Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:New findings raise concerns over Zenstox’s offshore licensing, internal trading structure, and reported fund access issues.

Zenstox is an online trading platform operated by VIE Finance Sey Ltd, offering access to forex and CFD products across multiple asset classes. While the broker positions itself as a global trading service, a closer examination of its regulatory coverage, operational structure, and exposure records reveals several risk indicators that traders should carefully evaluate.

Information compiled from WikiFX data, regulatory disclosures, and user exposure reports suggests that Zenstoxs risk profile differs notably from brokers operating under stronger regulatory frameworks.

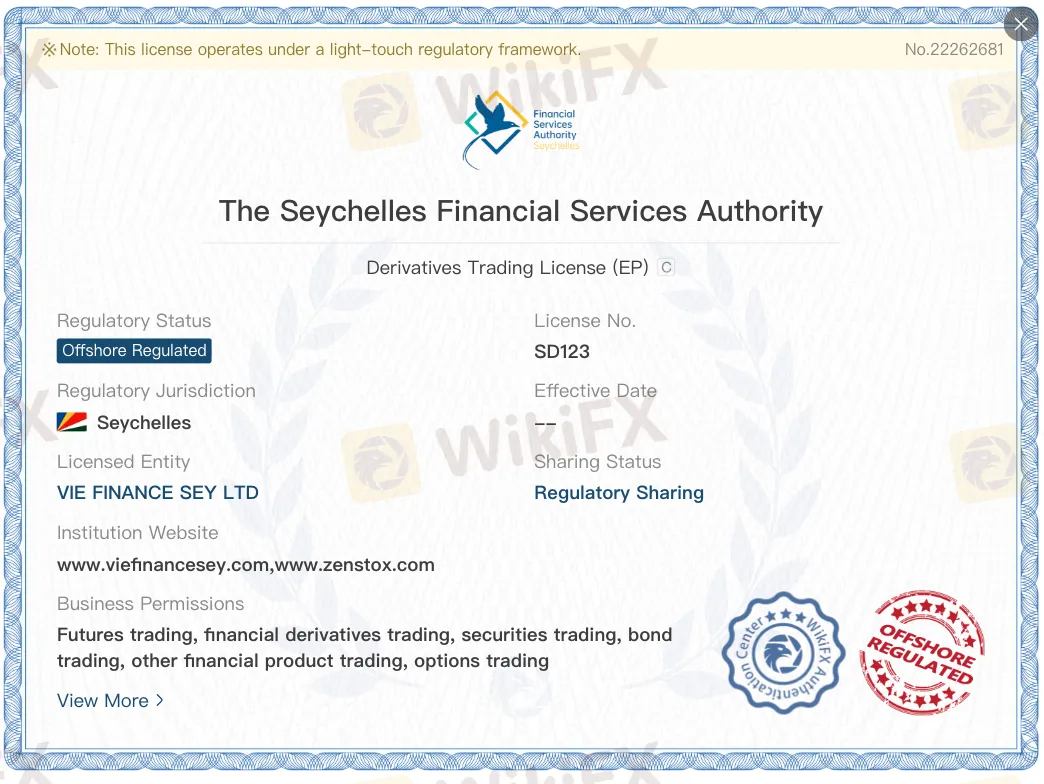

According to WikiFX records, Zenstox holds a derivatives trading license issued by the Seychelles Financial Services Authority (FSA). This type of license falls under an offshore regulatory framework, which typically applies a lighter supervisory approach compared to major onshore regulators.

From a risk perspective, offshore licensing often involves:

While such licenses are legally valid within their jurisdiction, they do not provide the same level of structural protection commonly associated with regulators such as FCA, ASIC, or CySEC. This distinction is particularly relevant for retail traders who may assume that all “licensed” brokers operate under equivalent safeguards.

On WikiFX, Zenstox currently carries a low overall safety score, reflecting weaknesses across several core assessment dimensions. The WikiFX scoring system evaluates brokers based on multiple verifiable factors, including regulatory strength, risk control mechanisms, software environment, and historical exposure records.

For Zenstox, the score highlights:

Rather than focusing on marketing claims, the WikiFX score is derived from objective data points, placing Zenstox in a comparatively higher-risk category within the broader trading platform landscape.

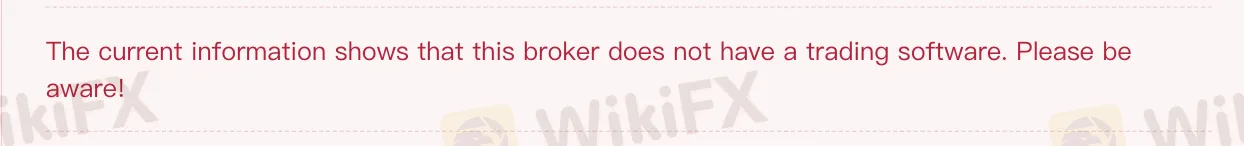

Another notable risk indicator lies in Zenstoxs platform structure. WikiFX information shows that the broker currently lacks a verifiable, independently audited trading software environment.

