简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MultiBank Group Analysis Report

Abstract:In the increasingly complex landscape of online forex trading, selecting a reliable broker requires thorough due diligence and objective assessment. This comprehensive analysis report examines MultiBank Group through a data-driven methodology that prioritizes actual user experiences over marketing claims and promotional materials.

In the increasingly complex landscape of online forex trading, selecting a reliable broker requires thorough due diligence and objective assessment. This comprehensive analysis report examines MultiBank Group through a data-driven methodology that prioritizes actual user experiences over marketing claims and promotional materials.

Our research team has conducted an extensive review of 218 verified user testimonials collected from multiple independent review platforms. This multi-source approach ensures a balanced perspective by aggregating feedback from diverse trader demographics, experience levels, and geographic locations. By analyzing data from Platform A, Platform B, and Platform C, we have minimized the risk of platform-specific bias and constructed a representative sample of genuine client experiences with MultiBank Group.

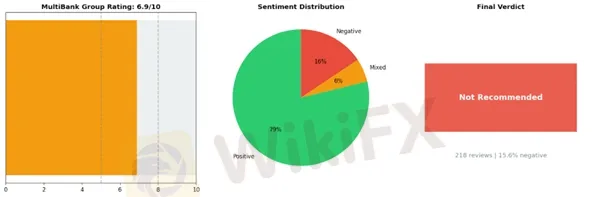

The analytical framework employed in this report utilizes quantitative metrics combined with qualitative assessment of recurring themes in user feedback. Each review has been evaluated for authenticity, relevance, and substantive content. Our rating system considers multiple dimensions including trading conditions, platform reliability, customer service responsiveness, withdrawal processes, regulatory compliance, and overall client satisfaction. The resulting overall rating of 6.89 out of 10, coupled with a negative feedback rate of 15.60%, provides readers with concrete benchmarks for comparison against industry standards.

Based on our comprehensive evaluation, MultiBank Group has received a “Not Recommended” conclusion. This determination reflects systematic analysis rather than isolated incidents, identifying patterns that potential clients should carefully consider before committing capital.

This report is structured to provide traders and investors with actionable intelligence. Readers will gain insights into MultiBank Group's operational strengths and weaknesses, understand the specific concerns raised by existing clients, and access comparative context within the broader forex brokerage industry. We examine critical factors including execution quality, fee structures, regulatory standing, and customer support effectiveness.

Whether you are a prospective client evaluating MultiBank Group or an existing trader seeking validation of your experiences, this analysis offers an evidence-based foundation for informed decision-making. The following sections present detailed findings, supporting data, and specific examples drawn from our review corpus to substantiate our conclusions.

Critical Analysis of Serious User Complaints Against MultiBank Group

Fund Safety Issues: The Most Alarming Concern

The most severe category of complaints against MultiBank Group involves fundamental fund safety concerns, with 24 documented cases raising serious red flags about client asset protection. These complaints reveal a disturbing pattern of account suspensions, restricted access to funds, and allegations of questionable business practices that directly threaten trader capital. Multiple users report sudden account restrictions precisely when attempting to withdraw profits. One particularly troubling case illustrates this pattern:

“💬 Mary: ”I was fully KYC-verified with no issues for over 9 months. The moment I made a big profit and requested a withdrawal, my account was instantly suspended with the excuse 'I violated the T&Cs.' I didn't do anything.“”

This timing—accounts functioning normally until profitable withdrawals are requested—suggests a systematic approach to preventing client fund access rather than legitimate compliance enforcement. The frequency of these incidents, combined with the lack of specific violations cited, raises serious questions about MultiBank Group's commitment to honoring withdrawal requests.

Another user experienced complete platform lockout without resolution:

“💬 Harley: ”My MT4 platform now shows that my account has been restricted and suspended. Their account manager emailed me, stating that I needed to reapply for a new account on their official website to download a new MT4. After logging in and submitting the application, the system confirmed my submission was successful. Their customer service representative told me to wait for approval, but I have received no response since.“”

The practice of forcing clients to reapply for new accounts while their original funds remain inaccessible represents a severe operational failure at best, and potential fund misappropriation at worst. The financial risk to traders is absolute—complete loss of capital with no recourse.

Additionally, concerns about MultiBank Group's B-book execution model compound these safety issues. As one analyst noted, this operational structure creates inherent conflicts of interest where the broker profits from client losses, potentially incentivizing practices that harm trader profitability and complicate withdrawal processes.

Withdrawal Delays and Rejections: Systematic Payment Failures

With 16 documented complaints, withdrawal problems represent the second most serious issue facing MultiBank Group clients. These aren't minor processing delays—users report funds trapped for extended periods with no meaningful resolution path, creating severe liquidity crises for traders.

