简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OANDA Review 2026: Comprehensive Safety Assessment

Abstract:OANDA holds an impressive regulatory scorecard with oversight from top-tier bodies like the FCA, NFA, and ASIC, earning it a high safety rating of 8.24. However, a significant volume of user complaints regarding withdrawal blocks and impersonation scams necessitates a cautious approach for new traders.

Executive Summary

In this in-depth review, we analyze the key metrics defining OANDAs position in the global financial markets. As a veteran entity in the industry, OANDA has built a reputation based on longevity and strict compliance.

The broker was established in 2003 and has since expanded its influence across multiple continents, including the United Arab Emirates, Australia, and Argentina. With an influence rank of AAA and a WikiFX score of 8.24, it stands as a heavyweight contender. However, recent data indicates a surge in complaints, primarily driven by fraudulent clone websites impersonating the brand. As a broker entity operating since the early 2000s, OANDA presents a complex profile of high-level regulatory adherence contrasted with a challenging environment of external impersonation risks.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation OANDA operates under. Unlike many competitors relying solely on offshore licenses, OANDA maintains a robust regulatory framework across several major jurisdictions. It is regulated by:

- United States: National Futures Association (NFA)

- United Kingdom: Financial Conduct Authority (FCA)

- Australia: Australian Securities & Investments Commission (ASIC)

- Singapore: Monetary Authority of Singapore (MAS)

- Japan: Financial Services Agency (FSA)

- Canada: Canadian Investment Regulatory Organization (CIRO)

This multi-jurisdictional oversight implies strict fund segregation and capital adequacy standards. However, traders should be aware of a 2021 disclosure where the NFA fined OANDA Corporation $200,000 for failing to submit accurate daily forex reports. Despite this, the overarching regulation structure remains one of the strongest in the industry, providing a significant safety net compared to unregulated entities.

2. Forex Trading Conditions

For traders focusing on Forex instruments, OANDA offers a versatile technological environment. The broker supports its proprietary platform alongside the industry-standard MT4 and MT5. This flexibility allow users to choose between the customizable features of the OANDA platform or the automated trading capabilities of MetaTrader.

An important question for potential clients is: Does Forex pricing compete with top-tier providers? While OANDA's specific spread data is variable, the availability of broad platform support suggests a deep liquidity pool. However, the WikiFX assessment rates the trading experience as “General,” and notably, there is no support for MacOS or other specific applications, which may limit accessibility for Apple ecosystem users. The leverage and transaction costs are heavily dependent on the specific entity and region the trader registers with, adhering to local regulatory caps (e.g., 1:30 in the UK/EU/Australia).

