Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

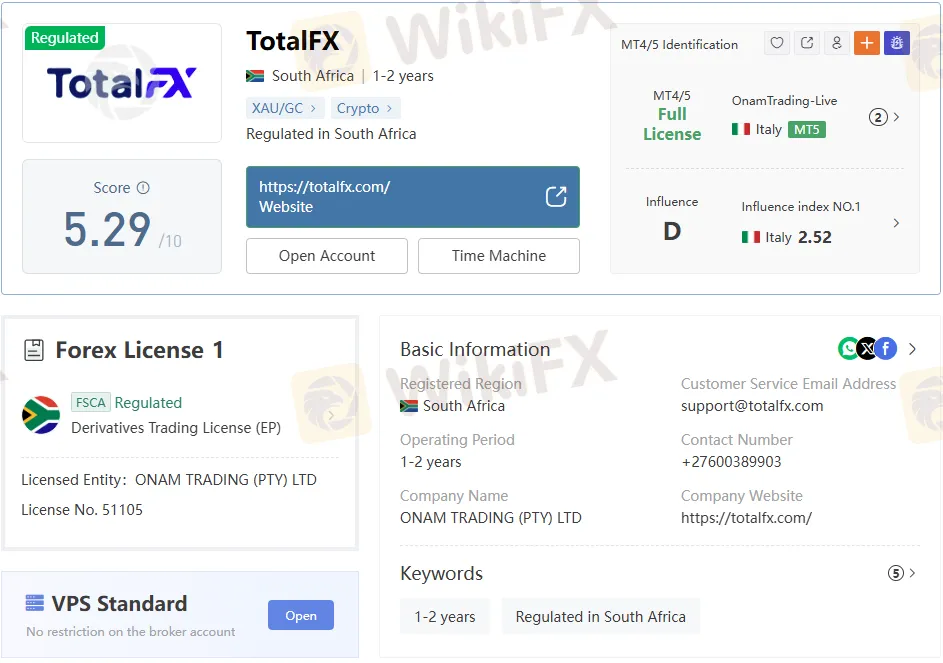

Abstract:TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

TotalFX operates under the regulatory supervision of the Financial Sector Conduct Authority (FSCA) in South Africa. The brokers license, No. 51105, is held by ONAM Trading (Pty) Ltd, with authorization granted on 10 February 2021. This license covers a wide range of financial activities, including derivatives trading, securities investment consulting, bond trading, and pension-related financial products.

The FSCA‘s involvement provides a layer of compliance assurance. Unlike offshore brokers with vague oversight, TotalFX’s South African registration offers traders a clear jurisdictional framework. This regulatory standing is a critical factor in evaluating trading safety, especially in a market where unregulated entities often pose risks.

The brokers official domain, totalfx.com, was registered on 30 March 2000 and is valid until 30 March 2032. The domain is hosted via Cloudflare name servers, with its status marked as “client transfer prohibited,” signaling protection against unauthorized transfers.

The company behind the broker, ONAM Trading (Pty) Ltd, has been operating for 1–2 years under the TotalFX brand. While the corporate entity is relatively new, the domains long-standing registration suggests continuity and brand stability.

TotalFX provides access to a broad spectrum of instruments:

This multi-asset offering positions TotalFX competitively against brokers that limit clients to forex or equities. The inclusion of cryptocurrencies and ETFs reflects an effort to align with modern trading demands, while traditional instruments such as bonds and commodities cater to conservative investors.

TotalFX offers two account types:

| Account Type | Minimum Deposit | Spread | Commission | Platforms |

| Zero | $0 | From 0.6 pips | $0 | MT5 & cTrader |

| Raw | $0 | From 0.0 pips | $2.75 per side | MT5 & cTrader |

Both accounts feature no minimum deposit requirement and leverage up to 1:1000. The Zero account appeals to traders seeking commission-free trading, while the Raw account provides institutional-style spreads with a transparent commission structure.

Compared to competitors, the leverage offered is significantly higher. While this can amplify profits, it also increases risk exposure, making risk management essential.

TotalFX supports three major platforms:

The availability of all three platforms is a notable advantage. Many brokers restrict clients to MT4 or MT5, but TotalFXs inclusion of cTrader broadens its appeal to experienced traders seeking alternative execution environments.

Pros:

Cons:

When compared to regional competitors, TotalFX‘s leverage of 1:1000 stands out. Many FSCA-regulated brokers cap leverage at lower levels to mitigate risk. Additionally, TotalFX’s dual account structure mirrors offerings from global brokers but with more aggressive spreads and commissions.

However, the brokers WikiFX score of 5.29/10 indicates mixed market perception. Competitors with longer operating histories and clearer payment transparency often score higher, suggesting TotalFX still has ground to cover in building trader confidence.

This TotalFX Review highlights a broker that combines regulatory compliance under FSCA with a diverse product offering and competitive trading conditions. The presence of license No. 51105 provides legitimacy, while the inclusion of MT5, MT4, and cTrader ensures platform flexibility.

Yet, traders should weigh the brokers relatively short operational history and lack of clarity on funding methods against its regulatory standing. For those seeking high leverage and multi-asset exposure under FSCA oversight, TotalFX presents a viable option.

Verdict: TotalFX delivers compliance-backed trading safety with expansive market access, but transparency in payment systems and longer operational history will be key to strengthening its reputation.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!