简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

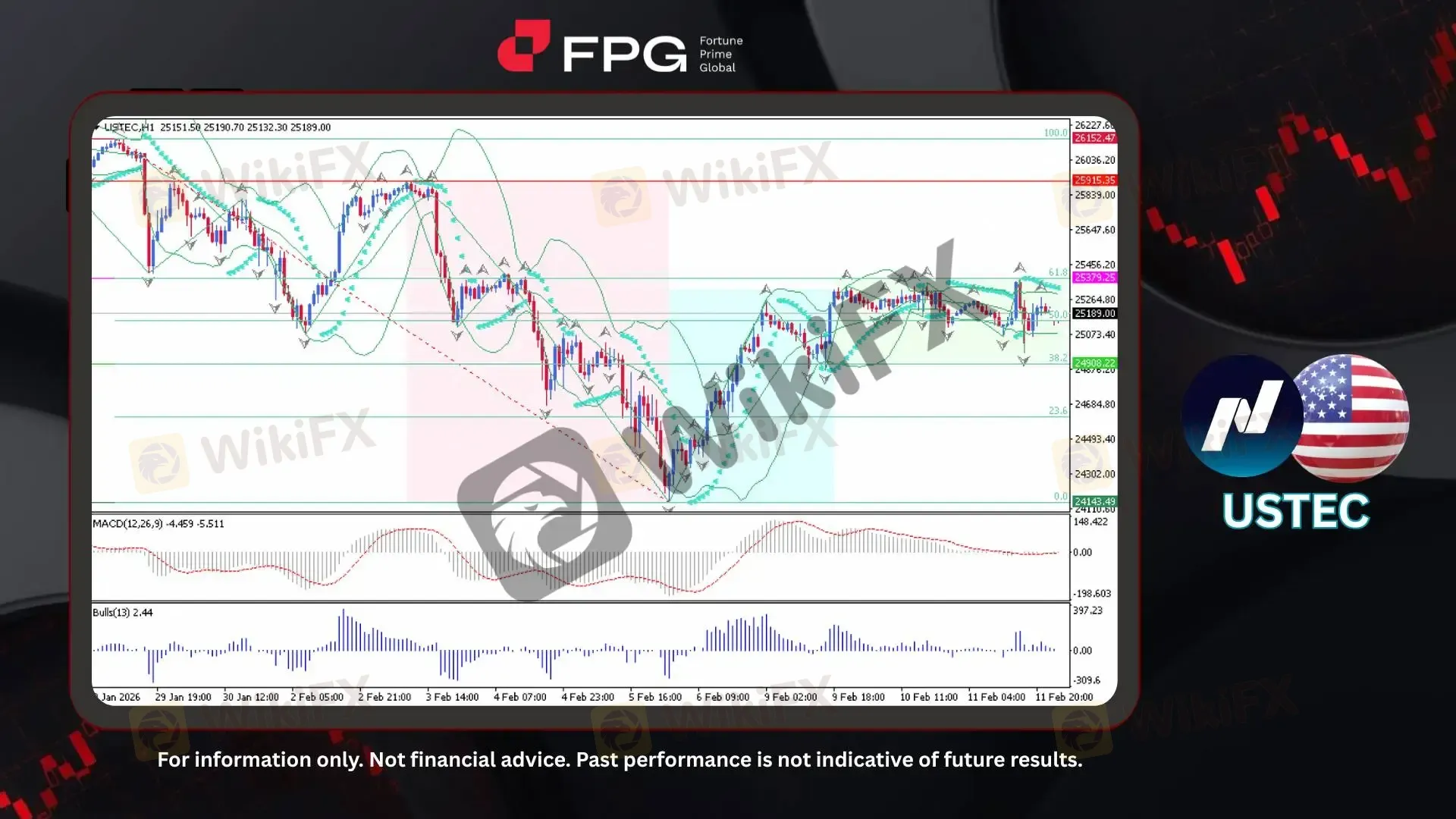

FPG USTEC Market Report February 12, 2026

Abstract:On the H1 timeframe, USTEC (Nasdaq-100) previously experienced a strong bearish move from 25,915 down to 24,143, forming a clear downward structure. After reaching that low, price rebounded sharply an