3. User Feedback & Complaints

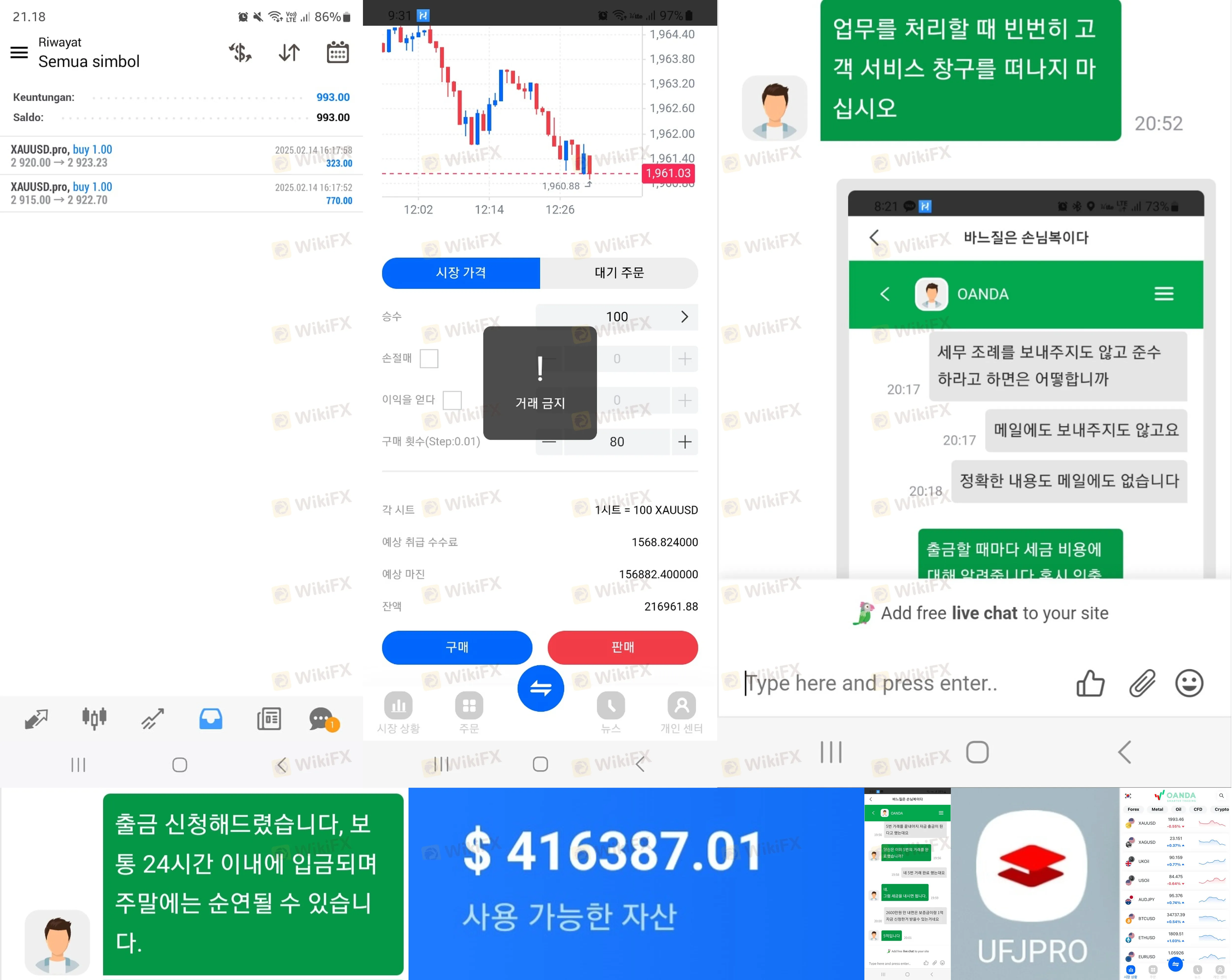

A disturbing trend has emerged in the user feedback logs. Over the past three months, WikiFX has received 103 complaints. Analyzing the `casesText`, a distinct pattern of “clone” scams appears. Victims across Indonesia, Korea, and Vietnam report being lured into private groups (Zalo/Telegram) by “teachers” who direct them to deposit funds into fake domains such as `oanda19.com`, `oanda-vip.com`, or `options-usd.com`.

While these scams likely do not originate from the official OANDA, they severely impact the brand's reputation. Real users have also reported difficulties. For instance, a trader in Japan (Case 8) reported severe slippage on the AUD-JPY pair that differed significantly from other market feeds. Additionally, confusion over these fake platforms has led to users reporting issues with their login stability, only to realize they were attempting to access a fraudulent interface designed to steal credentials.

4. Software & Access

OANDA provides access via mobile, web, and desktop interfaces. The proprietary software is highly customizable and offers clear fee reporting, which is a significant advantage for transparency. However, the software assessment highlights a security gap: the platform currently lacks two-step login or biometric authentication features for enhanced security.

To access the platform, traders must complete the login security steps, which currently rely on standard password protocols. Given the prevalence of phishing sites targeting OANDA clients, the absence of 2FA is a notable weakness. Traders must be hyper-vigilant to ensure they are entering their credentials on the official `oanda.com` or region-specific official subdomains, rather than the malicious URLs cited in user complaints.

Final Verdict

OANDA remains a tier-one financial provider with an exceptional regulatory footprint and a long history of operation. The score of 8.24 reflects its institutional stability. However, the proliferation of clone scams and mixed reviews regarding trading costs and slippage warrants caution.

Prospective clients must strictly verify they are interacting with the official entity. For real-time updates on regulation status or to verify the official login page, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Pocket Option Faces ISA Crackdown Over Illegal Trades

OANDA Expands CFD Trading to US and European Traders

Currency Calculator