简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is OneRoyal Safe or a Scam? What Hundreds of Trader Testimonials Reveal in 2025

Abstract:For any trader, the question "Is OneRoyal safe or a scam?" is not just common; it is the most important research you need to do. The answer is rarely a simple "yes" or "no." Instead, you find it by looking at the shared experiences of traders who use this broker around the world. This investigation goes beyond marketing materials to examine independent ratings and real client testimonials. Our goal is to bring together this large amount of user feedback into a clear, fact-based picture. We will look at both the consistent praise and the serious, repeated complaints to help you make an informed decision about the safety of your money with OneRoyal. This analysis is designed to uncover the truth behind the numbers and the stories shared by traders who have direct, hands-on experience with the broker.

For any trader, the question “Is OneRoyal safe or a scam?” is not just common; it is the most important research you need to do. The answer is rarely a simple “yes” or “no.” Instead, you find it by looking at the shared experiences of traders who use this broker around the world. This investigation goes beyond marketing materials to examine independent ratings and real client testimonials. Our goal is to bring together this large amount of user feedback into a clear, fact-based picture. We will look at both the consistent praise and the serious, repeated complaints to help you make an informed decision about the safety of your money with OneRoyal. This analysis is designed to uncover the truth behind the numbers and the stories shared by traders who have direct, hands-on experience with the broker.

What Users Are Saying Overall

Combined data from major review websites shows a mixed story for OneRoyal. On one hand, the broker has an impressive score on Trustpilot, holding a 4.5 out of 5 rating from over 400 reviews. This suggests a high level of happiness among a large portion of its clients. This creates a picture of a legitimate, well-respected broker with a long operating history.

However, this positive image is challenged by serious accusations found on other platforms. Investigation sites like WikiFX host reports from users claiming severe issues, including claims of AI trading fraud schemes linked to the platform and, most importantly, blocked withdrawals. The main conflict is clear: while the overall rating is high, a vocal minority of traders reports problems that strike at the very heart of broker trustworthiness—trade execution and the ability to access one's own funds. This contradiction creates a complex picture that requires a deeper look into both the positive and negative aspects of the user experience.

What Traders Like

To understand why OneRoyal maintains a high rating, we must examine the specific aspects that satisfied clients consistently highlight. This positive feedback provides a balanced perspective, showcasing the broker's strengths from a user's point of view.

Strong Rules and Oversight

A primary reason traders express confidence in OneRoyal is its multi-country regulatory status. Users frequently mention the dual licenses from top-tier authorities—the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC)—as a significant trust signal. These regulatory bodies are known for their strict oversight and client protection measures.

Good Trading Conditions

Many positive OneRoyal client reviews focus on the broker's competitive trading environment. Users often report satisfaction with the tight spreads, especially on the ECN account types where spreads can start from 0.0 pips. This, combined with feedback on fast execution speeds, makes the broker attractive to scalpers and algorithmic traders. Furthermore, the low barrier to entry is a frequently praised feature. With a minimum deposit of just $50 for the Classic and ECN accounts, and as low as $10 for the Cent account, OneRoyal makes it accessible for beginners to start trading with real money or for experienced traders to test strategies without a large capital commitment.

Platform and Tools

The stability and functionality of the trading platforms are another source of positive sentiment. OneRoyal offers the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are praised for their reliability. A specific feature that receives positive mentions is the MT4 Accelerator package. This suite of 12 add-ons enhances the standard MT4 experience with advanced tools for trade management, order execution, and market analysis, which is highly valued by technical traders. Additionally, the availability of Trader Trading app.

Customer Support

A responsive and professional customer support team is often the backbone of a positive broker-client relationship. Numerous reviews describe OneRoyal's support team as helpful, knowledgeable, and quick to respond during their 24/5 operating hours. This level of service is crucial for resolving technical issues or account-related questions promptly, contributing significantly to overall user satisfaction.