On the H1 timeframe, USTEC (Nasdaq-100) previously experienced a strong bearish move from 25,915 down to 24,143, forming a clear downward structure. After reaching that low, price rebounded sharply and shifted into a bullish recovery phase. Currently, USTEC is trading around 25,189 and moving sideways within a consolidation range. This sideways structure aligns with the Fibonacci 38.2%–61.8% retracement zone, with price hovering near the 50% retracement level, indicating a temporary equilibrium between buyers and sellers.

From a structural perspective, the bearish impulse has been followed by a corrective bullish phase, creating higher lows after the 24,143 bottom. However, the upward momentum has slowed as price approaches the mid-Fibonacci retracement zone. The market is now compressing beneath the 61.8% Fibonacci resistance around 25,379 and holding above the 38.2% support near 24,908, forming a short-term consolidation channel. This indicates hesitation as the market evaluates whether the recovery is sustainable or merely corrective. MACD (12,26,9) remains below the zero line at -4.459 / -5.511, suggesting that broader momentum still carries residual bearish pressure despite the recent rebound. Meanwhile, Bulls Power (13) prints positive at 2.44, showing that buying pressure is present but not dominant. Bollinger Bands are slightly contracting, reflecting declining volatility and reinforcing the consolidation narrative. Overall, indicators suggest a neutral-to-cautious stance rather than strong directional conviction.

USTEC remains highly sensitive to global macroeconomic developments, particularly Federal Reserve interest rate policy, inflation data, and overall investor risk sentiment toward technology stocks. In periods of economic uncertainty or hawkish monetary expectations, volatility in USTEC tends to increase due to the growth-dependent valuation structure of tech equities. As price consolidates near the 50% Fibonacci level, the next breakout, either above 61.8% or below 38.2%, will likely determine short-term directional bias.

Market Observation & Strategy Advice

1. Current Position: USTEC is trading around 25,189, consolidating near the 50% Fibonacci retracement level, reflecting temporary market balance.

2. Resistance: 25,379 (61.8% Fibonacci) acts as immediate resistance, limiting further upside recovery.

3. Support: 24,908 (38.2% Fibonacci) serves as key short-term support within the consolidation structure.

4. Indicator Observation: MACD remains below zero, indicating underlying bearish momentum has not fully reversed. Bulls Power (13) is positive at 2.44, suggesting moderate buying pressure but lacking strong bullish dominance.

5. Trading Strategy Suggestions:

Range strategy: Consider trading within the 24,908–25,379 range while consolidation persists.

Bullish scenario: A confirmed breakout above 25,379 may open room toward 25,915 resistance.

Bearish scenario: A breakdown below 24,908 could expose downside risk toward 24,143.

Market Performance:

Indices Last Price % Change

US500 6,945 +0.02%

US30 50,145 +0.07%

Todays Key Economic Calendar:

US: Monthly Budget Statement

US: Fed Logan Speech

UK: RICS House Price Balance

AU: RBA Hunter Speech

UK: Business Investment QoQ Prel

UK: GDP 3-Month Avg

UK: GDP Growth Rate QoQ & YoY Prel

UK: GDP MoM

UK: Goods Trade Balance (Total & Non-EU)

UK: Industrial & Manufacturing Production MoM

US: Initial Jobless Claims

US: Existing Home Sales

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

AssetsFX Review : Read This Before You Put Money In it

DeltaFX Broker: No Regulation Exposed

INVESTIZO Review: Profit Cancellation Claims, Withdrawal Denials & Poor Customer Support

Is Stonefort Legit Company? Understanding the Risks

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

Warsh Likes It Hot, And Will Move The Fed's Inflation Target To 2.5-3.5%

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Currency Calculator