简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ICM Brokers: Real User Reviews and Common Issues — Is ICM Brokers Safe or Scam?

Abstract:This article will give you the facts you need to make a smart choice. We won't keep you guessing - keeping your money safe is what matters most. We will look at the facts, starting with what it means that they have no regulation. Then we'll examine real ICM Brokers complaints to show you what actually happens to people who use them. Finally, we will break down their trading rules to show you the risks. This clear plan will give you a complete picture of Is ICM Brokers safe or scam so you can protect your money.

Is ICM Brokers safe or scam? We will give you a direct answer. After carefully studying how they are regulated and what users say about them, ICM Brokers has serious warning signs that make it very risky for traders. The biggest problem is that no trusted financial authority actually regulates them.

This article will give you the facts you need to make a smart choice. We won't keep you guessing - keeping your money safe is what matters most. We will look at the facts, starting with what it means that they have no regulation. Then we'll examine real ICM Brokers complaints to show you what actually happens to people who use them. Finally, we will break down their trading rules to show you the risks. This clear plan will give you a complete picture of Is ICM Brokers safe or scam so you can protect your money.

The Biggest Warning Sign: No Regulation

The most important thing that makes a broker trustworthy is regulation. It's what protects investors. but if you ask Is ICM Brokers safe or scam? Answer is ICM Brokers has no regulation at all, which is the most serious answer about Is Is ICM Brokers safe or scam?

What Regulators Say

The facts are clear: ICM Brokers is not regulated by any trusted financial authority. Global broker checking websites like WikiFX give clear warnings, saying “This broker lacks valid forex regulation. Please be aware of the risk!” and “Warning: Low score, please stay away!”

For traders, this means you have no protection. There is no fund to protect your money if the broker goes out of business. There is no government watching to make sure they treat you fairly with honest prices and quick withdrawals. Most importantly, if you have a problem, like the broker refusing to give you your money back, there is no official group you can complain to for help. You are completely on your own.

Understanding Offshore Registration

ICM Brokers is registered in places like Saint Vincent and the Grenadines and the Marshall Islands. These are well-known offshore locations that companies use when they want to avoid strict rules. These places don't have financial authorities that properly regulate forex brokers.

To understand this better, brokers regulated by the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) in Australia must follow strict rules. These include keeping client money separate from company money, having enough money to operate properly, and providing clear ways to solve disputes. Choosing an offshore, unregulated broker is like playing a high-stakes game with no referee, where the rules can change at any time without warning.