From a risk-control standpoint, this raises several concerns:

When platform operations, pricing, and fund access are managed within the same internal system, traders face increased dependency on the brokers internal controls rather than externally supervised mechanisms.

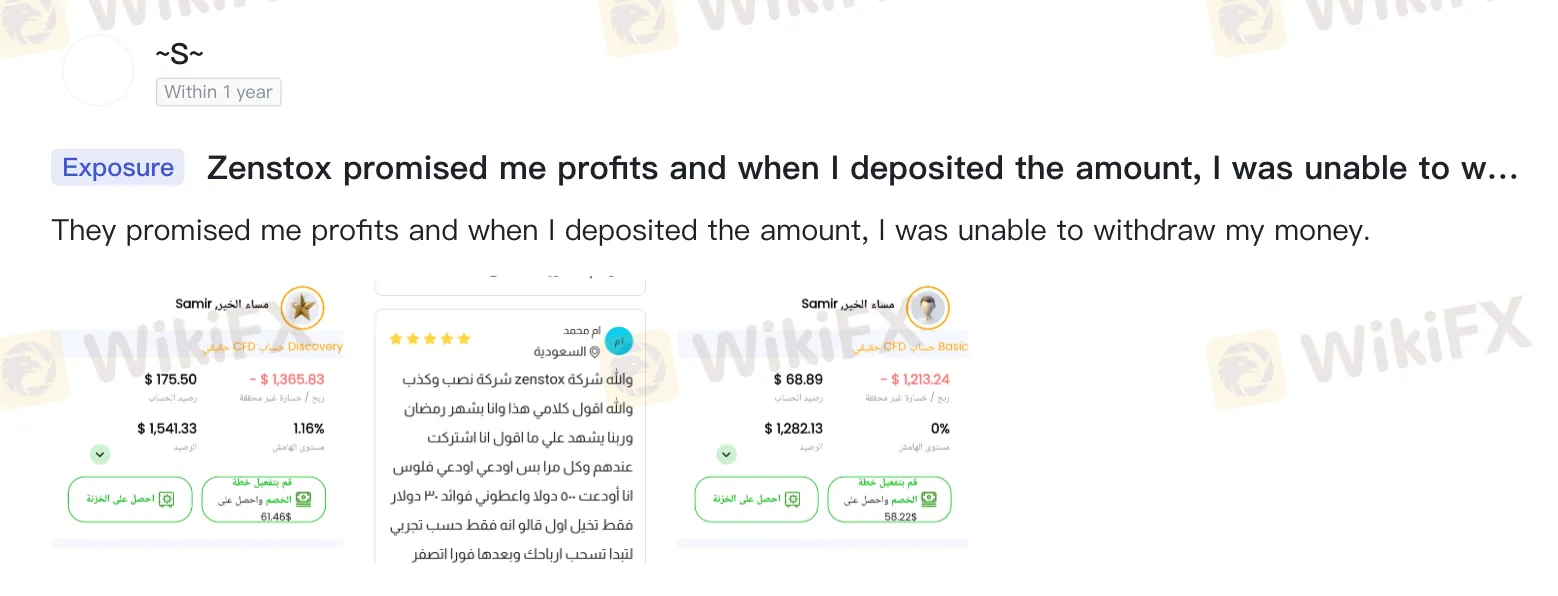

In addition to structural indicators, user exposure reports published on WikiFX reveal recurring patterns related to account handling and sales practices.

Multiple users describe scenarios involving:

These user submissions, collected over time, point to a sales-driven account management approach where continued trading or further deposits are encouraged instead of facilitating fund withdrawals. While individual cases may vary, the consistency of these reports adds context to the broader operational risk profile.

Additional user complaints and exposure records can be found on the WikiFX broker profile page: https://www.wikifx.com/en/dealer/1165781752.html

Viewed together, Zenstoxs risk profile is shaped not by a single red flag, but by a combination of reinforcing factors:

Each element contributes to a pattern that traders should assess carefully before committing funds.

WikiFX is a global broker information platform focused on regulatory verification, risk alerts, and data-based evaluations. By aggregating official licensing records, platform disclosures, and real user exposure cases, WikiFX provides traders with factual references to assess potential risks.

Reviewing regulatory depth, safety scores, and historical exposure records remains a practical step for managing trading risk before engaging with any online trading platform.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!