简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ISM Manufacturing PMI Report: Key Takeaways

Abstract:This week marks a heavy slate of macroeconomic data releases. On December 5, the December ISM Manufacturing PMI was published, coming in at 47.9, down 0.3 points month over month, and marking the lowe

This week marks a heavy slate of macroeconomic data releases. On December 5, the December ISM Manufacturing PMI was published, coming in at 47.9, down 0.3 points month over month, and marking the lowest reading since October 2024. The data underscores continued weakness across the U.S. manufacturing sector.

Following the release, the U.S. Dollar Index initially moved higher before reversing lower, which in turn supported a renewed rally in gold. Prices pushed toward the $4,450 psychological level, where gold has since traded sideways during the Asian session.

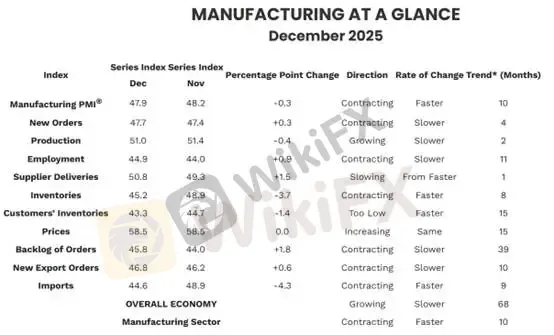

(Figure 1: ISM Manufacturing PMI | Source: ISM Report)Tariffs Continue to Pressure Prices and Margins

A closer look at the ISM PMI survey reveals mounting pressure from tariffs, with respondents highlighting their impact on end-product pricing.

Computer & Electronic Products

Survey participants noted that while tariff-related tensions have eased somewhat, prices across all product categories remain elevated. Rising input costs have forced companies to raise selling prices, though margins continue to compress as higher costs cannot be fully passed on to consumers.

Chemical Products

Respondents pointed to a decline in real consumer spending, attributing much of the weakness to tariffs. One participant remarked that a return to free trade would better reflect consumer preferences as expressed through purchasing behavior.

Why “Bad” May Not Get Much Worse

New Orders rose by 0.3 points month over month in December, while

Inventories fell sharply from 48.9 to 45.2, a decline of 3.7 points.

Customer Inventories dropped from 44.7 to 43.3, signaling rapid inventory drawdowns.

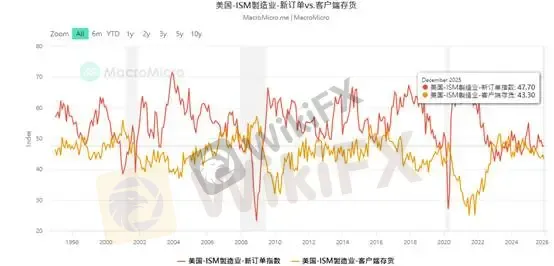

(Figure 2: ISM New Orders vs. Customer Inventories | Source: MacroMicro / M平方)

Outlook: From Caution to Catch-Up Demand

Gold Technical Analysis

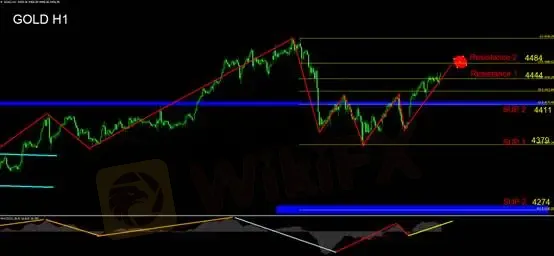

MACD histogram bars continue to print above the zero line, signaling short-term bullish momentum.

Beyond these two sectors, manufacturers broadly reported declining order volumes, underutilized capacity, and workforce reductions as firms attempt to preserve efficiency amid soft demand.

Both U.S. manufacturers and consumers are grappling with high interest rates, tariff pressures, and weakening consumption, leaving the overall investment environment in a state of stagnation.

For investors, however, the key question is not simply how weak conditions feel, but how much worse they can realistically get.

Based on the underlying data, we believe U.S. manufacturing activity is facing strong cyclical headwinds, yet corporate behavior has already turned overly conservative. This sets the stage for potential order replenishment in the period ahead.

Evidence of excessive pessimism can be seen in the details:

This combination of modestly improving new orders and aggressive inventory depletion explains why the headline ISM PMI registered its weakest level since October 2024.

When companies broadly perceive customer inventories as too low, history suggests a transition toward restocking, increased hiring, and renewed capital investment, which typically supports a cyclical recovery in manufacturing activity.

As such, the spread between New Orders minus Customer Inventories provides a more forward-looking gauge of future economic momentum.

Corporate reluctance to rebuild inventories has been driven by the current interest rate environment and weak end-demand. Looking ahead, potential tailwinds include tax cuts under a Trump administration and persistently low energy prices, both of which could lift disposable income.

Once corporate sentiment shifts from pessimism to optimism, inventory restocking could accelerate sharply.

The resilience of risk assets has been supported not only by aggressive capital spending from major U.S. cloud service providers, but also by Wall Streets expectation that tax relief could drive a structural improvement in end-market demand.

This pattern of near-term pessimism followed by a scramble to secure orders echoes conditions last seen during the late-2022 to 2023 transition period.

During the Asian session, gold prices broke above the 50% Fibonacci retracement level, opening the door for a test of the 61.8% resistance at $4,484.

Momentum indicators remain constructive:

Reviewing yesterdays price action, gold opened higher and initially tested the Fibonacci neutral zone resistance. While the hourly chart showed signs of momentum exhaustion, downside follow-through ultimately failed. Short positions should remain sidelined for now, with attention focused on defensive price action near $4,484.

From a broader technical perspective, the $4,379–$4,411 range currently serves as a short-term base. To sustain further upside, gold must hold above $4,411 support. For now, a wait-and-see approach is warranted.

Risk Disclosure

The views, analysis, research, prices, and other information provided above are for general market commentary only and do not represent the position of this platform. All readers assume full responsibility for their own risk. Please trade with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Inside the Elite Committee: Talk with Elyzabeth Bulan

Markets Pricing 'Perfection': AI Euphoria Eclipses Geopolitical Realities in Asia Session

97 Scams Crushed: KL Police Seize Over RM5 Million

Gold Surges Past $4,400 as Venezuela Crisis Rattles Global Markets

Geopolitical Risk Alert: Trump Expands Threats to Iran, Mexico, and Greenland

Geopolitical Shockwaves: Dollar and Franc Rally as US Detention of Maduro Rattles Markets

eToro Adds 43 New Assets to Its Lineup of Investment Instruments

OXO Review (2025): Is it Safe or a Scam Platform?

Currency Calculator