Warning Signs and Complaints

While many users report a positive experience, it is impossible to ignore the serious warning signs raised by a segment of OneRoyal's client base. These complaints are not minor inconveniences; they relate to core functions that define a broker's integrity. Directly addressing these allegations is essential to answering the “scam” part of the user's question.

Unfair Execution and Slippage

The most frequent and damaging complaint against OneRoyal concerns trade execution. Imagine setting a stop-loss to protect your capital from excessive risk, only to find your trade closed out at a price that was never reached on the chart, resulting in an unexpected and unjustified loss. This is the essence of the stop-loss hunting and abnormal slippage allegations. Users report that their protective orders are triggered too early or filled at significantly worse prices than set, particularly during volatile market conditions or periods of low liquidity. This suggests a potential lack of transparency in the broker's execution mechanism and liquidity feed. This user sentiment aligns with external analysis that gives OneRoyal a mediocre 6/10 score for execution quality, highlighting it as a significant risk factor.

Withdrawal and Blocked Funds

A broker's most fundamental duty is to process client withdrawals in a timely and fair manner. Any failure in this area immediately destroys trust. While these complaints represent a minority of OneRoyal's user base, their severity cannot be overstated. Reports detail significant delays, demands for excessive and repetitive documentation, and, in the most extreme cases, outright refusal to process withdrawal requests. Platforms like WikiFX contain specific allegations where users, sometimes lured by promises related to AI trading, found their accounts and funds blocked when they attempted to withdraw their profits or initial capital. Even if infrequent, such issues are a major warning sign.

Complex Regulatory Structure

On the surface, OneRoyal's regulation by ASIC and CySEC appears robust. However, a deeper look reveals a complex and potentially misleading corporate structure. The broker also operates through entities registered in offshore jurisdictions, namely Vanuatu (VFSC) and St. Vincent & the Grenadines (FSA). The critical risk here is that a client's level of protection depends entirely on which of these entities their account is registered under. A trader might sign up believing they are protected by ASIC's strict rules, only to discover their account is actually held under the much lighter regulatory oversight of the VFSC. This uncertainty is a significant concern. Some analysis from external sites like Forexnewsnow has even raised questions about whether the primary operational license for many clients is effectively the Lebanese CMA, further complicating the picture of who is truly protecting client funds.

Connecting User Feedback to Features

To fully understand the divided user sentiment, we must connect the feedback directly to OneRoyal's specific features, policies, and structure. This “cause and effect” analysis reveals why the broker is perceived so differently by various groups of traders. The following table combines user reviews with the broker's offerings.

| User Sentiment / Review Theme | Corresponding OneRoyal Feature/Fact | Our Analysis |

| Positive: “I feel secure” | ✅ CySEC & ASIC licenses, FinaCom Membership | Top-tier regulation is a legitimate and powerful trust signal for many users. The €20,000 FinaCom compensation fund adds a tangible layer of security that resonates well with traders. |

| Positive: “Great for pros” | ✅ ECN Elite Account ($3.5/lot commission), MT4 Accelerator | The broker provides genuinely competitive, low-cost options for high-frequency or professional traders. The raw spreads and low commission on the ECN Elite account are a clear draw for this segment. |

| Positive: “Easy to start” | ✅ $10 Cent Account, $50 Classic/ECN Account | The low minimum deposits make the broker highly accessible. This attracts a large volume of beginners and traders testing new strategies, contributing to the high number of overall reviews. |

| Negative: “My stop was hunted!” | ⚠️ Widespread slippage complaints, 6/10 execution score | This is the most significant risk. The positive aspects of low spreads are undermined if trade execution is not reliable or perceived as unfair. This is a deal-breaker for traders who prioritize execution integrity. |

| Negative: “I'm confused about my safety” | ❌ Complex structure (ASIC, CySEC, VFSC, FSA entities) | The multi-entity structure creates uncertainty and risk. Users may not be getting the top-tier protection they think they are, leading to a mismatch in expectations and a potential for serious issues. |

| Negative: “Withdrawal was a nightmare” | ❌ Reports of withdrawal issues (minority, but severe) | While not widespread according to the overall high rating, any verifiable issue with accessing funds is a critical warning sign that can completely destroy all trust built by other positive features. |

Final Decision: Opportunity vs. Risk

Based on the evidence from hundreds of user testimonials and an analysis of its corporate structure, OneRoyal is not an outright scam. It is an established broker with nearly two decades of operational history, legitimate top-tier licenses, and a suite of competitive features that understandably attract a large client base. This explains its largely positive online ratings and the loyalty of many traders.