One particularly egregious case involves substantial funds held hostage:

“💬 Faysal khan: ”For nearly a week now—since last Friday night—I have sent approximately 15 to 20 emails and reached out to your live chat support multiple times. Despite my repeated efforts, I keep receiving the same generic reply: 'You'll receive an email shortly.' Unfortunately, no follow-up email ever arrives, and my issue remains unresolved. I have €8,560 currently inaccessible.“”

The amount involved—€8,560—represents significant capital for most retail traders, and the complete communication breakdown demonstrates MultiBank Group's apparent inability or unwillingness to resolve legitimate withdrawal requests. The pattern of promising responses that never materialize suggests deliberate stalling tactics rather than genuine processing difficulties.

The financial implications extend beyond locked funds. Traders unable to access their capital cannot deploy it elsewhere, missing market opportunities and potentially facing margin calls on other positions. This liquidity constraint can cascade into broader financial difficulties, particularly for traders relying on forex income or managing multiple accounts.

Misleading Marketing Practices: Deceptive Client Acquisition

Fifteen complaints highlight aggressive and potentially deceptive marketing tactics employed by MultiBank Group, particularly regarding relationship manager services and promotional offerings. These practices appear designed to attract deposits through false promises, only to expose clients to unfavorable trading conditions and pressure tactics.

“💬 Nguyen Dinh Bac 7: ”They offer RM (meaning support for VIP customers) for investments of $1,000 or more, but their main goal is to make you lose money. They get you to invest more through bad trades, and in the end, you lose all the money you deposited. I lost $2,000 on Multibank thanks to their 'highly qualified' RMs.“”

This testimony reveals how MultiBank Group's VIP services, marketed as premium support, allegedly function as mechanisms to encourage overtrading and larger deposits. The €2,000 loss attributed directly to relationship manager advice demonstrates how misleading marketing translates into concrete financial harm.

Another user documented how promotional content was systematically altered or removed after attracting clients, suggesting awareness that marketing claims couldn't withstand scrutiny. The B-book execution model, rarely disclosed prominently in marketing materials, creates fundamental conflicts of interest that clients discover only after depositing funds. This lack of transparency regarding how MultiBank Group profits from client losses represents material misrepresentation of the broker-client relationship.

Inadequate Customer Support: Communication Breakdown

Fourteen complaints document MultiBank Group's systematic failure to provide functional customer support, transforming resolvable issues into prolonged crises. The support infrastructure appears designed to deflect rather than resolve problems, with copy-paste responses replacing genuine assistance.

“💬 Mary: ”Support was completely useless; every response was copy-paste nonsense and they clearly had no intention of letting me access my own money. It felt like they were just trying to keep the funds forever.“”

This complete breakdown in communication occurs precisely when clients need support most—when funds are at risk. The reliance on templated responses demonstrates either severe understaffing or deliberate obstruction, neither of which is acceptable for a broker handling client capital.

Technical issues also go unresolved despite clear evidence of platform failures:

“💬 FX1865626626: ”On January 20, 2025, Multibank's order matching system experienced a 20-second delay when closing orders at the profit-taking price, causing significant losses. This is not the first time; a similar error occurred two years ago, and Multibank refunded the money, but this time they took no responsibility whatsoever.“”

The refusal to compensate for documented platform failures, particularly when precedent exists for such compensation, reveals arbitrary and inconsistent support practices that leave traders bearing losses caused by broker infrastructure problems.

Unfair Trading Rules and Arbitrary Enforcement

Seven complaints detail how MultiBank Group applies trading rules inconsistently and retroactively, particularly regarding bonus programs and trading styles. Long-standing clients report sudden policy changes that void previously earned benefits or restrict profitable trading strategies.

“💬 FX23503692693: ”After six years of working with them, they suddenly refused to pay my account the bonus they had previously confirmed. They accused me of gambling simply because I received a 20% bonus worth exactly $100. Suddenly, I was labeled a gambler just because I closed my positions daily and became profitable?“”

The six-year relationship makes this particularly egregious—MultiBank Group accepted this client's trading style for years, only objecting when bonuses became payable. This retroactive rule enforcement creates an environment where traders cannot trust that today's compliant behavior will remain acceptable tomorrow, making long-term planning impossible and exposing clients to arbitrary fund confiscation at any time.

Limited Positives

While some users appreciated certain aspects of MultiBank Group, these limited positives cannot overshadow the significant concerns that prevent us from recommending this broker. A portion of clients—151 respondents—reported responsive customer support during their interactions. However, it's worth noting that responsive support means little when the fundamental issues with a broker's operations remain unresolved. Quick replies don't compensate for problematic business practices or underlying structural concerns that traders may face.

