简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HEADWAY Review 2026: Comprehensive Safety Assessment

Abstract:HEADWAY holds an FSCA license and a WikiFX score of 4.40, offering competitive spreads and unlimited leverage for high-risk strategies. However, the broker's safety rating is severely compromised by a massive volume of unresolved complaints regarding withdrawal denials and platform manipulation.

Executive Summary

In this in-depth review, we analyze the key metrics defining HEADWAY's current standing in the financial markets. HEADWAY is a South African broker established in 2023, attempting to capture market share through aggressive marketing and high-leverage offerings. The platform is primarily regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. Our review 2026 mandate is to determine if their operational history matches their regulatory status.

As a broker entity operating since 2023, HEADWAY presents a mix of standard infrastructure and alarming user feedback. While the WikiFX score currently sits at 4.40, suggesting a mid-tier ranking, the underlying data reveals significant friction in fund management processes. This article audits their regulatory framework, trading environment, and the validity of serious allegations raised by clients globally.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation HEADWAY operates under. The broker is authorized by the FSCA (South Africa) with license number 52108. For traders, specific regulation standards are the primary line of defense against insolvency or malpractice.

While the FSCA is a respected regulator on the African continent, it is generally considered a Tier-2 authority compared to the FCA (UK) or ASIC (Australia). The FSCA framework ensures that the entity exists and meets capital requirements, but it may not offer the same level of granular dispute resolution or compensation schemes found in Tier-1 jurisdictions. The pivotal question remains: Does this license translate to actual fund safety? In HEADWAY's case, the disparity between their legal status and client experience suggests that while the license is valid, the internal safety protocols regarding withdrawals may be lacking.

2. Forex Trading Conditions

For traders focusing on Forex instruments, HEADWAY offers conditions that are statistically attractive but carry inherent risks. The broker provides three account types: Cent, Standard, and Pro. The “Unlimited” leverage (1:Unlimited) is a standout feature, allowing extreme exposure relative to capital. While this attracts aggressive traders, it substantially increases the risk of rapid liquidation.