However, this positive profile is shadowed by significant and recurring complaints regarding trade execution and the inherent risks of its complex regulatory setup. The question of whether OneRoyal is safe depends heavily on two factors: which legal entity a trader is registered with and their personal tolerance for execution risk. The stark contrast between the praise for its low costs and the severe allegations of stop-loss hunting creates a high-risk, high-reward scenario that is not suitable for everyone.

We provide the following guidance for any trader considering this broker:

1. Do Not Take Our Word For It: This analysis is a summary of publicly available user sentiment and should serve as a starting point, not a final judgment. The experiences of others are a valuable guide, but not a guarantee of your own outcome.

2. The Essential Verification Step: Crucially, we urge all traders to conduct their own independent verification before engaging with any broker. A vital tool for this is using third-party verification platforms. Before you proceed, visit a site like WikiFX to check the latest regulatory status, user reviews, and any new complaints filed against the broker. This step is non-negotiable for protecting your capital.

3. Clarify Your Regulatory Body: If you are still considering this broker, you MUST confirm in writing which legal entity and regulatory jurisdiction your account will fall under before depositing any funds. Do not assume you are covered by ASIC or CySEC unless you have explicit confirmation.

In conclusion, while OneRoyal presents an appealing package of low costs and advanced tools, the reported risks, particularly concerning the integrity of trade execution, cannot be ignored. We do not endorse or recommend opening an account. The decision must be based on your individual risk appetite and, most importantly, thorough personal verification of the broker's claims and your specific account protections.