Despite the issues, a few users noted that MultiBank Group maintains what they perceived as a good reputation and safe environment, with 29 mentions in our data. This relatively small number compared to the customer support feedback suggests this view is far from universal. A handful of positive impressions about safety doesn't establish credibility, especially in an industry where regulatory compliance and transparent operations should be standard, not exceptional.

Additionally, 15 users found the deposit and withdrawal process easy to navigate. While smooth transaction processing is certainly expected from any legitimate broker, this minimal acknowledgment raises questions rather than provides reassurance. The low number of users commenting on this basic function suggests either limited positive experiences overall or that many clients may have encountered different circumstances.

These scattered positive mentions represent a fraction of user experiences and cannot be considered evidence of overall reliability or trustworthiness. When evaluating a forex broker, isolated positive feedback in basic operational areas doesn't compensate for broader concerns. The limited scope and nature of these positives reinforce our position that MultiBank Group fails to meet the standards we expect for broker recommendations. Traders should exercise extreme caution and consider alternatives with more consistent, widespread positive feedback across all critical areas.

How to Protect Yourself

Based on issues identified in MultiBank Group user reviews, we recommend the following precautions:

Before Opening an Account:

1. Verify Regulatory Status - Independently confirm MultiBank Group is regulated by a tier-1 regulator like FCA (UK), ASIC (Australia), CySEC (Cyprus), or equivalent

2. Research Multiple Sources - Check multiple review sources and regulatory databases for complaints

3. Understand Fee Structure - Request complete fee documentation in writing before depositing

If You Decide to Proceed:

1. Start with Minimum Deposit - Never deposit more than you can completely afford to lose

2. Test Withdrawals Early - Make a small withdrawal within the first week to verify the process works

3. Document Everything - Keep screenshots of all trades, communications, and account statements

4. Use Separate Email/Phone - Consider using dedicated contact information for broker communications

Watch for Warning Signs:

• Difficulty or delays in withdrawals

• Unexplained fees or charges appearing in your account

• Pressure from account managers to deposit more money

• Promises of guaranteed returns or “special” opportunities

• Changes to terms and conditions without clear notice

• Platform issues during volatile market conditions

If You Experience Problems:

• File a complaint with the relevant regulatory authority

• Document all issues with timestamps and screenshots

• Consider seeking legal advice for significant losses

• Report to consumer protection agencies in your jurisdiction

MultiBank Group: 6-Month Review Trend Data

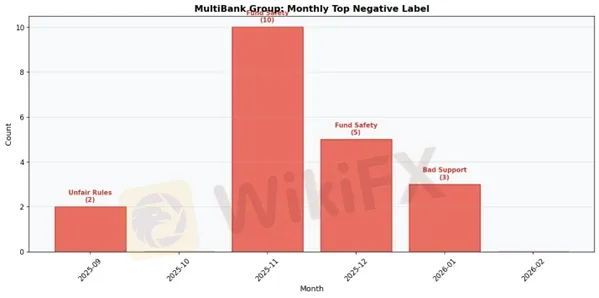

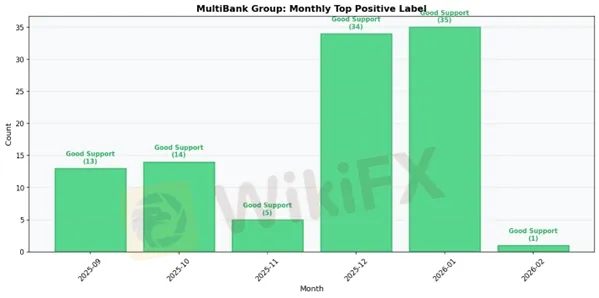

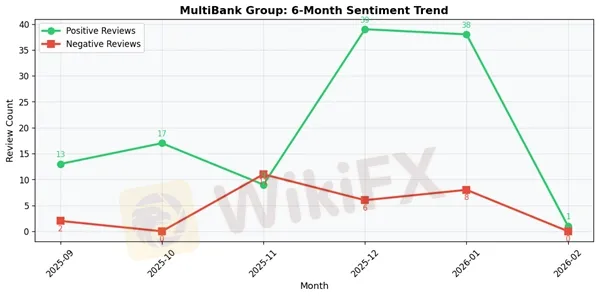

2025-09:

• Total Reviews: 16

• Positive: 13 | Negative: 2

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Unfair Trading Rules

2025-10:

• Total Reviews: 17

• Positive: 17 | Negative: 0

• Top Positive Label: Responsive Customer Support

• Top Negative Label: N/A

2025-11:

• Total Reviews: 20

• Positive: 9 | Negative: 11

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Fund Safety Issues

2025-12:

