketU.S. equities were mixed on Monday, with the SP 500 and Nasdaq eking out gains — largely supported by mega-cap AI stocks — masking

US Market Momentum Clouded; Whats next for US Dollar & Equities Market

U.S. equities were mixed on Monday, with the S&P 500 and Nasdaq eking out gains — largely supported by mega-cap AI stocks — masking underlying weakness across broader sectors.

Meanwhile, the ISM Manufacturing PMI contracted sharply to 48.7, reinforcing fears of a deeper manufacturing slowdown and pressuring the Federal Reserves policy outlook. At the same time, the prolonged U.S. government shutdown added another layer of uncertainty to the market.

U.S. Uncertainty – Shutdown and Manufacturing Contraction

The U.S. government shutdown, now in its 35th day, has tied the longest in history, delaying key federal data releases and complicating policy assessments. Combined with the weak ISM Manufacturing PMI released yesterday, this has added further uncertainty to the U.S. market.

· U.S. Shutdown: The federal government shutdown has entered its 35th day (including today), tying the all-time record and standing just one day away from setting a new historical high.

· Manufacturing Slump: The ISM Manufacturing PMI‘s drop to 48.7 highlights deteriorating factory activity and tariff-related stress, challenging the Fed’s “hawkish cut” stance.

The current landscape has eroded much of the recent optimism in U.S. equities, where gains were largely driven by mega-cap AI stocks. The underlying weakness across broader sectors is now beginning to resurface.

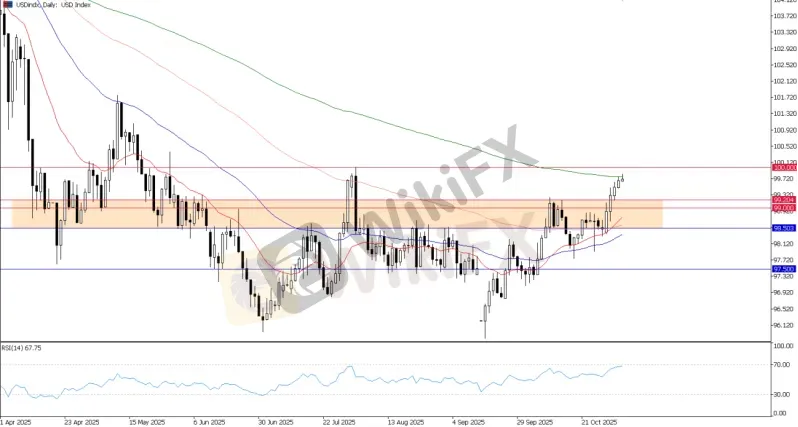

USD Index – Supported but Facing Headwinds

Despite that, the U.S. Dollar Index remains supported by the Feds “hawkish cut” momentum, keeping the index on track toward the key 100.00 level. However, the Dollar could still face both technical and fundamental headwinds as it approaches this critical threshold.

USD Index, Daily Chart

U.S. Equities – Tech Resilience Masks Broader Market Fragility

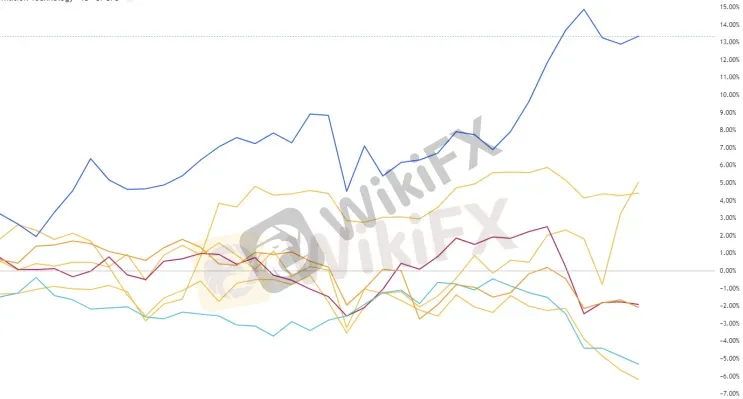

While broader U.S. equities remain firm, gains are largely supported by the sustained strength in mega-cap AI and tech stocks. In contrast, the S&P 500 — when viewed by sector — shows clear signs of fatigue, as cyclical and industrial sectors struggle under weakening sentiment.

S&P500 By Sector, Source: Trading View

According to the S&P 500 sector performance, the main contributors to recent gains are technology and consumer discretionary names such as Amazon, while other key sectors — including consumer staples, financials, and industrials — have turned lower.

This growing divergence between tech-led gains and broader market softness highlights a fragile risk environment that remains highly sensitive to upcoming U.S. data. Should this weeks JOLTS or ISM Services reports reveal deeper cracks in growth momentum, even high-flying tech names could face profit-taking pressure.

US Indices Outlook: S&P500 & Nasdaq100

US500, Daily Chart

The S&P 500 continues to display resilience, with its broader uptrend still intact. However, the recent advance is showing signs of exhaustion near the 6,900 level, where price action has encountered clear resistance over the past few sessions.

US500, H2 Chart

In the near term, the US500 appears vulnerable to a potential pullback, as recent price action suggests fading momentum. The 6,760 level remains a key short-term support — holding above it would maintain the overall uptrend structure.

Conversely, a decisive break below 6,760 could trigger a deeper corrective phase.

Fundamentally, the S&P 500s next direction will likely depend on developments surrounding the U.S. government shutdown. Should the impasse extend further, prolonging the data blackout and heightening market uncertainty, downside pressure on the index could intensify.

UT100, H4 Chart

Meanwhile, the Nasdaq 100 (UT100) is showing a similar technical setup to the S&P 500, with recent momentum beginning to stall. The next key support is located near 25,200, while the immediate upside resistance sits around 26,200.

Should market uncertainty deepen — particularly amid the prolonged U.S. shutdown and weaker economic data — a pullback toward 25,180 appears likely in the near term.

Bottom Line: Not a Bear Market Yet

Despite emerging signs of weakness, the overall technical outlook remains intact, with the broader trend still leaning to the upside — supported largely by tech resilience. However, risks tied to the U.S. government shutdown, data blackout, and slowing economic momentum could trigger a wave of profit-taking.

Simply put, the U.S. market is not yet in bear territory, but underlying risks and weakening macro signals — especially from this weeks key data — could prompt a deeper corrective move in the short term.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IC Markets Global

octa

STARTRADER

Vantage

AVATRADE

FXCM

IC Markets Global

octa

STARTRADER

Vantage

AVATRADE

FXCM

WikiFX Trader

IC Markets Global

octa

STARTRADER

Vantage

AVATRADE

FXCM

IC Markets Global

octa

STARTRADER

Vantage

AVATRADE

FXCM

Rate Calc