简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Jan 7, 2026

Abstract:The “Everything Rally” and the Jobs Week Gauntlet; Outlook for Dollar Index, Dollar Pairs GoldThe global markets have kicked off the first 48 hours of the new year with a powerful and rare “everythin

The “Everything Rally” and the Jobs Week Gauntlet; Outlook for Dollar Index, Dollar Pairs & Gold

The global markets have kicked off the first 48 hours of the new year with a powerful and rare “everything rally.” In a unique market phenomenon, the US Dollar, global equities, Gold, and Silver have all surged in tandem.

As institutional liquidity fully returns, the focus is shifting from recent geopolitical “shocks” to the fundamental health of the U.S. economy. Today marks the beginning of the “Jobs Week Gauntlet,” where labor data will determine whether the Feds hawkish stance is a strategic necessity or a policy risk.

The ADP & NFP Countdown: Seeking a Labor Rebound

Tonights ADP Employment Report is the first significant “reality check” of 2026. Following the shock contraction of -32,000 private-sector jobs in November, markets are desperately looking for a rebound.

· ADP Expectations (Release Tonight): Consensus is clustered near +45,000 to +50,000 jobs. A print in this range would suggest that the year-end labor chill was a seasonal anomaly rather than a structural freeze.

· The NFP Anchor (Friday): All eyes remain on the Non-Farm Payrolls (NFP) report on January 9th. With a consensus forecast of +59,000, this is the ultimate “make-or-break” for 2026 opening sentiment.

The Logic: A “beat” in both reports would validate the Fed's recent “Hawkish Hold” narrative, while a consecutive miss would ignite fierce speculation of an emergency rate cut in late Q1.

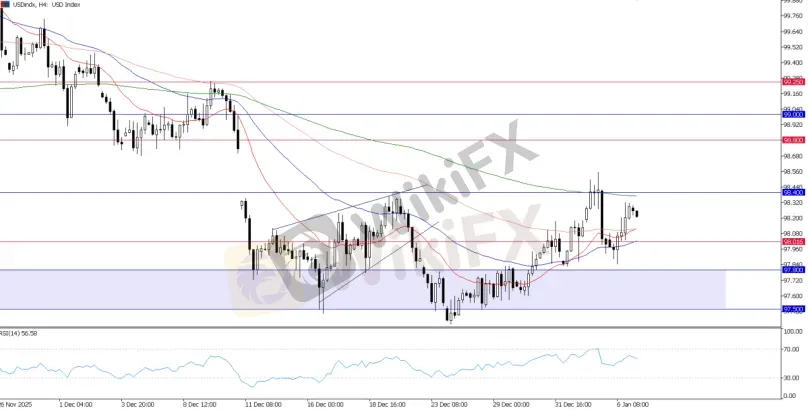

US Dollar: The Pivot at 98.40

The Greenback is entering the “Jobs Week” on a tentatively firmer footing, currently trading near the 98.40 mark. After logging its worst annual performance since 2017, Dollar is attempting to carve out a definitive 2026 base.

The USD Index has successfully broken its November downtrend, finding a solid floor in the 98.00–98.20 zone. With the trend currently moving into consolidation, the stage is set for a potential reversal.

USD Index, H4 Chart

To confirm a full-scale bullish reversal, the Index needs a decisive daily close above the 98.40 area. Beyond that, the 98.80 and 99.00 corridor represents the next target for USD bulls.

Analysis: The Dollar is effectively “coiling” below resistance. A strong ADP print tonight would likely act as the spring, propelling the Index toward and above 98.40 as markets price out any chance of a January rate cut. Conversely, a lack of surprise data would shift the focus back to the yearly-open support at 98.00, keeping the price range-bound.

FX Majors: EUR/USD & GBP/USD at the Crossroads

“Jobs Week” volatility is already rippling through major currency pairs, especially those heavily weighted in the Dollar Index, with technical levels being tested ahead of the New York open.

EUR/USD: 1.1700 & 1.1800 Wall

The Euro is struggling to sustain a break above the 1.1800 psychological barrier and has recently faced renewed pressure below the 1.1700 level.

EURUSD, H4 Chart

While the pair remains in a structural uptrend, momentum is fading near 1.1730–1.1760. A strong ADP print tonight could send the Euro back toward or even below the 1.1700 support, leading to a deeper pullback (or a short-term bearish trend) on a stronger Dollar.

Additional Notes: Recent cooling Eurozone inflation signals the potential for another round of easing from the ECB, posing a short-term bearish outlook for the Euro.

GBP/USD: Cable Resilience

Unlike the Euro, the Pound is showing cleaner bullish construction, currently eyeing the 1.3500 support level.

GBPUSD, H4 Chart

The structural uptrend remains healthy, but the 1.3500 level is now in check. If the Dollar gains strength in the near term, we could see a break below 1.3500, which would invalidate the near-term uptrend and potentially trigger a period of corrective waves.

The next major support likely lies in the key 1.3350 area.

Gold: Geopolitical Hedges and Safe-Haven

The relationship between the Greenback and the “Safe-Haven” king is currently defined by a tug-of-war between central bank policy and global unrest. Despite a firmer Dollar, the Venezuela “Political Game” (specifically the capture of Maduro and U.S. intervention) has kept a massive “unrest premium” embedded in the price.

XAU/USD, Daily Chart

On the broad trend, the “pullback and resume” pattern suggests the Gold bull trend is intact and likely to extend gains. However, it is worth noting that if the Dollar gains further strength, it may cap Gold's upside alongside the $4,500 psychological resistance.

XAU/USD, H1 Chart

In the near term, Gold has successfully turned the $4,450 – $4,500 range into a structural battlefield—a major “war zone” between bulls and bears.

Intraday Outlook: Gold may undergo a corrective move near $4,500 with imminent support at $4,450. As long as this base holds, bulls remain in control of the intraday trend, eyeing a re-test of the $4,510 resistance.

For swing traders, the focus remains on a potential near-term pullback, while $4,400 remains the key structural support for the broader bullish move.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Merin Review (2025): Is it Safe or a Scam?

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Currency Calculator