简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TenTrade Review 2026: Is this Broker Safe?

Abstract:TenTrade is an offshore brokerage established in 2018, currently holding a low trust score of 4.19 due to unverified regulatory claims and severe withdrawal complaints. While it offers high leverage via MT5, the prevalence of blocked accounts and denied fund requests highlights significant risks for traders.

Executive Summary

In this in-depth TenTrade review, we analyze the key metrics defining this off-shore financial provider to determine if it meets modern safety standards. The TenTrade broker was established in 2018 and has expanded its operations primarily across the UAE, Canada, and parts of Europe, utilizing a Seychelles base.

While the firm offers a variety of account types and high leverage, our TenTrade review data suggests significant caution is warranted. The company currently holds a relatively low WikiFX score of 4.19, reflecting a disparity between its marketing claims and its regulatory reality. As a broker operating with offshore oversight, TenTrade faces substantial scrutiny regarding fund safety, further compounded by a recent surge in user complaints regarding withdrawals.

1. TenTrade Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under, as this dictates the safety of client capital. TenTrade claims affiliation with multiple authorities, but verified data paints a complex picture. While there is a listing for the Seychelles Financial Services Authority (FSA), this is classified as “Offshore Regulation,” which generally offers less stringent protection than Tier-1 bodies like the FCA or ASIC.

More concerning is the status of other claimed licenses. Returns indicate that the license from the Cyprus Securities and Exchange Commission (CySEC) is “Unverified,” and specific registrations are marked as potentially unauthorized. Regarding regulation , the entity lacks the robust compensation schemes found in strictly regulated jurisdictions. For traders, this means that in the event of insolvency or disputes, there may be no legal recourse to recover funds, a risk highlighted by the broker's offshore status.

2. TenTrade Forex Trading Conditions

For traders focusing on Forex instruments, TenTrade offers aggressive trading conditions that are typical of offshore entities but carry elevated risk. The broker provides access to the MetaTrader 5 (MT5) platform with leverage options peaking at 1:500 for standard accounts and an exceedingly high 1:2000 for the “Dynamic Leverage” account type.

Does Forex pricing compete with top-tier providers? The broker offers seven account types, ranging from “VIP Bonus” to “ECN.” Spreads start from 0 pips on ECN accounts (with commission) and around 1.1 to 2.2 pips on standard accounts. While the entry barrier is low—ranging from $25 to $1000—the extreme leverage exposes retail clients to rapid capital loss. The availability of high leverage allows for flexibility, yet it often encourages overexposure in volatile markets without the safety nets mandated by tighter regulatory frameworks.

