简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Jan 8, 2026

Abstract:The Service-Sector Shield Bolster Dollar Rebounds; Outlook for Dollar, Gold SilverThe market narrative for the first week of 2026 has taken a decisive turn. While the Everything Rally dominated the f

The "Service-Sector Shield" Bolster Dollar Rebounds; Outlook for Dollar, Gold & SilverThe market narrative for the first week of 2026 has taken a decisive turn. While the "Everything Rally" dominated the first 48 hours, a massive divergence in U.S. economic data has successfully bolstered the U.S. Dollar. This shift has recalibrated expectations across the board, placing precious metals under near-term pressure as the "inflation hedge" trade meets a resurgent Greenback.

How ADP and ISM Bolstered the Dollar Rebound?

Yesterdays data release provided a masterclass in "American Exceptionalism," allowing the U.S. Dollar Index (DXY) to successfully breach the 98.40 pivot and set its sights on the critical 98.80 resistance zone.

· The ADP “Not Bad” Impact: Private sector employment added 41,000 jobs in December. While this slightly missed the 47,000 forecast, the "not that bad" nature of the data successfully eased extreme labor market anxiety—especially considering last month's ADP was in negative territory (revised to -29K).

· The ISM Services "Surprise": The true game-changer was the ISM Services PMI, which unexpectedly surged to 54.4 (vs. 52.2 forecast), marking its highest reading of the year.

Since the services sector accounts for nearly 80% of the U.S. economy, this massive beat provided the fundamental "muscle" needed to back up the stabilizing labor data. It signalled that economic activity remains robust despite a slight cooling in hiring, forcing traders to price out aggressive January rate cuts.

This "Service-Sector Shield" has propelled the USD to retest the 98.40–98.50 range, setting the stage for a run toward 98.80 if tomorrows NFP follows suit.

Dollar Outlook

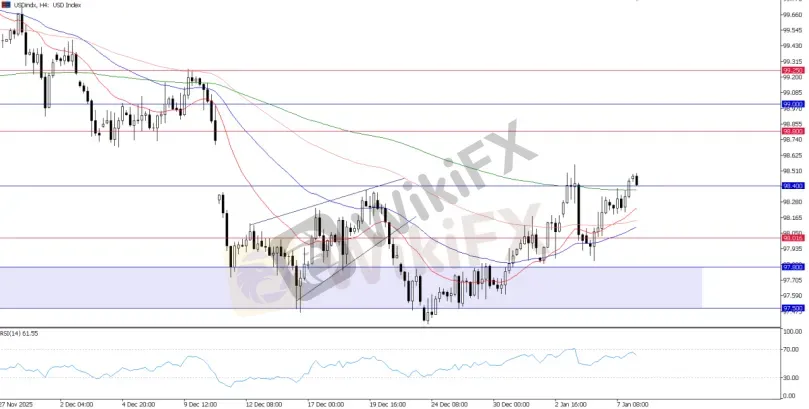

USD Index, H4 ChartTechnically, after finding support at 98.00, the rebound suggests Dollar bulls are setting the stage. The key test is whether the USD can hold above the 98.40 breakout level. While a confirmed breakout remains subject to volatility, any pullback above 98.00 (or the 20/50-EMA) continues to support the potential bullish reversal narrative.

Key Risk: Tonight‘s Initial Jobless Claims and tomorrow’s Non-Farm Payrolls (NFP) remain the ultimate wildcards that could trigger immediate volatility.

Gold: Profit-Taking Meets a Resurgent Greenback

Gold is currently undergoing a healthy correction as the "Safe-Haven" premium meets the reality of a rebounding Dollar and a natural market rebalancing following a strong multi-month rally.

XAU/USD, H4 ChartAfter facing heavy pressure at $4,500 that capped the upside, the focus has shifted to the $4,450 support. Recent range-bound price action and indecisive candles suggest a fierce tug-of-war between bulls and bears.

XAU/USD, H1 ChartOver the short-term, Intraday momentum relies heavily on the $4,440–$4,450 area. If Gold breaks below $4,450, we expect a slide toward the lower boundary of the $4,400 structural support. Conversely, holding above this base would likely lead to further range-bound trading toward the $4,500 upper boundary.

Outlook: We maintain a Neutral/Cautious Bullish bias. For now, Gold is in a consolidation phase, providing range-trading opportunities between $4,400 and $4,500.

Silver: The "Volatility King" Faces Valuation Reset

Silver is leading the correction in the metals complex as it faces the brunt of "commodity index rebalancing" which commenced on January 8.

Spot Silver has seen a sharp 3.7% drop, currently trading near $78.10 after briefly failing to hold above the $80.00 mark. This move suggests the long-term rally may be running out of steam in the short term.

XAGUSD, H2 ChartTechnically, the brief break above $80 followed by a failure to regain that level hints at a "false breakout." This could lead to a deeper short-term bearish reversal toward the $75.00 area.

In the broader term, this appears to be a necessary consolidation or pullback within a broad upward trend, but silver traders should brace for continued high volatility as the revaluation and overbought concern remain.

Bottom Line: The Final Gauges Before NFP

Today‘s market is transitioning from the "Everything Rally" to a data-dependent reality. Before the definitive Non-Farm Payrolls (NFP) report tomorrow, tonight’s U.S. Initial Jobless Claims (Expected: 213K vs. Previous: 199K) will serve as the final essential gauge for the market.

· A lower-than-expected claims number would further validate the "Service-Sector Shield" and likely cement the Dollar's breakout above 98.40.

· Conversely, a spike in claims would re-ignite recession fears and could provide a sudden "lifeline" to Gol(or may be silver), allowing them to reclaim their broken supports.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Merin Review (2025): Is it Safe or a Scam?

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Currency Calculator