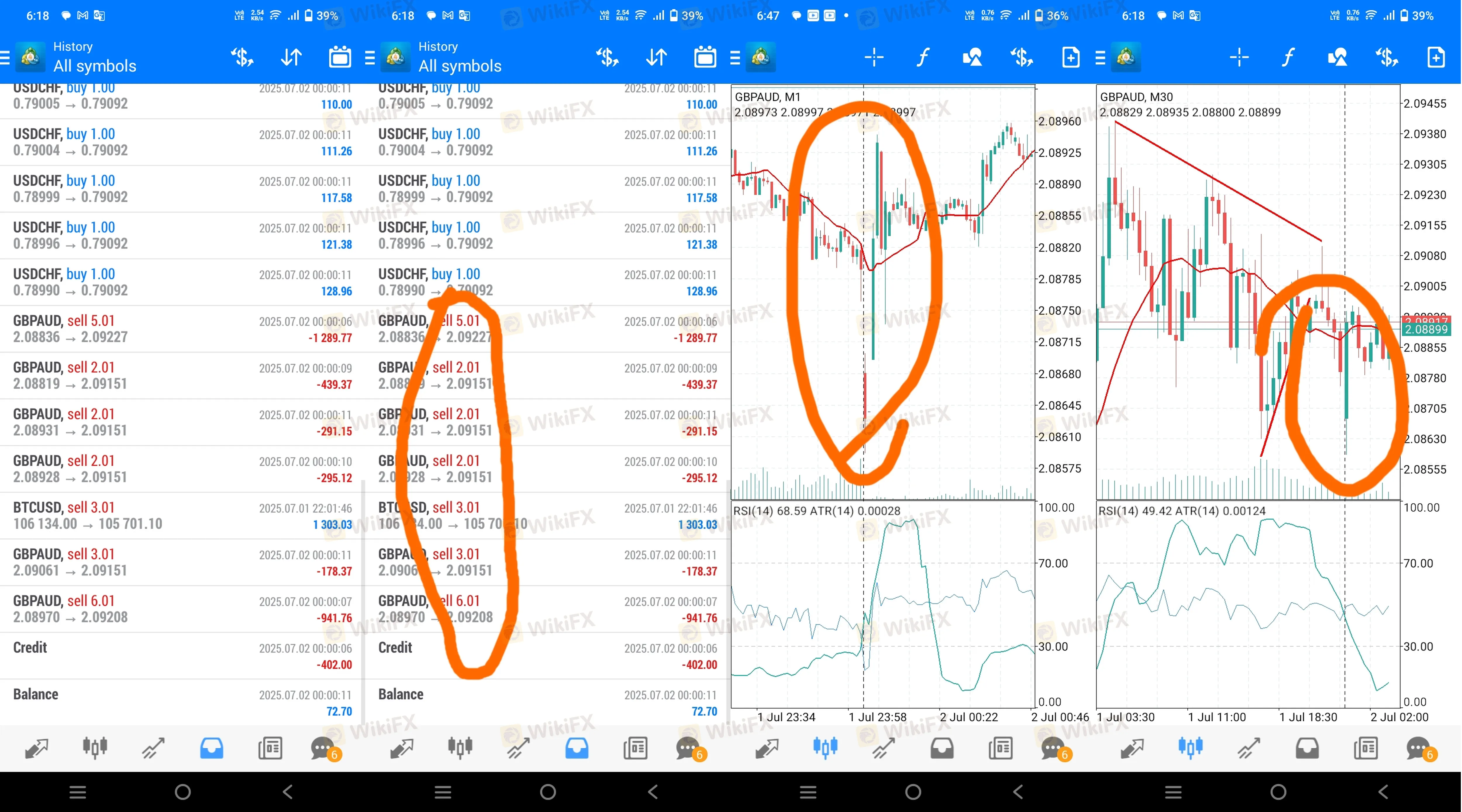

In terms of costs, the Pro account claims spreads from 0.0 pips, while Standard accounts start at 0.3 pips. However, does Forex pricing compete with top-tier providers when execution quality is factored in? User reports suggest that advertised spreads may not always reflect live trading conditions, with specific allegations of widening spreads during news events (floating spreads) that deviate significantly from market averages.

3. User Feedback & Complaints

An analysis of 95 recent cases reveals a troubling pattern of operational friction. The volume of complaints is disproportionately high for a broker established only recently.

Key Complaint Themes:

- Withdrawal Barriers: A significant number of users report being unable to withdraw funds. Excuses cited by users include “data anomalies” and requests for irrelevant documentation. One particularly egregious report mentions customer service demanding an “environmental impact assessment report for the factory” (Case 23) before processing a withdrawal, which signals potential obstruction tactics.

- Bonus Traps: Several traders reported that the $111 bonus and other promotions come with virtually impossible volume requirements (e.g., trading 3,800 lots) or that profits generated from bonuses are confiscated arbitrarily.