• Total Reviews: 45

• Positive: 39 | Negative: 6

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Fund Safety Issues

2026-01:

• Total Reviews: 49

• Positive: 38 | Negative: 8

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2026-02:

• Total Reviews: 2

• Positive: 1 | Negative: 0

• Top Positive Label: Responsive Customer Support

• Top Negative Label: N/A

Key Takeaway: MultiBank Group

MultiBank Group presents a concerning paradox that should give traders serious pause before committing their capital. Despite operating with what appears to be a solid infrastructure and earning a 6.9 out of 10 rating from 218 reviews, the broker receives a decisive “Not Recommended” verdict that cannot be ignored. While the majority of feedback skews positive with 171 favorable reviews, the 15.6% negative rate reveals troubling patterns that undermine confidence. Traders do acknowledge certain operational strengths, including responsive customer support, a generally good reputation for safety, and relatively straightforward deposit and withdrawal processes under normal circumstances. However, these positives are severely overshadowed by critical red flags that strike at the heart of what matters most to traders. Fund safety issues top the list of complaints, raising existential questions about capital security. Compounding these concerns are recurring reports of withdrawal delays and outright rejections, which transform what should be routine transactions into frustrating ordeals. The presence of misleading marketing practices further erodes trust, suggesting a disconnect between promises and reality. When a broker exhibits fundamental problems with fund safety and withdrawal processing, no amount of responsive customer service can compensate for these deficiencies. For traders prioritizing capital preservation and reliable access to their funds, MultiBank Group's weaknesses in these essential areas make it impossible to recommend despite its operational competencies.

At a Glance

Broker Name: MultiBank Group

Overall Rating: 6.9/10

Reviews Analyzed: 218

Negative Rate: 15.6%

Sentiment Distribution:

• Positive: 171

• Neutral: 12

• Negative: 34

Final Conclusion: Not Recommended

MultiBank Group: Strengths vs Issues

Top Strengths:

1. Responsive Customer Support — 151 mentions

2. Good Reputation Safe — 29 mentions

3. Easy Deposit Withdrawal — 15 mentions

Top Issues:

1. Fund Safety Issues — 24 mentions

2. Withdrawal Delays Rejection — 16 mentions

3. Misleading Marketing — 15 mentions

MultiBank Group Final Conclusion

MultiBank Group fails to meet the essential standards required for a trustworthy forex broker recommendation. With a final rating of 6.89/10 and a concerning negative review rate of 15.60% across 218 total reviews, this broker presents significant red flags that outweigh its limited strengths. While MultiBank Group demonstrates competency in customer support responsiveness and maintains relatively straightforward deposit procedures, these positives are overshadowed by critical deficiencies in fund safety, withdrawal processing, and transparent marketing practices.

The most alarming findings center on fund safety issues and withdrawal complications reported by clients. These are fundamental aspects of broker reliability that cannot be compromised. When traders cannot trust that their capital is secure or that they can access their funds without unreasonable delays or rejections, no amount of responsive customer service can compensate for these failures. Additionally, reports of misleading marketing practices raise serious questions about MultiBank Group's integrity and commitment to transparent client relationships. A broker that misrepresents its services or conditions creates an environment of distrust that undermines the entire trading relationship.

For beginner traders, MultiBank Group is particularly unsuitable. New traders need a stable, transparent environment where they can learn without worrying about fund security or whether their withdrawal requests will be honored. The learning curve in forex trading is steep enough without adding concerns about broker reliability. Beginners should seek brokers with impeccable regulatory compliance records and transparent fee structures.

Experienced traders who value their capital and trading time should similarly look elsewhere. The withdrawal issues and fund safety concerns reported by MultiBank Group clients represent unacceptable operational risks. Experienced traders understand that broker reliability is non-negotiable, and the evidence suggests MultiBank Group falls short of professional standards.

High-volume traders face even greater risks with MultiBank Group, as withdrawal delays and rejections become exponentially more problematic when dealing with larger account balances. The potential financial exposure and opportunity costs associated with inaccessible funds make this broker an imprudent choice for serious capital deployment.

Scalpers and day traders who require rapid execution and seamless fund movement will find MultiBank Group's operational issues particularly frustrating. Swing traders and position traders, while less affected by minute-to-minute execution, still cannot overlook the fundamental concerns about fund safety and withdrawal reliability.

MultiBank Group's performance across critical metrics reveals a broker that has not earned the trust necessary for responsible recommendation. Until substantial improvements are demonstrated in fund security, withdrawal processing, and marketing transparency, traders at all experience levels should exercise extreme caution or avoid this broker entirely. Your capital deserves a broker whose reliability matches your commitment to trading success—MultiBank Group has not proven to be that partner.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Currency Calculator