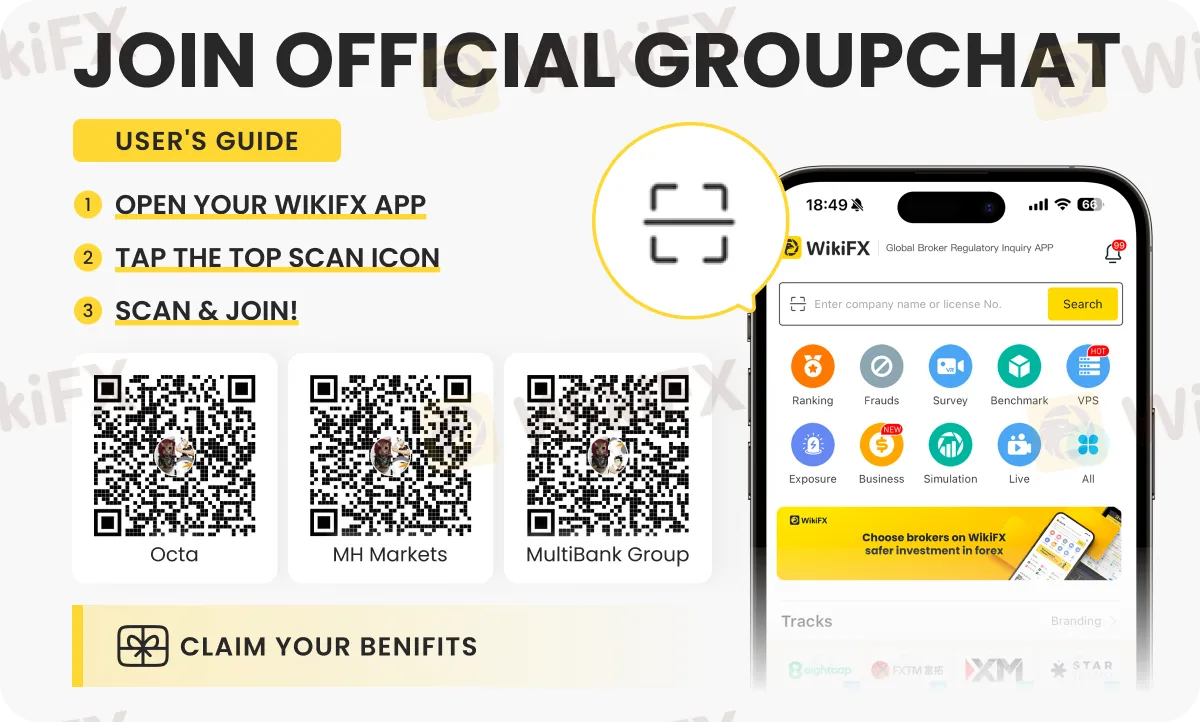

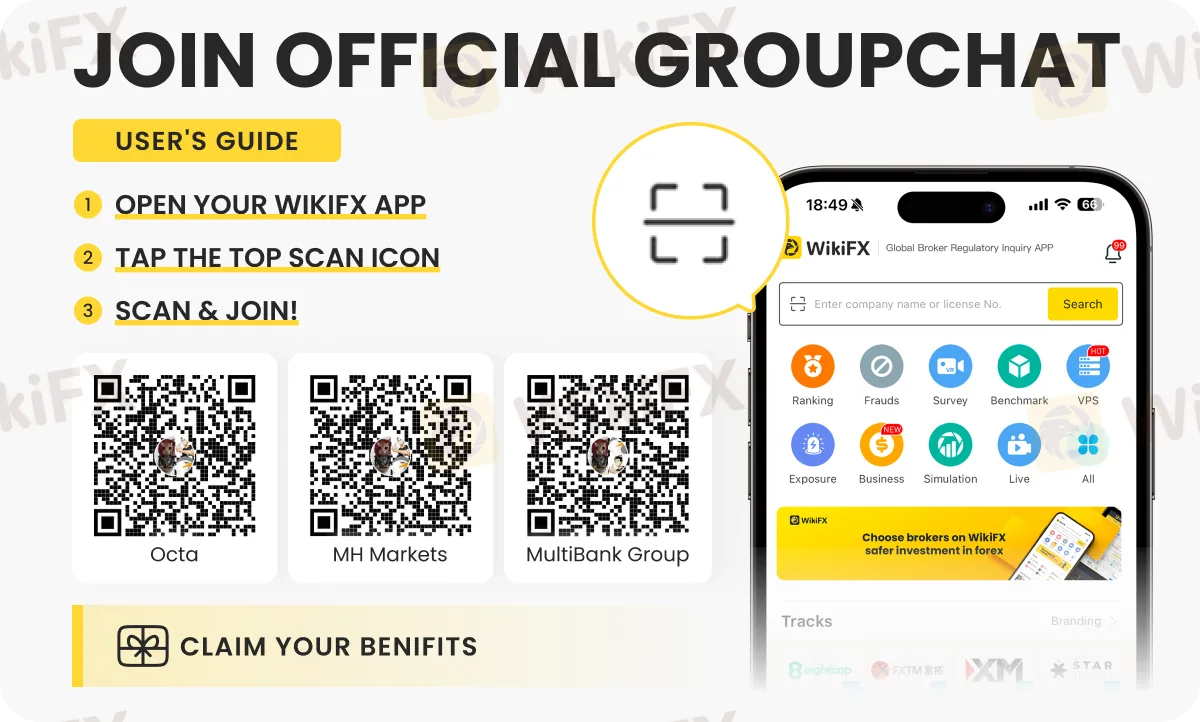

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

BitPania Review 2026: Is this Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Macron's India Trip Exposes EU Tech Overreach And Policy Failures

Five key takeaways from the Supreme Court's landmark decision against Trump's tariffs

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

FXORO Review 2026: Is this Forex Broker Legit or a Scam?

Binomo Review: Safety, Regulation & Forex Trading Details

VenturyFX Review 2025: Is This Forex Broker Safe?

Currency Calculator