Checking the Facts

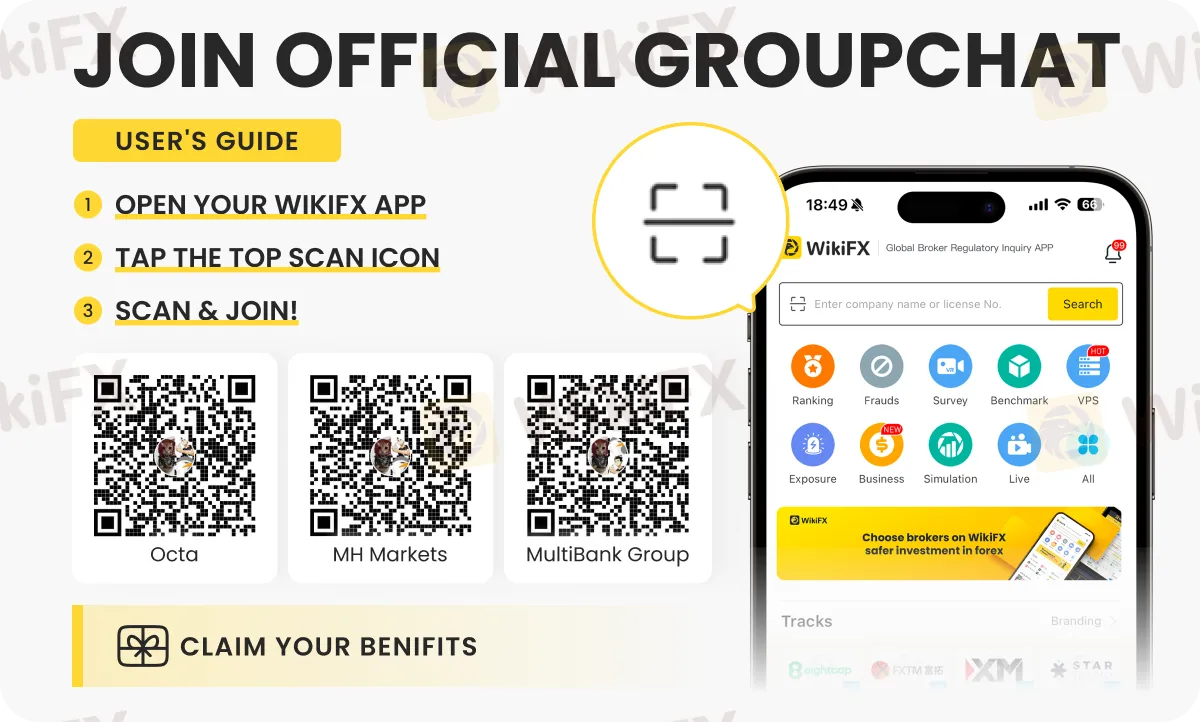

You should always verify trust with evidence. We encourage you to do your own research. To see the full regulatory breakdown, the official “No Regulation” status, and the broker's low score for yourself, you can check the detailed report on WikiFX's official page for ICM Brokers and know Is ICM Brokers safe or scam?

The risks of using an unregulated broker are extremely serious. Here's what you're exposed to:

• No Separation of Money: The broker can mix your investment money with its own business money, putting your funds at risk for their expenses and debts.

• No Protection from Losing More Than You Put In: In volatile markets, you could lose more money than you initially deposited, leaving you owing money to the broker.

• No Help with Problems: If the broker cancels your profits or refuses to let you withdraw money, you have no official way to complain or get help.

• Possible Cheating: Without oversight, the broker can cheat by changing prices, making spreads wider, or triggering your stop-losses to benefit themselves.

Looking at a Real Complaint

Theoretical risks become much clearer when you see what actually happened to a real person. Looking at actual ICM Brokers complaints shows you what could happen when trading with an unregulated company.

Real Example: Profits Deleted

A recent complaint from late 2025 shows a shocking example. A user from Germany reported a disturbing experience with their ICM Brokers account. Shortly after the market opened for the week, the trader made several trades, with some wins and some losses - which is normal in trading.

However, the broker then did something alarming without warning. According to the user's report, ICM Brokers removed all the profitable trades from the account history. The losing trades stayed there. The most concerning part was that there was no communication at all. No email, no notification on the platform, and no explanation. The profits just disappeared. This complaint tells you Is ICM Brokers safe or scam?

Understanding When Brokers Delete Profits

This practice, called “profit elimination” or “profit canceling,” is a major warning sign of dishonest brokers. It happens when a broker decides on their own that a client's successful trades don't count and removes them from the account. The broker will often use vague, unclear rules in their terms and conditions, like “abnormal trading,” “scalping,” or “arbitrage,” as an excuse.

In a fair and regulated system, trade disputes are handled through a clear and organized process. A good broker would never simply delete a client's profits without lots of communication and a clear, evidence-based reason. The fact that this happened without any notice suggests a business that doesn't care about being fair or transparent with clients. It shows how much power an unregulated broker has over their clients' money and trading results.

Looking Deeper: Trading Rules

While attractive advertising might draw traders in, you need to carefully examine a broker's trading conditions for risks, especially when there's no regulation. A closer look at ICM Brokers' account types, leverage, and spreads shows more reasons to be careful.