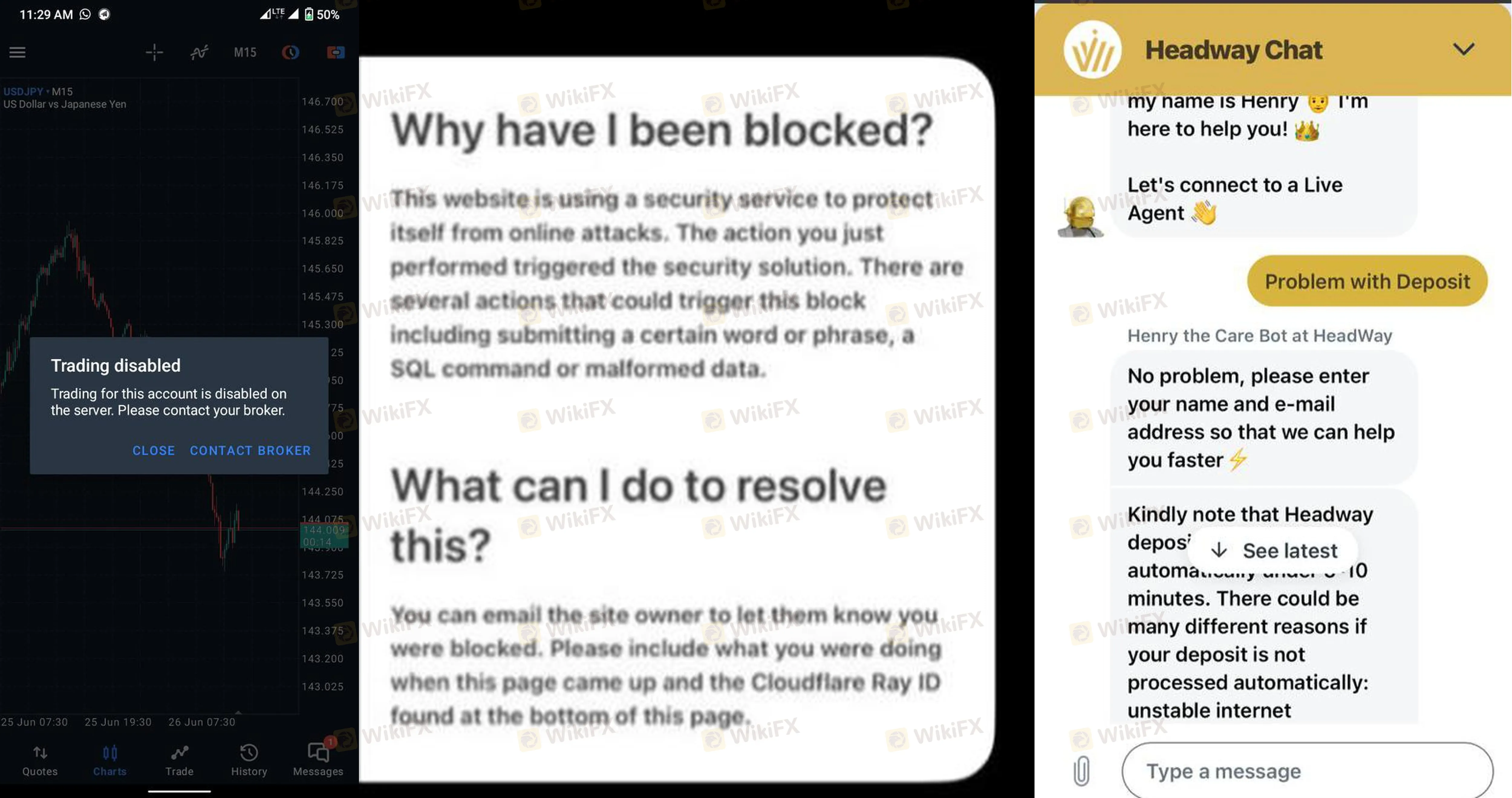

- Platform Instability: Users have reported difficulties with their login stability during critical market movements.

<case>

Case 47 (India): “I can't believe what's happening with my Headway account. I'm completely locked out and can't log in. I need access to my funds...”

<case>

Case 16 (Malaysia): “Now, not only can I not withdraw my money, I can't even log in! Is this what they call 'data-based'? They're just using fake data to scam users out of their money!”

4. Software & Access

HEADWAY utilizes the industry-standard MT4 and MT5 platforms, alongside a proprietary app. The availability of MetaTrader is a positive aspect, ensuring familiarity for seasoned traders. To access the platform, traders must complete the login security steps, though our technical review notes a lack of advanced two-factor authentication (2FA) or biometric integration on the desktop interfaces.

Despite the robust software architecture, the reliability of the client portal login process has been questioned in user feedback. Reports of “frozen” connections and accounts being disabled post-profit (Case 86) undermine the technical competence of the software offering. A trading platform is only as good as the server execution behind it, and frequent “slippage” reports suggest backend latency or configuration issues.

Final Verdict

HEADWAY presents a dichotomy: it possesses a valid FSCA license and popular trading software, yet it is plagued by severe allegations of withdrawal denial and account manipulation. The offering of unlimited leverage is a high-risk feature that requires experienced handling. While the regulation status is legitimate, the sheer volume of complaints urges extreme caution.

Pros:

- FSCA Regulated.

- MT4/MT5 available.

- Low minimum deposit ($1-$10).

Cons:

- “Unlimited” leverage encourages high risk.

- Severe withdrawal complaints (90+ cases).

- Allegations of spread manipulation.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Currency Calculator