3. User Feedback & Complaints

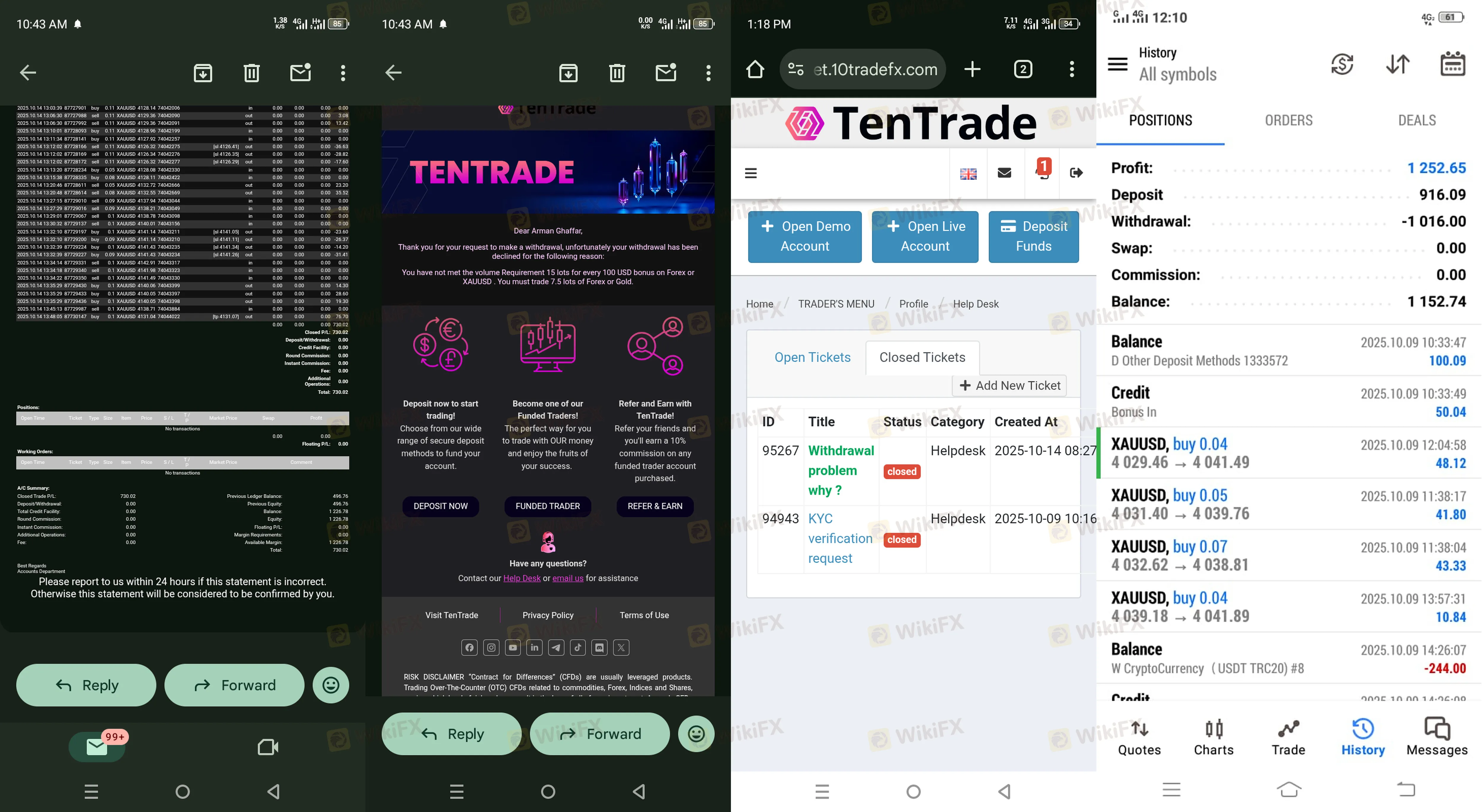

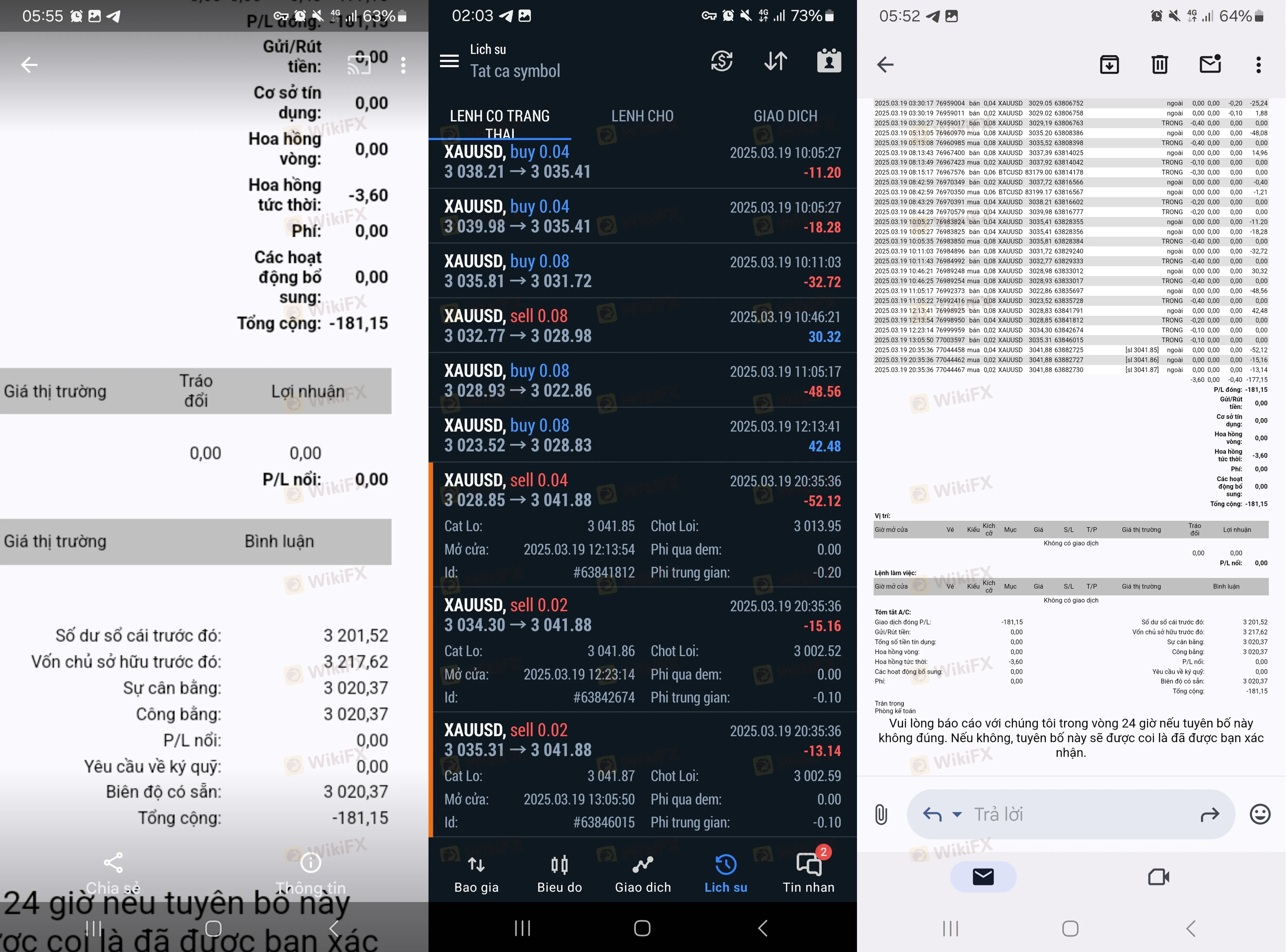

Analysis of recent user data reveals a troubling pattern of denied withdrawals and account closures. Multiple complaints filed in late 2025 describe scenarios where profitable accounts were blocked. For instance, a user from Pakistan reported that after growing a balance to $1,226 through legitimate trading, the withdrawal option was disabled, and support ceased communication.

Similarly, a Vietnamese trader detailed severe slippage significantly deviating from market prices on Gold trades, alleging intentional manipulation.

Users have reported difficulties with their TenTrade login stability during these disputes. One specific case from China (translated) stated: “Closed my account without notification, even the permission to login to the client backend was removed, making withdrawal impossible.” Another report from Vietnam accused the broker of locking accounts immediately after stop-losses were hit, citing ambiguous “risk violations.”

These patterns suggest a systematic issue with honoring payouts for profitable traders.

4. Software & Access

TenTrade utilizes the industry-standard MetaTrader 5 (MT5) platform, known for its advanced charting and algorithmic capabilities. To access the platform, traders must complete the login security steps, though the audit notes a lack of advanced biometric authentication or enforced two-factor authentication (2FA) for the client portal.

While the software itself is robust, the reliability of the TenTrade login credentials remains a point of contention given the user feedback about sudden access restrictions. The digital onboarding process is described as simple, but the ease of entry contrasts sharply with the reported difficulties in exiting with funds.

Final Verdict

TenTrade presents itself as a competitive option with high leverage and diverse account types, but the risks outweigh the benefits. The TenTrade regulation status is primarily offshore or unverified, and the consistent volume of complaints regarding blocked withdrawals and account terminations is a major red flag.

Pros:

- Access to MT5 platform.

- High leverage up to 1:2000.

- Multiple funding methods (crypto/e-wallets).

Cons:

- Offshore/Unverified regulatory status.

- Confirmed reports of withdrawal denials.

- Complaints of severe slippage and account blocks.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App before depositing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

Currency Calculator