Understanding the Risks

These numbers might look normal at first, but they have hidden risks when you look at the bigger picture and inform you Is ICM Brokers safe or scam? The spreads on the basic Standard account, starting at a fixed 2.0 pips for major currency pairs, are much higher than what most brokers offer. Good brokers often offer spreads below 1.5 pips, or even lower. Higher spreads mean every trade costs you more money, making it harder to make a profit.

The offer of extremely high leverage, up to 1:400, is a huge warning sign. While high leverage can increase your gains, it's dangerous because it equally increases your losses. A single bad market move can wipe out all your money in seconds. Good regulators in major countries like the UK, Europe, and Australia have put strict limits on leverage (often around 1:30) for regular traders specifically to protect them from this risk. When an unregulated broker offers extremely high leverage, it's often a tool to encourage too much trading and speed up client losses.

ICM Brokers provides the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. While these are good and popular platforms, the software itself doesn't guarantee the broker is honest. An untrustworthy broker can still use a legitimate platform, and sometimes use special tools to manipulate trades against their clients.

These trading conditions are what the broker claims to offer. For a complete and independently verified overview of their platforms, servers, and account details, we recommend reviewing the full profile on WikiFX.

The Final Decision: A Report Card

To put all the evidence together, we have created a simple risk report card for ICM Brokers. This gives you a clear, quick summary to help you answer the main question: Is ICM Brokers safe or scam?

ICM Brokers Risk Assessment

• Regulatory Oversight: FAIL. The broker operates with no valid license from any reputable jurisdiction. This is the most serious failure and exposes clients to the highest level of risk.

• User Trust & Feedback: FAIL. Verified user complaints from 2025 detail harmful practices, such as profit elimination, which directly hurt clients' money.

• Transparency: FAIL. The broker has shown a lack of transparency by allegedly changing account histories without telling the client, leaving no way to resolve disputes.

• Money Safety: HIGH RISK. As an unregulated company registered offshore, there is no legal guarantee that your money is kept separate. Your money is not protected from the broker's business risks or potential misuse.

• Trading Conditions: WARNING. The combination of expensive spreads and extremely high leverage creates a high-risk trading environment designed to benefit the broker, not the client.

Answer to the Main Question

Based on this complete assessment, the conclusion is clear. The combination of no regulation, serious user complaints about profit removal, lack of transparency, and high-risk trading conditions leads us to determine that ICM Brokers is not a safe choice for any trader. The evidence strongly suggests it operates in a way that is not consistent with trustworthy brokers and shows characteristics of a scam.

Your Safest Next Step

Trading in the forex market can be complex, but protecting your money doesn't have to be. After looking at a high-risk broker like ICM Brokers, the most valuable lesson is learning how to choose a trustworthy partner for your trading.

The Most Important Rule

The single most important rule for choosing a broker is this: never, under any circumstances, put money with a broker before you have thoroughly checked its regulatory status with an independent source. Regulation is not an extra feature; it is absolutely required for your financial safety. A fancy website or tempting bonus offer can never make up for the lack of regulatory oversight.

Your Research Tools

Before you consider any broker, make it mandatory to do a full background check. This process is simpler than you might think and is the most effective way to protect yourself from scams.

We strongly recommend using an independent, global verification tool like WikiFX. It brings together regulatory data, license information, user reviews, and expert analysis from around the world into a single, easy-to-understand score. A quick search on the platform can show you a broker's regulatory status, its history, and any complaints filed against it. This simple check can be the difference between a secure investment and a big financial loss. Protect your money. Always verify before you invest. You can start by searching for any broker on the WikiFX platform.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

FX Movers: Yen Soars on Intervention Watch; CAD Tumbles on Trade Threats

Gold Pierces $5,000 Milestone; Pan African Resources Signals Cash Flow Surge

PRCBroker Review: Where Profitable Accounts Go to Die

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

USD Outlook: Markets Eye 'Politicized' Fed Risks as Tariff Impact Deepens

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

Currency Calculator